Bitcoin mining is increasingly a story about energy economics and industrial strategy. In 2026, miners are adapting to tighter margins, competition for power from AI/HPC, and a more explicit “infrastructure business” identity — where owning contracts, interconnects, and flexible loads can matter as much as ASIC fleets.

Key Takeaways

Mining margins compress when hashprice falls and power costs rise; many operators diversify toward AI/HPC hosting. (Investing.com transcript)

Miners increasingly compete with AI data centers for power and interconnects. (The Verge)

Strategy is shifting toward maximizing profit per megawatt-hour, not only BTC produced. (Investing.com transcript)

Difficulty adjustments provide short-term relief, but competitiveness still depends on cost structure and energy strategy.

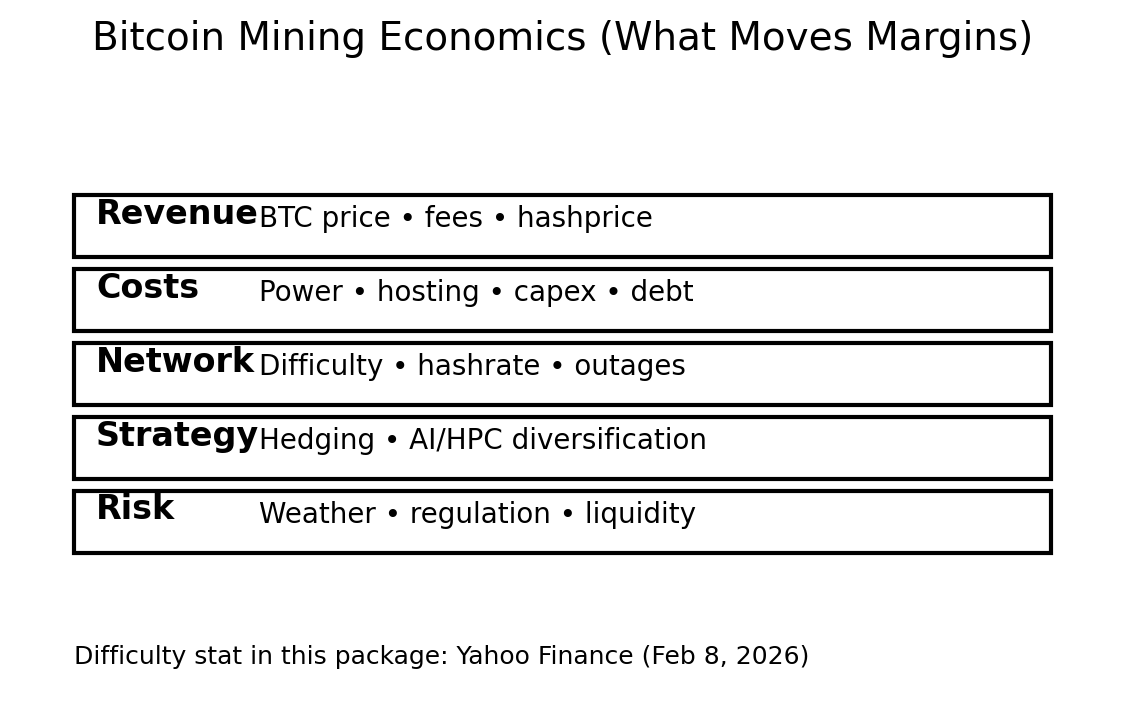

Mining economics framework (original visual) — the main levers that move margins.

Energy is the core constraint

Mining is often described as “compute,” but the binding constraint is usually energy: cheap, stable power; flexible contracts; and the ability to curtail when the grid needs it. This is why many miners now present themselves as digital infrastructure firms rather than “crypto companies.”

In a September 2025 industry panel transcript published by Investing.com, MARA Holdings CFO Salman Khan summarized that approach: “Our goal is to maximize our profit dollar profit per megawatt hour, whether it’s Bitcoin mining or whether it’s AI inference on the edge.”

Why AI/HPC changes the mining landscape

AI data centers and Bitcoin miners both chase similar resources: power interconnects, cooling, and large-scale sites. The Verge highlighted research suggesting AI’s power draw could rival or surpass Bitcoin mining, increasing scrutiny and competition for electricity.

When AI buyers lock in long-term power contracts, miners can lose the most attractive pricing. That pushes miners toward owning generation, seeking interruptible load agreements, or building hybrid campuses where mining monetizes power quickly while HPC builds out over longer timelines.

How miners are adapting

1) Diversifying revenue: hosting AI/HPC workloads alongside mining where feasible. 2) Owning more of the stack: acquiring sites, securing interconnects, or buying generation. 3) Hedging + treasury management: managing exposure to BTC price and operational volatility.

The strongest operators are typically those with low all-in power costs, strong balance sheets, and flexibility to repurpose infrastructure if mining margins compress further.

What to watch

Track difficulty, hashprice, and power-market conditions. If difficulty rises while BTC price is flat, margins compress. If difficulty falls or power costs drop, margins improve. Also watch public miner updates on curtailment, financing, and moves toward AI/HPC hosting — those decisions often reveal how executives see the next cycle.

Sources

Investing.com transcript — Marathon Digital at H.C. Wainwright (includes Salman Khan quote): https://www.investing.com/news/transcripts/marathon-digital-at-hc-wainwright-strategic-shifts-in-bitcoin-mining-93CH-4232431

The Verge — AI could consume more power than Bitcoin by the end of 2025: https://www.theverge.com/climate-change/676528/ai-data-center-energy-forecast-bitcoin-mining

February 9, 2026