Crypto just got its own trust score — built for the chain, not the banks.

Summary Points:

- Crypto credit ratings are like DeFi’s version of your credit score.

- They turn on-chain chaos into risk insights for investors and protocols.

- Ratings can help protect users from scams, hacks, and overhyped projects.

- The endgame? Smarter lending, safer investing, and real yield without guesswork.

Okay, What the Hell Is a Crypto Credit Rating?

Think of it like this: in traditional finance, your credit score determines whether you get approved for a mortgage or receive another polite rejection email from the bank.

In crypto, there’s no central credit bureau — just wallets, smart contracts, and data scattered across blockchains. That’s where the idea of a cryptocurrency credit rating comes in: a system that brings order and accountability to decentralized finance by translating on-chain transparency into measurable trust.

Now, new “rating” systems are trying to make sense of that mess. They’re the crypto-native answer to “can I trust this thing?”

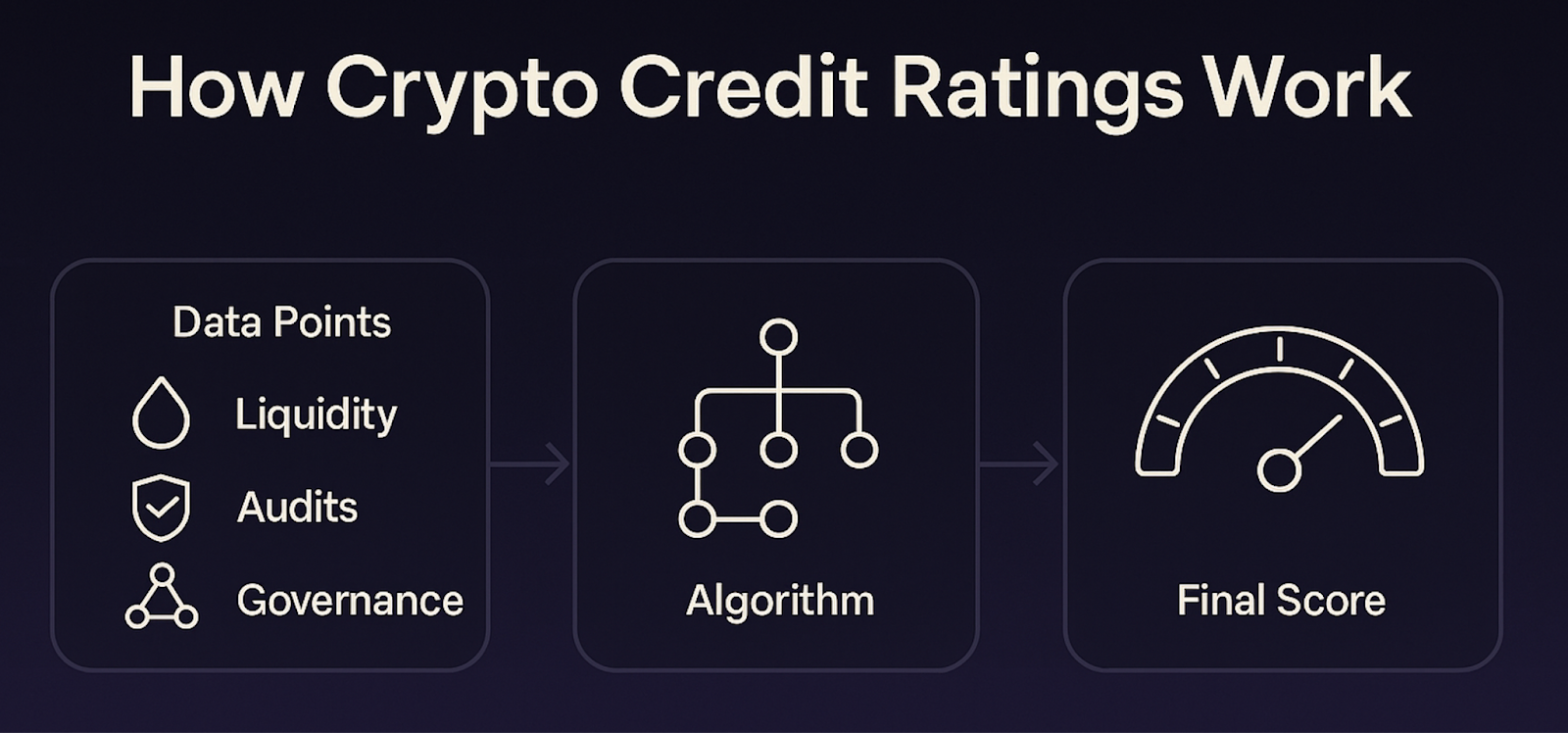

Instead of checking your income or payment history, they look at stuff like:

- On-chain activity (is this project alive or just bots?)

- Security track record (have they been hacked before?)

- Liquidity (can you actually trade this thing without breaking the market?)

- Governance and transparency (who’s calling the shots?)

Put simply: a crypto credit rating tells you how stable, secure, and legit a token, protocol, or DeFi borrower is — all using public data.

Why It Matters: Risk, Reward, and Reality

“The point of crypto was transparency. Ratings just make that transparency useful.” — Caitlin Long, CEO of Custodia Bank

Caitlin Long’s point cuts to the core of DeFi’s evolution. Transparency has always been crypto’s superpower — every transaction, audit, and governance vote sits in plain sight. But raw data alone doesn’t drive smarter decisions; context does. Ratings translate that open information into actionable insight, turning transparency into a tool rather than just an ideal.

Crypto’s early days were marked by rapid innovation — and equally rapid losses from rug pulls and flash loan exploits. Ratings help distinguish the projects with real fundamentals from those driven purely by speculation.

Here’s the deal:

- For investors: ratings = confidence. You can spot which protocols actually manage risk and which are one exploit away from zero.

- For institutions: ratings bridge the trust gap between DeFi and Wall Street.

- For builders: they give feedback loops — fix security, boost transparency, score higher.

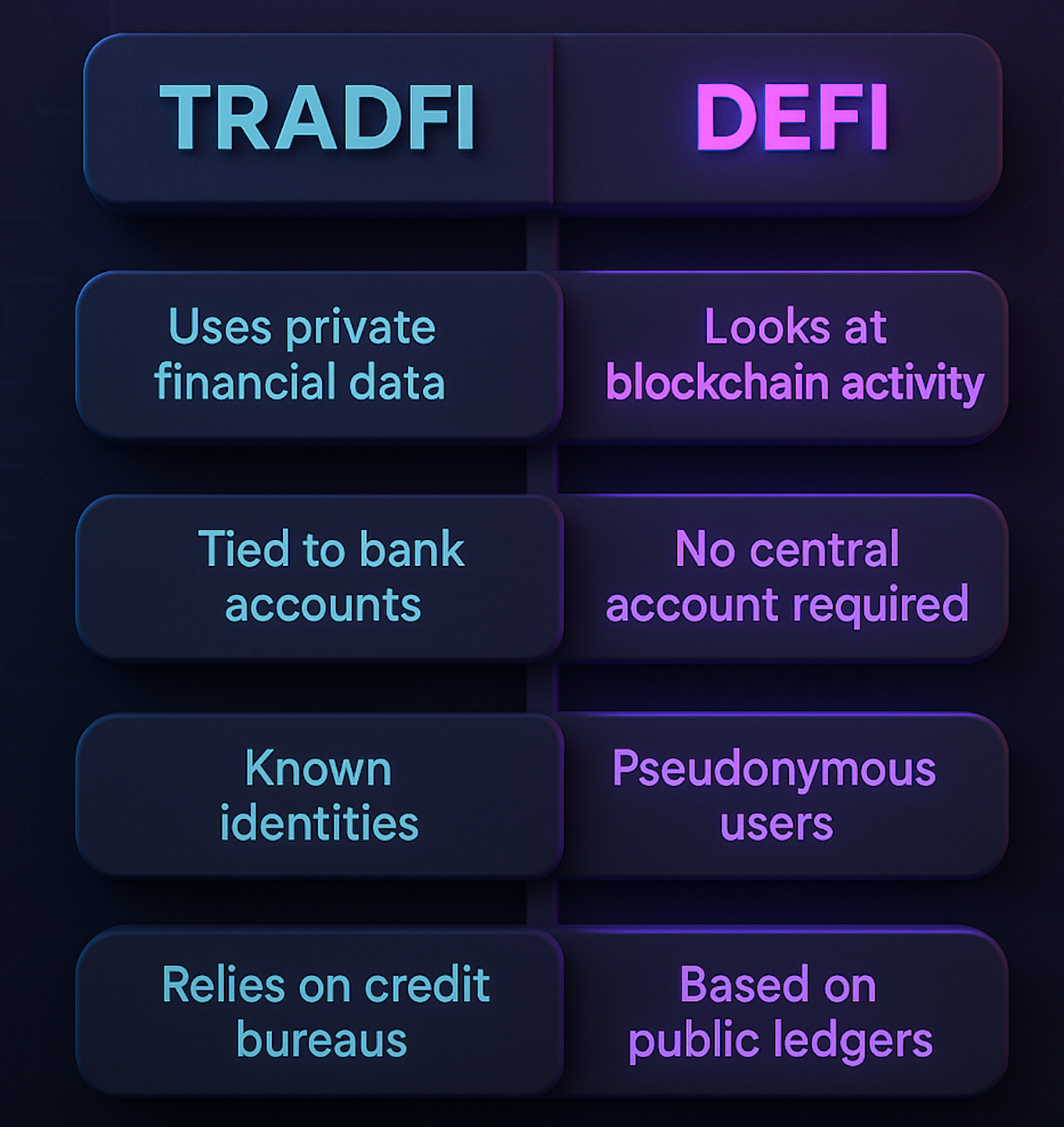

In TradFi, credit ratings focus on governments and big corporations, using private financial data that only a few people ever see. Updates come slowly — quarterly if you’re lucky — and the main goal is to figure out who’s least likely to miss a payment. It’s closed, cautious, and built for the old world.

DeFi does things differently. Ratings look at tokens, DAOs, and protocols, pulling straight from public, on-chain data and open audits. Everything’s transparent and often updated in real time. Instead of just asking “can they pay it back?”, it’s about understanding how stable, trustworthy, and resilient a project really is.

TradFi keeps the data behind closed doors. DeFi keeps it in plain sight — for anyone to check, anytime.

In short: same goal, completely different universe.

Benefits and Trade-offs

Real-time crypto ratings offer big benefits: they give instant insight into risk, help users steer clear of scams and rug pulls, and add credibility that institutions actually trust. They also set clear benchmarks for DeFi lending and borrowing. And while people still ask “does crypto affect credit scores?” — not yet, but the rise of crypto ratings might start to blur that line. But there are trade-offs — no universal standard means one platform’s “A” could be another’s “meh,” and on-chain data can still be messy or misleading.

Plus, if projects pay for their own ratings, conflicts of interest creep in. Still, the upside is huge: these ratings could do for crypto what Moody’s and S&P did for traditional finance — just without the suits and the paperwork.

The Money Part: Turning Ratings Into Alpha

Here’s where things get spicy.Once crypto projects have standardized risk scores, DeFi lending platforms can start acting like smart, automated credit markets.

Imagine:

- You stake into a protocol with a top-tier “AA” DeFi rating.

- You get better yields with less risk exposure.

- Or, you can borrow more confidently from a stable protocol because you know it’s well-audited and liquid.

Platforms like Weiss Ratings, TokenInsight, and DeFi Safety are already building these trust layers. Others — like RociFi or Quadrata — are experimenting with on-chain identity and decentralized “credit passports” that move with your wallet.

When DeFi Safety upgrades a project like Aave or Curve, the ripple effect is instant — more lenders, more liquidity, lower risk premiums. When a protocol gets downgraded after an exploit? Borrowing dries up overnight. That’s the power of a strong crypto score in action — a single metric that can shift sentiment and capital in real time. That’s what happens when transparency meets money flow.

From Ratings to Real Income

Here’s where it connects to the real world.

If you’re putting aside money, staking, or yield farming, crypto credit ratings — or even your broader cryptocurrency score — are your new guide. They help you tell the difference between genuine opportunities and the sketchy hype — making it easier to invest with confidence.

Even for everyday users, platforms like GoMining are making these principles accessible.You don’t need to understand hash rates or proof-of-work mechanics — GoMining uses transparent, on-chain data to show real-time mining efficiency, helping users earn Bitcoin in a verified, risk-aware way.

It’s the same logic as ratings: see the risk, manage it smarter, and get rewarded.

Crypto’s next evolution isn’t just faster transactions or new tokens — it’s trust, quantified. Credit ratings won’t make DeFi boring; they’ll make it usable at scale. And in a world where transparency is the new currency, that might just be the real alpha.

FAQs

1. What is a crypto credit rating, in plain English?

It’s a trust score for tokens and protocols. It uses blockchain data — not banks — to measure risk.

2. Who gives out these ratings?

Agencies like Weiss Ratings, TokenInsight, and DeFi Safety, plus newer on-chain ones like RociFi or Quadrata.

3. Are crypto ratings actually reliable?

They’re improving fast. The data is public, but methods differ — think early internet search engines before Google standardised the game.

4. Can ratings prevent scams?

Not 100%, but they’re like headlights on a dark road — you’ll see danger coming sooner.

5. What’s next for this space?

Expect AI-driven real-time ratings, regulatory oversight, and maybe even community-run DAOs that crowdsource trust scores.

October 28, 2025