In this article, you will learn how not to lose money on trading strategies, and which of them are considered the least profitable, why it is important for every investor to recognize them. We will analyze which trading approaches systematically lead to losses, which metrics to use to check effectiveness, and how forecasts for 2025–2026 will help you avoid pitfalls and build a sustainable profitability model.

"Beginner mistakes in 2025 are repeating themselves: trading without a plan, ignoring risk management, and following FOMO. These approaches systematically lead to losses." — Blockchain Council

What are the least profitable trading strategies?

Unprofitable strategies are not just mistakes in individual trades, but entire trading methods that are based on incorrect assumptions from the outset. In cryptocurrency, they are often disguised as "get-rich-quick schemes" or "popular signals," but when tested, they prove to be ineffective. The reason for their prevalence is that the cryptocurrency market remains highly volatile and emotional: many beginners focus on hype, social media news, or superficial charts, without considering fundamental factors such as on-chain data, ETF inflows and outflows, tokenomics, and cycles.

Examples of the least profitable strategies in cryptocurrency

One of the most common mistakes is blindly following the trend. When the price rises, traders buy without analysis, and when it falls, they sell without considering the market phase. As a result, they enter at the peak and exit at a loss. Another example is excessive scalping on illiquid pairs. Commissions and slippage in such trades eat up any potential profits, and the strategy turns into a constant loss.

Trading based on signals from social networks is no less dangerous. Most of these sources do not have transparent methodologies, and their forecasts are often based on manipulation or advertising purposes. Beginners lose money by following the "noise" rather than the facts. Another unprofitable practice is ignoring market phases. Attempting to trade a sideways market as a trend leads to a series of stop losses and the gradual depletion of your deposit.

Source: tradingview.com

This mistake is particularly noticeable on the Ethereum chart for November 2025: the price was moving within a descending channel, and most retail traders were trying to "catch the reversal" without confirmation. The daily timeframe shows how the breakout of the channel was accompanied by weak volume and a negative MACD, which indicated a continuation of the decline. Ignoring these signals led to entering into losing trades, especially when trying to trade as if a trend had started, while the market was in a distribution phase.

"Bitcoin reacts more strongly to liquidity than to news, while Ethereum moves in line with the expansion and contraction of open interest. This changes the rules of the game for traders." — MyCryptoParadise

Why these strategies won't work in 2025–2026

The modern cryptocurrency market has become more complex. Institutional players set the pace through ETFs and derivative positions, and retail traders are struggling to keep up. Liquidity is distributed across different segments: spot exchanges, derivatives, staking, and DeFi protocols. Simple price charts and technical analysis only partially reflect the real picture.In addition, the behavior of large holders has changed. "Whales" use complex asset allocation schemes that are not visible in superficial indicators. They can simultaneously withdraw coins from exchanges, increase positions in ETFs, and hedge risks through options. For a trader who relies solely on candlestick charts, this becomes a trap: the price moves against their expectations, and the strategy turns out to be unprofitable.

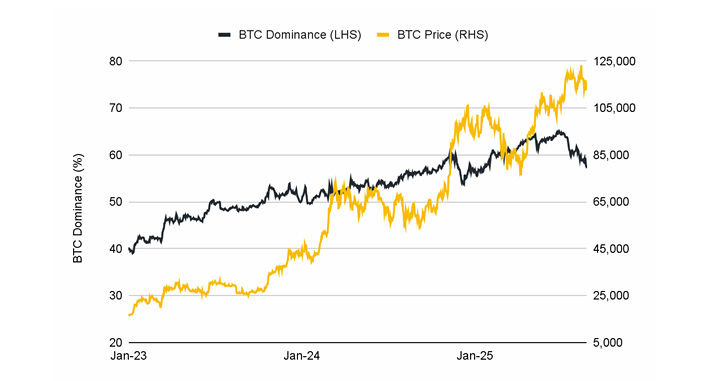

Source: binance.com

The chart shows how Bitcoin's dominance and price grew in sync from January 2023 to January 2025. BTC dominance is Bitcoin's share of the total crypto market capitalization, and it plays a key role in assessing market phases. When dominance grows along with the price, it is a signal that capital is concentrated in the "main asset" and altcoins are losing market share. For traders, this means that strategies focused on altcoins become less effective, while the focus on BTC becomes more stable.

In 2025, growth in dominance above 60% was accompanied by a price rise to $120,000, confirming that institutional flows, ETF inflows, and macro capital are primarily going into Bitcoin. Ignoring this factor is a common mistake, especially when attempting to trade altcoins during a phase of BTC dominance. Strategies that do not take this shift into account lose their relevance and profitability.

How to tell if trading strategy will be profitable

In 2025, evaluating strategy effectiveness requires not only basic indicators, but also an understanding of crypto-specific factors that directly influence the outcome. Strategies based on emotions, guesswork, or "visual patterns" without checking metrics almost always lead to losses.

Basic indicators remain the foundation:

- ROI reflects the overall profitability of the strategy over a period of time.

- Win rate shows the proportion of profitable trades.

- Drawdown records the maximum capital loss.

- Sharpe Ratio measures risk-adjusted returns and is especially useful when comparing strategies with different volatility.

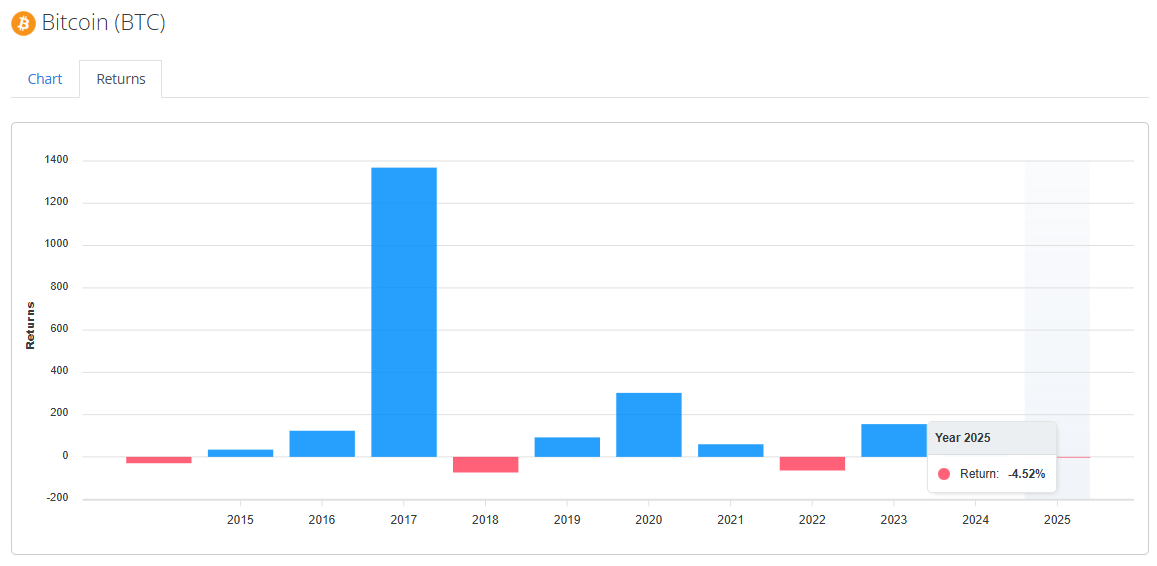

Source: slickcharts.com

The graph of Bitcoin's return by year shows how dramatically the result changes depending on the market phase: 2017 yielded a profit of over 1200%, while 2025 ended with a negative result of minus 4.52%. This emphasizes that even when choosing a strong asset, the result depends on the entry point and strategy.

For cryptocurrencies, it is important to consider additional metrics:

- The movement of coins on exchanges is a signal of possible selling pressure.

- The activity of long-term holders is an indicator of confidence in the asset.

- Custodian balances — reflect institutional accumulation or withdrawal.

- Inflows and outflows into ETF funds — show real demand from regulated investors.

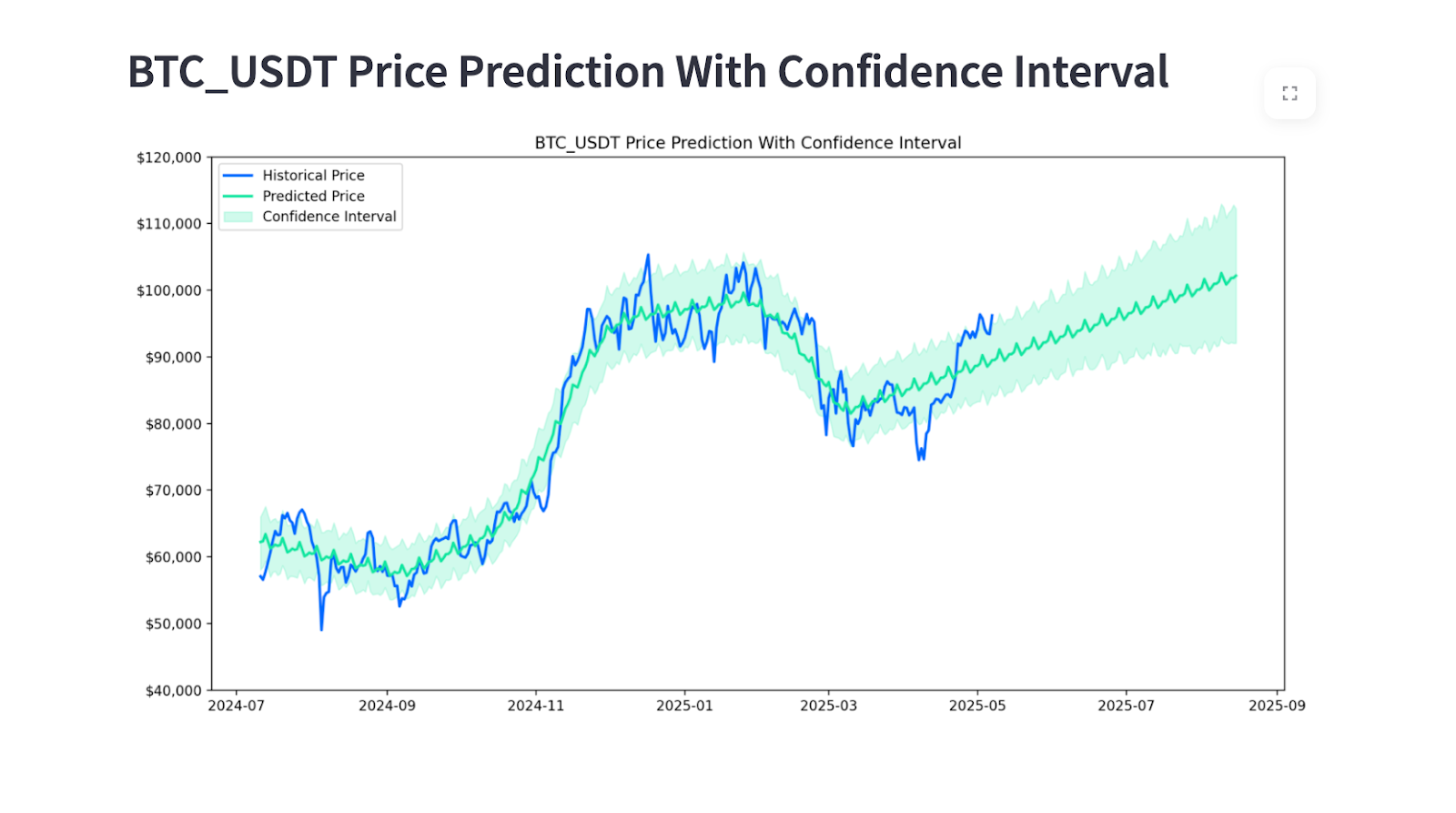

The second chart shows the RSI Bounce strategy, one example of a technical approach that can work when properly configured and in the right market phase. Combined with fundamental metrics such as inflows into ETF funds and on-chain activity, such strategies can strengthen entry points and improve decision accuracy. The key is to use them not in isolation, but as part of a comprehensive model where each signal is confirmed by data.

Source: coinography.com

How to avoid the least profitable strategies

The first step is to filter information sources. Only use verified dashboards, fund reports, and on-chain data. The second step is to assess the market phase: trend, sideways, accumulation, or distribution. The third is to compare signals with institutional metrics: if inflows into ETFs are growing, this confirms demand; if outflows are increasing, this is a signal of risk.

It is equally important to consider commissions and spreads, especially on illiquid assets. Many strategies look profitable "on paper" but in reality lose money due to hidden costs. Finally, keeping a decision log helps systematize experience: by recording the reason for entry, metrics, and results, traders learn to avoid repeating mistakes.

Forecasts and scenarios for trading strategies for 2025–2026

Three main scenarios can be identified for the coming years. The first is institutional dominance. Strategies without fundamental analysis will be massively displaced, and the market will become more predictable for those who work with data. The second is the growth of the role of ETFs and capital distributed through DCA. Short-term speculation will lose its effectiveness, and long-term approaches will strengthen. The third is increased regulation. Manipulative signals and schemes will be blocked, and the transparency of funds and custodians will increase.

Source: gate.com

"In 2025, the market no longer rewards predictions, it rewards structure. The traders who survive are those who build strategies around liquidity, volatility timing, and execution discipline." — MyCryptoParadise

Conclusion on trading strategies

The least profitable trading strategies are systemic errors that arise from ignoring the real structure of the crypto market. In 2025–2026, they will become particularly dangerous: institutional players will increase their influence, liquidity will be more difficult to distribute, and regulators will introduce new rules. To avoid these pitfalls, it is necessary to rely on metrics, analyze the market phase, take on-chain data into account, and monitor ETF flows.

And if you want to not only avoid unprofitable strategies but also build your own balance in Bitcoin, the most reliable option is to have real BTC in your account. GoMining helps with this — a cloud mining platform that allows you to rent computing power and receive daily accruals in Bitcoin. This is direct ownership of the asset, independent of funds and intermediaries, with transparent returns and flexible management. GoMining makes the path to financial results easier, faster, and more efficient.

Subscribe and get access to GoMining's free course on crypto and Bitcoin

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

- What are the least profitable trading strategies? These are trading approaches that systematically lead to losses or below-market returns. In cryptocurrency, they are often disguised as "get-rich-quick schemes," but when tested, they prove to be ineffective.

- How do the least profitable strategies manifest themselves in cryptocurrency? Usually, it is blindly following the trend, scalping without taking commissions into account, trading based on signals from social networks, or ignoring market phases. All of them lead to losses because they do not take into account the real liquidity structure and institutional flows.

- What are the advantages and risks of such strategies? There are almost no advantages: they seem simple and accessible to beginners. The risks are obvious: constant losses, capital loss, and psychological pressure.

- How can we use our knowledge of the least profitable strategies in 2025? The main thing is not to apply them in practice, but to use them as a filter. Understanding weaknesses helps us build more sustainable earning models and avoid pitfalls.

- What metrics are associated with evaluating unprofitable strategies? ROI, win rate, drawdown, Sharpe Ratio, as well as crypto-specific indicators: coin movement on exchanges, long-term holder activity, custodian balances, and inflows/outflows into ETF funds.

- Is it possible to make money on the least profitable strategies? No. They systematically lead to losses. Earnings are only possible if you abandon them and switch to disciplined strategies with verifiable metrics.

- What mistakes do beginners make most often? Beginners buy at the peak and sell at the bottom, ignore commissions, trust signals from social networks, and do not take into account the market phase.

- How do unprofitable strategies affect the cryptocurrency market? They create short-term noise, increase volatility, and generate liquidity for more experienced players. In the long run, such approaches do not change the trend but increase the risk for retail investors.

- What do experts predict for unprofitable strategies in 2026? The forecasts converge: institutional dominance and the growing role of ETFs will supplant superficial tactics. Manipulative signals will be blocked, and the market will become more transparent.

- Where can you follow updates on strategies? The best places are fund analytical reports, on-chain dashboards, institutional research, and official publications on ETF flows.

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided "as is", all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

Find out which trading strategies are considered the least profitable and why they are dangerous for investors. The article explains how such approaches work in cryptocurrency, what metrics help to recognize them, and what forecasts experts give for 2025–2026. This practical guide will help you avoid systemic errors and build more effective profitability models.

December 25, 2025