Market Analysis with Mike Ermolaev

The past week in the crypto market was packed with Bitcoin reaching an all-time high, regulatory announcements, and shifts in market on-chain activity. Mike Ermolaev — a crypto expert, head of editorial at CryptoDaily, and Outset PR founder—will be offering his insight exclusively to the GoMining community in a series of weekly articles on the most significant crypto developments which could shape the future of the industry.

Biden's Fiscal 2025 Budget Proposal Targets Crypto Mining and Wash Trading

A good place to start analyzing the crypto market situation is looking into regulatory developments. As part of broader efforts to address environmental concerns, energy prices, and market manipulation, the administration of US President Joe Biden proposed new taxes and regulations on cryptocurrency mining. Budget proposal for fiscal 2025 includes an excise tax of 30% on the electricity costs of mining digital assets, expected to generate $302 million in its first year and $7.7 billion over a decade. Further to this, the administration is seeking to clamp down on wash trading using crypto assets by amending tax code anti-abuse rules, which should generate about $26 billion over the next decade.

In yet another example of the perpetual tug-of-war that defines US budget talks, the Biden proposal is not receiving universal applause, with Republicans fiercely pushing back, claiming it could speed up America's downturn.

Should the proposals get the green light, big shifts could be in store for the crypto scene. The most significant potential outcome could be miners grappling with rising operating expenses, which might push them to hunt down methods that are more energy-efficient or pack up and move where electricity is cheap and regulations are friendlier. Some might even stop operating in case profitability becomes too low.

EU Expands Sanctions Scope to Include Crypto

Meanwhile, the European Union is not far behind, with new laws that tighten the grip on sanctions violators by including cryptocurrencies in the legal framework. Under these new rules, the definition of what counts as a violation of sanctions is broadened, making it clear that activities ranging from ignoring freeze orders on funds to dealing with sanctioned entities are prohibited. This includes the world of cryptocurrencies, where providing certain services like crypto wallets to sanctioned parties will now be considered a breach of these rules, with repercussions including up to five years in jail and massive financial penalties for businesses. For the crypto sector, this unmistakably signals it’s increasingly being swept into the vortex of regulated fiscal activities, implying that crypto service providers must significantly amp up their regulatory adherence initiatives.

Wyoming's Legal Recognition of DAOs

In the meantime, Wyoming is pulling off a major game-changer, by legally acknowledging in-state Decentralized Autonomous Organizations (DAOs). Decentralized Unincorporated Nonprofit Association Act (DUNA) is set to take effect on July 1. Gov. Mark Gordon signed a bill making Wyoming's laws more supportive of DAOs, which already had limited liability corporation status. It is now possible for DAOs to register as unincorporated nonprofit associations as well – – an understated tip of the hat to the unique nature of these entities. The influence of this law isn't limited to Wyoming—it might trigger other states, and even countries, to ponder over laws of a similar nature. Therefore, we're glimpsing at a possible alteration in the way corporations function worldwide during this age of digitization.

Bitcoin's Record High and Halving Anticipation Suggest Bullish Future

The original cryptocurrency reached an all-time peak of $73.6K on Wednesday amidst ETFs fetching a record $1 billion of net inflows on March 12, led by the iShares Bitcoin Trust of BlackRock.

This latest milestone marks a steady upward trend, with BTC’s price surging by approximately 11% over the past week and an impressive 47% over the last 30 days.

Notably, these gains come as Bitcoin prepares for the highly anticipated halving event, which naturally increases its price because of the scarcity factor. Historically, after each halving Bitcoin price skyrocketed. For example, in a year following the 2012 halving, BTC price went up by over 8k%. After the 2016 halving event, the price soared by over 2.5k%. The most recent Bitcoin price halving in 2020 saw the price hit a previous all-time high and grow by almost 600%.

As we can see, the pace of growth tends to decrease over time, but still it is there. In other words, if history is any indication, the BTC price will continue to rise, albeit at a slower rate.

Record Inflows into Bitcoin ETFs Signal Institutional Bullishness

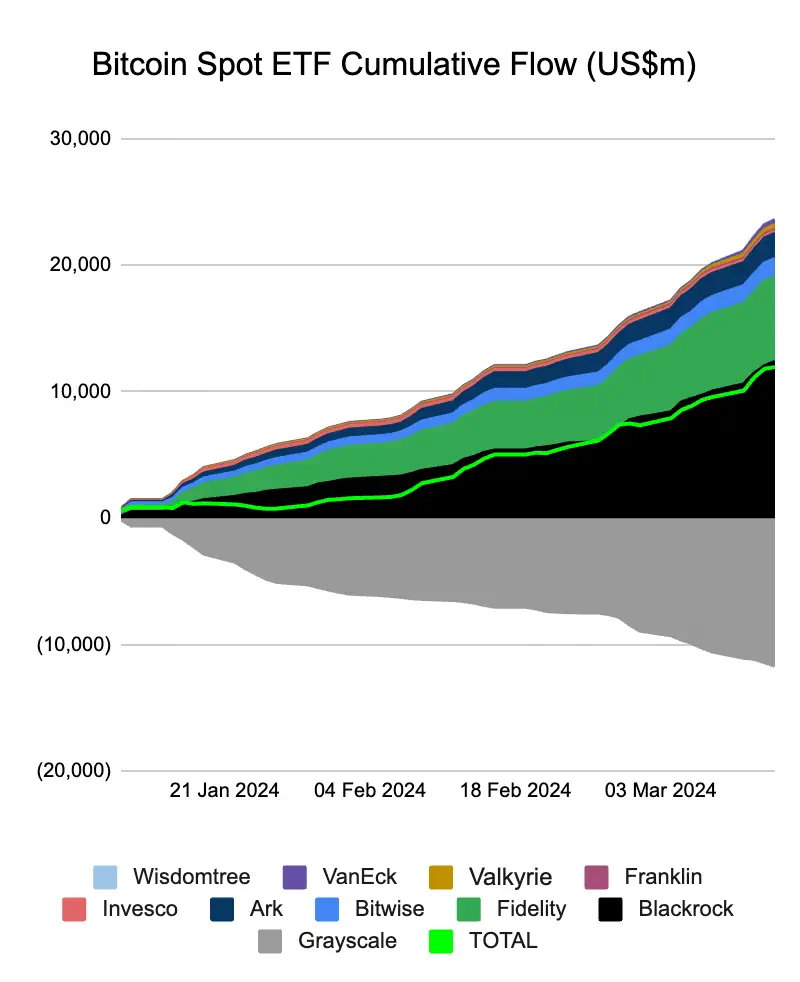

Further, among other significant factors contributing to the BTC upward trajectory are substantial inflows into spot Bitcoin ETFs and heightened institutional interest. According to Farside Investors, Bitcoin ETFs’ substantial numbers show no signs of stopping, with these investment products seeing their most significant single-day inflow exceeding $1 billion on March 12.

The total inflows into Bitcoin ETFs from March 8 to March 14, 2024, amounted to approximately $4.39 billion, where BlackRock’s iShares Bitcoin ETF (IBIT) received the lion’s share – an inflow of about $2.68 billion, the Fidelity Wise Origin Bitcoin Fund (FBTC) had an inflow of about $1.16 billion, Bitwise’s BITB saw an inflow of $88 million, ARK Invest’s ARKB received $155.8 million, Franklin Templeton’s EZBC had an inflow of $23.1 million, Valkyrie’s BRRR attracted an inflow of $58.8 million, VanEck's HODL received an inflow of $223.4 million, and Fidelity’s BTCW saw an inflow of $11.1 million.

There were outflows though. Grayscale Bitcoin Trust (GBTC) faced a significant outflow of approximately $1.41 billion, while Invesco Galaxy’s BTCO had an outflow of about $37 million. Nonetheless, the unprecedented wave of capital inflow has been historic – a phenomenon that's largely down to major investors beginning to acknowledge Bitcoin as a true asset class.

Moreover, Bitwise CIO Matt Hougan said that major institutions "representing trillions of dollars in assets" are likely to begin investing in spot Bitcoin ETFs in Q2, further underscoring the growing acceptance of cryptocurrencies by institutions.

Shift in Bitcoin Holdings: Retail Wallets Grow as Whales Decrease

Looking into on-chain data, there’s a shift in accumulation dynamics, with an increase in small Bitcoin wallet holders and a decrease in large 'whale' wallets. According to Santiment data, wallets holding less than 0.1 BTC have increased by 0.6% in the past two weeks, suggesting that more retail investors are entering the market or current investors are diversifying their portfolios. Meanwhile, those containing 0.1 to 1 BTC saw a minor decrease of 0.8% which could signal that mid-tier investors are either consolidating their positions or possibly cashing out some of their investments. Notably, larger wallets with 1k+ BTC declined by 4.9%, and wallets with 10-1k BTC dropped by 0.5%, hinting at possible profit-taking or redistribution of holdings by larger investors in response to market conditions or broader economic factors. This shift from larger to smaller wallets could also mean a decentralization of holdings within the Bitcoin network.

Soaring Bitcoin Mining Profits & US Stock Market Resilience Add to the Bullish Outlook

In terms of mining profitability, Bitcoin miners are reaping record profits. According to Blockchain.com data, daily mining rewards reached record-high $78.89 million on March 11. This surpasses the previous high of $74.4 million recorded in October 2021, reflecting the robust health of the Bitcoin ecosystem.

Also supporting a consistent upward Bitcoin trajectory, consider the US stock market, which has showcased resilience, weathering February's unexpectedly high inflation rates with a strong performance. This momentum seems rooted in a surge of liquidity, a trend that persists despite the Federal Reserve's tightening measures. Since mid-2023, increased liquidity has been aligned with rising stock prices, supporting the view that a major dip in Bitcoin or the broader crypto market is unlikely.

Ethereum ETF Outlook Dims, but Layer 2 Tokens Rally Post-Dencun Upgrade

Unfortunately, there is less optimism regarding the possibility of an Ethereum ETF. The chances of its approval have been downgraded to 35% by Bloomberg ETF analyst Eric Balchunas, adding an element of uncertainty to the market.

Even so, Layer 2 Protocol tokens are enjoying solid gains amid Ethereum's Dencun upgrade. The upgrade took place on 13 March, implementing the long-awaited EIP-4844, which introduces blob transactions, type-3, enhancing how Layer 2 solutions integrate with Ethereum.

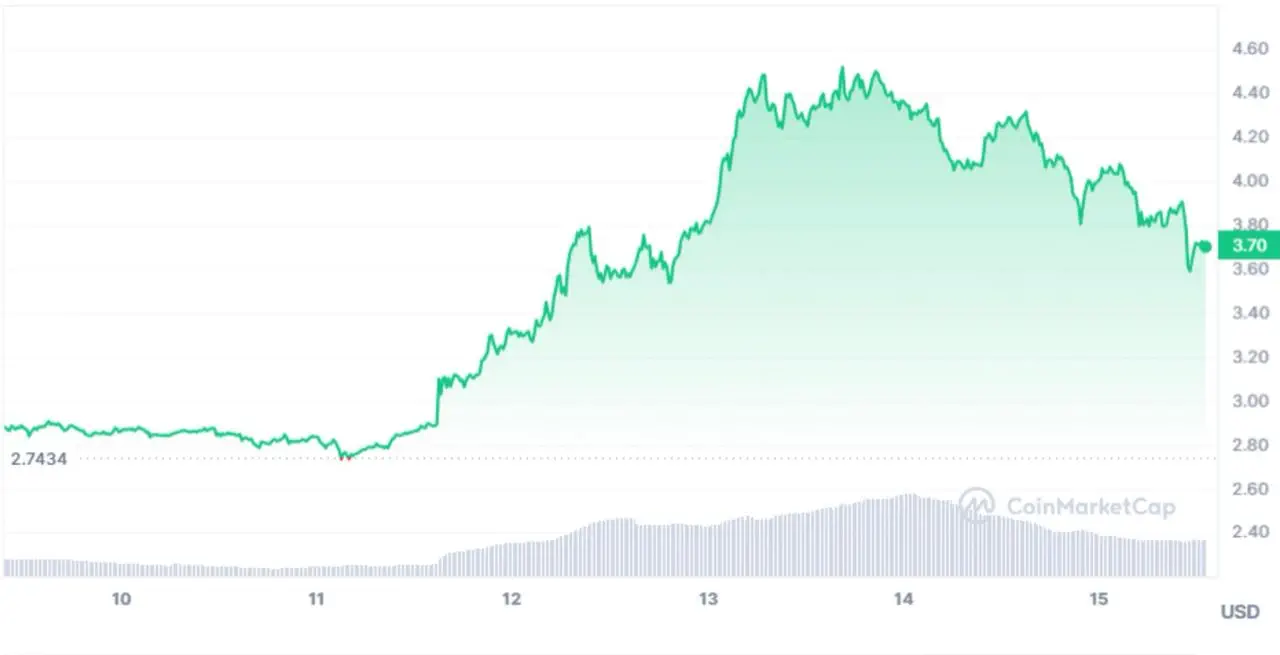

Toncoin (TON) Soars as Telegram Eyes IPO, Fuelling Investor Excitement

In a notable turn of events, the value of Toncoin (TON), the native token of the TON Network, has surged over 60% following the news that Telegram founder Pavel Durov is contemplating taking the company public. This messaging titan has consistently held the TON Network in high regard as its preferred choice for blockchain infrastructure. Amidst a broad market rally, TON's value leapfrogged from $2.72 to $4.38 before retreating to around $3.5 currently. Its market capitalization stands at a solid $12.8 billion as of this writing.

Source: CoinMarketCap

TON's ascent has led to gains of about 34% over the past week and stirring excitement among investors as Telegram hit 900 million monthly active users and nears profitability.

Also, it's essential to mention that Telegram is poised to launch an ad revenue distribution program via Toncoin, offering a financial incentive for channel administrators – all pointing towards promising prospects on the horizon for TON.

Conclusion

In the end, we're seeing all sorts of regulatory changes coming our way: the US considering new mining taxes, Europe is getting stricter with crypto laws, and Wyoming breaking new ground by legally recognizing DAOs. Bitcoin's worth is soaring sky-high, and heavyweight investors are actively funneling cash into Bitcoin ETFs.

While Ethereum might be having a rough time with ETF prospects, Layer 2 tokens are thriving post-upgrade. Toncoin is riding high on Telegram's IPO hype, leading to a surge in its value. There are also some significant moves happening on-chain, plus mining profits are up. From what we can see, the market isn't merely maturing but is boldly forging ahead into fresh and diverse pathways. And despite all these changes, it's as vibrant as ever before.

Disclaimer: Please remember, the information discussed here isn't meant to be taken as investment advice. Conduct your own research and consult with financial advisors before making any investment decisions

March 15, 2024