In the crypto world, there’s a term you’ll hear everywhere — in Telegram chats, in Twitter threads, in analytical research and trader communities: whales.

Sometimes they’re portrayed as mysterious billionaires capable of pushing Bitcoin up 10% with a single trade or nuking the market at will. But once you strip away the memes, conspiracy theories, and dramatic headlines, the picture becomes far less mythical:

Whales are large capital holders who influence liquidity, market trends, and expectations. Their actions set the tone of bull and bear cycles, determine capital flows between Bitcoin, Ethereum, and altcoins, and shape liquidity movements in DeFi. And in 2025–2026, their impact expands further into ETF flows, institutional custody, and on-chain transparency.

Who Crypto Whales Really Are

When newcomers hear the word whale, they often imagine a meme-like caricature: a smug billionaire sitting in a penthouse, sipping matcha latte, pressing a button to crash Bitcoin. In reality, a whale is a far more grounded concept.

A crypto whale is an entity holding such a large volume of digital assets that their actions materially affect the market. They aren’t simply wealthy participants — they are liquidity nodes. Their moves change the balance of supply and demand in places where regular traders don’t even notice the ripples.

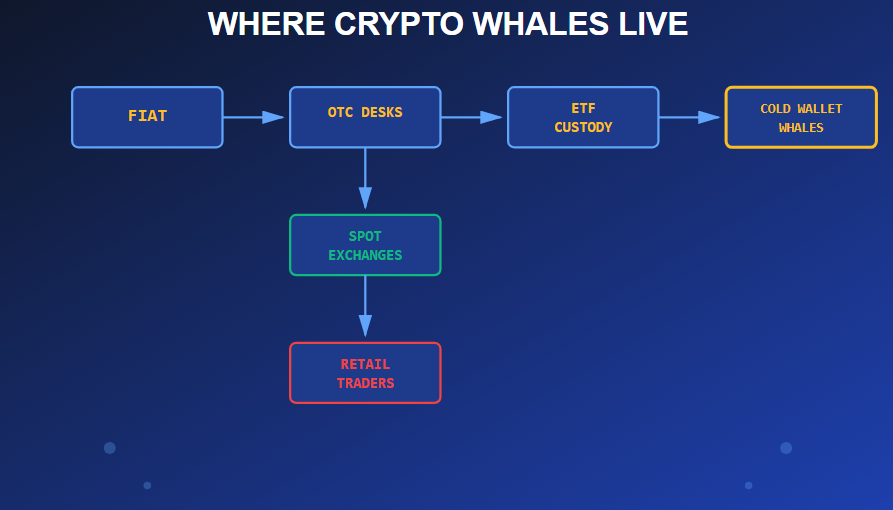

Where Crypto Whales Live

Imagine the market as a lake.

- Retail investors are pebbles tossed into the water — creating tiny ripples.

- A whale is a grown adult jumping off a pier — the waves can overturn boats, drag rafts away, or change the direction of the entire current.

That’s the scale difference.

Why the 2017 Whale Archetype Is Obsolete

Many retail traders still picture crypto whales as early Bitcoin believers who bought BTC for $2 and forgot the flash drive in a drawer. Yes, such OG whales exist, and yes — sometimes they “wake up,” moving coins dormant since 2013 and sending Crypto Twitter into a frenzy: “Ancient wallet moved 5000 BTC!”

But 2025 whales are a different species. The term now covers a whole taxonomy of roles — almost like classes in an MMORPG, each with its own objectives, influence zones, and tools.

Below are the six dominant whale types shaping today’s market.

OG Whales — The Grandfathers of Crypto

These are the earliest Bitcoin holders — people who were buying BTC when prices sounded like a joke: $1, $10, maybe $100. Many have held their coins for a decade or longer. When they suddenly move assets, the entire market stops breathing.

Why it matters: A single transaction from one of these addresses can trigger marketwide speculation. Traders interpret such moves as early indicators of a cycle shift — bullish or bearish.

ETF & Institutional Whales — The Financial Dragons

Think BlackRock, Fidelity, and other giants now holding crypto not directly, but through ETFs. These entities don’t buy Bitcoin the way retail does — they accumulate in volumes comparable to sovereign gold reserves.

Their power: When they’re accumulating, liquidity dries up and the market rises for weeks or months. Demand no longer comes from hype — it comes from structured financial pipelines.

Exchange Whales — The Water Stations of Liquidity

These are centralized exchanges like Binance and Coinbase, which custody assets for millions of users.

Their influence: They can inject liquidity into the market or drain it overnight. For a trader, it’s like trying to swim in a sea where a tanker occasionally churns the waves — direction becomes irrelevant when the mass of water moves.

Mining Whales — The Bitcoin Manufacturers

Mining companies don’t just produce BTC — they accumulate it. Historically, they hoard coins approaching the halving, then deploy those reserves strategically afterward.

Effect: This behavior underpins the cyclical DNA of Bitcoin. Miners don’t follow the cycle — they help create it.

DeFi Whales — The On-Chain Aristocrats

These are early and high-volume participants in protocols like Aave, Lido, MakerDAO.

Their game: They can move billions between pools, shifting yields, altering collateral dynamics, and breaking old strategies simply by reallocating capital.

Stablecoin Whales — The Digital Dollar Barons

These aren’t speculators — they’re liquidity custodians. They hold tens or hundreds of millions in USDT/USDC and decide where liquidity lives.

Their danger: A single withdrawal can trigger a liquidity crisis, like pulling the floor out from beneath an entire DeFi ecosystem.

If a crypto market is a stadium, the crowd is the noise, opinions, and excitement. But the match is decided not by the fans — but by the 22 professional players on the field.

Whales are those players.

Why Crypto Whales Matter So Much to the Market

A whale is not “a rich guy with a big wallet.” A whale is a point of concentrated influence. Their capital works like a hydroelectric dam — it doesn’t just flow, it redirects the entire river.

Here’s what that power looks like in practice:

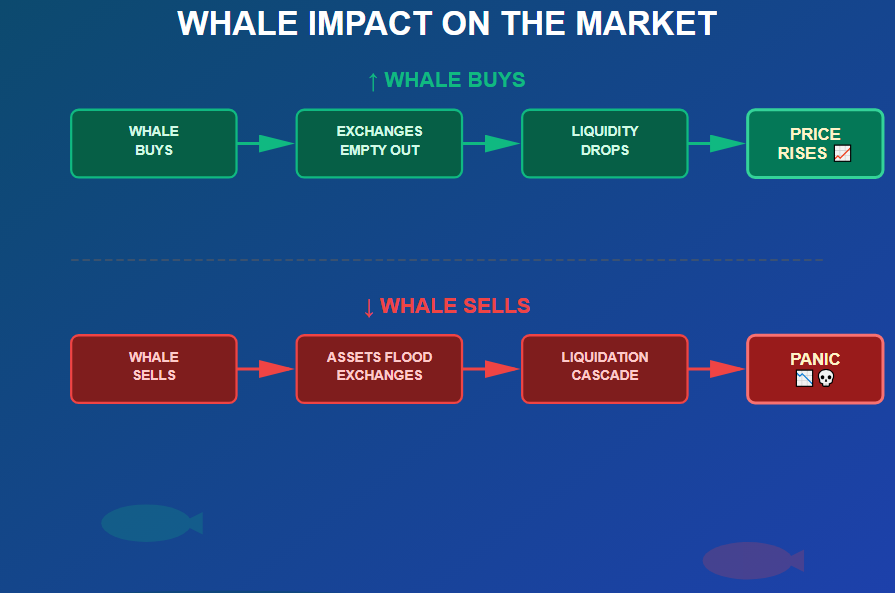

1. They can create liquidity shortages.When a whale buys Bitcoin for $200–$500 million, the supply on exchanges disappears and the price shoots up. Retail traders think, “the market woke up!” — but in reality, it’s just one oversized wallet moving coins into cold storage, removing liquidity from circulation.

2. They can crash the market.A whale sends assets onto an exchange, sells them, and triggers a cascade of liquidations on leveraged positions. It’s like tipping the first domino — you only push once, but everything else falls by itself.

3. They can launch new trends.When a large address enters a DeFi protocol, liquidity follows within days. It’s not magic — it’s herd psychology, except this herd plays with millions.

The Real Impact of Whales on the Crypto Market

Crypto is still far from the liquidity depth of traditional finance. There are no thousands of market makers and no trillion-dollar buffers like in equities or treasuries. Because of this, one large wallet can do what entire funds are needed for in classical markets:

Change the balance of supply and demand in minutes.

That’s why crypto feels “volatile,” but volatility is not chaos — it’s simply the visible movement of too much capital in too small a pool.

The Numbers That Kill the Romance

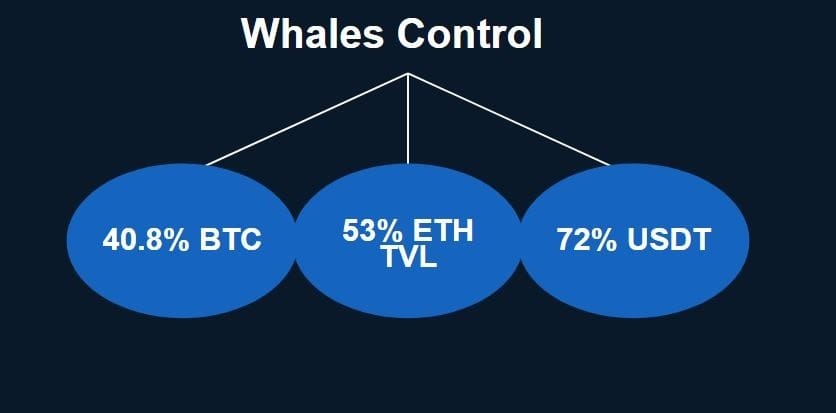

According to Glassnode and DeFiLlama, in 2025 whales control:

- 40.8% of all BTC — nearly half of Bitcoin’s entire digital gold supply,

- 53% of Ethereum TVL — like if half the real estate in a city belonged to twenty people,

- 72% of USDT liquidity — a monopoly on digital dollars.

What Crypto Whales Actually Control

These numbers aren’t opinions. They are architecture. Crypto isn’t decentralized in ownership — it’s transparent, measurable concentration.

Blockchain is the most transparent financial system ever created, but transparency doesn’t mean equal distribution. In theory, crypto is democratic. In reality, it’s an ocean where:

- the crowd are anchovies,

- the whales are predators,

- and they decide which way the current flows.

If you don’t want to end up as sushi on someone else’s plate, you need to understand where those whales are moving — because they don’t follow trends…

They start them.

The Four Whale Indicators Anyone Can Track

Blockchain doesn’t rely on trust — it relies on transparency. That’s the biggest gift for traders who prefer data over impulses.

Here are the four metrics that reveal whale intentions long before headlines do:

Wallet Size (Balance Thresholds)

A wallet becomes a whale not by nickname, hype, or profile photo — but by numbers. Typical thresholds:

- from 1 000 BTC

- from 10 000 ETH

- from $10M–$50M in stablecoins

These are not random figures — this is the capital mass capable of:

✔ buying liquidity dry ✔ triggering price imbalances ✔ shifting TVL between ecosystems

Once you know who holds size, the rest is behavioral analysis.

Exchange Inflows / Outflows

This is the heartbeat of whale positioning:

- Coins leaving exchanges → whales are accumulating, expecting growth

- Coins entering exchanges → whales are preparing to sell or rebalance

It’s like watching trucks move in and out of a warehouse. You don’t need to see the goods — only the direction.

Net Position Change

This metric shows whether whales are building or exiting exposure. It’s the difference between "what they say" and where they actually put money.

Retail listens to influencers.

Professionals watch balance sheets.

Dormant Coins Awakening

If a wallet untouched for 5–10 years suddenly moves coins, the market reacts instantly.

These awakenings are never random.

Something — or someone — has decided it’s time.

Where to Track Whale Movements

You don't need a PhD in cryptography to observe whales. The tools are free — the hard part is knowing how to interpret them.

The most reliable dashboards today:

Glassnode — the primary tool for BTC/ETH wallets and on-chain metrics. Glassnode is a Swiss army knife for on-chain analytics. It reveals: • how many coins sit on specific addresses, • which wallets are accumulating, • who is selling, • and which long-term holders have “woken up.” In fact, most of the charts you see shared by analysts on Twitter (X) originate here.

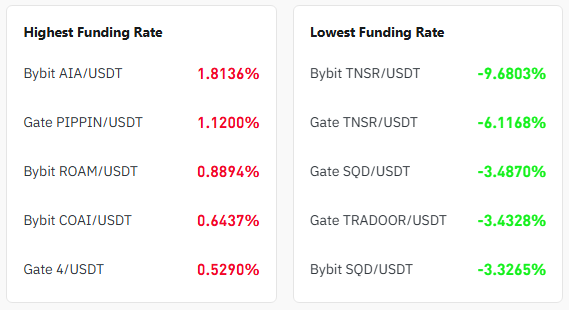

CoinGlass — liquidations, funding rates, and derivatives. CoinGlass uncovers a side of the market that’s often invisible: futures liquidations, leveraged positions, and funding rates. When a whale prepares to sell, liquidations become their weapon — they push the price into stop zones, and the market collapses on its own.

DeFiLlama — the liquidity map of the DeFi universe.If Nansen shows where addresses move, DeFiLlama shows what that movement means. It’s the No.1 tool for tracking TVL — the total value locked in DeFi. When a whale exits Aave or MakerDAO, yields and liquidity models change instantly.

CoinGecko — tokenomics and core market metrics. The most popular free source for market cap, FDV, MCAP, trading volumes, and supply. If Glassnode shows who drives the market, CoinGecko answers the question: with what capital?

Whale Alert (X / Twitter) — live whale transactions. Whale Alert tracks large blockchain transfers in real time. It spots movements of massive amounts of BTC, ETH, USDT, and other assets across wallets, exchanges, and cold storage. If someone moves 3000 BTC or $200M in USDT, Whale Alert reports it — usually before the market reacts. Simply put, it’s the radar of whale capital.

These platforms aren't astrology for traders — they’re x-rays for capital. The market stops being chaotic once you see the skeleton.

Expert Views on Crypto Whales

Glassnode Insights puts it very bluntly:

“Crypto whales can trigger significant market swings when they move size. Their transactions are not just coin transfers – they are events that reshape the balance of supply and demand.”

In one of its weekly on-chain reports, Glassnode goes even further:

“Whale entities for Bitcoin are often cited as key parties that can have an outsized influence on price performance.”

Nansen Research describes the psychological side of this:

“Accumulation by whales often sparks FOMO and rallies, while large sell-offs can trigger panic, price drops, and cascading liquidations.”

Finally, a Federal Reserve–backed study, “Beneath the Crypto Currents: The Hidden Effect of Crypto Whales” (Chernoff & Jagtiani, 2024), shows that this is not just trader folklore but a measurable pattern:

“Large ETH holders tend to increase their ETH holdings prior to a price increase, while small ETH holders tend to reduce their holdings before the same move. In other words, returns tend to move in the direction that benefits whales while hurting minnows.”

How to Profit by Following Whales

Tracking whales isn't about copying their moves. It's about positioning next to the tide before it turns.

Here are three strategies that have survived every market cycle:

Strategy #1 — Trade Against Retail Sentiment

When fear spikes, whales accumulate.When greed explodes, whales distribute.

If you see stablecoins flowing into exchanges during a green candle — you're late.

Strategy #2 — DCA Into Whale Accumulation Zones

You don’t need to predict the bottom.

You only need to know where someone with $500M is buying. That’s not a price prediction — that’s a survival strategy.

Strategy #3 — DeFi Tracking

If a whale moves into a protocol, TVL follows like iron filings to a magnet.

Liquidity doesn’t migrate randomly — it migrates with purpose.

The Rookie Traps

Here’s the most important part — how not to turn whale tracking into a trap.

1. Blindly copying whales. A whale may enter a position not to spark growth, but to hedge, execute an OTC deal, or rebalance exposure. If you mimic the move without understanding the motivation behind it, you’re not participating in the strategy — you’re just background noise in someone else’s play.

2. Ignoring ETF flows. In 2025, the main buyer of Bitcoin is no longer retail — it’s funds operating through ETFs. ETF flows are the new liquidity rails. If you don’t track them, you’re analyzing the market with half the puzzle missing.

3. No context. A whale selling is not always a crash signal. It can be a rebalance, tax optimization, risk transfer, or margin cleanup. Confusing the action with the consequence is the most expensive mistake you can make.

What Crypto Whales Really Teach Us

If you remember just one thing from this entire research, let it be this:

Whales don't guess — they position.Retail doesn't position — it reacts.

That’s why the majority loses money not at the bottom, but at the top. They arrive when whales have already feasted. The crypto market rewards those who think in flows, not feelings.

Whales are not magical overlords. They are simply entities operating with constraints and opportunities most people never see. They don’t move price — they move liquidity. Price follows.

FAQ

What are crypto whales?Large holders of digital assets whose capital can move prices, redirect liquidity and set long-term market structure. They don’t wait for trends — they build them.

Can you profit from tracking whales?Yes — but only if you treat on-chain data as signals, not prophecies. Profit comes from understanding positioning, not worshipping addresses.

Where do I find whale data?On transparent dashboards that track capital flows:Glassnode for holder cohorts,Nansen for smart money mapping,CoinGlass for leverage and liquidations,DeFiLlama for cross-chain liquidity,CoinGecko for macro context.

Why do whales matter so much?Because crypto markets are thin. One deep-pocketed player can move equilibrium — not by emotion, but by supply mechanics.

Should I copy whale trades?No. You don't know their hedges, time horizon or liquidity profile. But understanding their direction is essential. It turns the market from chaos into choreography.

Do whales crash the market on purpose?Only when it benefits them. Panic is profitable for those who accumulate, not for those who panic.

What mistakes do beginners make?Confusing movement with motive. A whale sending assets to an exchange is a message. The meaning depends on whether it’s profit-taking, hedging, or rotation — context is king.

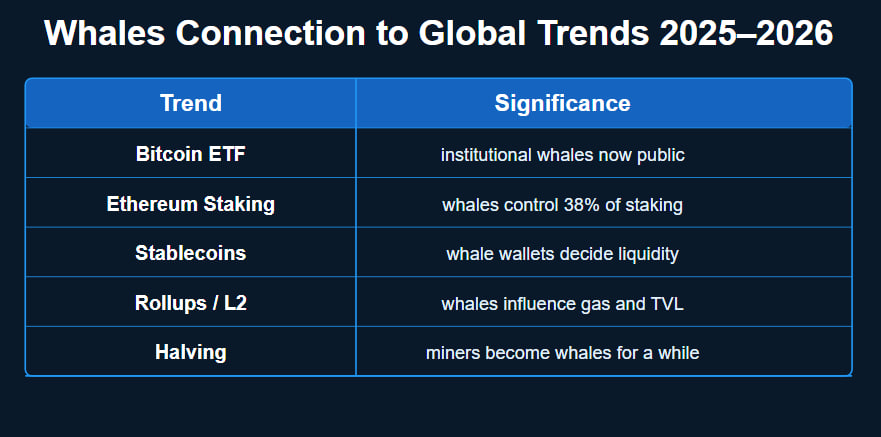

What’s changing in 2026?For the first time, whales have addresses you can name:Bitcoin ETFs.Institutional whales won't hide — they'll file quarterly reports.Their flows will be slower, larger, and more predictable.Crypto's invisible hand will finally have a legal signature.

What to Do Next

If you’ve made it this far, you’re no longer gambling — you’re thinking strategically. Saving this article is already an advantage over 90% of the market that still trades on headlines and emotions. In our upcoming guides, we’ll break down:

- how to read on-chain data without drowning in charts,

- how to track ETF flows and understand institutional demand,

- how whale behavior shapes market structure long before price reacts.

Want to stay ahead of everyone else? Join us and get access to GoMining’s free crypto and Bitcoin course — while it’s still free.

Telegram | Discord | Twitter (X) | Medium | Instagram

Summary

Crypto markets are not random — they are structured around those who control liquidity. Whales don’t move with trends; they define where trends begin and where they end. The sooner you stop treating price as information and start treating capital flows as the real signal, the быстрее исчезает хаос.

Understanding whales isn’t about idolizing big players — it’s about seeing the market the way it actually operates. When you follow emotions, you trade reactions. When you follow liquidity, you trade reality. There are only two positions in this game:

- be early, because you understand the flows,

- or be late, because you're reacting to the consequences.

Whales don't win because they are big. They win because they act before everyone else realizes what’s happening.

December 25, 2025