Market Analysis with Mike Ermolaev

In this 24th installment of GoMarket Weekly, Mike Ermolaev, our resident crypto analyst, gives the GoMining community the lowdown on what's happened to Bitcoin since the 2022 bear market downturn, zooming in on how different types of holders are feeling the impact. Recent market signals, Ethereum's latest developments, institutional investors’ activity, and crypto-related political trends are also worthy of our attention this week, as is the Bitcoin mining space.

Bitcoin Dominance Soars, LTHs Profits Rise, and STHs Overreact

The price of Bitcoin has fluctuated between $57,918 and $61,524, over the past week. According to the latest Glassnode report, since the bear cycle ended in November 2022, Bitcoin's market dominance has surged from 38.7% to an impressive 56.2%, reflecting a significant shift of capital towards the leading digital asset.

Source: Glassnode

Meanwhile, long-term Holders (LTH) have maintained strong conviction, accumulating Bitcoin steadily and locking in an average daily profit of $138 million with a +75% profit margin.

Despite the market's choppy conditions, healthy buy-side demand appears to be reining in price instability, fostering a more stable environment.

Source: Glassnode

In contrast, Short-Term Holders (STH) are facing substantial financial pressure, with the STH-MVRV Ratio and STH-SOPR both dipping below 1.0, highlighting realized losses among these investors. This suggests a potential overreaction, particularly as the market sold off below $50k. The current bull market corrections have seen only a slight deviation between the spent and holding cost basis, supporting the argument that the market may have reacted prematurely. While pressure's mounting, the scale of losses remains modest – a sign the market could be leveling out, and a recovery might be on the horizon.

Bullish Sentiment Seen in Election-Linked Bitcoin Options and BTC Futures

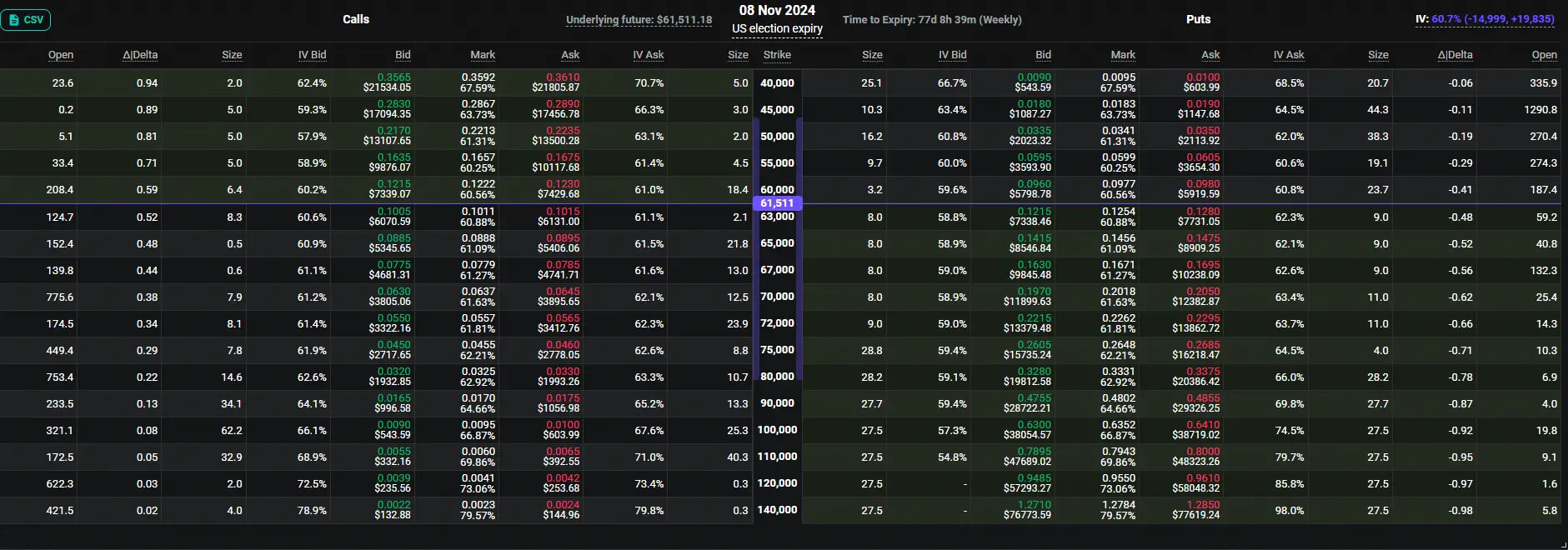

The crypto market has seen a surge in election-linked Bitcoin options, reflecting traders' optimistic sentiment post-U.S. elections. Wintermute, an algorithmic trading firm, reported that the current put-call ratio of 0.50 indicates a bullish market outlook, with twice as many calls being traded as puts. In total, traders have locked in nearly $345 million in Bitcoin options set to expire four days after the November 4 elections.

These election-linked options, which began trading on Deribit on July 18, have garnered significant interest, with call options accounting for 67% of the total open interest. Among these, the most popular call option has a strike price of $60,000, with an open interest of 18.4 contracts and a bid price of $7,339.07. This is closely followed by the $70,000 and $80,000 strike prices, which have also seen strong interest, with open interest of 13.3 and 11 contracts, respectively, and bid prices of $4,727.75 and $3,032.20. The concentration of call options at higher strike prices, ranging from $70,000 to $140,000, indicates that traders are positioning for potential new record highs around the election period.

On the other hand, the put options have also seen substantial activity, with the $45,000 strike price leading the pack with an open interest of 44.3 contracts and a bid price of $1,087.27. This suggests that while the market sentiment is generally bullish, there is still a degree of hedging or downside protection among traders as the elections approach.

Source: Deribit

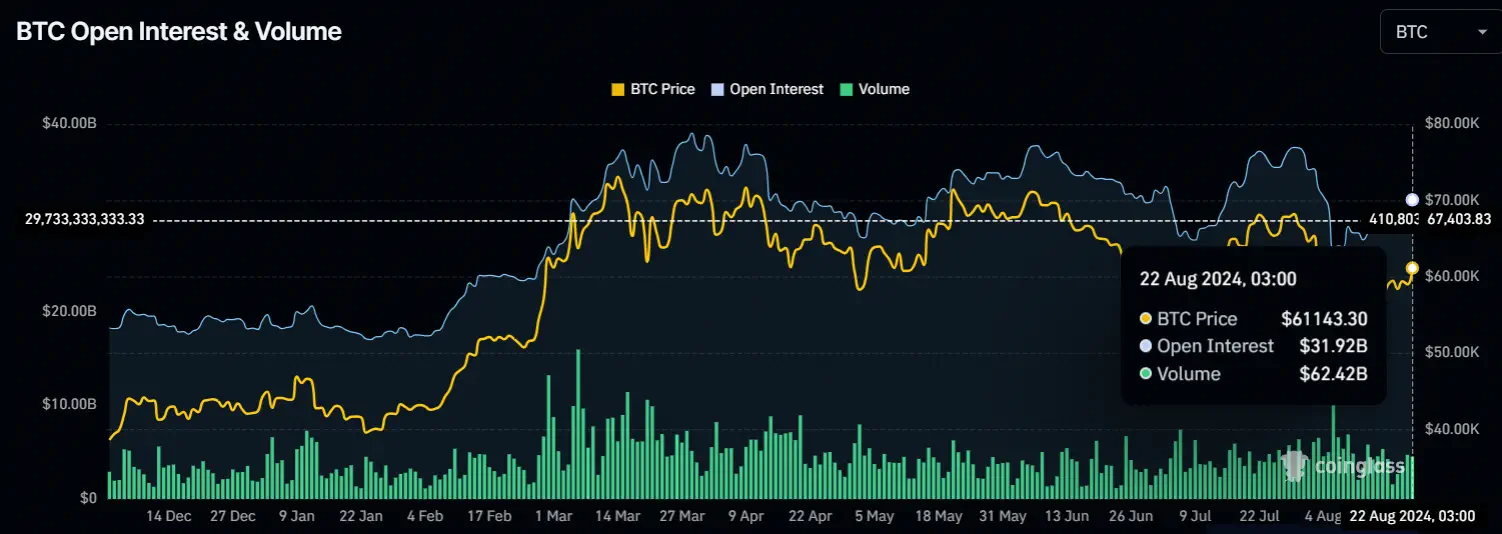

Buoyed by renewed optimism following the release of the Federal Open Market Committee minutes, which suggested a more dovish policy direction, Bitcoin futures open interest skyrocketed from $30.21 billion to $31.92 billion.

Source: CoinGlass

Market Resilience Amid Mt. Gox Transfers

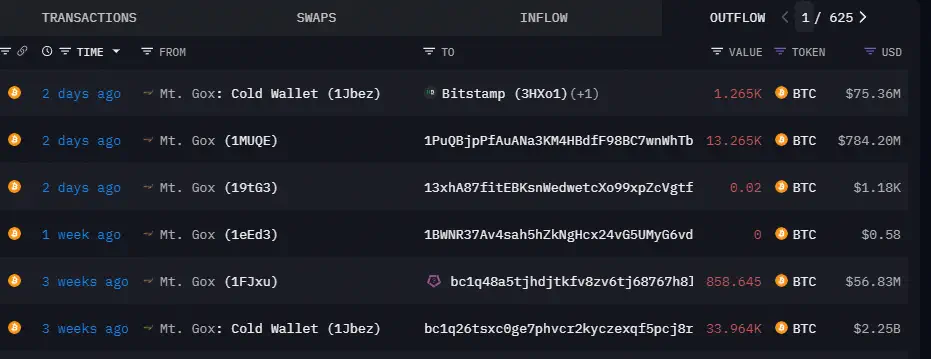

Despite recent sell-side pressures, including the transfer of 13,265 BTC (valued at $807.58 million as of this writing) from Mt. Gox to an unknown address, the market remains resilient. This resilience is particularly notable given the significant outflows from Mt. Gox’s cold wallet, including a recent transfer of 1,265 BTC ($75 million) to the crypto exchange Bitstamp to facilitate creditor repayments.

Source: ArkhamIntelligence

Market experts, such as Alex Thorn, do not anticipate significant selling pressure from these activities. Thorn, the head of research at Galaxy Digital, noted that out of the 13,265 BTC recently moved, only 1,265 BTC is intended for distribution, while the remaining 12,000 BTC has been moved to fresh cold storage, suggesting a limited immediate impact on the market.

Moreover, as highlighted in GoMarket Weekly #22, a recent survey reveals that the majority of Mt. Gox creditors plan to hold onto their assets rather than sell them upon receipt, further alleviating potential market pressure.

Buterin's Post Boosts Price Amid Market Share Decline and Mixed ETF Flows

Vitalik Buterin recently sparked a surge in Ethereum's price with his X post, which humorously acknowledged the need for more bullish sentiment in the Ethereum community, leading to a 2.76% price increase within 30 minutes. Buterin later commented on the post's impact, noting, "Defeated the 11,700-word blog post on all three engagement metrics in three minutes".

Nevertheless, over the longer term, Ethereum's overall market share has seen a decline. According to the above-mentioned Glassnode report, Ethereum's market dominance has decreased by 1.5%, from 16.5% to 15.2%, though it has remained relatively stable over the past two years.

Another noteworthy analysis comes from Galaxy Digital's report, "150 Days After Dencun," which offers detailed insights into the recent economic impact of Ethereum's EIP-4844 upgrade. While the upgrade has significantly improved the economics of rollups — reducing operating costs and increasing profit margins for optimistic and zero-knowledge rollups — Ethereum's revenue from rollups has dropped by 69%, with ETH burned declining by 84% compared to pre-Dencun levels. As demand for blobs surges, a cloud of uncertainty looms over Ethereum Layer 1, sparking concerns about its long-term viability.

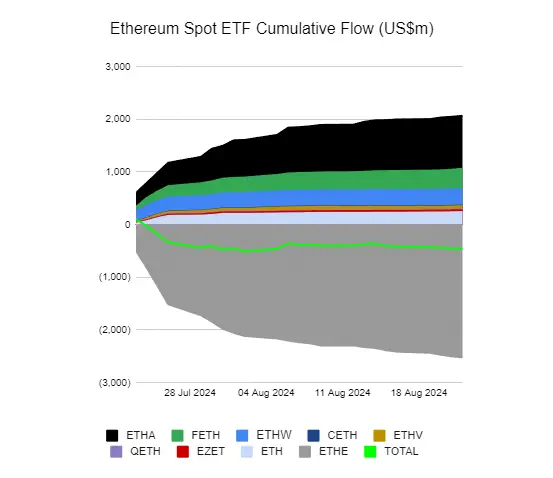

On the institutional front, there has been a mixed performance among Ethereum ETFs during the period from August 16-23, 2024. According to Farside Investors data, BlackRock's Ethereum ETF (ETHA) led the inflows with a net increase of $37.1 million, followed by Fidelity's ETF (FETH) with $29.4 million and Bitwise's ETF (ETHW) with $5.6 million. However, not all funds fared well—Grayscale's Ethereum Trust (ETHE) saw a significant outflow of $135.9 million, reflecting investor caution despite the broader market's resilience. Additionally, VanEck's ETF (ETHV) experienced a smaller outflow of $3.8 million.

Source: Farside Investors

End of Miner Capitulation & Rising Mining Profitability

According to the latest CryptoQuant analysis, the Hash Ribbons indicator has signaled the end of Bitcoin miners' capitulation, suggesting a reduction in selling pressure from this cohort. The indicator, which tracks the moving averages of the Bitcoin hashrate over monthly and bi-monthly periods, has shown a positive crossover, marking the first time this has occurred since the April halving. Although the indicator is not designed to pinpoint the exact price bottom, it is considered a "significant and healthy signal" as it has historically been a reliable precursor to market uptrends, as it signals the end of financial stress within the mining community and a potential stabilization or increase in Bitcoin's market value.

Source: CryptoQuant

Furthermore, the Bitcoin Hashprice Index, specifically measuring the revenue earned by miners in USD per petahash per day (USD/PH/Day) revealed a relatively stable trend with minor fluctuations between $42 and $45 USD/PH/Day over the past week. However, on August 22, 2024, there was a sharp increase, with the hashprice spiking to $52.89 USD/PH/Day. This significant rise suggests the mining sector is finally getting a break, mobilizing investors to pump in funds for mining equipment and contribute to network stability.

Harris' Supports Crypto, Gensler's Potential Appointment Looms

A crucial about-face is taking place in the U.S. cryptocurrency landscape, now that Kamala Harris' team has expressed her commitment to the industry. A representative from Harris' team said she plans to create an environment that fosters "further growth of new technologies and industries like this one", sparking interest within the crypto community.

However, this optimism is tempered by concerns over Harris' potential appointments. The Washington Reporter, citing insider sources, claimed Harris is considering SEC Chairman Gary Gensler for Treasury Secretary if she takes the Oval Office. With Gensler at the helm, crypto companies fear his abrasive approach to regulatory policies might just squeeze the life out of the industry. However, when the news broke, many people in the industry were skeptical, brushing it off as just another rumor.

Closing Thoughts

In summary, this week's analysis shows a complex but promising picture for Bitcoin and the broader crypto market. Bitcoin's dominance has surged to 56.2% since the end of the 2022 bear market, with long-term holders reaping significant profits, while short-term holders face losses, potentially due to overreactions. Ethereum, despite a short-term price boost from Vitalik Buterin's bullish post, has seen its market share slip slightly, and the EIP-4844 upgrade has led to a decline in revenue, even as institutional interest remains strong with BlackRock's ETF leading inflows. Miners are finally seeing some relief, as evidenced by the rising Bitcoin Hashprice Index, signaling a renewed wave of confidence across the industry. However, uncertainty lingers in the U.S. political landscape, where Harris' support for the crypto industry is tempered by speculation about a potential appointment of SEC Chairman Gary Gensler as Treasury Secretary.

Stay tuned for next week's update where Mike'll analyze what's brewing in the market and identify new trends before they materialize.

August 23, 2024