Market Analysis with Mike Ermolaev

This week in the world of crypto was quite a roller coaster. Bitcoin went on a wild ride, suddenly dropping down after hitting record highs. On the other hand, there are Ethereum's potential regulatory revamps. Mike Ermolaev, a seasoned crypto analyst, head of editorial at CryptoDaily, and founder of Outset PR, returns with his second article in an insightful series tailored for the GoMining community. Embark on this journey with us as we sail through the intricate undercurrents of this week's crypto market, guided by Ermolaev's seasoned perspective.

Bitcoin's Rollercoaster Ride: From a Soaring High to a Rapid Correction

Bitcoin broke an all-time high (ATH) of $73,783 on March 14, 2024, and then seemed to be nonchalantly approaching $75,000—a psychological threshold for many—but instead fell into a correction that is still ongoing. This led to the most negative market sentiment towards Bitcoin since December 2023, according to Santiment.

The market faced a steep decline, marking its worst day since the FTX collapse, with Bitcoin falling below $61,000. Yet, from a cyclical perspective, it appears we're merely navigating through fluctuations in anticipation of the halving event. So, there's reason to believe that the March ATH is just one waypoint in a larger journey.

Regarding the reasons for the decline, this rollercoaster ride reflects the broader financial landscape's sensitivity to macroeconomic indicators and policy decisions; and it's always been like that. This downturn is partly attributed to diminished demand for spot Bitcoin ETFs, notably Grayscale's ETF facing a record outflow, and an overall loss from the market since Bitcoin's peak. Around $212 billion has been wiped out from the total crypto market cap since last Friday.

Source: TradingView

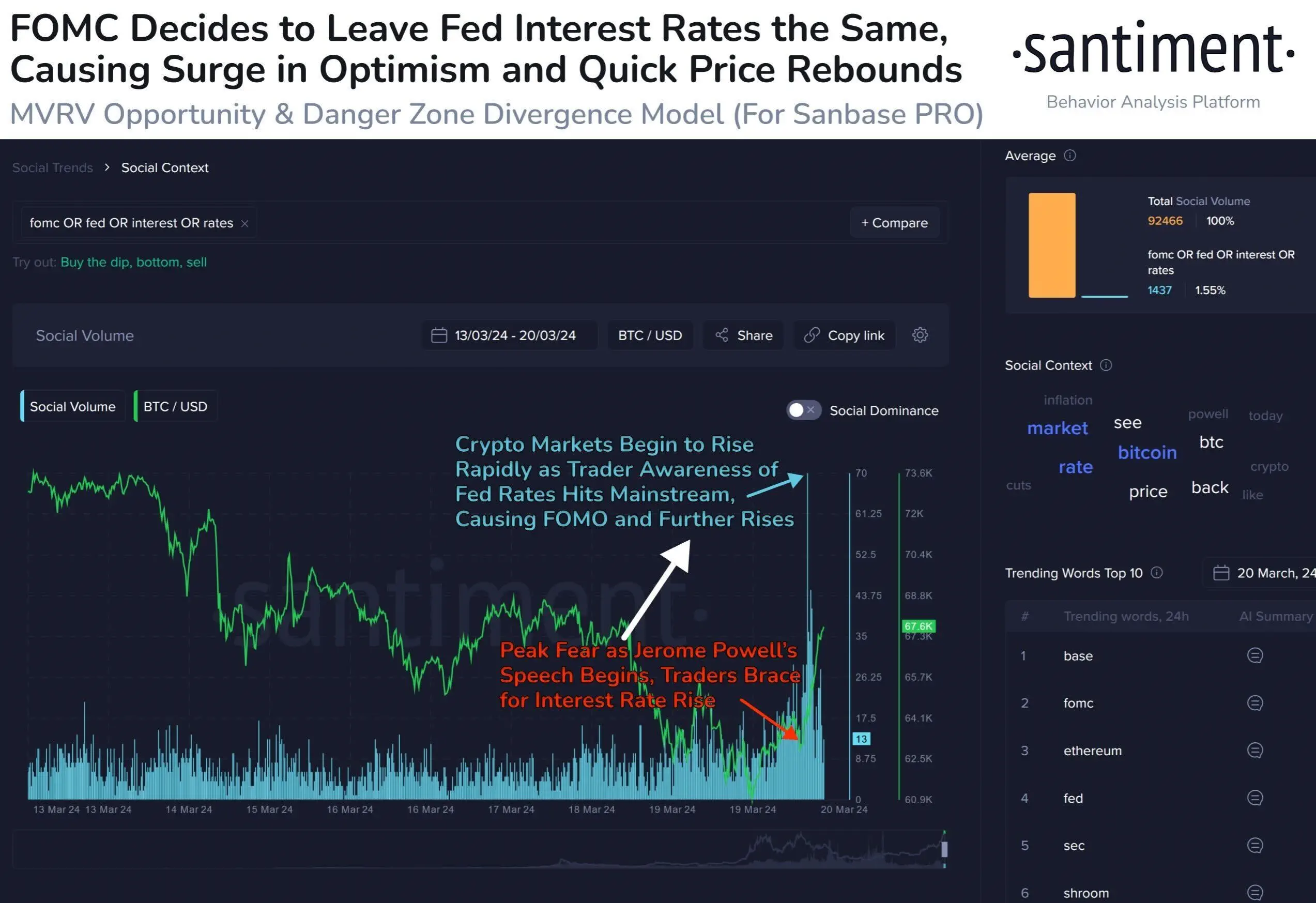

Federal Reserve's Steady Rates Boost Bitcoin's Recovery

However, the narrative took a positive turn following the Federal Reserve's decision on Wednesday, March 20, 2024, to maintain interest rates unchanged in the 5.25%-5.50% range and hints of a rate cut this year. As a result, Bitcoin is rebounding to around $64,500 as of this writing.

While the rates remain steady for now, the anticipation of future cuts suggests that more liquidity could be on the horizon. When more cash starts flowing around, more people are willing to take risks with their investments. They start putting money into assets like crypto instead of just sticking to the tried-and-true bonds that don't give much return but are usually a safe bet.

Following the FOMC announcement, the crypto markets rebounded quickly, showing high levels of trader bullishness:

The economy's big picture, including the Fed's outlook on growth and inflation, impacts the crypto market too. The Fed is totally rooting for economic growth, but at the same time, it’s trying to tame inflation. For crypto, a booming economy could mean more people investing and using it. But inflation that rises unexpectedly can bring volatility into the market.

The Fed's recent actions make it blindingly obvious that crypto is tightly knotted up with regular finance systems. Should the Fed succeed in maintaining that stable yet cautious economic policy stance, it could bring some stability to crypto's turbulence, paving the way for a healthier growth scene. But let's not forget, it isn't only the Fed's moves that dictate crypto's fate. Given its volatile behavior and speculative bent, there are more pieces in play when considering its future trajectory.

MicroStrategy's Bold Bitcoin Bet and Standard Chartered's High Stakes Forecast

Amid the fluctuations and uncertainties surrounding the cryptocurrency market, Michael Saylor's MicroStrategy has made a bold statement of confidence in Bitcoin's future. With the acquisition of an additional 9,245 BTC for almost $623 million, MicroStrategy's current holdings of almost 1% of all BTC now underscore a profound belief in the cryptocurrency's value proposition. This isn't just some big Bitcoin buy-in – it's a shout from the rooftops that crypto is here to stay.

Meanwhile, Standard Chartered is on board too, with the institution's projections being totally in sync with MicroStrategy’s optimism – they expect Bitcoin to reach $150,000 by the end of the year and eyeing a staggering $250,000 peak by 2025.

These actions and projections, in stark contrast to the market's current confusion, could just be the shot in the arm that Bitcoin needs.

I suggest taking a moment to breathe deeply – we're witnessing the market rebounding before Bitcoin can pull itself together and launch into a new sustained rise. Should growth materialize, I anticipate that BTC could potentially break the $75,000 mark, allowing those poised at their psychological selling points to act. Meanwhile, long-term holders might view this as further validation of their investment strategy, opting to retain their holdings in anticipation of even greater future value. Speculators, on the other hand, may strategize their positions for potential short-term gains, while accumulators could seize the moment to increase their holdings, betting on continued upward momentum.

2024's Bitcoin Halving: A Unique Pre-Event Rally, Ordinals-Driven Revenue, and the Race for the Most Valuable Block

Furthermore, this year's Bitcoin halving truly stands apart, marked by a pre-event price rally, a phenomenon not observed in previous halvings. Historically, halvings have been precursors to significant price surges, yet 2024's anticipation breaks new ground, according to Bitcoin historian Pete Rizzo.

Adding to its uniqueness, this halving sees transaction fees forming a substantial slice of miners' revenue for the first time, largely due to increased network activity spurred by the Ordinals protocol. Furthermore, the upcoming halving block, predicted to be the most valuable ever due to its expected content including 'rare sats', is stirring excitement and speculation about its worth. In the midst of this historic moment, the rollout of Runes – a novel mechanism to initiate Bitcoin-oriented tokens – syncs perfectly with the event and hints at further trailblazing advancements on the horizon. Against this setting, the expected worth of the halving block has ignited talks about unmatched rivalry among miners. It suggests a potentially game-changing "mega reorg" in the race to mine this block.

Court Rejects Wright's Satoshi Claim; U.S. Advances Stablecoin Bill

In a landmark decision from London's High Court, Australian computer scientist Craig Wright's claim to be Satoshi Nakamoto, the mysterious founder of Bitcoin, was rejected. In the wake of a legal showdown spearheaded by COPA (the Crypto Open Patent Alliance), aiming to halt Wright's lawsuits against Bitcoin developers, it was Judge James Mellor who determined there exists an ample reservoir of proof contradicting Wright's self-proclaimed identity as Satoshi Nakamoto.

Wright's caught in a tricky legal situation, slapped with accusations of tampering with evidence, and there are rumors that he might've used artificial intelligence such as ChatGPT. So, this stirs up serious doubts about whether his word is trustworthy. Clearly, this ruling is a win for open-source developers and Bitcoin's legacy.

There's also a fresh wave of hope washing over regulating the wild west of digital currencies. Key Washington D.C. lawmakers Sen. Patrick McHenry and Sen. Cynthia Lummis forged ahead with efforts to pass a pivotal stablecoin bill. Despite recent congressional tumult and budgetary standoffs that momentarily sidetracked crypto legislation, a "workable frame" for stablecoin regulation has emerged within the House of Representatives, signaling a potential breakthrough in the U.S. approach to digital currency oversight. McHenry's dedication in his last congressional term, coupled with Lummis's joint discussions with the Senate leaders, marks a key move toward giving stablecoins their due credit within the larger crypto conversation.

Ethereum's Dencun Upgrade and the SEC's Watchful Eye

In its latest report, Glassnode Insights explores the inner workings of Ethereum's Dencun Upgrade—highlighting standout enhancements like amplified data storage capacities that aim to lower Layer-2 scaling solution expenses and a strategic cap on validator entries for sustainable growth. According to Glassnode, these tweaks are anticipated to do more than just fine-tune Ethereum's monetary policy; they may also result in a decrease in Ethereum's issuance rate. But it doesn't stop there; user interaction and the overall smooth running of the network are also getting an upgrade. Ethereum seems to be trying hard to find that perfect spot between scalability, security, and decentralization.

Following up on Ethereum (ETH), an undisclosed government authority is currently investigating the Ethereum Foundation, amidst transformative changes in Ethereum's technology and heightened interest in ETH-based exchange-traded funds (ETFs) in the United States. According to rumors, the SEC is considering classifying ETH as a security, which could seriously mix up the legal scene for ETH, impacting not only how the foundation runs things but also whether or not ETH ETFs have a shot in the U.S.

The removal of a warrant canary from the Ethereum Foundation's website in February 2024, previously signaling freedom from secret government requests, adds a layer of intrigue and suggests the onset of a critical regulatory juncture for Ethereum and its global stakeholders.

Conclusion

So, despite the current rollercoaster ride we're seeing with market prices, there’s a belief in Bitcoin's potential for the long haul. Big-name businesses like MicroStrategy are pouring money into Bitcoin, and even institutions such as Standard Chartered are making some pretty hopeful predictions. It's all the chatter about how the next Bitcoin halving, with its one-of-a-kind scenario, is stirring up excitement; not to mention the intrigue around Ethereum. Watching major events unfold, like court rulings against Craig Wright and advancements in stablecoin laws, it's also pretty clear that big changes are coming for the crypto scene.

Disclaimer: Please remember, the information discussed here isn't meant to be taken as investment advice. Conduct your own research and consult with financial advisors before making any investment decisions.

March 22, 2024