April 2025 proved to be one of the most dynamic months for Bitcoin mining in recent memory, as BTC price action, mining fundamentals, and geopolitical developments all collided. Bitcoin went from a five-month low to approaching $100,000 again, driven by renewed ETF demand.

The digital asset showed signs of decoupling from traditional markets, once again asserting its role as an emerging macro asset class. Meanwhile, the mining sector experienced both record highs and steep corrections, underscoring the volatility introduced by the global trade uncertainty.

Bitcoin Price Dynamics

Tariff Volatility

Bitcoin opened the month of April at $82,300 and closed at $94,200, resulting in an 14.4% month-over-month (MoM) price appreciation. Early in the month, BTC experienced a sharp drop, briefly dipping to a five-month low just above $74,000 amid rising geopolitical tensions and renewed concerns over U.S. trade policies.

However, after President Trump eased tariffs on all countries except China, the market responded positively, pushing BTC back into the $83,000–$85,000 range. The rally gained further momentum following favorable U.S. CPI data, which helped restore investor confidence.

Sentiment took a decisive turn on April 22, with BTC surging 6.5%—nearly $6,000—after President Trump signaled a potential shift in his trade stance with China. Amid ongoing market volatility, he stated that the high tariffs on Chinese goods would “come down substantially, but it won’t be zero.”

BTC price movement reacting to tariff announcements (Source: TradingView).

Bitcoin Decoupling

Investor confidence in Bitcoin was clearly reflected in its performance following “Liberation Day,” as BTC began to decouple from other asset classes. In the weeks that followed, Bitcoin (14.40%) significantly outperformed the Nasdaq 100 (1.12%), S&P 500 (-0.83%), oil (-15.54%), and 20-year U.S. Treasury bonds (+2.26%). The asset that came closest to keeping pace with Bitcoin was gold, which posted a +3.30% gain.

BTC decoupling from other assets (Source: TradingView).

Return of ETF Demand

A major driver behind Bitcoin’s recent momentum has been the resurgence in demand for spot Bitcoin ETFs, which saw approximately $3.9 billion in inflows eight consecutive trading sessions—marking the strongest streak for Bitcoin ETF inflows in 2025. This surge reflects renewed interest from institutional investors and a sharp reversal from the previous trend of outflows. The rally gained particular strength on April 22 and 23, when eleven Bitcoin ETFs attracted over $1.8 billion in two days.

ETF inflows surged in the second half of April (Source: Glasscoin).

The Bitcoin Accumulation Race Heats Up

Michael Saylor’s Strategy (MicroStrategy) added 15,355 Bitcoin on the 28th of April, spending $1.42 billion at an average price of $92,737, bringing its total holdings to 535,555 BTC—now valued at over $50 billion. This marks Strategy’s largest purchase since March and comes alongside a shareholder vote to increase authorized shares, potentially paving the way for even larger Bitcoin acquisitions. Speculation is swirling that the company could target up to $2.43 trillion in future BTC buys, as Saylor positions Strategy ahead of a potential increase in corporate and sovereign interest. Earlier in April, Strategy did two smaller purchases as well 6,556 BTC on the 21st and 3,459 on the 14th of the month).

Meanwhile, new competitors are entering the arena. Twenty One—a SPAC-backed entity supported by Tether, Cantor Fitzgerald, SoftBank, and Jack Mallers—is set to go public with over 42,000 BTC, making it the third-largest corporate holder after Strategy and Tether. Additionally, Brazil’s largest bank, Itaú, just launched "Oranje" with a $210 million starting cap, signaling that the corporate Bitcoin accumulation race is heating up fast.

Twenty One holding almost as much BTC as publicly traded miner MARA Digital (Source: Glasscoin).

A Volatile Month for Network Hashrate

Sharp Rise to Record High

While the mining industry faced growing uncertainty around tariffs, the network's hashrate told a very different story—skyrocketing at the start of April. On April 7, the hashrate reached a new all-time high of 929 EH/s on the 7-day moving average (7DMA), seemingly unfazed by the macroeconomic turbulence that marked the first week of the month.

1-DMA Crosses the Zetahash Mark

Moreover, the 1-day moving average (1-DMA) hashrate surged past the 1 Zetahash (ZH) mark for the first time ever. That’s 1 sextillion hashes, or a trillion trillion calculations every second. Despite the 1-DMA being less reliable than the 7- or 30-DMA, this is a monumental achievement showcases the immense computational power securing the Bitcoin blockchain.

Network Hashrate 1-DMA crossing 1 zeta hash for the first time in history (Source: Lincoin Lens).

From Record High to Record Decline

After reaching a record high of 929 EH/s at the start of April, Bitcoin’s network hashrate dropped sharply, hitting a monthly low of 817 EH/s on April 23rd. This 12% decline is the steepest percentage drop the network has seen in 2025. It also marks only the third time in Bitcoin’s history that hashrate has fallen by more than 100 EH/s—two of which have occurred this year. The first such drop happened in May 2024. Network started April at 826 EH/s and ended the month at 851 EH/s, reflecting a net change of 25 EH/s or 3% month-over-month growth.

Network Hashrate drops over 100 EH/s (Source: Lincoin Lens).

Network Difficulty

Bitcoin’s difficulty adjustment is an automatic system that changes how hard it is to mine new blocks, aiming to keep the time between blocks close to 10 minutes regardless of the amount of hashrate online. Every 2026 block (about two weeks), the network adjusts the difficulty based on how fast blocks were mined in the previous period.

In April, we witnessed 2 difficulty adjustments on April 5 there was an adjustment of +6.81%, the biggest upward adjustment since July 2024. The adjustment of April 19 was a mild 1.42% but pushed Bitcoin mining difficulty hit a new all-time high — a direct result of the network hashrate surging past 900 EH/s since the start of the month.

Two upwards difficulty adjustments during the month of April (Source: Digital Mining Solutions).

Hashprice - Daily Miner Revenue

Hashprice is the amount of revenue a Bitcoin miner earns per unit of hashrate (PH/s) per day, reflecting the combined impact of block rewards, transaction fees, and Bitcoin’s price. With Bitcoin price dropping after Trump did the initial tariffs announcement and simultaneously a new all-time high in hashrate triggering a +6.81% difficulty increase, hashprice was heading towards its historic lows of $38/PH/day but luckily it stopped on its tracks when BTC price action turned bullish. Hashprice is still relatively suppressed and a bit over a.

Following Bitcoin’s bullish price action, hashprice rebounded from a local low of $40/PH/day on April 8 to $49/PH/day by month’s end—a 22.5% rebound from the local low, reflecting a partial recovery in miner economics and a 6.5% month-over-month gain.

Hashprice recovering from a yearly low of $40/PH/day (Source: Lincoin Lens).

Auradine Launches First Hydro-Cooled Miner

At the end of March Auradine, a U.S.-based Bitcoin mining chip designer, unveiled the Teraflux AH3880, a next-generation hydro-cooled Bitcoin miner. The rack-mounted miner delivers an exceptional 600 TH/s at an efficiency of 16.5 J/TH in turbo power mode while in normal power mode the machines delivers 450 TH/s at an efficiency of 14.5 J/TH

The Hydro-Cooled Teraflux AH3880 (Source: Auradine).

The AH3880 is part of Auradine’s broader effort to challenge industry giants like Bitmain and MicroBT while reducing the sector’s dependence on Chinese chipmakers. For comparison, Bitmain’s S21XP Hydro, launched in 2024, remains the most efficient hydro-cooled miner at 12 J/TH, while Bitdeer’s SEALMINER A2 Pro delivered the highest hashrate output until the AH3880 was introduced.

Hydro-cooled miner models compared (Source: Digital Mining Solutions).

Tariffs Shake Up the U.S. Bitcoin Mining Landscape

The U.S. mining industry, heavily reliant on hardware from Asia, is now caught in the crosshairs of Trump’s renewed trade war. New tariffs will likely drive up costs across the board—from building out facilities to acquiring ASIC machines. Markets reacted swiftly, with shares of publicly traded U.S. miners taking a hit in after-hours trading. But beyond the short-term shock, what are the longer-term implications?

The Most Recent Recap on Current and Upcoming Rates (Source Compass Logistics & Marine).

A Push Toward Global Hashrate Redistribution

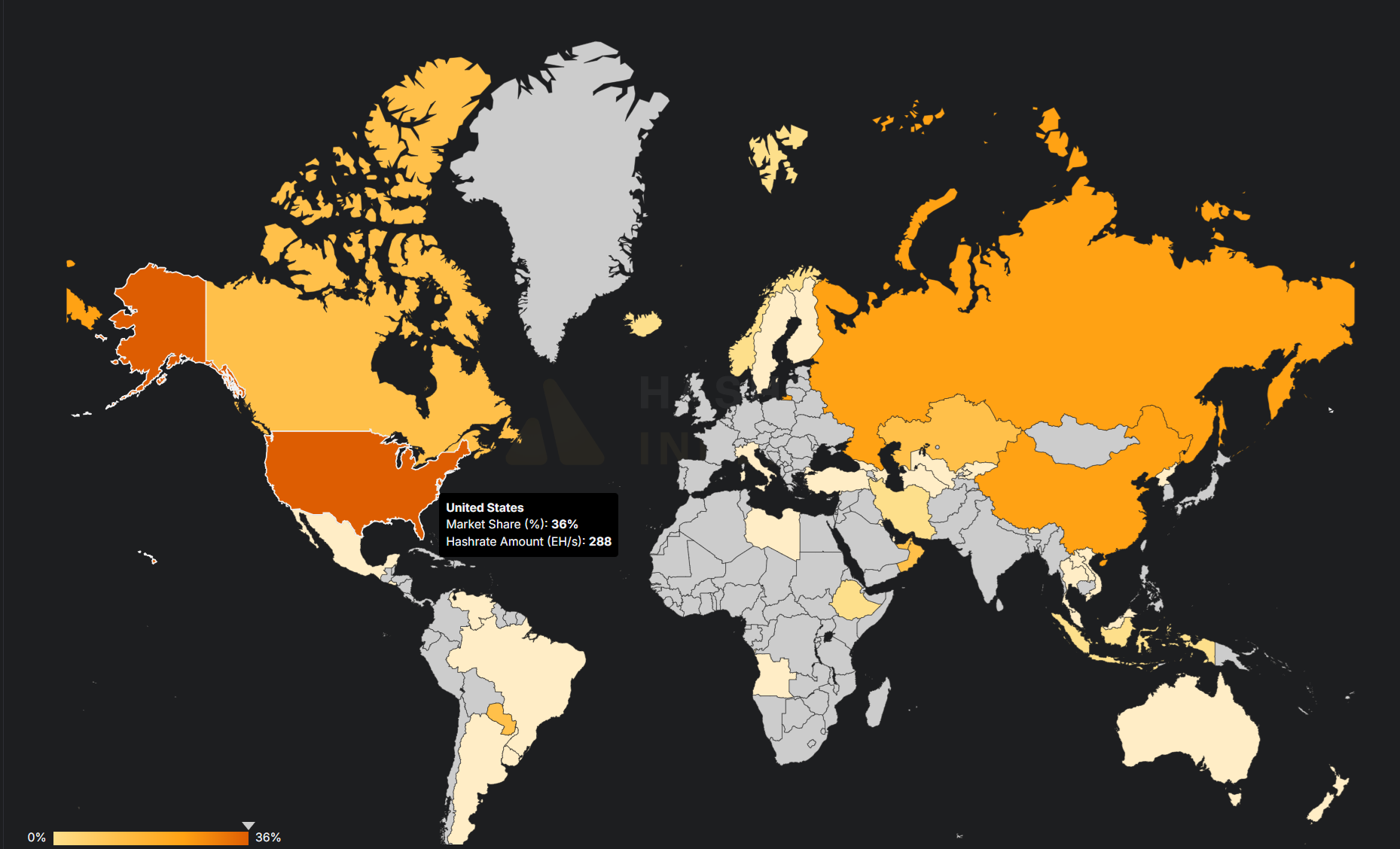

As mining in the U.S. becomes more expensive, the country’s 36% share of global hashrate could begin to decline. Regions with fewer trade barriers—like Latin America, Africa, or Central Asia—may attract miners looking for cheaper equipment and infrastructure. This shift could accelerate the decentralization of hashrate, reducing U.S. dominance.

Global Hashrate Distribution (Source: HashrateIndex).

A Focus on Domestic Production

ASIC manufacturers are already pivoting. MicroBT already assemblies in the U.S. and BITMAIN announced its plans for local assembly lines last December. U.S.-based companies like Auradine are well-positioned to benefit from this trend, offering homegrown solutions to meet rising domestic demand.

U.S.-Based ASICs Could Command Higher Prices

With tariffs looming, distributors are scrambling to secure inventory. This rush is pushing up shipping costs already and a tighter supply of ‘tariff free’ next-gen equipment could lead to longer-term pricing pressure.

Second-Hand Market May See a Revival

Limited access to new ASICs could force miners to extend the life of older hardware. Used machines in the U.S. may see a bump in demand, leading to a more active secondary market. The restricted availability of well priced new ASICs could fuel demand for existing equipment, increasing premiums also for used machines. This may slow down efficiency upgrades for miner fleets while boosting the secondary market for second-hand units. Larger operations with significant ASIC inventories could gain an advantage, widening the gap between major players and smaller miners.

As the Bitcoin network enters a more mature growth phase, defined by physical limits and rising deployment complexity, operators are evolving from pure miners into broader infrastructure providers. GoMining Institutional remains focused on delivering professionally managed exposure to this foundational layer, combining operational scale with long-term capital alignment.

Nico Smid – Research Analyst, GoMining Institutional.

May 6, 2025