The cryptocurrency market never ceases to surprise. Tokens that start as jokes or memes suddenly shoot up thousands of percent, attracting both retail traders and even institutional capital. Pepe is one of those assets — a token that managed to become a true cultural phenomenon in crypto in an extremely short time.

In this article, we take a detailed look at the five most optimistic — and five most pessimistic — PEPE price forecasts for 2026, drawing on fundamental analysis, technical indicators, and macroeconomic factors.

History of Pepe: From Meme to Cryptocurrency

Before we dive into forecasts, it’s important to understand where this token came from in the first place. Pepe the Frog is an internet meme created by artist Matt Furie back in 2005. Over the years, Pepe has become one of the most recognizable symbols of online culture, going through countless transformations and interpretations.

Matt Furie

In April 2023, the PEPE token launched on the Ethereum blockchain — a decentralized cryptocurrency created by an anonymous team of developers. The project positioned itself as a pure memecoin with no inherent utility or roadmap, which, paradoxically, is exactly what helped it gain massive attention.

The launch took place on April 17, 2023. Within just a few weeks, the token posted explosive growth, reaching a market capitalization of more than $1 billion.

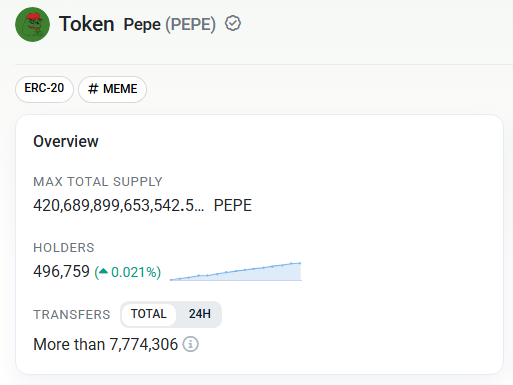

The total supply of PEPE is 420.69 trillion tokens — a number referencing meme culture and the “420” joke. Initially, 93.1% of the tokens were sent to a liquidity pool on Uniswap, while the remaining 6.9% were placed in a multisig wallet for future listings on centralized exchanges and liquidity expansion.

It’s also important to highlight that the team announced zero transaction fees and burned all LP tokens, making PEPE more decentralized compared to many other memecoins.

In the summer of 2023, PEPE reached its all-time high near $0.00000431, but then underwent a correction typical for memecoins. By the end of 2023, the token was trading far below its peak levels — yet it retained its place in the top-100 cryptocurrencies by market cap. In 2024, on the back of the broader crypto rally, PEPE once again gained momentum, refreshed its highs, and attracted a new wave of investors.

As of December 2025, PEPE trades around $0.0000043.

Why PEPE Price Predictions Matter

Memecoins are a special category of crypto assets that require a different approach to analysis. Unlike projects with real utility — like Ethereum or Chainlink — memecoins such as PEPE do not have obvious fundamental value. Their price is shaped by speculative demand, community sentiment, viral content, and the overall state of the crypto market.

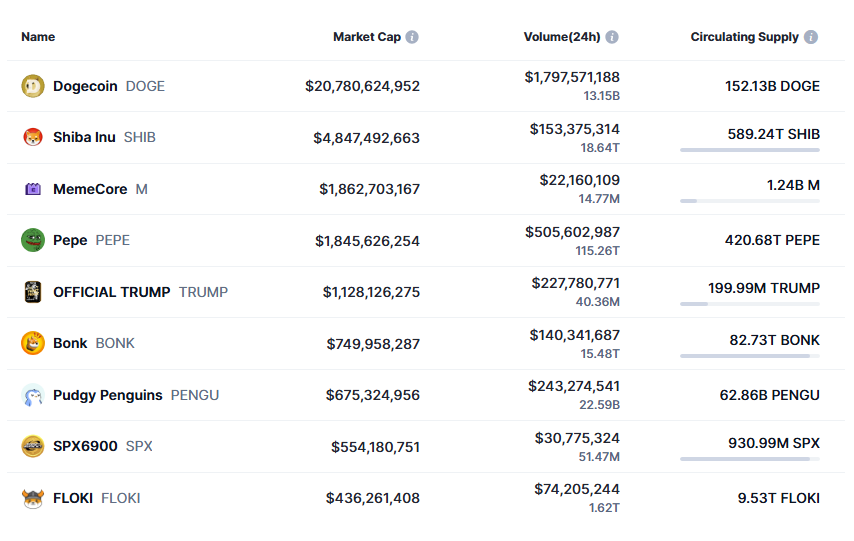

CoinMarketCap: the largest memecoins by market capitalization (December 2025)

Nevertheless, despite its speculative nature, PEPE does display certain patterns you can analyze. Trading volumes, token concentration among whales, correlation with Bitcoin and Ethereum, and activity on social media — all of these factors influence price dynamics.

Moreover, in 2024–2025 we’ve seen rising institutional interest in the meme sector, which could fundamentally change the rules of the game.

Understanding potential scenarios is crucial for any investor planning to hold PEPE in their portfolio. This is not fortune-telling — it’s a balanced assessment of risks and opportunities based on available data.

Now let’s move to the actual forecasts.

Top-5 Optimistic PEPE Price Predictions for 2026

1. Super Bull Market Scenario: $0.0001–$0.0002

The most optimistic scenario assumes that the crypto market enters a full bull phase in 2025, reaching its peak in the first half of 2026. Historically, Bitcoin cycles repeat roughly every four years, and the next peak traditionally occurs 12–18 months after the halving — which took place in April 2024.

In such a scenario, Bitcoin could set a new all-time high, breaking above $150,000–$200,000, while Ethereum follows, reaching $8,000–$10,000. In such periods, altcoins typically show explosive growth relative to the top assets. PEPE, being one of the most liquid and recognizable memecoins, could benefit greatly from a massive influx of speculative capital.

If the price reaches $0.0001, PEPE’s market capitalization would be around $42 billion, comparable to Dogecoin’s levels during previous bull cycle peaks. It sounds ambitious, but it is not impossible — especially considering that Dogecoin once exceeded an $80 billion market cap.

If PEPE maintains its cult status and attracts media attention, such growth becomes technically possible. Key drivers of this scenario:

- listing on major exchanges like Coinbase Pro with full functionality

- integration into DeFi protocols

- potential collaborations with major brands or influencers

- institutional capital flowing into crypto via BTC and ETH ETFs

2. Sustainable Growth Scenario: ~$0.00005

A more realistic, yet still optimistic scenario assumes moderate but steady growth of the crypto market in 2025–2026. In this case, we wouldn’t see an insane rally, but the overall trend would remain upward thanks to broader adoption of blockchain technology and clearer regulatory frameworks.

In this scenario, PEPE grows 5–10× from early 2025 levels, reaching $0.00003–$0.00005. This would place the token’s market cap near $12–$20 billion — still significant, but much more achievable, assuming continued community interest.

This outlook assumes PEPE remains in the top-30 cryptocurrencies by market cap, continues to receive listings on regional exchanges, and is used within NFT projects and gaming platforms leveraging meme culture to attract attention.

A crucial factor will be maintaining social media activity and constant creation of viral content involving Pepe branding.

Another key point: even though the team is anonymous, they must maintain at least minimal coordination with the community and avoid severe reputational scandals. History is full of examples where meme projects lost traction due to internal conflicts or manipulation accusations.

3. Institutional Interest Scenario: $0.00004–$0.00007

One of the more intriguing scenarios involves potential institutional interest in the meme sector. In 2024, we already saw large venture firms paying attention to tokens previously considered purely retail.

If this trend continues, PEPE could enter institutional portfolios not as a core asset, but as a small speculative allocation — similar to a high-beta satellite position.

Even a 0.5–1% allocation from institutional crypto portfolios into memecoins could translate into billions of dollars flowing into the sector.

In this scenario, PEPE reaches $0.00004–$0.00007, corresponding to a market cap of $16–$29 billion.

Institutional money differs from retail: it has a longer investment horizon and is less prone to panic selling during corrections. This could stabilize volatility and help form a more sustainable upward trend. Possible triggers:

- launch of dedicated memecoin index products

- inclusion of PEPE in broad crypto ETFs

- positive commentary from well-known traders or fund managers

- wider recognition of memecoins as a distinct asset class

4. Technological Evolution Scenario: $0.00002–$0.00004

This prediction assumes that PEPE moves beyond being a pure meme-token and gains additional utility. Although the project originally launched without aspirations of functionality, history shows that successful memecoins often evolve.

Dogecoin became a payment method for small purchases and charity. Shiba Inu launched its own DEX (ShibaSwap) and an NFT ecosystem.

PEPE could theoretically follow a similar path — launching an NFT platform, integrating into games as an in-game currency, or becoming a governance token for a DAO.

If such initiatives are implemented, the price could rise to $0.00002–$0.00004, reflecting a $10–$16B market cap. This would be more of a fundamental shift rather than pure speculation.

Crucial challenge: preserve the balance between the “meme vibe” and utility. If PEPE becomes “too serious,” the magic that drives interest could fade — Shiba Inu provides a good example of maintaining this balance.

5. Macro Economic Boom Scenario: $0.00005–$0.00008

The last optimistic scenario is tied to global macroeconomic conditions. If, in 2025–2026, central banks of developed countries start aggressively lowering interest rates and the U.S. economy avoids a major recession, the environment for risk assets — including crypto — becomes extremely favorable.

In periods of cheap money, investors tend to seek high-risk/high-return assets, and crypto traditionally thrives under such conditions. PEPE, as a high-volatility speculative token, could receive an outsized capital inflow from traders hunting quick gains.

In this scenario, the price reaches $0.00005–$0.00008, with a market cap of $21–$33 billion. This would reflect not so much PEPE’s internal success as the broader improvement in global liquidity. Important macro triggers include:

- Fed rate cuts

- positive performance in S&P 500 and Nasdaq

- weakening of the U.S. dollar

- increase in the M2 money supply

- U.S. 10-year yields falling below 3%

Top-5 Pessimistic PEPE Price Predictions for 2026

1. Bear Market Scenario: $0.000001–$0.000003

The most negative scenario assumes that the cryptocurrency market enters a prolonged bearish phase in late 2025 or early 2026. Such periods have happened many times in crypto history and are usually marked by price declines of 70–90% from peak values — especially for altcoins.

If Bitcoin corrects from a potential $100,000–$150,000 down to $30,000–$40,000, altcoins would suffer even more. Without fundamental value backing it, PEPE could lose 95–99% of its highs, falling to $0.000001–$0.000003. At that point, the market cap would shrink to $400M–$1.2B, bringing the token back to mid-2023 levels.

Historically, memecoins take the biggest hit in bear markets because they are the first to lose liquidity. Investors unload speculative assets early, shifting into “blue chips” like Bitcoin and Ethereum — or moving entirely into stablecoins.

Trading volume for PEPE could collapse by 90%, making exits difficult for large holders. Potential triggers for this scenario:

- global recession

- aggressive monetary tightening by central banks

- major hacks or exploits in the crypto industry

- increased regulatory pressure on exchanges

- negative news surrounding top-tier crypto companies

2. Loss of Community Interest: $0.000002–$0.000005

This scenario is not driven by the overall market but specifically by fading interest in PEPE as a meme. Internet culture is extremely volatile — what goes viral today may be forgotten tomorrow. If a new, more attractive meme or token appears, attention and capital may quickly rotate away from PEPE.

We’ve already seen this happen with dozens of memecoins that enjoyed a short-lived hype and then vanished. PEPE has a stronger brand thanks to the long history of Pepe the Frog, but even that does not guarantee perpetual relevance.

If mentions on Twitter/X, Reddit, and TikTok start steadily declining, the price will follow.

Under this scenario, PEPE stabilizes around $0.000002–$0.000005, corresponding to a market cap of $800M–$2B. The token wouldn’t disappear completely, but would turn into a secondary asset with low trading volumes — interesting only to a narrow circle of enthusiasts. Critical metrics to watch:

- number of unique holders (addresses with non-zero balance)

- daily trading volume on DEXs and CEXs

- frequency of social-media mentions

- activity in official community channels (Telegram, Discord)

3. Regulatory Pressure Scenario: $0.000003–$0.000007

Regulatory uncertainty remains one of the biggest risks across the crypto industry. Although 2024 brought some positive momentum — for example, the approval of Bitcoin ETFs in the U.S. — the situation can change rapidly.

If regulators begin to pressure memecoins specifically as high-risk speculative instruments or potential fraud vectors, PEPE could face serious consequences.

Imagine a scenario where the SEC declares memecoins to be unregistered securities and requires exchanges to delist them. Or where European regulators — under MiCA — impose strict limits on promoting and trading speculative tokens.

In such a situation, the price of PEPE could fall to $0.000003–$0.000007, as new investors would face limited access to the token. Market cap would shrink to $1.2B–$2.9B, with PEPE remaining mostly on decentralized exchanges — dramatically reducing its liquidity and attractiveness.

It’s important to understand that regulatory risks don’t disappear even in a generally positive environment for crypto. Memecoins occupy a gray area where the lack of utility makes them vulnerable to accusations of manipulation or pyramid-like behavior.

4. Technical Issues Scenario: $0.000004–$0.000008

Although PEPE is an ERC-20 token on Ethereum — which provides a high level of technical stability — risks still exist. The issues may not arise from the token’s smart contract itself, but from the broader ecosystem around it. For example:

- a major hack of an exchange where most PEPE liquidity is concentrated

- issues within the Ethereum network (despite PoS reducing many risks)

- gas fees spiking dramatically during network congestion

- revelations showing that a small group of whales controls a disproportionate share of supply

If on-chain analysts uncover coordinated manipulation or suspicious wallet links, trust in the token could be damaged.

Under this scenario, PEPE drops to $0.000004–$0.000008 (market cap $1.6B–$3.3B) and remains stuck at those levels until technical or reputational issues are resolved. Restoring confidence may take months or even years.

5. Global Economic Crisis Scenario: $0.000001–$0.000004

The last pessimistic scenario is linked to a possible global economic crisis in 2025–2026. If the world economy enters a deep recession comparable to 2008, conditions for risk assets become extremely unfavorable.

In such an environment, investors flee into safe assets — cash, gold, government bonds. The crypto market could lose 80–90% of its total capitalization, and memecoins would face the greatest pressure.

In this case, PEPE may collapse to $0.000001–$0.000004, returning nearly to its early-2023 levels.

History shows that during systemic crises, even Bitcoin — despite the “digital gold” narrative — struggled to hold value. (Recall March 2020, when BTC dropped 50% in a single day.) And memecoins with no intrinsic utility are even more vulnerable. Possible triggers:

- banking crisis

- sovereign default of a major country

- escalation of geopolitical conflicts

- systemic failure in the financial system

- stock market crash of 40%+ from highs

- unemployment spiking above 8–10% in developed economies

Key Metrics to Track for PEPE

To understand where PEPE is heading, it’s important to ignore the noise and focus on a few truly meaningful metrics.

1. Market Cap and FDV

For PEPE, MCAP and FDV are the same — all tokens are already in circulation. The simplest benchmark: compare PEPE’s market cap to other memecoins like Dogecoin and Shiba Inu to understand its relative position.

2. Daily Trading Volume

Volume/MCAP indicates liquidity. For memecoins, 10–30% is considered healthy. If it falls below 5%, market interest is weakening.

Source: CoinGecko — Markets → Volume.

3. Number of Holders and Concentration

Growth in unique wallets is a positive sign — but you must also see who owns the large balances. If the top-10 addresses control more than 50% of supply, manipulation risk increases

.

Source: Etherscan → Holders.

4. Social-Media Activity

Memecoins depend heavily on attention. Track mentions of PEPE across Twitter/X, Reddit, TikTok.

Tools: LunarCrush, Santiment.

A sharp decline in social activity often precedes price corrections.

5. Correlation with Bitcoin

Watch the 30-day correlation coefficient. If BTC rises while PEPE falls — that’s a warning sign showing capital rotation out of speculative assets.

Source: CoinMetrics → Correlations.

6. Funding Rate on Futures

Binance, OKX, and Bybit offer PEPE perpetual futures. Positive funding = long dominance; negative = short dominance.

Large deviations from zero often signal upcoming reversals.

Binance Futures → Funding Rate.

7. On-chain Whale Activity

Track where whale wallets move their tokens. Deposits to exchanges are a potential sell signal; transfers to cold storage tend to be bullish.

Tools: Nansen, Etherscan, Arkham.

8. Listings on Major Exchanges

Every new listing on Coinbase, Kraken, or Gemini opens PEPE to new audiences and provides additional price momentum. It’s worth monitoring announcements.

Practical Strategies for Working with PEPE

Trading memecoins requires a specific approach — very different from working with fundamentally strong projects. Here are several strategies that can actually be useful:

Dollar-Cost Averaging (DCA)

Instead of trying to catch the bottom or sell at the absolute top, buy PEPE for a fixed amount at regular intervals — weekly or monthly. This reduces the influence of volatility and emotion on your decisions. DCA is especially effective during periods of uncertainty when it’s unclear which direction the market will take.

Profit-Taking Strategy

Set clear levels where you will lock in profits. For example:

- sell 20% of your position after a 100% gain

- sell another 30% after a 300% gain

- and so on

This protects you from situations where profits “on paper” disappear because of a sudden crash. In memecoins, greed is the biggest enemy.

Rotation Strategy

If PEPE shows weakness relative to other memecoins, rotate capital into stronger assets. Track PEPE’s relative strength compared to Dogecoin, Shiba Inu, and trending new memecoins. Capital inside the meme sector often flows from one token to another like waves.

Hedging Strategy

If you hold a large PEPE position, consider hedging through futures shorts or options (if available). This can protect you from sudden crashes. A softer alternative — keep part of your portfolio in stablecoins or Bitcoin, which are less volatile.

News Trading Strategy

PEPE is extremely sensitive to news and viral content. Follow social media trends and be prepared to react quickly. But always remember the classic trap: “buy the rumor — sell the fact.” Often, positive news is already priced in before it becomes official.

Typical Beginner Mistakes When Trading PEPE

1. Investing money they can’t afford to lose

PEPE is pure speculation. Money for rent, debt payments, or healthcare does not belong here. Only invest what you’re truly prepared to lose.

2. Buying during hype peaks

If everyone — from your friends to news outlets — starts talking about PEPE nonstop, the best entry points are already gone. Big profits go to those who buy in silence, not during euphoria.

3. Overloading the portfolio with one memecoin

The hope of “hitting the jackpot” usually ends the same way — with a blown-up account. Even if you like PEPE, keep the memecoin allocation reasonable — definitely not your entire portfolio.

4. Panic-selling during dips

Memecoins can drop 50–70% and then bounce just as sharply. Selling in a moment of fear turns temporary volatility into a permanent loss. Decisions should follow your strategy — not your emotions.

5. Blindly trusting influencers

Many “analysts” promote tokens simply because they hold those tokens themselves. Their interest is to find buyers. Your interest is independent analysis and a cool head.

6. Trading with high leverage

Using 20x–50x leverage on PEPE almost always ends with liquidation — volatility is simply too high. If you absolutely must use leverage, keep it minimal and always use stop-losses.

PEPE’s Relationship With Other Crypto Trends

PEPE doesn’t exist in a vacuum — its future is tightly connected to broader processes across the crypto market. Understanding these relationships helps you better anticipate price behavior.

Bitcoin as the Market Barometer

When Bitcoin grows, altcoins usually follow with a delay and greater amplitude. But during distribution phases — when BTC stalls or begins correcting — altcoins may keep rising. This is called “altseason.” PEPE tends to perform best during these phases, when speculative capital rotates from Bitcoin into higher-risk tokens.

Ethereum and Gas Fees

Since PEPE is an ERC-20 token, Ethereum gas fees directly affect its trading activity. When gas exceeds $50–$100 per transaction, smaller investors simply can’t afford to buy or sell PEPE. Layer-2 solutions (Arbitrum, Optimism) can help in theory, but most liquidity is still on Ethereum mainnet.

DeFi and Staking

If PEPE is integrated into DeFi protocols — for staking or liquidity provision with yield — that could add real utility. Users would then hold PEPE not just in hopes of price growth, but also to earn passive income. This reduces sell pressure and stabilizes price.

NFTs and Metaverses

Pepe the Frog has deep roots in NFT culture — thousands of art collections use this iconic image. If the PEPE token integrates with NFT projects or metaverses (e.g., for purchasing digital items), it would generate additional demand.

Meme-Coin Indexes and Basket Products

In 2024, the first attempts emerged to create memecoin index products that include Dogecoin, Shiba Inu, PEPE, and others. If regulators approve such products and they appear on traditional broker platforms, PEPE gains access to a massive TradFi audience.

Expert Opinions on PEPE’s Future

Michaël van de Poppe, well-known analyst and trader

“Memecoins are a casino within a casino, but ignoring them is a mistake. PEPE has shown surprising resilience compared to other memes, which speaks to the strength of its community. If the market enters a bull phase in 2025, I wouldn’t be surprised to see PEPE in the top-20 by market cap.”

Alex Krüger, economist and crypto investor

“The problem with all memecoins, including PEPE, is that they have no safety net when the market falls. When money leaves the sector, these tokens lose 90% of their value in weeks. I wouldn’t keep more than 3–5% of a portfolio in such assets — and only as a speculative bet.”

CoinGecko analytics team, annual report 2024

“PEPE has demonstrated the best liquidity among second-tier memecoins. If it maintains a top-50 position by trading volume and continues receiving new listings, the chances of surviving the next cycle are high. However, investors should remember: out of the hundreds of memecoins launched in 2023–2024, 95% will be forgotten by 2026.”

FAQ

1. What exactly is PEPE and why is there so much hype around it?

PEPE is a memecoin on Ethereum launched in April 2023 by an anonymous team. It exploded thanks to the viral popularity of Pepe the Frog and quickly moved into the top memecoins by market cap.

2. Why do PEPE forecasts matter if it’s “just a meme”?

Because behind the meme there’s a real market: liquidity, volume, whales, listings. Yes, it’s speculative — but speculation can also be analyzed using data and scenarios.

3. What’s the most optimistic scenario for PEPE by 2026?

In a super bull market with ideal conditions (strong BTC/ETH growth, hype, listings, institutional money), the optimistic range is $0.0001–$0.0002.

4. What’s the more “down to earth” positive scenario?

Without a crazy rally, but with a steady market and stable interest in memecoins — $0.00002–$0.00005.

5. How much can institutional interest and new utility help?

If funds begin taking small PEPE allocations and the token gets utility (games, NFT, DeFi, DAO), the price could rise into the $0.00002–$0.00007 range.

6. In the worst case, how low can PEPE fall?

In a prolonged bear market or crisis, with regulatory pressure and liquidity leaving the sector — $0.000001–$0.000003, roughly returning to its early-2023 levels.

7. Which metrics are actually worth watching for PEPE?

Market cap, FDV, daily volumes, number and concentration of holders, social activity, correlation with BTC, futures funding, whale movements, new listings.

8. What strategies work besides “buy and pray”?

DCA, predefined profit levels, rotation among memecoins, partial hedging via futures, and news trading based on actual events rather than emotions.

9. What are the most common mistakes newcomers make with PEPE?

Investing money they can’t lose, buying at hype peaks, stuffing the portfolio with one token, panic-selling dips, blindly trusting influencers, using high leverage.

10. What does PEPE’s future depend on most?

A combination of three factors:

- overall crypto market conditions (BTC/ETH + macro)

- attention toward the meme sector

- whether PEPE stays a “living meme” — with liquidity, community, and culture — rather than a one-time hype wave.

Summary

PEPE is not “the new Bitcoin,” nor is it a technological revolution. It’s a high-risk memecoin sitting at the intersection of culture, speculation, and liquidity flows.

In bullish scenarios, PEPE can deliver multiples — especially in an environment of strong market growth, cheap liquidity, and heightened interest in the meme sector.

In bearish scenarios, it can just as easily lose 90%+ of its value and return to where it started.

A healthy approach to PEPE is to treat it as a speculative add-on to a portfolio, not its foundation. Focus on metrics, not on someone’s “10× predictions on Twitter.” Know in advance where you plan to take profit, and where you’re prepared to accept loss.

Handled this way, PEPE becomes a risky but controlled bet — not a lottery ticket with an unpredictable ending.

What to Do Next

If you’ve made it this far, you’re no longer gambling — you’re starting to build a system.

Save this article as a framework for working with forecasts: Come back to it in a month, compare fresh data — ETF inflows, TVL, ETH price — with the scenarios we covered, and see which one the market is currently drifting toward.

In the next materials from Crypto Academy, we will break down:

- how to read Ethereum on-chain data without unnecessary math

- how ETF flows shape market cycles

- how “smart money” (whales, funds, protocols) drives trends in ETH and other assets

Subscribe to Crypto Academy and get access to the crypto and Bitcoin course — it remains free while most people are still waiting for the “perfect entry.”

Telegram | Discord | Twitter (X) | Medium | Instagram

December 25, 2025