لا يعتمد سوق العملات المشفرة على التكنولوجيا وحدها، بل يعتمد على القصص. فكل عملة رئيسية لها قصة وراءها. تجعل Bitcoin الناس يؤمنون بالندرة الرقمية. تبيع Ethereum رؤية لاقتصاد قابل للبرمجة. تعد Solana بعالم خالٍ من الاحتكاك وحدود الإنتاجية.

ومع ذلك، لم يتم إنشاء Dogecoin للتفوق على أي شخص في سرعة المعاملات أو قابلية التوسع أو الأمان. بدأت كنكتة — ميم عشوائي تطور إلى علامة تجارية عالمية بشكل عارض تقريبًا.

في الواقع، Dogecoin هي العملة المشفرة الوحيدة التي يمكنك شرحها لسائق تاكسي أو طالب في المدرسة الثانوية أو مصرفي أو عمتك بسطر واحد:

”إنها عملة ميمية تساوي مليارات الدولارات — وإيلون ماسك يحبها.“

لو كان الأمر يتعلق فقط بالميمات، لكان Dogecoin قد اختفى منذ زمن طويل، مثل آلاف العملات الرديئة المنسية. لكن شيئًا آخر حدث — تحول Dogecoin إلى أصل ثقافي. والثقافة، على عكس الضجة الإعلامية، لها زخم.

المصدر: GoMining.com

دوجكوين اليوم ليست مزحة. إنها ليست موضة عابرة. إنها أكبر تجربة حية تثبت فرضية جذرية:

القيمة لا تُبنى دائمًا بالكود — أحيانًا تُبنى بالإيمان.

ليس بالورقات البيضاء — بل بالإجماع الاجتماعي.

تاريخ Dogecoin: من مزحة إلى اقتصاد الاهتمام

لفهم توقعات الأسعار لعام 2026، عليك أن تفهم كيف أصبحت Dogecoin ما هي عليه اليوم.

تم إطلاق Dogecoin في ديسمبر 2013 من قبل بيلي ماركوس وجاكسون بالمر، وهما مطوران كانا قد سئما من الوعود الطنانة لمشاريع التشفير المبكرة.

المصدر: GoMining.com

كل شركة ناشئة في تلك الحقبة ادعت أنها تبني ”نموذجًا جديدًا“ أو ”نهضة مالية“ أو ”مستقبل المال“. كان السؤال الواضح هو:

أين كل ذلك في الواقع؟

صادف بالمر ميم شيبانو وكتب تغريدة مازحة:

”استثمر في دوجكوين — إنه الشيء الكبير التالي.“

كان ذلك سخرية. محاكاة ساخرة. نوع من السخرية من السوق. لكن السوق لم تفهم النكتة. وردت بالمال.

مفارقة Dogecoin

بدأت Dogecoin بدون:

- حد أقصى للإصدار،

- حالة استخدام فريدة،

- فريق بحث وتطوير قوي،

- خطة عمل على مستوى Ethereum،

- ورقة بيضاء تقليدية.

ومع ذلك — وصلت قيمتها السوقية إلى مليارات الدولارات وتمكنت من دخول قائمة أفضل 10 عملات مشفرة عالمية في ذروتها.

لماذا؟

لأن دوجكوين لم تبيع فائدة؛ بل باعت العواطف. لم تكن بلوك تشين — بل كانت مرآة. انعكاس لما يحدث عندما:

الاهتمام الجماعي = رأس المال

الميمات → السيولة

الثقافة → السوق

ثم جاءت نقطة التحول.

عندما دخل إيلون ماسك إلى الدردشة

من عام 2020 فصاعدًا، حصلت Dogecoin على محفز جديد — إيلون ماسك. رجل يفهم كيفية تحقيق الدخل من الاهتمام أفضل من أي شركة بميزانية تسويقية تبلغ مليار دولار.

المصدر: GoMining.com

في كل مرة كان ماسك يغرد ”Doge to the Moon“، كان السعر يرتفع. عندما نشر ميمًا مع Shiba Inu في بدلة فضاء، جن جنون السوق. وعندما ألمح إلى إمكانية الدفع بـ DOGE في Tesla، انفجرت السيولة.

إذا كنت تعتقد أن هذا مجرد ”تأثير تويتر“، ففكر في ما يلي:

- كانت قيمة Amazon تقدر بمليارات الدولارات قبل تحقيق الأرباح،

- وكانت قيمة Bitcoin تقدر بآلاف الدولارات قبل إنشاء البنية التحتية،

- وقد أصبحت قيمة Dogecoin تقدر بمليارات الدولارات لأن الاهتمام أصبح عملة.

لم يكن من المفترض أن تكون Dogecoin جادة — وهذا بالضبط سبب عدم إمكانية إيقافها.

لماذا تهم توقعات عام 2026

2025-2026 ليس مجرد نطاق زمني آخر. إنه ذروة الدورة التالية للعملات المشفرة المتوقعة — وهو نمط يتكرر تاريخياً بدقة مذهلة:

انخفاض البيتكوين إلى النصف → انخفاض العرض

ارتفاع الأسعار → تدفق التجزئة

العملات الميمية → جنون المضاربة

تضخم السرد → فقاعة → التحول إلى البنية التحتية

الانهيار → إعادة الضبط → دورة جديدة

المصدر: GoMining.com

ترتفع عملة Dogecoin دائمًا خلال المرحلة الثالثة — اللحظة التي تتغلب فيها العواطف على المنطق. هذه المرة، تدخل Dogecoin الدورة الجديدة بـ خمس قوى دافعة:

- علامة تجارية ميمية عالمية

- تأثير اتصالات ماسك

- قاعدة مستخدمين لا تتطلب أي تدريب

- توافق السرد مع المنصات الاجتماعية

- أصل لا يتم تسعيره وفقًا للأساسيات، بل وفقًا للاعتقاد

لهذا السبب يأخذ المحللون DOGE على محمل الجد — ليس لأنه متفوق من الناحية الفنية، ولكن لأنه يتحرك بنفس الطريقة التي تحلم بها الأسواق.

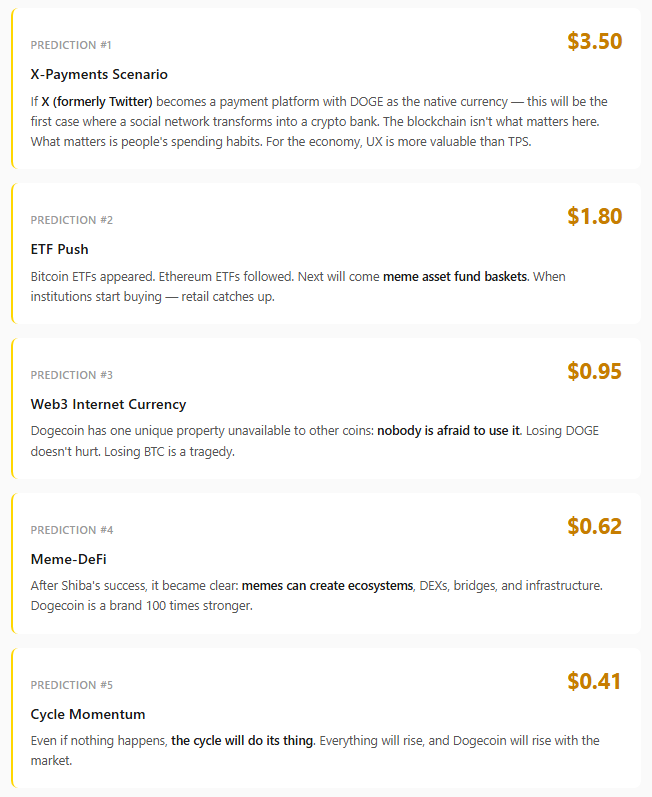

أفضل 5 توقعات لأسعار Dogecoin لعام 2026

هذه ليست خيالات. إنها سيناريوهات سلوكية قائمة على البيانات وتشكلها السيولة والسرد وعلم نفس السوق.

التوقع رقم 1 — 3.50 دولار (سيناريو X-Payments)

إذا قامت X (المعروفة سابقًا باسم Twitter) بدمج DOGE كعملة دفع أصلية، فسنحصل على أول شبكة اجتماعية في العالم تعمل كبنك للعملات المشفرة.

في هذا النموذج، التكنولوجيا ليست هي المهمة — بل السلوك هو المهم.

لا يتبنى الناس الأنظمة بسبب TPS. إنهم يتبنون ما يشعرون أنه سهل.

تجربة المستخدم > الأساسيات.

التنبؤ رقم 2 — 1.80 دولار (زخم ETF)

لدينا بالفعل صناديق ETF لبيتكوين. صناديق ETF لإيثريوم موجودة هنا. الحدود التالية هي السلال المواضيعية: صناديق ETF لاقتصاد الميمات التي تضفي الطابع المؤسسي على الاهتمام.

بمجرد أن تبدأ الصناديق في تخصيص الأموال لـ DOGE، لن تحتاج التجزئة إلى إقناع — فهي ستتبعها.

التنبؤ رقم 3 — 0.95 دولار (عملة الإنترنت Web3)

تتمتع Dogecoin بميزة نفسية فريدة: لا أحد يخشى إنفاقها.

خسارة DOGE لا تؤلم.

خسارة BTC تبدو وجودية.

المعاملات الصغيرة، البقشيش، مدفوعات المبدعين — هذا هو المكان الذي يكون فيه Dogecoin منطقيًا دون محاولة.

التنبؤ رقم 4 — 0.62 دولار (توسع Meme-DeFi)

أثبت SHIB أن عملات الميم يمكنها بناء أنظمة بيئية. DEXes، الجسور، وحدات NFT — كلها نشأت من مزحة.

تتمتع Dogecoin بعلامة تجارية معروفة 100 مرة أكثر. إذا بنى المجتمع أخيرًا البنية التحتية — فسوف يتبع ذلك ارتفاع السعر.

التنبؤ رقم 5 — 0.41 دولار (قصور الدورة)

حتى لو لم يحدث شيء — لا ابتكار، لا ضجة إعلامية، لا ماسك — فإن دورة العملات المشفرة وحدها يمكن أن ترفع DOGE إلى أعلى.

أحيانًا ترفع موجات السوق كل شيء. بما في ذلك Dogecoin.

المصدر: GoMining.com

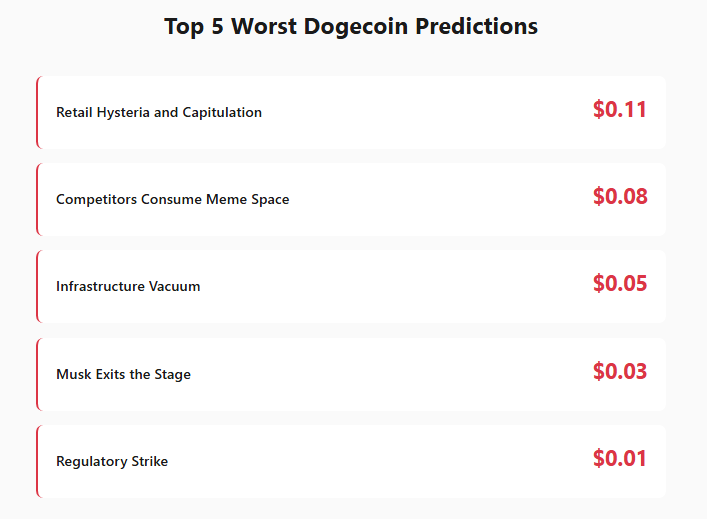

أسوأ 5 توقعات لأسعار Dogecoin لعام 2026

ليست كل القصص لها نهاية سعيدة. إذا ازدهرت Dogecoin بفضل الاهتمام، فإنها يمكن أن تموت أيضًا بفقدان هذا الاهتمام. فيما يلي السيناريوهات التي لا ترتفع فيها DOGE — بل تنهار.

0.11 دولار — استنفاد التجزئة والاستسلام

هذا هو السيناريو الأقل كارثية. هنا، لا ينقلب السوق ضد Dogecoin — بل يتوقف ببساطة عن الاهتمام. المستثمرون الأفراد عاطفيون بطبيعتهم. إنهم يشترون الأحلام، وليس الرسوم البيانية. يدخلون على أساس عبارة ”DOGE إلى القمر“ ويخرجون عند أول بادرة من الملل.

Dogecoin هو الأصل الأكثر عاطفية في العملات المشفرة. إذا ماتت الأجواء، يموت السعر أيضًا.

كما قال نسيم نيكولاس طالب ذات مرة:

"الناس يشترون الأمل ويبيعون الخوف. لا يوجد منطق في ذلك — لكن الأسواق لا تعمل بالمنطق."

0.11 دولار ليس الموت. إنه الإرهاق.

0.08 دولار — منافسو الميمات يلتهمون الحصة الذهنية

الميمات تتقادم أسرع من البرمجيات. كانت Dogecoin تسيطر على الإنترنت في يوم من الأيام، لكن TikTok و X تغمرهما الآن منافسون جدد:

PEPE و WIF و BONK وعشرات غيرهم.

إنها أحدث وأكثر صخبًا وتتطور مع روح الدعابة الخاصة بجيل Z. في سوق الميمات، الشباب ليس ميزة — إنه ميزة. كما لاحظ نيك كارتر:

”دوجكوين هي علامة تجارية لعام 2021. الميمات تتقادم أسرع من العملات.“

إذا توقفت DOGE عن كونها النكتة وأصبحت مجرد مزحة، فإن السيولة تنتقل إلى روايات أحدث.

0.05 دولار — فراغ في البنية التحتية

لا يزال Dogecoin يفتقر إلى:

- نظام بيئي DeFi قابل للتطوير

- عقود ذكية أصلية

- تطبيقات قوية

- أدوات مؤسسية

إنه يعيش على الحنين إلى الماضي، وليس على البنية. في الوقت نفسه، تعمل الرموز الميمية الأخرى على بناء عوالم كاملة. بعضها لديه DEXes وجسور وطبقات NFT ومرافق رمزية لم يطورها Dogecoin أبدًا.

لخص محلل Kaiko ذلك بشكل مثالي:

”بدون فائدة، DOGE هو شعار — وليس اقتصادًا.“

0.05 دولار هو سعر ميم فشل في النضوج.

0.03 دولار — إيلون ماسك يغادر المسرح

لم يرتبط أي أصل في تاريخ التمويل بشكل واضح بهذا القدر بشخص واحد. ماسك يغرد → DOGE يرتفع. ماسك يتوقف → DOGE ينزف.

إذا حول ماسك انتباهه إلى فكرة أخرى، ميم آخر، هوس آخر — فإن Dogecoin يصمت. والصمت قاتل.

سخر بيتر شيف، أحد المتشددين في دعم الذهب، ذات مرة قائلاً:

”دوجكوين ليست عملة. إنها عبادة تتبع ملل رجل واحد.“

0.03 دولار هو سعر DOGE بدون قديسها الراعي.

0.01 دولار — المقصلة التنظيمية

هذا هو السيناريو النووي. لا تكره هيئة الأوراق المالية والبورصات (SEC) الابتكار. إنها تكره الغموض. ودوجكوين هي غموض خالص ومسلح.

الأصل المشفر الذي ولد على سبيل المزاح، دون أي قيمة رسمية، هو هدف مثالي للتدخل البيروقراطي. إذا تم تصنيف DOGE على أنه ورقة مالية غير مسجلة:

- ستقوم البورصات بإزالته من القائمة،

- وسيختفي المستثمرون المؤسسيون،

- وستنهار عمق السوق،

- وستتبخر السيولة.

لم يتردد رئيس قسم الإنفاذ السابق في هيئة الأوراق المالية والبورصات الأمريكية (SEC) جون ريد ستارك في التعبير عن رأيه:

”الرموز الميمية هي كازينوهات متنكرة في شكل ابتكار“.

0.01 دولار ليس سعرًا.

إنه شاهد قبر.

المصدر: GoMining.com

كيفية استخدام هذه التوقعات في عام 2025

يعامل معظم المبتدئين التوقعات كأنها قدر محتوم. أما المحترفون فيعاملونها كأنها منارات ملاحية. التوقعات لا تخبرك بما سيحدث — بل تظهر لك أين يمكن أن تخطئ.

Dogecoin هو دراسة حالة سلوكية مثالية. مخططه البياني ليس أداة تقنية؛ إنه خاتم مزاج يعكس المشاعر الجماعية. وهو يظهر:

- تحول الخوف إلى ذعر،

- وتحول الضجة إلى جشع،

- وتحول الاهتمام إلى سيولة.

إليك ما يميز المستثمر عن المقامر:

المستثمرون يفهمون دورات السوق

العملات المشفرة تتنفس على شكل موجات:

التراكم → الاختراق → الهياج → الإنكار → الانهيار → الولادة من جديد

تضخم Dogecoin هذه المراحل لأنها لا تعمل على أساس العوامل الأساسية — بل تعمل على أساس المشاعر.

المستثمرون الأذكياء لا يطاردون الارتفاعات الصاروخية. إنهم ينتظرون الدورة.

المستثمرون يحللون السيولة

السعر لا معنى له بدون سياق. من يشتري؟ متى؟ بأي رأس مال؟

الاهتمام يغذي Dogecoin.

رأس المال يتبع الاهتمام.

عندما يتلاشى الاهتمام — يتلاشى DOGE أيضًا.

المستثمرون يشترون قبل الأخبار

إذا اشتريت بعد الأخبار — فأنت تشتري خروج شخص آخر.

لقد علمتنا Dogecoin هذا الدرس بشكل مؤلم:

تغريدات ماسك → ارتفاع السعر → خوف فقدان الفرصة لدى المستثمرين الأفراد → تصحيح → ندم

إذا كنت تتصرف عاطفياً، فإنك تدفع رسوم الدراسة للسوق.

يستخدم المستثمرون DCA

لا تحتاج إلى توقع القمم أو القيعان.

تشتري تدريجياً. تتغلب على التقلبات.

تعاقب Dogecoin القرارات الاندفاعية بشكل أقسى من معظم الأصول.

لا يتداول المستثمرون العواطف

Dogecoin هي تجسيد للعواطف:

الخوف، الجشع، الميمات، الروايات الطائفية، الخيال الكوني، القبلية.

عندما تتداول العواطف، فأنت لا تملك الأصل.

الأصل هو الذي يملكك.

دوجكوين كأصل اجتماعي: لماذا تغلب الميمات على الأوراق البيضاء

اسأل المبتدئين لماذا اشتروا دوجكوين. 99٪ منهم لن يذكروا إنتاجية البلوك تشين، أو نماذج اللامركزية، أو اقتصاديات التوكن. سيقولون:

"لأن الجميع كان يتحدث عنها. لأن ماسك يحبها. لأنها مضحكة."

الفكاهة ليست عيبًا في Dogecoin — إنها المحرك.

إذا كان Bitcoin هو الذهب الرقمي، و Ethereum هو نظام تشغيل لامركزي، و Solana هو جهاز توجيه مالي عالي السرعة، فإن Dogecoin هو أول أصل مدعوم برأس المال الاجتماعي وحده:

ليس بالرمز،

بل بالثقافة؛

ليس بالفائدة،

بل بالسرد؛

ليس بالإجماع،

بل بالاهتمام.

لهذا السبب يرفض Dogecoin أن يموت.

القصص التي جعلت Doge خالدًا

NASCAR

أصبح Dogecoin أول عملة ميمية ترعى سباق NASCAR حقيقي. انطلق السائق جوش وايز على المضمار مع صورة Doge ضخمة ملصقة على غطاء المحرك.

المصدر: GoMining.com

لم تكن هذه حيلة تسويقية. كانت إعلانًا:

”نحن موجودون في العالم الحقيقي.“

في اللحظة التي لامس فيها الميم الأسفلت، تجاوزت Dogecoin حدودًا نفسية لم تستطع أي ورقة بيضاء تجاوزها.

اقتصاد البقشيش على Reddit

كانت Dogecoin أول عملة مشفرة تُستخدم كعملة للامتنان. اكتب تعليقًا مضحكًا — احصل على بقشيش. ساعد شخصًا — احصل على DOGE.

حوّلت نقل القيمة إلى تصفيق. ليس من أجل الربح — بل من أجل المشاركة.

موسك والمريخ

قال إيلون موسك ذات مرة:

”قد تكون Dogecoin عملة المريخ“.

لا أحد يهتم بما إذا كان ذلك مجديًا من الناحية الاقتصادية. ما يهمهم هو أن الأمر يبدو جنونيًا بما يكفي ليكون حقيقيًا.

لا يشتري الناس DOGE من أجل الصرامة المالية. يشترونها من أجل امتياز الانضمام إلى مزحة قد تصبح تاريخًا.

المصدر: GoMining.com

كيف تقرأ Dogecoin في عام 2026: ليس كعملة، بل كجمهور

Dogecoin ليست مجرد أصل. إنها مرآة سلوكية. إنها تكشف كيف تعمل الأسواق عندما يصبح المنطق اختياريًا والثقافة رأس مال. تقلب العملة ليس عشوائيًا — إنه رد فعل. إنه يعكس التقلبات الجماعية في المزاج: الإثارة، القبلية، عبادة الأبطال، والشعور المثير بالانتماء إلى شيء سخيف ولكنه ذو مغزى.

تُعلّم دوجكوين درسًا يتجاهله معظم المستثمرين: السوق لا يكافئ المعرفة — بل يكافئ التوقيت. الحشد لا يطارد الأساسيات — بل يطارد المشاعر.

إذا فهمت ذلك، ستتوقف عن التعامل مع DOGE على أنها ميم وستبدأ في قراءتها على أنها خريطة لعلم النفس البشري.

دوجكوين كظاهرة اجتماعية: الثقافة فوق الكود

يسأل التمويل التقليدي: ما المشكلة التي يحلها هذا الأصل؟ تجيب دوجكوين بسؤال آخر: ماذا لو كانت القيمة نفسها هي المشكلة؟

دوجكوين يكسر القاعدة غير المعلنة للأسواق: أن المال يجب أن يكون جادًا وعقلانيًا ومدفوعًا بالمنفعة. بدلاً من ذلك، يظهر أن:

- الميم يمكن أن يتفوق على الأساسيات،

- والمزحة يمكن أن تصبح خزانة،

- والمجتمع يمكن أن يحل محل الورقة البيضاء،

- والاهتمام يمكن أن يحل محل المنفعة.

هذه هي القوة التخريبية الحقيقية لدوجكوين — إنه لا يحارب النظام المالي.

إنه يكشفه.

الأسئلة الشائعة

ما هي أفضل 5 توقعات وأسوأ 5 توقعات لأسعار Dogecoin لعام 2026؟

إنها توقعات تستند إلى سيناريوهات تحدد المكان الذي يمكن أن تصل إليه DOGE اعتمادًا على سلوك المستثمرين وتدفقات الاهتمام وتقدم البنية التحتية ونتائج التنظيم.

كيف يعمل هذا في العملات المشفرة؟

لا يتبع سعر Dogecoin دورات الابتكار. إنه يتبع دورات عاطفية. في العملات المشفرة، يمكن أن تعمل الروايات مثل المرافق.

ما هي المزايا والمخاطر؟

الميزة: Dogecoin يجذب الانتباه بشكل أفضل من أي أصل آخر.

المخاطر: الانتباه هش — بمجرد أن يتحول، ينهار DOGE بسرعة.

كيف أستخدم هذه التوقعات في عام 2025؟

ليس كنبوءة. كدليل. أنت تستعد للنتائج، لا تتشبث بواحدة منها.

ما هي المقاييس المهمة؟

السيولة، والمشاركة الاجتماعية، وتدفقات التبادل، ونمو المستخدمين، وبصمة Musk في مجال الاتصالات.

هل يمكنك كسب المال من DOGE؟

نعم — ولكن فقط إذا توقفت عن التفكير كالمقامر. لا يتعلق الأمر بأن تكون على صواب. يتعلق الأمر بعدم الوقوع في الخطأ في الوقت الخطأ.

ما الأخطاء التي يرتكبها المبتدئون؟

الدخول في ظل الضجة الإعلامية، والخروج بدافع الخوف، وخلط الميمات باليقين، والتفكير بأن DOGE مدين لهم بأي شيء.

كيف يؤثر DOGE على سوق العملات المشفرة؟

إنه يثبت أن السوق يكافئ الإيمان على المنطق، والرواية على الرياضيات.

ماذا يتوقع الخبراء لعام 2026؟

سوق مستقطب: إما أن يصبح DOGE وسيلة دفع لـ X — أو يتلاشى خلف الميمات الأحدث.

أين يمكن متابعة التحديثات؟

منصات بيانات السوق، وأدوات قياس الثقة، وموجز وسائل التواصل الاجتماعي لإيلون ماسك — نعم، بجدية.

تحذير ضروري

من المغري النظر إلى Dogecoin والتفكير:

”هذه متعة غير ضارة مع جانب إيجابي.“

هذه هي بالضبط الطريقة التي تتشكل بها الفقاعات.

العملات المشفرة ليست كازينو فقط عندما تفهم اللعبة. بالنسبة لجميع الآخرين، فهي كذلك. Dogecoin تطمس الخط الفاصل بين الثقافة ورأس المال بشكل مقنع لدرجة أن الناس ينسون حقيقة مزعجة واحدة: الأسواق المدفوعة بالعواطف تكون رائعة في طريقها إلى الصعود

وقاسية في طريقها إلى الهبوط.

إذا استثمرت أموالاً لا يمكنك تحمل خسارتها، فأنت لا تستثمر — بل تراهن بمستقبلك على نكتة. هذا لا يعني أنه لا يجب عليك المشاركة. بل يعني أنه يجب عليك المشاركة وأنت واعٍ.

العملات الميمية لا تدمر المحافظ الاستثمارية. الناس هم من يفعلون ذلك — عندما يخلطون بين الترفيه واليقين.

ملخص

دوجكوين ليست عملة مشفرة. دوجكوين هي مرشح. وهي تظهر:

- أن القيمة يمكن أن تكون عاطفية، وليست هيكلية

- أن الميمات يمكن أن تتفوق على التكنولوجيا

- أن الاهتمام يمكن أن يتفوق على الأساسيات

- أن الثقافة يمكن أن تحدد أسعار الأصول بشكل أفضل من جداول البيانات.

في غضون عشر سنوات، قد لا يسأل الناس:

”لماذا تبلغ قيمة دوجكوين كل هذا المبلغ؟“

قد يسألون:

”لماذا اعتقدنا أن المال يجب أن يكون أمرًا جادًا؟“

ماذا تفعل بعد ذلك

إذا وصلت إلى هذه المرحلة، فأنت لم تعد تقامر — بل بدأت في بناء نظام.

احفظ هذا المقال كإطار عمل للتعامل مع أفضل 5 توقعات وأسوأ 5 توقعات لأسعار XRP لعام 2026. ارجع إليه بعد شهر، وقارن البيانات الجديدة عن تدفقات ETF و TVL والنشاط على السلسلة وأسعار XRP مع السيناريوهات التي قمنا بتفصيلها هنا — وانظر أي منها يتجه إليه السوق.

في المواد القادمة من Crypto Academy، سنغطي:

- كيفية قراءة البيانات على السلسلة لـ Ethereum دون تعقيد الحسابات الرياضية،

- كيف تعيد تدفقات ETF تشكيل دورات السوق،

- كيف يبني ”المال الذكي“ (الحيتان، الصناديق، البروتوكولات) الاتجاهات في ETH والأصول الأخرى.

تابع Crypto Academy واحصل على إمكانية الوصول إلى دورة العملات المشفرة والبيتكوين — فهي تظل مجانية بينما لا يزال معظم السوق ينتظر ”الدخول المثالي“.

Telegram | Discord | Twitter (X) | Medium | Instagram

January 24, 2026