Market Analysis with Mike Ermolaev

The long-awaited Bitcoin Halving took place on April 19-20, marking a significant event in the cryptocurrency world. This week's crypto market dynamics were largely influenced by the halving, sparking widespread speculation about its enduring impact. Our weekly digest, featuring insights from Mike Ermolaev, a seasoned crypto analyst and lead at the CryptoDaily editorial team, delves into this topic. Also, this digest tells the GoMining community about the progress in Ethereum ETF approvals, security challenges in El Salvador, innovative applications of Bitcoin in daily life, and environmentally friendly mining practices. Read on to get more details.

Post-Halving BTC Weekly Performance and Projections

Over the past few months, the impending Bitcoin halving had captured the attention of many crypto analysts, with several making bold predictions of a significant price surge post-event. However, the anticipated explosion turned out to be more of a hiss. At the beginning of this week the leading cryptocurrency was hovering near $65,000, adding a modest 6% since last week. Throughout the week, BTC was ranging between $62,824 and $67,221.

Source: Trading View

Just before the halving, analysts at Deutsche Bank (DB) suggested that bitcoin halving has already been priced in by the market, so they did not expect any massive rally at all. And their expectations were met.

The short-term forecast is cautious. Some analysts expect the near-term bitcoin price to fall after the halving, citing overbought conditions. This assumption is confirmed by the on-chain metrics from IntoTheBlock revealing that 91% of BTC holders are in the money, meaning the market can be overheating. So, there is a possibility of a short-term correction in the price.

However, the long-term effect of the quadrennial event can be more pronounced. By halving the rate at which new bitcoins are introduced into circulation, the cryptocurrency's inherent scarcity mechanism gradually exerts greater influence. This alteration in supply and demand dynamics could notably influence the long-term trajectory of Bitcoin.

Bitcoin's appeal stems significantly from the predictability of its supply. According to its protocol, the maximum supply of Bitcoin is capped at 21 million, while the current circulating supply stands at 19.69M.

The latest Bitfinex-Alpha report revealed that the daily amount of BTC mined fell about 30% in a month. According to the report, a daily average of about 374 BTC was sent to spot exchanges by miners over the last month, which is significantly lower than the 1,300 BTC observed in February. As fewer Bitcoins are introduced into the market and as the total supply approaches its limit, this scarcity effect is likely to become more pronounced, potentially enhancing Bitcoin's appeal and increasing its price, especially if the demand remains strong or increases.

U.S. Bitcoin Mining Stocks Surge Post-Halving

The quadrennial event significantly influenced the broader market, beyond the BTC price. Specifically, the U.S. Bitcoin mining stocks saw a significant surge. The day following the halving, major publicly traded Bitcoin miners like Marathon Digital, CleanSpark, and Cipher Miningrecorded impressive gains, with some stocks increasing by double-digit percentages. The strongest performer was Stronghold Digital Mining (SDIG), registering a rise of 35% on April 22.

This rally was part of a broader uptrend in the U.S. market, which also saw gains in the Nasdaq Composite and the S&P 500. Despite the reduction in mining rewards per block, investor enthusiasm for these stocks did not wane, indicating a robust market response to the halving event.

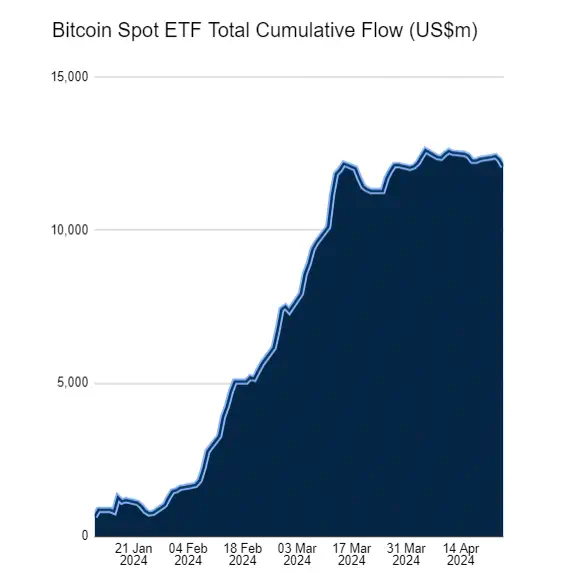

Shifts in Bitcoin ETF Inflows and Progress in Ethereum ETFs Approval

ETFs are expected to significantly impact market volatility, given their capacity for large inflows and outflows that can sway market sentiment and pricing, often beyond traditional supply-demand dynamics. The halving event, which reduces supply, combined with ongoing ETF demand, could further boost BTC prices.

Despite a recent slowdown in ETF inflows since their peak in March, data from Farside indicates a tentative resurgence in momentum as of late April, with total cumulative flows in BTC spot ETFs reaching $12,295 million by April 24. This rebound in ETF investments signals a recovering interest and potentially higher future prices for Bitcoin.

Source: Farside

Regarding the progress of Ethereum ETFs, the SEC has deferred its decision on Franklin Templeton's spot Ethereum ETF application until June 11, 2024. Originally filed in February, this ETF would track the price of Ether, with Coinbase Custody Trust Company and Bank of New York Mellon acting as custodians.

The delay is due to the SEC needing more time to assess the proposed rule changes and the complexities of classifying Ethereum for a spot ETF. This move reflects a broader cautious approach by the SEC, which has also delayed other cryptocurrency ETF proposals.

El Salvador's Bitcoin Adoption Faces New Challenges

Shifting focus from regulatory matters, we delve into the updates on El Salvador's pioneering adoption of Bitcoin as legal tender. Unfortunately, the developments have taken a concerning turn. Hackers known as CiberInteligenciaSV have leaked part of the source code for El Salvador's government-operated Bitcoin wallet, Chivo, on the BreachForums platform. Reported on April 23, 2024, this leak is the latest in a series of security breaches affecting Chivo, which previously exposed personal data of many Salvadoran adults.

Despite these issues, the Salvadoran government has not issued an official response. Chivo is crucial for facilitating Bitcoin transactions and supporting its legal status in the country, but it has been plagued by technical problems from the start.

Green Innovations and Enhanced Utility in Bitcoin Mining to Foster Mass Adoption

In positive crypto news, PayPal has teamed up with Energy Web and DMG Blockchain Solutions to foster green Bitcoin mining through a new incentive program. This initiative was unveiled in a blog post on Mirror on April 22.

This program uses a crypto economic approach where Bitcoin miners who use sustainable energy sources receive additional Bitcoin rewards. This is supported by a clean energy validation platform developed by Energy Web that provides "green keys” to miners with verifiable low-carbon energy usage. These green miners benefit from lower transaction fees and are prioritized in the transaction processing, which not only incentivizes cleaner mining practices but also supports the broader goal of decarbonizing the Bitcoin network.

In Finland, a new initiative by Hashlabs Mining integrates Bitcoin mining with the district heating system to use the energy from mining to heat homes. Hashlabs Mining co-founder Jaran Mellerud shared the details about this project in a post on X on April 23. The project utilizes WhatsMiner M63S devices, which produce hot water at 70 degrees Celsius, contributing to the district heating network. This innovative approach not only supports Finland's efforts to use nuclear power for heating but also aims to replace other heat sources like biomass and coal, enhancing environmental sustainability.

These initiatives by PayPal and Hashlabs Mining in Finland highlight the adaptability and utility of cryptocurrency technologies. Aligning them with broader environmental and sustainability goals, such initiatives enhance the mass adoption of cryptocurrency.

Conclusion

In wrapping up, the recent Bitcoin halving event, though it didn't cause a huge stir in prices immediately, sets the stage for significant shifts in the crypto market over the long term. The deeper, structural changes to Bitcoin’s supply mechanics hint at price surges in future. This is underscored by sustained interest in ETFs, progressive strides in regulatory landscapes, and robust enthusiasm among investors in the U.S. Bitcoin mining sector.

Additionally, the integration of innovative, environmentally sustainable practices in mining and the continued evolution of cryptocurrency utilities demonstrate the sector's adaptability and alignment with broader economic and environmental goals. With these developments, the cryptocurrency ecosystem continues to mature, promising a more stable and sustainable future that could foster wider adoption and deeper integration into the global financial system. The focus on security, regulatory clarity, and environmental sustainability will likely be pivotal in shaping the trajectory of Bitcoin and other cryptocurrencies.

April 26, 2024