Market Analysis with Mike Ermolaev

This week's edition of GoMarket Weekly, led by the seasoned crypto market analyst Mike Ermolaev, offers a comprehensive overview of the latest and most impactful news in the cryptocurrency world. In this section, we’ll delve into the US Federal Reserve's decision on interest rates, look into the headwinds weighing on the crypto market and the broader implications of legal challenges and regulatory changes. Also, we’ll take a look at the emerging issues as well as unprecedented opportunities occurring now in Bitcoin mining.

Federal Reserve's Rate Decision: Implications for the Crypto Market

In the latest monetary policy move, the US Federal Reserve has decided to keep its benchmark interest rate unchanged at 5.25-5.5%. Jerome Powell, the Federal Reserve Chairman, hinted that further rate hikes might not be on the table for the next meeting. This decision is a neutral development for the crypto market as keeping rates unchanged maintains the status quo, which can be seen as potentially less stimulating for investment in risk assets like cryptocurrencies. In contrast, a rate cut would likely be much more beneficial for crypto, potentially sparking an influx of liquidity due to reduced borrowing costs, prompting investors to seek higher returns generally offered by digital assets compared to cash-like investments. Moreover, options like Bitcoin would seem like smart moves to protect cash from devaluation. However, in the near future, such a decision to cut rates by the Fed is unlikely due to the challenging economic conditions that require a hawkish stance by the regulator.

Bitcoin’s Market Dynamics: Correction Not Capitulation

Over the past week, Bitcoin has experienced about a 7% decline in value, fluctuating within a range of $56,803.96 to $64,925.19. This decrease moves Bitcoin further away from its all-time high of $73,737.94, which was reached approximately two months ago on March 14, 2024, now sitting about 20.6% below that peak.

The cryptocurrency sector is facing headwinds from broader stock market sell-offs and a strengthening US dollar index, impacting asset prices including Bitcoin. Bitcoin might also be under pressure from market participants' fears about the slowdown in the pace of key rate cuts. However, the original cryptocurrency’s decline to the $57,000 level is more indicative of a local correction than the start of a bearish phase.

Supporting this view, Glassnode's latest report suggests that Bitcoin is forming a local bottom, indicating that such corrections are typical and expected market behaviors at this stage.

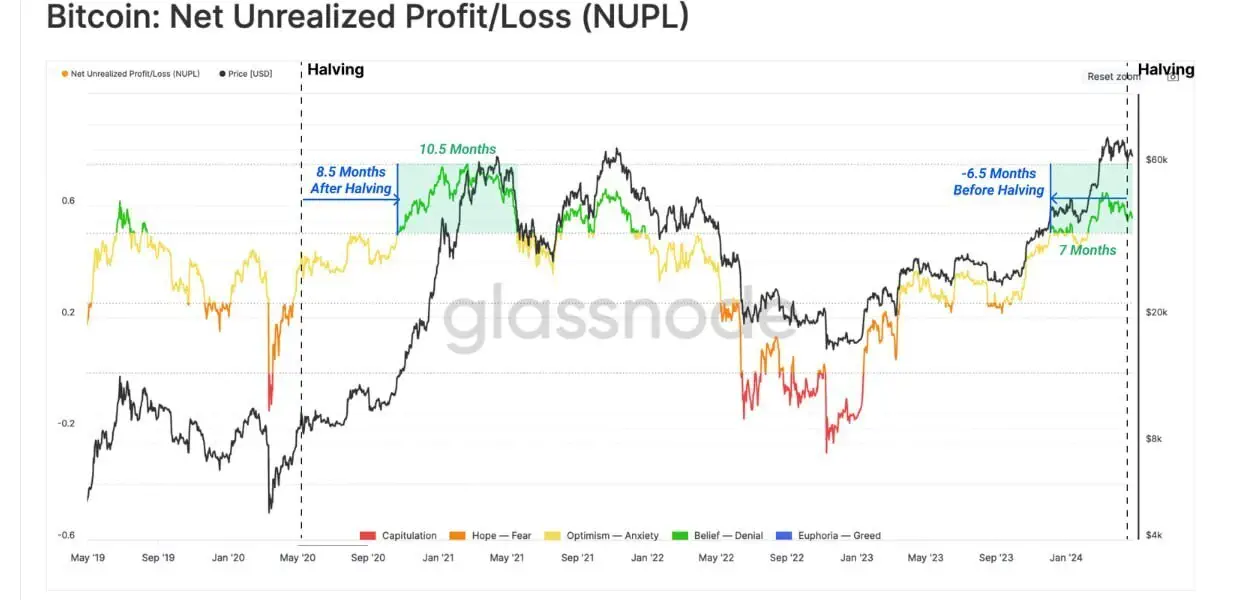

According to their metrics, the Net Unrealized Profit/Loss (NUPL) remains in the 'Euphoria' phase, highlighting a significant phase of profit realization that has not deterred the bullish sentiment completely despite the recent corrections. The report pinpoints that the NUPL value breached 0.5 approximately 6.5 months before the expected halving event, underscoring the impact of U.S. Spot ETFs in fostering a bullish environment by introducing robust demand into the market.

Source: Glassnode

Additionally, the report introduces the concept of navigating local bottoms during market contractions, focusing on the cost basis of short-term holders. Glassnode’s breakdown shows that the 1-week to 1-month cohort, with their cost basis around $66.7k, significantly contributes to the price sensitivity during downturns. As Bitcoin approached these levels, the MVRV (Market Value to Realized Value) ratio for this cohort typically dipped into the 0.9-1 range, indicating that prices were falling close to or just below the short-term holders' entry points, often leading to a slowdown in selling as market participants await clearer signals for recovery or further decline.

Source: Glassnode

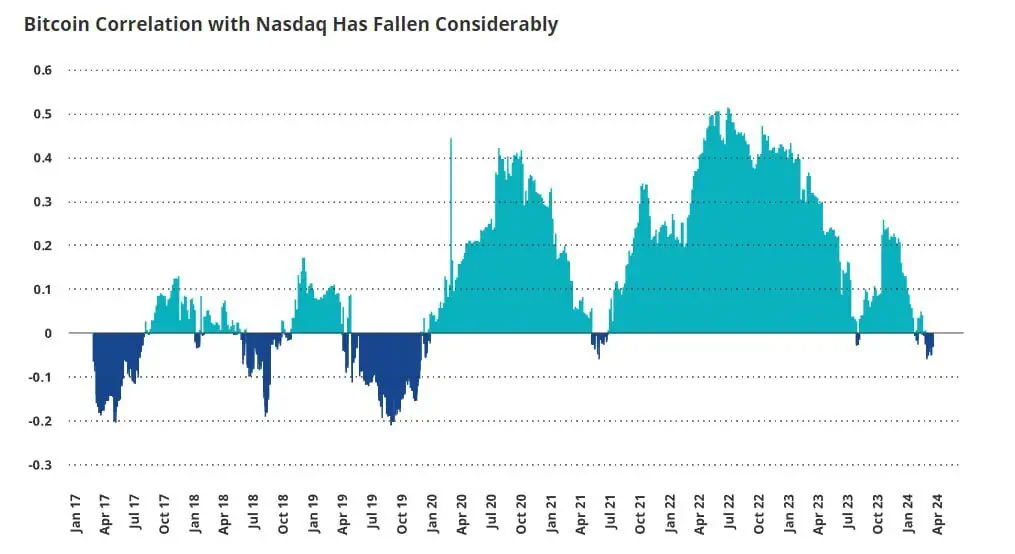

Furthermore, the recent VanEck report highlights a notable decrease in the correlation between Bitcoin and the Nasdaq, a trend that has become more pronounced in recent years. As shown in the graph, the correlation peaked around mid-2021 with a value close to 0.5, indicating a moderate positive relationship between Bitcoin and Nasdaq performance. However, by April 2024, this correlation has sharply declined to just above -0.1, illustrating a significant divergence in the behavior of Bitcoin compared to traditional tech stocks.

Source: VanEck

Changpeng Zhao's Sentencing Stirs Debate Amidst Broader Crypto Regulatory Tensions

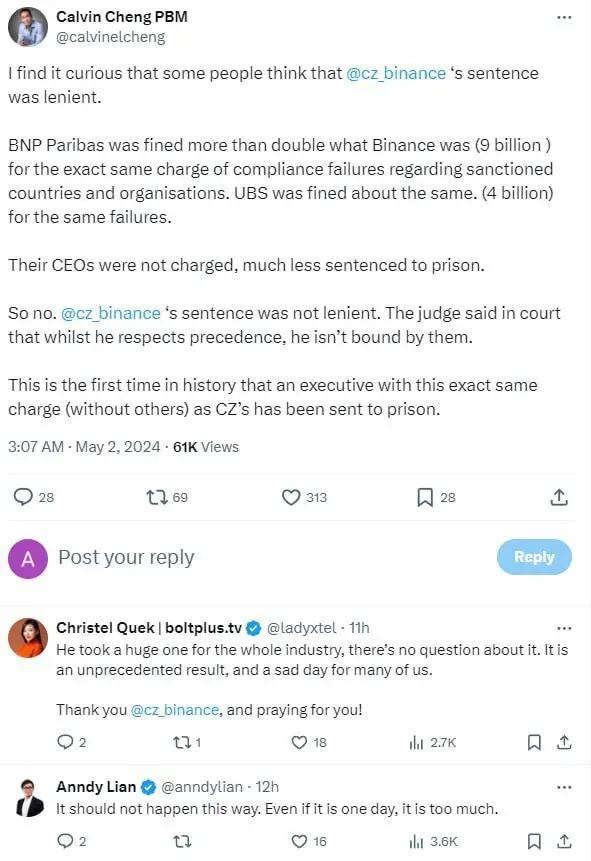

The founder of Binance, Changpeng Zhao, has been sentenced to four months in prison, a development that has stirred mixed reactions within the cryptocurrency community.

Prosecutors originally sought a three-year sentence, but the judge decided on a shorter term due to the lack of evidence that Zhao was directly informed about illegal activities taking place at Binance.

Crypto market participants expressed different opinions regarding Zhao's sentence. In spite of some arguing that this is justified, others emphasized that the case was unprecedented, as it was the first time an executive faced prison for these specific charges without other accusations involved, especially in contrast to BNP Paribas and UBS, which were heavily fined for similar compliance issues yet saw no criminal charges against their CEOs.

Among notable regulatory developments, US Senator Cynthia Lummis has voiced strong objections against the Department of Justice's stance on crypto self-custody, arguing that it conflicts with existing Treasury guidelines and undermines the rule of law. Highlighting the Biden Administration's efforts to criminalize certain activities within the Bitcoin network and decentralized finance, Lummis stands in opposition. The cryptocurrency community has rallied against these interpretations, contending they contradict FinCEN's established guidelines as by the DOJ's logic, essentially all cryptocurrency wallets and smart contracts involve unlicensed money transmission.

Meanwhile, the UK Treasury presented a report on the department’s work over the past two years, highlighting the risks associated with crypto. The cryptocurrency business in the UK may face increased regulatory control and heightened compliance requirements as the government continues to refine its approach to AML/CTF.

Resilience and Legislative Support Bolster Bitcoin Mining Amid Revenue Challenges

Despite a significant decline in revenues following the Bitcoin halving event in April, Bitcoin miners have not shown signs of capitulation, according to CryptoQuant CEO Ki Young Ju. Ju highlighted that Bitcoin miner revenue has reached a 14-month low, yet there is no evidence that miners are giving up. Instead, they face a choice between capitulating or holding out for a potential increase in Bitcoin prices to cover operational costs. This resilience is underscored by the 365-day Puell Multiple chart, which indicates that the sell pressure from miners remains low for now. Despite the post-halving profit squeeze and ongoing price corrections, the Bitcoin mining community appears to be weathering the storm without resorting to mass sell-offs of their mined bitcoins.

In a related development that highlights the rewards of persistence in the mining sector, a solo Bitcoin miner succeeded in solving a block by themselves, claiming the entire 3.125 Bitcoin reward. This rare event showcases the potential high rewards waiting beyond hard times.

Moreover, there have been legislative developments geared toward supporting such resilience in the mining industry. US Congressmen Drew Ferguson (R-GA) and Wiley Nickel (D-NC) have introduced a bipartisan bill, the Providing Tax Clarity for Digital Assets Act, which aims to amend tax regulations for cryptocurrencies, suggesting that block rewards should only be taxed when they are sold or spent. This could significantly simplify the financial obligations of miners and remove potential double taxation currently facing the digital asset industry.

Conclusion

Signing off this week's GoMarket Weekly, we've seen cryptocurrencies dance to the rhythm of fresh regulations, shifting markets, and groundbreaking legal work. From the US Federal Reserve's stance on interest rates to the resilience shown by Bitcoin miners amid revenue dips, the sector is navigating through challenging yet opportunistic times. Recent court dramas paired with Senator Lummis's pushback against restrictions show us how much everyone involved wants simpler, more equitable guidelines governing crypto. Market movements create waves; laws set the stage; yet it’s the growing community of crypto enthusiasts that will determine the future of crypto.

May 3, 2024