Market Analysis with Mike Ermolaev

Welcome to the 18th edition of GoMarket Weekly, presented by Mike Ermolaev, a veteran crypto market analyst. For our latest update, we've got details on Bitcoin's recent valuation nose-dive, as well as Ethereum whales moving amidst ETF anticipation. Also, we’ll look into crucial regulatory developments, as well as notable trends in the Bitcoin mining sector. Let's GoMarket!

Bitcoin Rebounds After Powell’s Statements

Bitcoin traded within a weekly range of $54,092 to $59,322 this past week. Despite the recent downturn, it showed signs of recovery following comments from Federal Reserve Chairman Jerome Powell. During a Senate Banking Committee hearing, Powell mentioned that the U.S. economy is no longer "overheated" and that the labor market has "cooled considerably" over the past two years. These factors support a potential easing of monetary policy as inflation indicators improve, making a case for lower interest rates. After these statements, the largest crypto by market cap gained 1.3% to reach $58,239 that day and $59,359 the next day before retracing to current levels around $57K.

Resilient Long-Term Holders vs. Pressured Short-Term Holders

According to Glassnode, Bitcoin plunged below its 200-day moving average (DMA) and caused significant unrealized losses for many short-term investors. A 26% price retracement from the all-time high (ATH) resulted in over 2.8 million BTC becoming unprofitable. Despite this significant drawdown, it remains relatively shallow compared to past cycles. The market experienced six daily drawdowns that exceeded the one-standard-deviation mark, indicative of reduced volatility and a robust market structure as Bitcoin matures as an asset class.

The current cycle has recorded the deepest correction since late 2022, yet the magnitude of losses remains subdued relative to the market size. The report highlights that short-term holders have been under pressure, with their realized losses totaling $595 million during the week ending July 8th. However, long-term holders remain resilient, with only 36% of capital flows across the Bitcoin network attributed to loss-taking events, suggesting a more stable market, with fewer severe capitulation events compared to previous cycles.

Bitcoin ETF Inflows Show Sustained Investor Interest

Below the surface of a volatile price environment, we see steady inflows into spot Bitcoin ETFs, a sign of ongoing institutional interest and confidence in Bitcoin as an asset class. According to Farside data, from July 5th to July 11th, the total inflows amounted to $997.3 million, with the highest inflows observed on July 8th ($294.8 million) and July 5th ($143.1 million), driven primarily by ETFs like IBIT and FBTC. During the same period, the total outflows were $116.7 million, with GBTC experiencing the largest single-day outflow of $37.5 million on July 9th. Overall, this period reflected strong investor interest across various Bitcoin ETFs.

Germany's BTC Sales Are a Standard Practice for Seized Assets

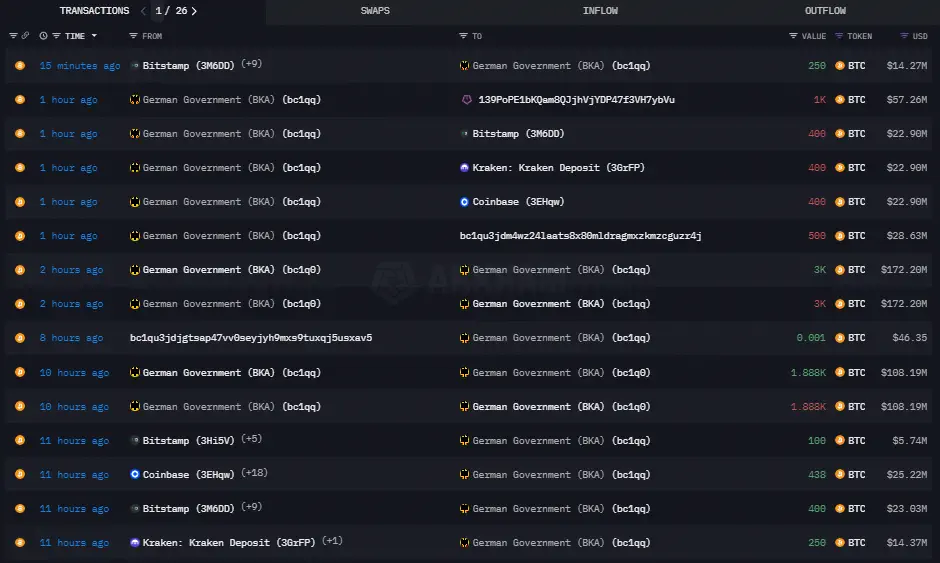

The government of Germany's state of Saxony has been selling the 50,000 bitcoins it confiscated from online film piracy platform Movie2K in January. It recently moved 2,700 bitcoins to centralized exchanges and OTC services. On July 12, 2024, the government transferred 500 BTC to an OTC address and 400 BTC each to Coinbase, Kraken, and Bitstamp. Additionally, 1,000 BTC were sent to B2C2 Group. Previously, 4,169 BTC were returned to it from Bitstamp, Coinbase, and Kraken, likely due to unsuccessful sale attempts. The government now has around 6,644 bitcoins left to sell.

This sale strategy has faced criticism from Bitcoin advocates, however Lennart Ante, co-founder and CEO of Blockchain Research Lab, clarified that this is a standard procedure for managing seized assets and not a reflection of investment strategy failures.

Source: ArkhamIntelligence

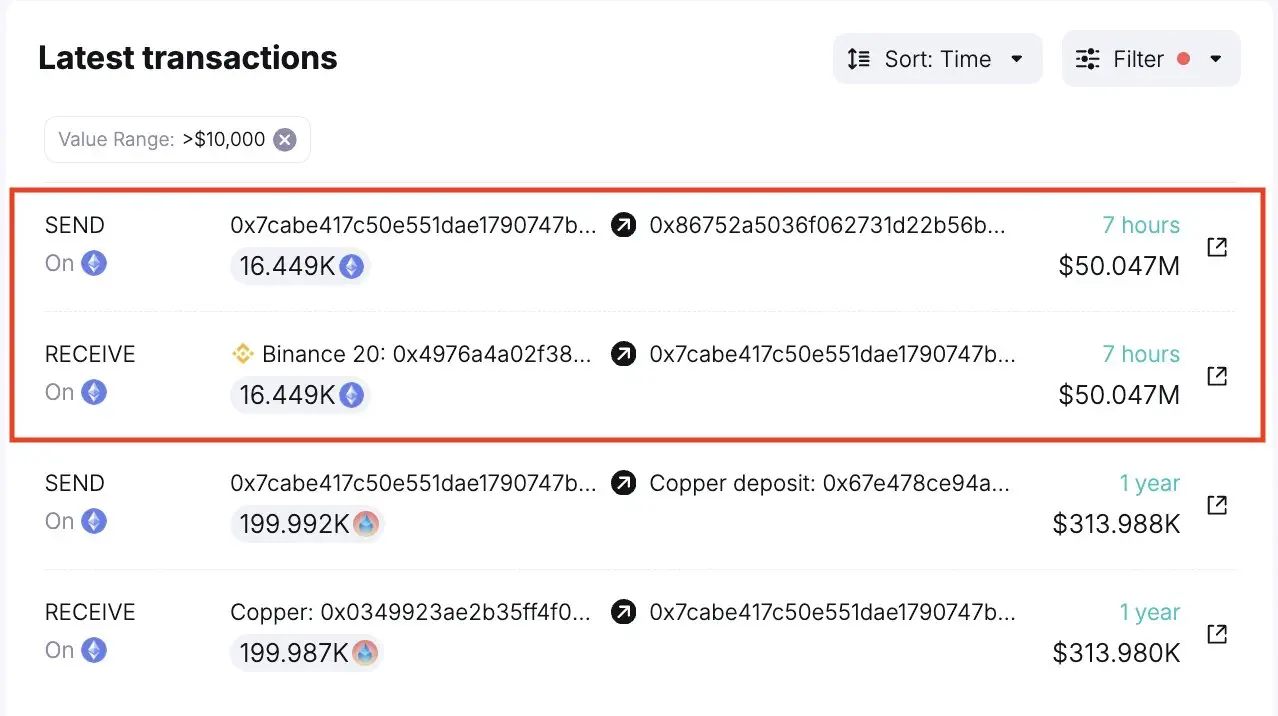

Ethereum Whale Activity and Staking Confidence Amid ETF Optimism

Ether (ETH) traded within a weekly range of $2,847 to $3,184 as a significant Ethereum whale has made notable moves by transferring 50,000 ETH, according to Spot On Chain. This whale accumulating Ether ahead of a spot ETF launch is definitely spreading optimism among those long on the asset.

Meanwhile, Julio Moreno of CryptoQuant highlighted that the total staked ETH has reached nearly 33.3 million, accounting for 27.7% of the total supply, underscoring the growing confidence in Ethereum's staking mechanism.

Catherine Dowling, CCO of Bitwise, noted that the approval of ETH-ETFs is nearing completion, with the SEC requiring fewer amendments to the S-1 filings. Also, one of the issuers told The Block it anticipates the next message from the agency will include valuable information about the launch.

Polymarket bettors are currently giving a 88% chance of ether ETFs being approved by July 26, showing high market optimism.

Source: Polymarket

Bitcoin and Ethereum Classified as Digital Commodities

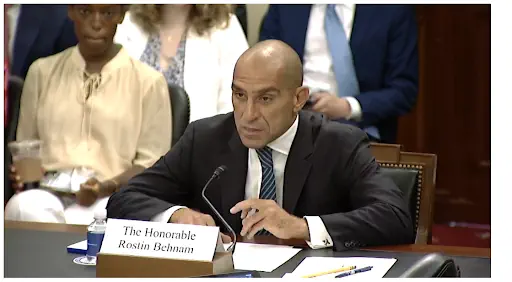

In a regulatory victory for the largest cryptocurrencies by market cap, Bitcoin (BTC) and Ethereum (ETH) were officially classified as digital commodities, during Wednesday’s Digital Commodities Senate AG hearing.

“Just last week, a District Court in the Northern District of Illinois entered summary judgment in favor of the CFTC in a case involving fraud by an unregistered entity that promised steady returns in digital asset commodities such as Bitcoin and Ether.In its decision, the court re-affirmed that both Bitcoin and Ether are commodities under the Commodity Exchange Act,” Rostin Behnam, Chairman of the Commodity Futures Trading Commission, said.

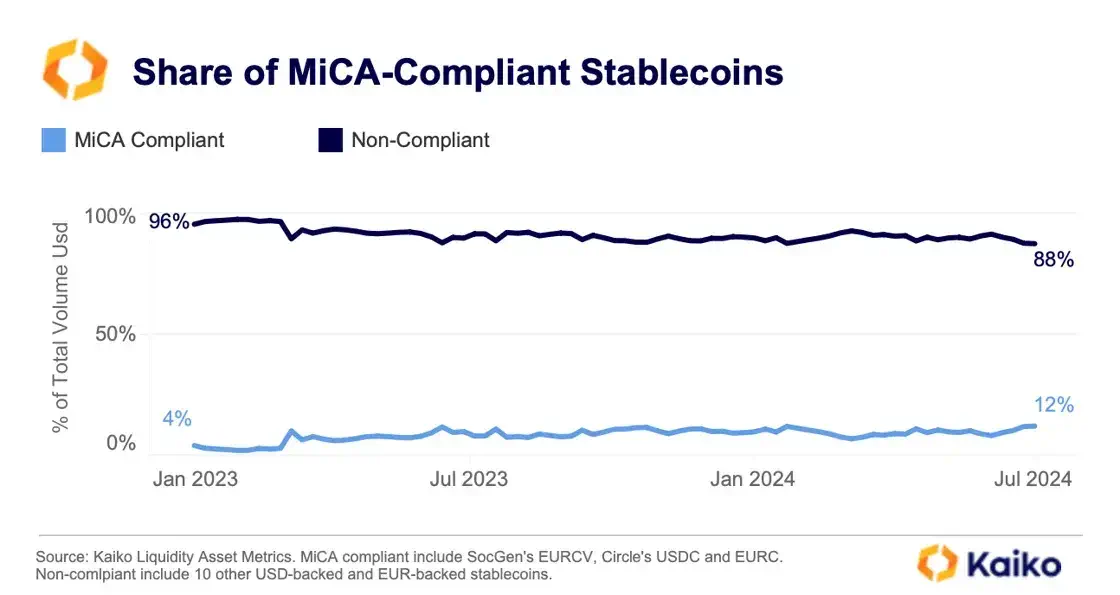

USDC Demand Surges Post-MiCA Compliance

Meanwhile, Kaiko Research's latest report highlights that Circle's USDC has seen a surge in demand following compliance with the European MiCA regulation. Since June 30, USDC's weekly trading volume increased to $23 billion in 2024, up from $9 billion in 2023. This rise highlights the growing preference for regulated stablecoins, with non-compliant stablecoins currently accounting for 88% of the market. Major exchanges like Binance and Kraken have begun delisting non-compliant stablecoins, further boosting USDC's market share, which now exceeds 90% on centralized exchanges.

Source: Kaiko Research

Donald Trump to Speak at Bitcoin 2024 Conference

Another significant development could attract major attention and influence public perception of Bitcoin: Donald Trump is set to speak at the Bitcoin 2024 conference in Nashville at the end of the month, according to event organizers. With this latest leap forward, Bitcoin has officially entered the primetime spotlight, with its mainstream awareness soaring skyward.

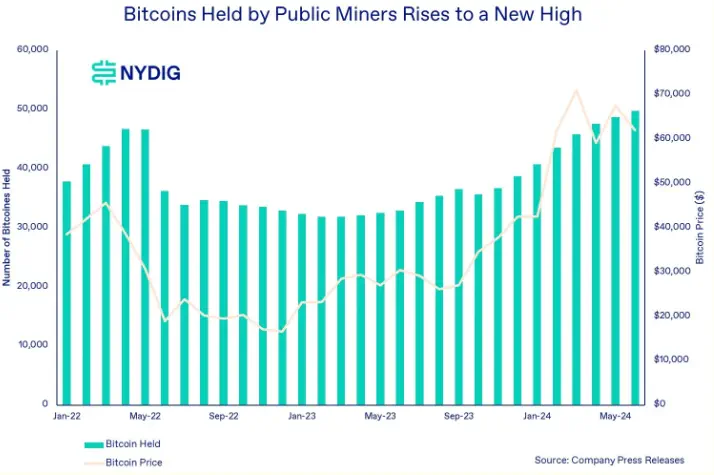

Public Miners Increase Bitcoin Holdings Contrary to Market Assumptions

NYDIG indicates that publicly listed mining companies increased their Bitcoin holdings in June, as opposed to the belief that they have been selling off their BTC holdings. Greg Cipolaro, head of research at NYDIG, noted that while public miners saw a slight increase in sales month-to-month (71 BTC), the overall balances on their balance sheets continue to grow, surpassing their 2022 highs. Apparently, this is strategic accumulation by miners as they are stockpiling their assets for the price surge they know is coming.

Source: Nydig.com

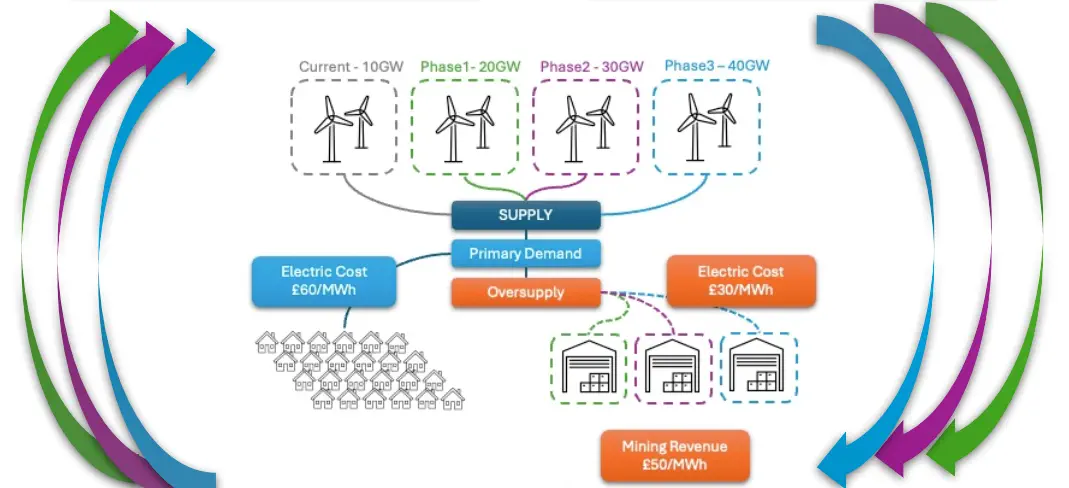

Bitcoin Mining as a Solution for UK’s Renewable Energy Challenges

The report by Bitcoin Policy UK, a Bitcoin (BTC) advocacy organization, emphasizes that Bitcoin mining can help stabilize the UK's energy grid by providing a flexible demand response for renewable energy. Come 2030, the UK hopes to be generating a substantial 50 gigawatts of electricity from offshore wind farms. And by 2035, the aim is to have 70 gigawatts of solar energy feeding the grid. Bitcoin mining can utilize the projected 72 TWh of annual energy oversupply by 2030, creating around £2 billion in annual revenue from green energy that would otherwise be wasted.

Source: Bitcoinpolicy.uk

Conclusion

In this edition of GoMarket Weekly, we’ve learned that despite Bitcoin's recent correction and short-term holder losses amounting to $595 million, long-term holders remain resilient. Ethereum's market optimism has been buoyed by whale activity and nearing ETF approvals. Also, crypto's evolving story is written in the demanding rhythm of USDC appetite and fresh regulatory classifications. Sustainable integration is no pipe dream for the UK's renewable energy sector, thanks to Bitcoin mining, which exhibits remarkable possibility. You won't want to miss our next batch of exclusive analysis, dropping next week!

July 12, 2024