Just a few years ago, buying cryptocurrency seemed complicated — requiring deep technical knowledge, registration on an exchange, long bank transfers, and mandatory verification. But by 2025, the market has changed dramatically. Users gained access to simple “one-click” services, regulated providers, and transparent rules, while Visa and Mastercard integrated crypto payments into their infrastructure.

Today, buying Bitcoin, Ethereum, or stablecoins like USDT is as easy as paying for a flight or a Netflix subscription. All you need is a bank card and a few minutes — and the crypto will arrive in your wallet almost instantly.

This guide is for those who want to do it without mistakes, understand real fees, European regulation specifics, and the difference between buying through an exchange, a wallet, an on-ramp, and alternative methods.

Why People in 2025 Are Increasingly Buying Crypto with a Bank Card

For most users, a bank card remains a familiar, fast, and psychologically comfortable tool. You only need three steps: choose the coin, enter the amount, confirm the payment — and you already own a digital asset.

The main advantage is speed: while a SEPA bank transfer may take several hours or even a day, a card payment delivers crypto in 1–5 minutes. This is crucial in a volatile market, where price direction can change within seconds.

There is another reason. After MiCA regulation came into force, European banks changed their approach to crypto: instead of a strict “no,” they increasingly say “yes — if rules are followed.” Many financial institutions now support crypto-related payments, and some fintech neobanks (Revolut, N26, etc.) even educate customers on safe digital asset purchases.

Buying with a card has become a natural part of Europeans’ financial behavior — like paying for goods online. The only difference is that you’re buying not a product, but a digital asset that can grow in value.

How Buying Cryptocurrency with a Card Works — in Simple Terms

To understand the process, imagine something familiar: booking a vacation on an airline’s website. You choose a destination, select dates, enter your card details, receive an electronic ticket — and you’re ready to travel. With crypto, it’s almost the same:

- You choose a cryptocurrency, for example Bitcoin, Ethereum, or USDT.

- You enter the amount — let’s say €150.

- You select the payment method — Visa or Mastercard.

- A specialized payment provider (a bridge between your bank and the crypto market) processes the transaction.

- The bank confirms payment, and within a couple of minutes you receive crypto into your exchange or personal wallet.

The buyer only sees a clean and simple interface, but behind the scenes there is a complex chain of financial, payment, and blockchain processes. The user no longer needs to deal with that — and this is the real progress.

Where to Buy Cryptocurrency with a Bank Card in 2025 - 2026

Today, the market of crypto-buying options resembles a well-organized supermarket: different “sections” for different needs. Some want maximum simplicity and trust a major exchange, others want full autonomy and self-custody from the first minute, while some prioritize speed and minimal formalities. Below is an overview of the main routes Europeans use in 2026.

Major Centralized Exchanges: The Familiar and Clear Path

For most users, the first experience with crypto still happens on major exchanges — Binance, Coinbase, Kraken. These platforms have become the equivalent of “crypto branches” of banks: everything is in one place.

The flow is simple: you create an account, link your bank card, pass basic verification (usually 3–5 minutes), enter the amount, and buy crypto at the current rate. The exchange acts as an intermediary, custodian, and teacher at the same time: there are educational materials, charts, stats, and sometimes a simulator for beginners.

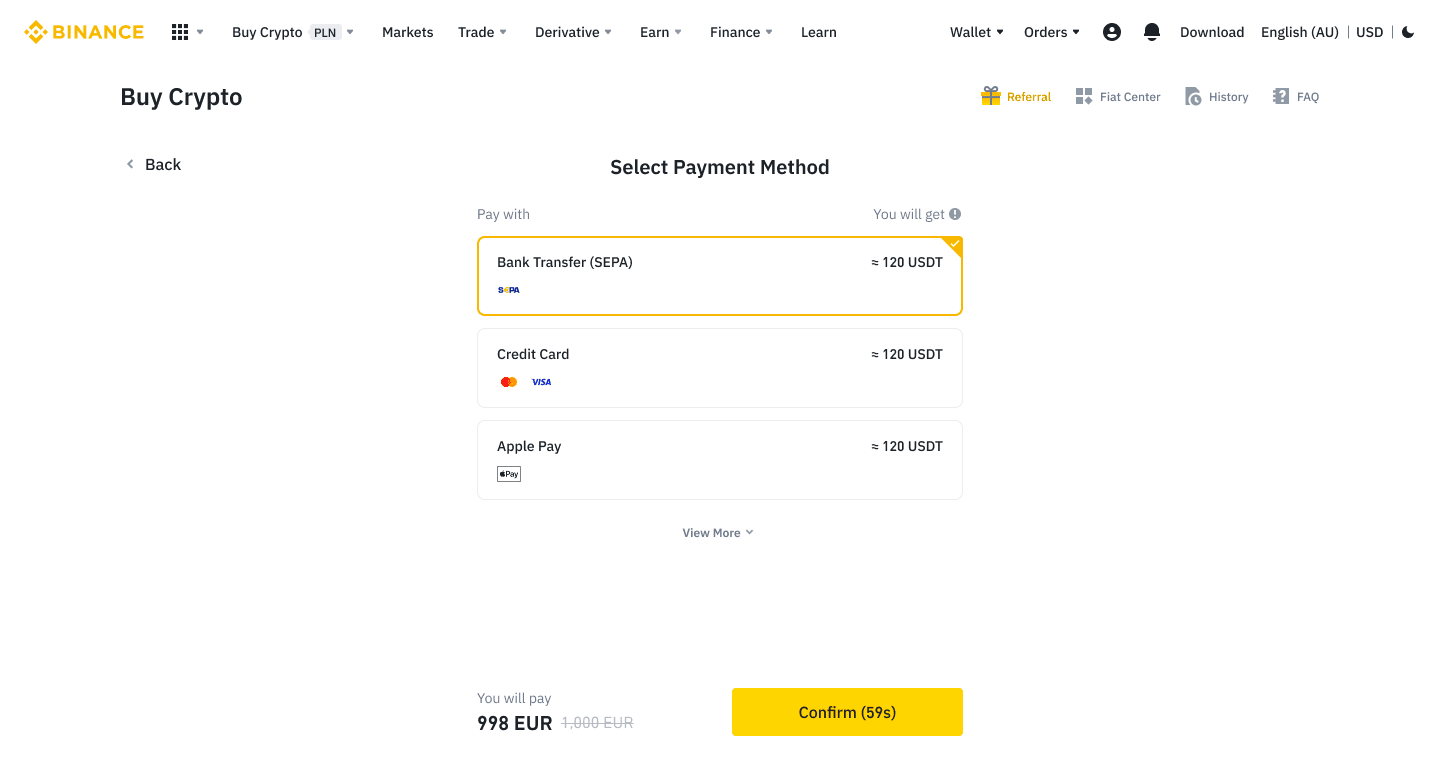

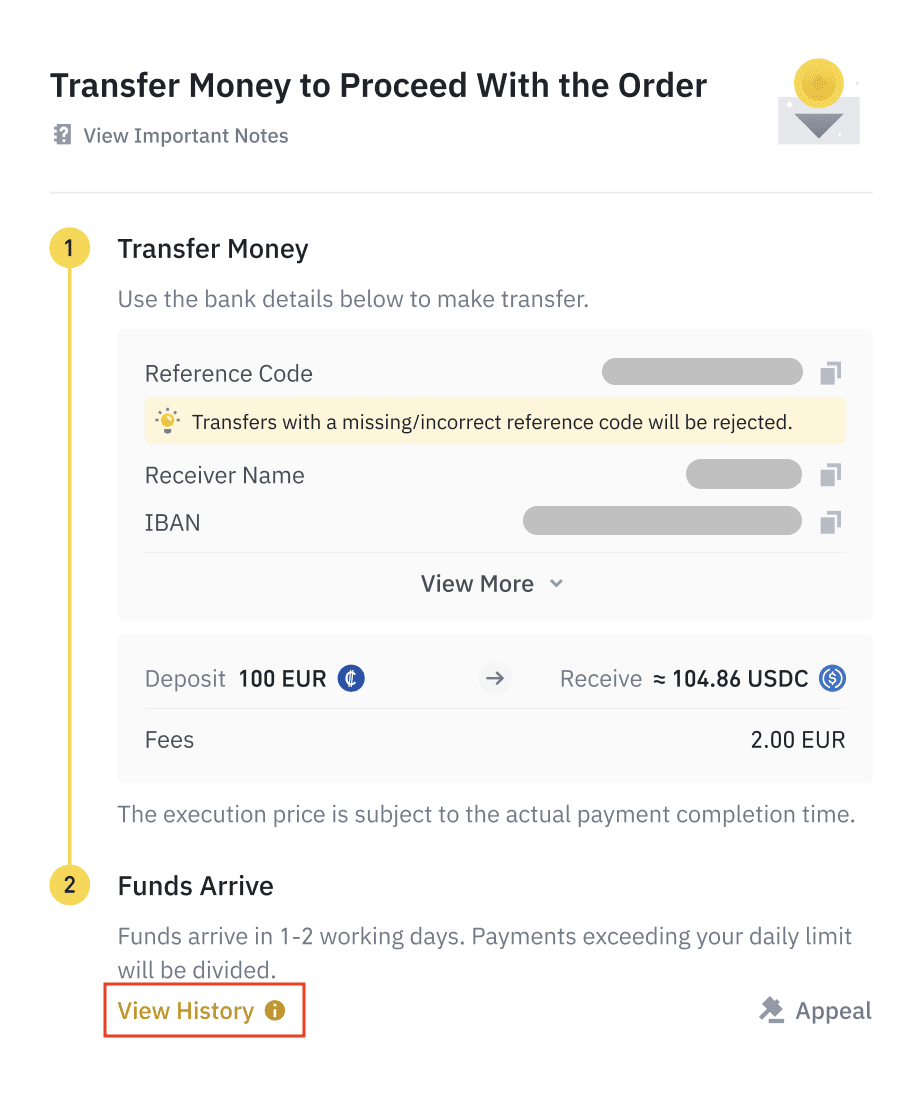

Source: www.binance.com

Source: www.binance.com

The advantages: reliability and service. You get support, clear instructions, the ability to sell crypto back, convert to euros, or withdraw to your card. Many exchanges offer “zero-fee” promotions for first purchases or introductory periods for new users.

The downside: exchanges require KYC/AML — from basic ID checks to full verification for larger amounts. For many, this is fine, but for some users, it remains a barrier.

On-Ramp Services: One-Click Purchases Without an Exchange

On-ramp platforms became for crypto what online payments once did for e-commerce: they turned a complex process into a “single button.” MoonPay, Ramp Network, Mercuryo, Coinify — these names are well-known to experienced users.

Their job is to act as a bridge between traditional finance and crypto. You open a website or app, choose a coin and amount, pay with a card — and the service sends crypto where you instruct: an exchange, a wallet, an NFT marketplace, or a Web3 app.

The benefits are clear: minimal bureaucracy, fast process, local payment method support, and user-friendly design. Many on-ramp providers operate under European or U.S. licenses, which adds trust.

The drawback: fees can sometimes be higher than exchanges, especially for small amounts. This is the price for speed, convenience, and “pain-free” onboarding.

Buying Cryptocurrency Through Exchange Aggregators and P2P Platforms

While large exchanges and licensed on-ramp providers build strict processes, there has always been another, parallel route to purchase crypto. It’s less formal, sometimes faster, more flexible — and for some users, even more familiar.

We’re talking about exchange aggregators and P2P platforms such as BestChange or the P2P sections of major exchanges. In this space, crypto is bought not from the platform itself but directly from other people or exchange services.

How It Works

Imagine an online marketplace where dozens of sellers offer to exchange your euros for cryptocurrency on their own terms. The aggregator acts as a navigator — collecting the best offers, comparing rates, displaying fees, payment methods, reviews, and the service’s reputation.

The user chooses a suitable offer, goes to that exchanger’s site, and completes the deal in direct dialogue with the operator or P2P seller. Usually, the process takes from 5 to 20 minutes — and there’s no need to create an account, pass long KYC, or reveal unnecessary data.

Why Thousands Choose This Route

There are several practical reasons:

- Minimal formalities — sometimes just an email or a Telegram contact is enough.

- Speed — no waiting for bank confirmations; the deal happens “here and now.”

- Flexibility — pay by card, SEPA, Revolut, Wise, PayPal, or even cash in some countries.

- Better rates — you can often find favorable exchange rates, especially for sums over €500.

For many, this method feels like a “freedom valve” — restoring the sense of a direct peer-to-peer transaction without excessive bureaucracy.

Where Caution Matters More Than Speed

Where there are fewer formalities, there’s more personal responsibility. Unlike exchanges, here you trade directly — so you must be careful choosing your counterparty. The most common risks:

- If a dispute arises, recovering funds is much harder.

- Offers that look too good may be traps.

- Banks may become suspicious of frequent transfers to individuals.

- There are no built-in safety guarantees or support systems.

Experienced users who prefer this route always start small, check reviews and service history, and stay calm during communication.

What a Real Deal Looks Like

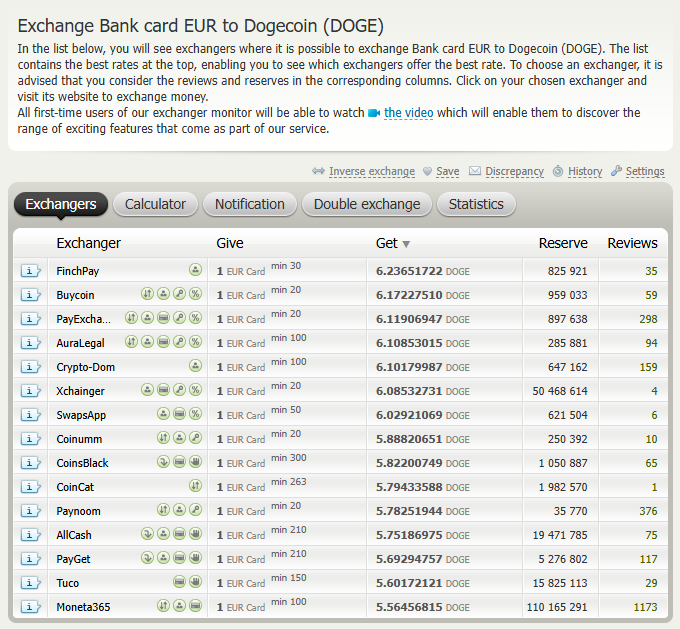

You decide to buy DOGE for €300. You open an aggregator and select “Buy DOGE for EUR, pay by card.” You see a list of exchangers with different rates, fees, and reviews. You pick one with a fair rate and solid feedback:

Source: bestchange.com

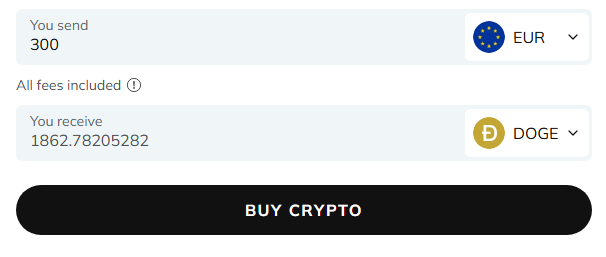

Then you go to the exchanger’s site, enter the amount and your wallet address. They send payment details — for example, a card or a Revolut account. You transfer the money, send confirmation, and within minutes DOGE appears in your wallet:

The entire process takes no longer than ordering food delivery — but unlike food, you must be twice as attentive.

How Much It Costs: Fees, Limits, and the Real Price of Buying Crypto with a Card

When buying crypto by card, users often notice only the visible fee — the one written in big letters on the screen. However, the final price may differ. This section will help you understand the full picture and avoid overpaying.

The Fees You See… and the Ones You Don’t

Most services honestly display the main commission — typically 2–6%, depending on the platform, payment method, and region. But the final cost is made up of several layers:

- Platform or exchange commission for the purchase itself

- Payment-provider fee for processing the transaction

- Possible currency conversion (e.g., your card is in PLN but the purchase is in EUR)

- Spread — the difference between the real market rate and the rate offered by the service

As a result, a €200 purchase might cost €8–€16 more — simply due to these combined costs.

That’s why experienced European users often choose SEPA + exchange for investments of €700–€1000 or more. For small sums, the difference isn’t critical, and card convenience outweighs it.

If you’re buying regularly under a DCA strategy (small, periodic purchases), limits are usually more than enough. For large entries, it’s worth preparing verification documents in advance or splitting the purchase between several services.

How to Save on Fees Without Losing Convenience

Crypto savings start not with “magic exchanges” but with understanding cost structure. A few simple habits can reduce annual purchase costs by 15–40%, especially if you buy regularly.

1. Use SEPA for amounts €500 and aboveCard fees hit hardest on mid- to large-size payments. For €500 +, it’s cheaper to send a SEPA transfer to an exchange and buy there — often with zero commission.

2. Watch out for hidden conversionsIf your card isn’t in EUR, double conversion can eat up 2–3% of the total. Use a euro card whenever possible, especially within the EU.

3. Track exchange promo periodsEvery few months, exchanges run promotions: “zero fee for new users,” “0% for 30 days,” or “bonus for €100 purchase.” That’s the perfect moment for your first step.

4. DCA = less stress, fewer feesRegular purchases (weekly or monthly) smooth out price volatility and distribute costs. Many Europeans invest this way — “bit by bit, but consistently.”

Security: How to Buy Crypto and Sleep Soundly

With growing convenience comes a new kind of carelessness. When everything happens in two clicks, it’s easy to forget basic safety rules. But like any financial field, the crypto world does not forgive naivety. Here are a few principles to protect your money:

- Use only official websites — go through verified sources: the project’s official site, App Store / Google Play, or links from the exchange itself. Phishing copies are more sophisticated than ever.

- Always enable 2FA — SMS codes are outdated. Use Google Authenticator or an equivalent app — your best insurance.

- Double-check all payment details — one wrong symbol in a wallet address can cost 100% of your funds. This is especially critical for P2P deals.

- Stay calm — crypto is an emotional environment. If an offer looks “too good to be true,” it probably is.

Common Rookie Mistakes (and How to Avoid Them)

To make this article not just helpful but practical, it’s important to highlight the mistakes almost all first-time buyers make. Knowing them in advance is already half the success.

- Chasing the lowest fee Beginners try to save €1–€3 and end up risking much more by choosing unverified services. For your first purchases, safety and experience matter more than mathematical precision.

- Investing the entire amount at once Many enter the market “on emotions” and see the price drop a week later. A calm, partial entry — DCA — is a strategy that protects both money and nerves.

- No plan after buying The question “What will I do with crypto after I buy it?” should come before the purchase. Will you invest, hold, transfer, spend, stake? The answer affects your choice of platform.

- Leaving all funds on an exchange Exchanges are reliable, but no system is perfect. For long-term storage, keep at least part of your assets in a personal wallet.

How to Buy Cryptocurrency with a Bank Card: A Step-by-Step Guide

To turn everything above into practical value, here is a simple, human, and clear roadmap. It helps you go from idea to owning crypto without stress.

Step 1. Decide why you need cryptoThis isn’t a formality — it’s the foundation. Do you want to invest, store value, send money, buy NFT, or try DeFi? Your goal determines the route: exchange, on-ramp, aggregator, or P2P.

Step 2. Choose the platform

- for beginners — an exchange with card support

- for those prioritizing speed — an on-ramp

- for confident users — an aggregator or P2P

Step 3. Prepare your cardA euro card works best to avoid hidden conversion fees. Make sure your bank doesn’t block crypto-related payments (sometimes enabling “international online payments” is enough).

Step 4. Make the purchaseEnter the amount, confirm payment, and wait for the crypto to arrive. Don’t rush — double-check the wallet address, payment details, and transaction info.

Step 5. Secure your assetsEnable 2FA, store your seed phrase safely (if using a wallet), and set up recovery options. It’s the “boring part,” but it protects your money.

Step 6. Take your first step mindfullyDon’t invest everything at once. Start small, observe the market, feel the dynamics. If going long-term — consider DCA.

Step 7. Decide on your next moveWill you hold? Move to DeFi? Exchange? Each path requires next steps — and we will cover them in separate Crypto Academy materials.

FAQ: Answers to Questions You Wanted to Ask but Didn’t Know Whom

Can I buy crypto with a bank card in Europe without verification?

Yes, but only through unofficial or partially verified methods — such as P2P or aggregators. They require caution and don’t suit everyone.

What is a normal fee?For cards — 2–6%. Anything above 6–7% requires careful review.

What’s safer: card or SEPA?Card is faster and easier. SEPA is more cost-efficient for €500–€1000+.

Should I withdraw crypto from the exchange immediately?

For small sums — not necessary. For long-term storage — better to move at least part to a personal wallet.

What if my bank blocked the payment?Try another bank/card or use an on-ramp. Some EU banks temporarily block crypto-related transactions to “protect customers.”

Can I lose money in a P2P trade?Yes — if you choose a dishonest seller. Start with small amounts, check reviews, and use offers with escrow.

Is it better to buy all at once or gradually?Historically, DCA is a calmer and more balanced strategy.

Where to follow guides and educational materials?Crypto Academy has a section with tutorials and analytics (internal link will be added during layout).

In Conclusion

Buying cryptocurrency with a bank card is no longer difficult or risky. It has become part of modern financial culture — where technology and regulation finally meet at the same level.

Yes, cards come with fees — but that’s the price for accessibility, speed, and removing barriers. For many, that first click “Buy” becomes the starting point of a journey — one that leads to discovering new opportunities: self-custody, staking, DeFi, Web3, and new income models.

Start small, act with understanding — and let your first step into the crypto world be not impulsive, but a conscious choice.

To strengthen your foundation, begin with the basics: subscribe to GoMining Academy and get access to the free course “From Zero to Advanced GoMiner” → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

November 17, 2025