Market Analysis with Mike Ermolaev

Mike Ermolaev, a crypto market expert and journalist, is back with the 19th edition of GoMarket Weekly to delve into the driving trends and what you need to know about the current crypto market. This week we're in for a close-up look at Bitcoin's local bottom, Ethereum's promising ETF developments, some frustrating hacking incidents, as well as significant legal, regulatory, and political news relevant to crypto. Let’s GoMarket to find out!

Bitcoin Large Sellers Exhausted, Positive Momentum Ahead

This week's trading range for Bitcoin, between $56,930 and $65,866, reflected a period of heightened volatility. On-chain indicators, however, show that Bitcoin has likely reached a local bottom as large sellers have exhausted their selling power. According to the CryptoQuantreport, traders’ unrealized margins have improved to -5.7% from a low of -17% last week, the worst since the aftermath of the FTX exchange collapse in November 2022. Historically, prices have bottomed out when traders' profit margins reach highly negative levels. This indicates a possible upward momentum for Bitcoin.

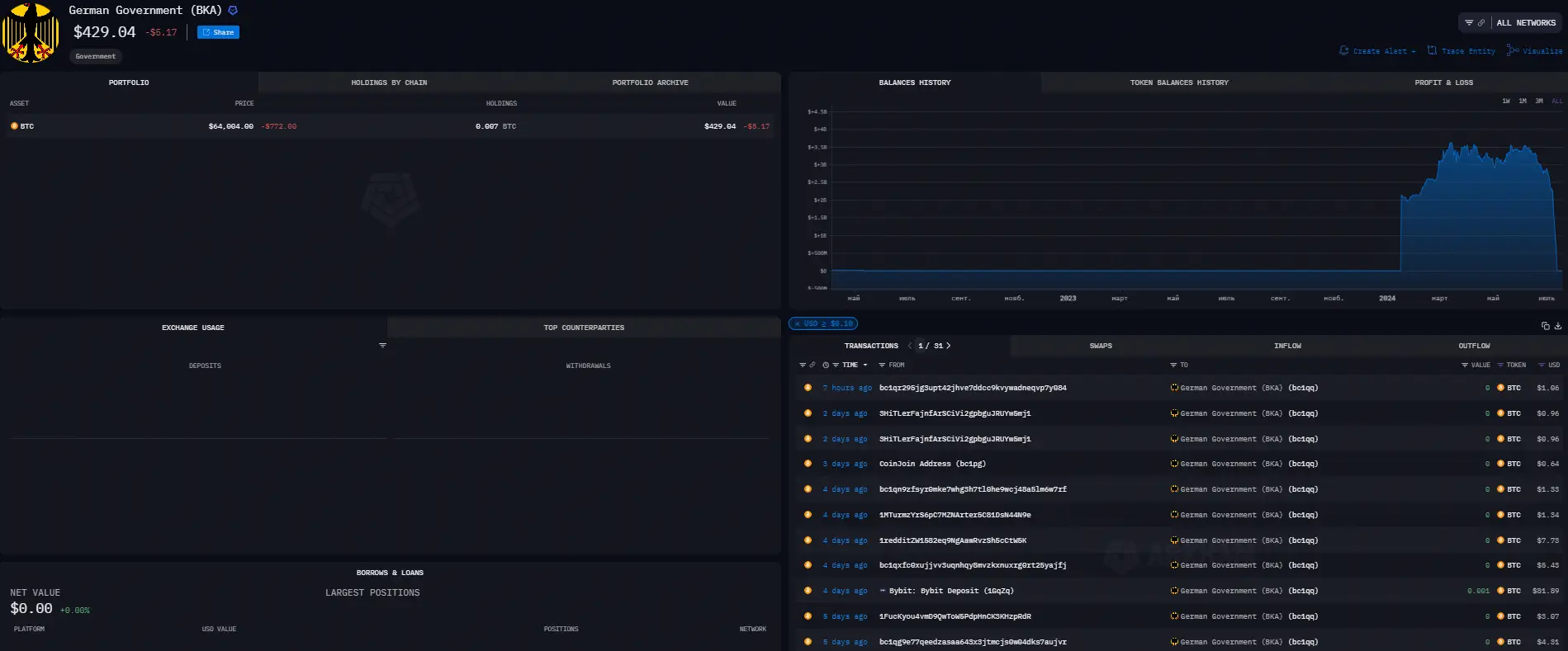

Prices may have hit their lowest point following the final sale of 49,858 bitcoins by the German government. According to a press release from German law enforcement, reported by Decrypt, the government concluded its Bitcoin liquidation on Friday, raising €2.6 billion ($2.88 billion). The prosecutor's office clarified "The proceeds do not initially represent any additional income for the Free State of Saxony, but are held in custody until the criminal proceedings have finally concluded." It added that the sale was carried out “in a way that was fair and gentle on the market.”

Source: ArkhamIntelligence

This finished sell-off has led to a reduction in its negative market impact, paving the way for a price recovery.

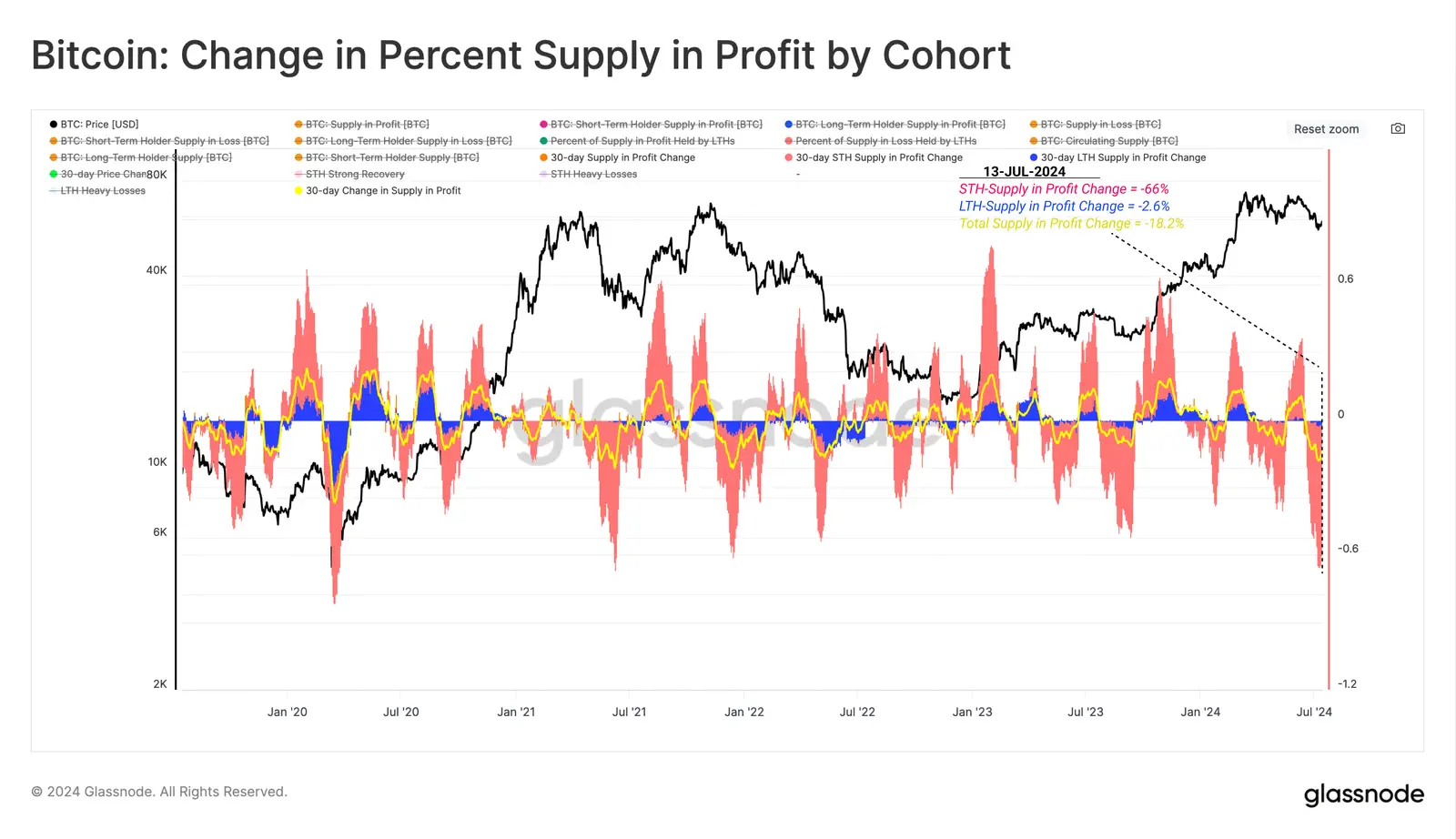

Glassnode supports this perspective, stating that there seems to be near-term sell-side relief, and meanwhile, a cluster of new buyers is stepping in to revitalize the market.

According to it, centralized exchanges and ETF custodians currently hold the largest portions of Bitcoin, with US ETFs alone holding 887,000 BTC. Despite a 25% market correction from recent highs, long-term holders remain largely unaffected, whereas short-term holders have seen over 66% of their supply now at an unrealized loss. This means that seasoned investors are holding firm to their convictions, but the recent market uncertainties have certainly made things difficult for those with shorter horizons.

Source: Glassnode

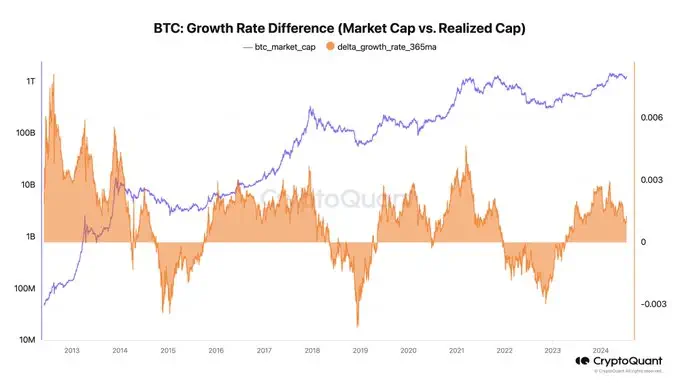

Recently, there have also been concerns about the impact of Mt. Gox's Bitcoin sales on the market. They appear exaggerated, according to CryptoQuant CEO Ki Young Ju. He noted that market cap growth is surpassing realized cap growth, and despite $224 billion being sold since 2023, the price has surged by 350%. Even if Mt. Gox sells $3 billion; it represents only 1% of the realized cap increase during this bull cycle, indicating that the market has sufficient liquidity to absorb it.

Among his other observations, over-the-counter (OTC) markets continue to overshadow centralized exchange (CEX) markets. Whale wallets holding over 1,000 BTC, including spot ETFs and custodial wallets, have accumulated 1.45 million BTC this year, bringing the total to 1.8 million BTC. In contrast, during 2021, approximately 70,000 BTC flowed into these wallets over the entire year; now, the influx has increased to 100,000 BTC weekly.

Source: CryptoQuant

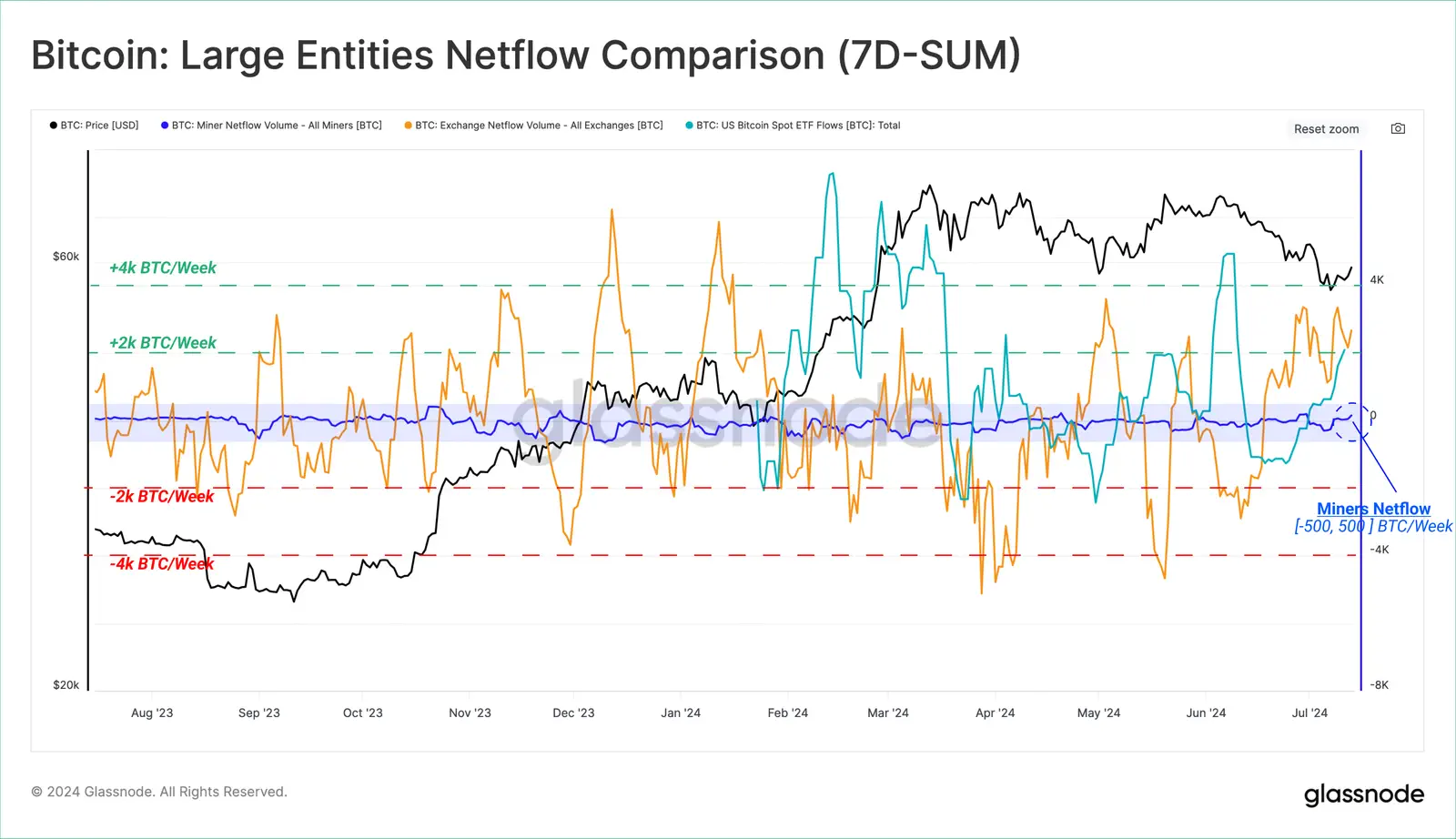

Miners' Diminished Influence on the Market

Continuing with the topic of diminishing selling pressure, miners are also in the spotlight. The Glassnode report also revealed that the influence of miner sell pressure has decreased notably since the last halving event. Currently, miner activity impacts the market significantly less compared to ETF flows and centralized exchange dynamics. Over the past 12 months, miner net flows have shown a typical aggregate balance change of around ±500 BTC per week. In contrast, centralized exchanges and ETFs often see much larger swings of ±4,000 BTC, suggesting these entities have a market influence 4 to 8 times greater than miners.

Source: Glassnode

Anticipation Builds for Spot ETF Launches

In the meantime, Ethereum (ETH) traded between $3,061 and $3,503, posting a 10% gain for the past week.

Ethereum's market dynamics are set to change with the anticipated launch of spot ETFs. Several spot Ethereum-ETFs have updated their filings with the SEC, indicating various fee structures and custodial choices. Notably, Proshares' ETF is yet to disclose its fees, while Grayscale has aligned its ETH trust fees with its Bitcoin trust. According to Bloomberg analyst Eric Balchunas, trading of spot ETH-ETFs in the U.S. is likely to begin on July 23, sparking optimism for substantial market inflows.

Bitwise has forecasted a potential price rise above $5,000 for ETH following these launches.

Mt. Gox Hack Attempts and WazirX Breach

On the security front, creditors of Mt. Gox have reported attempted hacks on their accounts. One user detailed receiving multiple login attempt emails shortly after the rehabilitation trustee transferred BTC/BCH to Kraken on July 16, 2024. Despite having two-factor authentication (2FA) enabled, the user received five emails about login attempts, leading to concerns that someone might have their password, but 2FA prevented unauthorized access.

Additionally, Indian crypto exchange WazirX suffered a major hack, losing over $230 million, which was allegedly carried out by North Korean hackers.

Key Political and Legal Developments

Donald Trump has selected pro-crypto Ohio Senator JD Vance as his vice-presidential pick, potentially influencing future crypto-friendly policies.

In an ironic development, Senator Bob Menendez, known for his anti-Bitcoin stance, claimingthat Bitcoin "is an ideal choice for criminals" has been found guilty of bribery. October 29 is the date set for sentencing, with decades of prison looming.

Furthermore, a long-awaited resolution has been reached, as FTX and the CFTC have agreed ona $12.7 billion settlement to reimburse clients hurt by the exchange's wrongdoing. The dust has settled, and customers who lost out when the exchange crashed are finally getting some answers – and compensation – after months of intense negotiations.

Also noteworthy, on Craig Wright's personal website, a legal notice has been publisheddeclaring that he is not Satoshi Nakamoto. The clear intention behind this straightforward declaration is to quell legal battles triggered by claims of his association with Nakamoto.

Conclusion

Lastly, a distilled version of everything we've covered. Bitcoin appears to have found a local bottom as large sellers, including the German government, have exhausted their selling power. Ethereum shows promise with the anticipated launch of spot ETFs, potentially driving prices above $5,000. Despite ongoing security threats, such as the Mt. Gox hack attempts and the WazirX breach, the market remains resilient. Key political moves and legal resolutions, including a significant settlement by FTX and the CFTC and the selection of a pro-crypto VP candidate, are set to shape the regulatory landscape. Next week, we'll be serving up fresh perspectives and market analysis in our GoMarket Weekly – don't miss it!

July 19, 2024