In an environment of high volatility and a growing number of projects in the cryptocurrency ecosystem, superficial analysis no longer works. It is important for investors and traders to understand what is behind the numbers on the chart: how much money is actually locked in the protocol, what is the potential token issuance, and how well the project's valuation corresponds to its current activity.

What do these metrics mean?

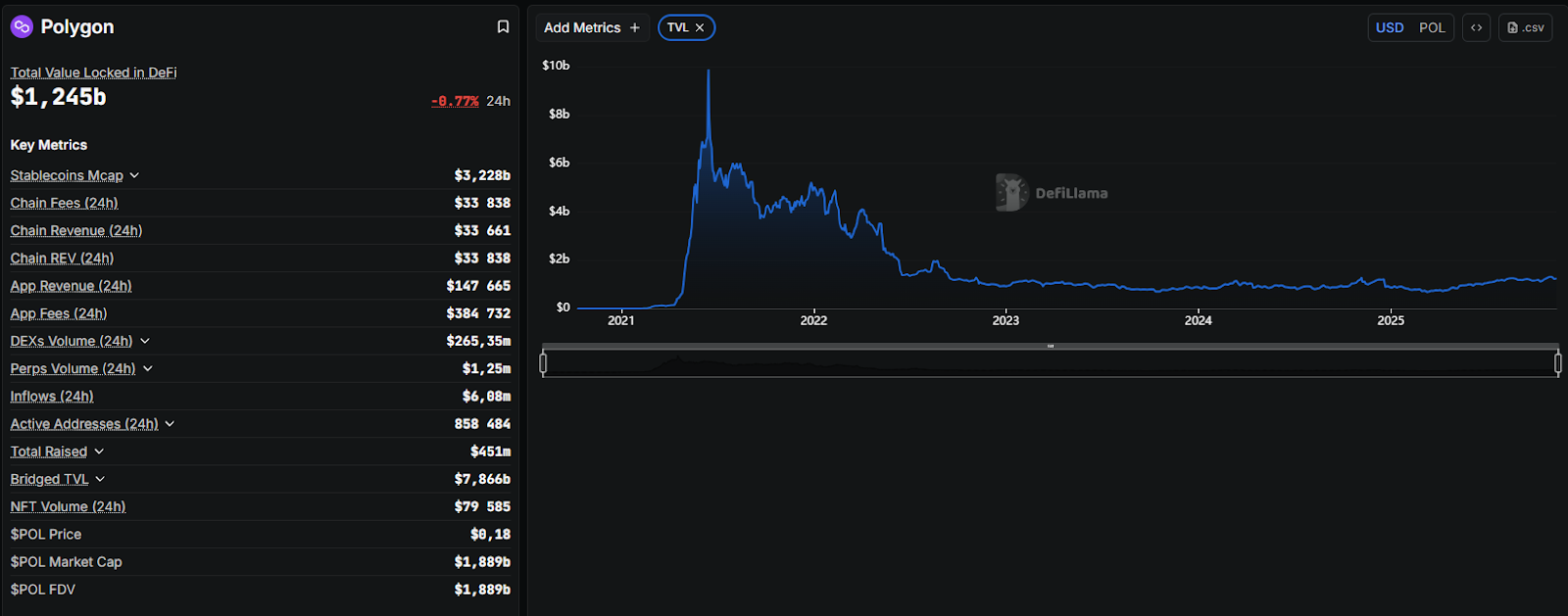

TVL — Total Value Locked

Shows how much money is locked in the project's smart contracts: in liquidity pools, staking, lending, and other DeFi. TVL = the sum of all assets placed by users on the blockchain.

Source: defillama.com

Why track it:

- reflects the real involvement of users in the coin;

- Helps compare DeFi projects in terms of scale within and outside the network.

- signals trust in the protocol.

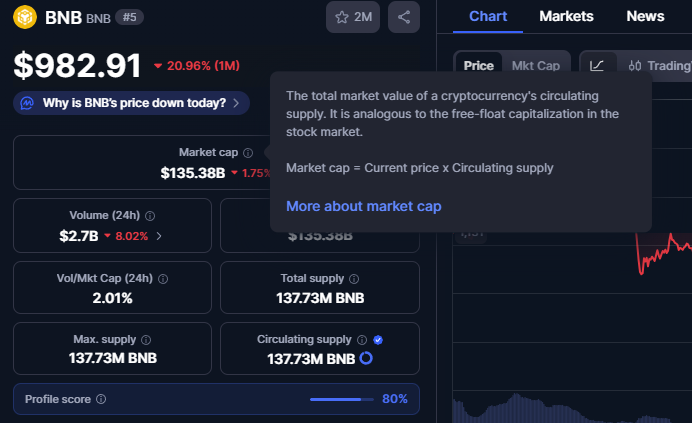

MCAP — Market Capitalization

Calculated as token price × number of tokens in circulation. MCAP = current market valuation of the project.

Source: coinmarketcap.com

Why track it:

- shows how the market currently values the project;

- helps compare projects based on their current value;

- Used in conjunction with TVL to assess effectiveness.

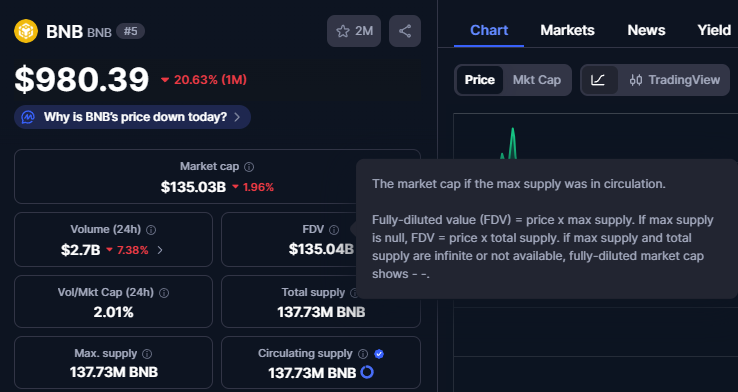

FDV — Fully Diluted Valuation

Calculated as token price × total maximum number of tokens that can be issued. FDV = potential valuation of the project if all tokens are unlocked.

Source: coinmarketcap.com

Why track it:

- shows how much your share could be "diluted" in a future offering;

- helps you understand how overvalued the current price is;

- is important when analyzing tokenomics and unlocking schedules.

How to apply these metrics in practice

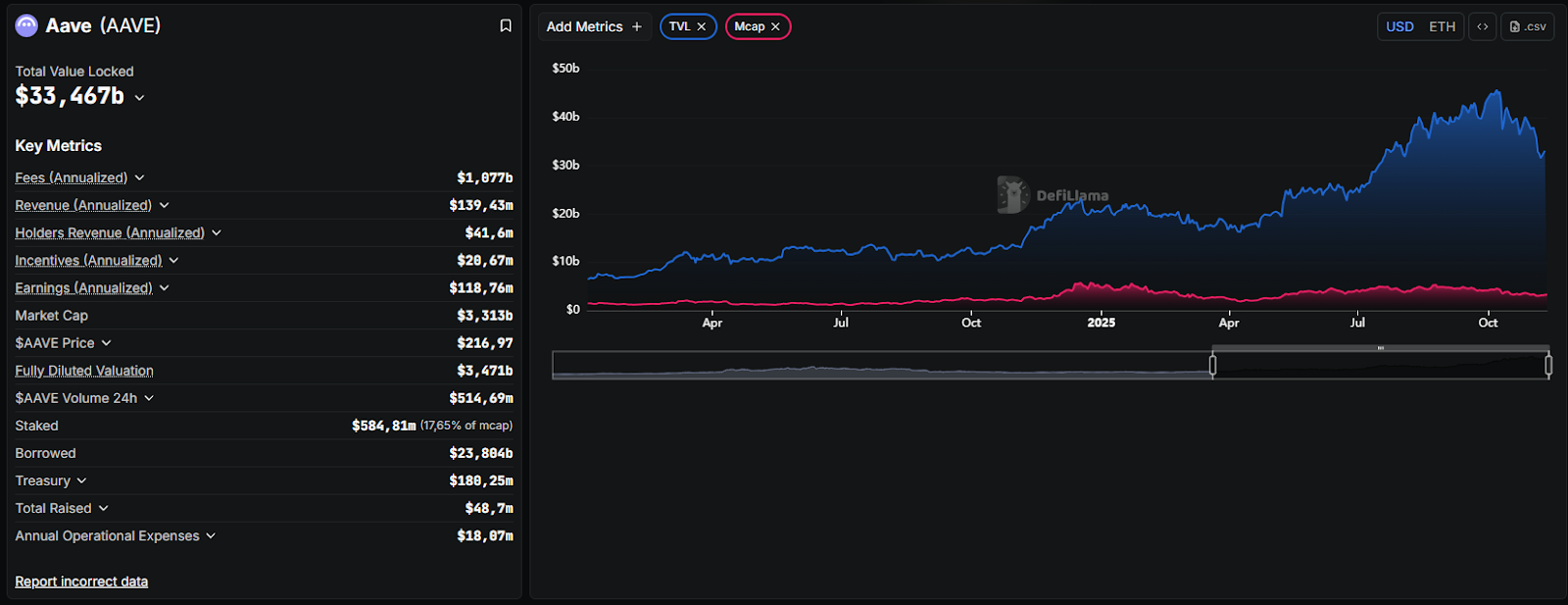

- Compare TVL and MCAP — If MCAP significantly exceeds TVL, the project may be overvalued. If TVL is growing and MCAP is stagnant, the asset may be undervalued.

- Look at FDV in the context of issuance — High FDV with low MCAP = risk of strong pressure when tokens are unlocked. Study the unlock schedule and the share of the team/investors.

- Use MCAP/TVL and FDV/TVL as ratios: MCAP/TVL > 2 possible overvaluation. FDV/TVL > 5 potentially dangerous tokenomics.

- Compare metrics between similar projects. For example, two DEXs with the same TVL but different MCAP: the one with the lower MCAP may be more interesting and have the potential for the project's token price to grow.

Practical examples

- Uniswap: high TVL, but even higher FDV — requires caution when entering.

Source: defillama.com

- Aave: stable TVL growth and a moderate MCAP/TVL ratio — a sign of maturity.

Source: defillama.com

"In June 2025, Aave demonstrates an impressive total value locked (TVL) of nearly $24.4 billion." — Binance Square, DeFi Market Analysis Report, June 2025

- New projects: often have low TVL and inflated FDV — a signal for additional verification.

"The FDV/TVL ratio helps assess a project's potential growth by showing how diluted the current valuation is relative to the capital invested. A higher FDV/TVL indicates that the valuation growth may be driven by speculation." — The CoinZone

Trends for 2025–2026

- Institutional investors are increasingly using TVL and FDV as filters when selecting DeFi projects for their portfolios.

- ETF structures require transparent tokenomics and stable TVL.

- AI analytics are beginning to take into account the dynamics of these metrics in real time.

- Regulators are paying attention to FDV and token distribution when assessing risks.

Conclusion

Understanding TVL, FDV, and MCAP is fundamental to making decisions in cryptocurrencies. These metrics allow you to distinguish hype from real value, assess risks, and select sustainable projects. And if you want to earn income without diving deep into analytics, you can use ready-made solutions — for example, contact GoMining, where the infrastructure and calculations are already set up, and reporting is transparent. This is a way to earn money in crypto without having to manually track every metric.

FAQ

- What are the key metrics in crypto: TVL, FDV, MCAP? TVL — total value locked: the sum of assets placed in the protocol. FDV — fully diluted valuation: the potential market valuation when all tokens are issued. MCAP — market capitalization: the current valuation of a project based on the price and number of tokens in circulation.

- How do these metrics work in the cryptocurrency ecosystem? Projects use TVL to demonstrate user activity and trust; MCAP reflects the current valuation by investors; FDV shows how much the value could be diluted with further token issuance. Together, they provide a picture of the liquidity, attractiveness, and risk of tokenomics.

- What are the advantages and risks of using TVL, FDV, and MCAP? Advantages: a quick filter for selecting projects, understanding real demand and valuation. Risks: metrics can be misinterpreted without context (e.g., high TVL with low liquidity; high FDV with a large unlock schedule), and data can be manipulated.

- How to apply these metrics in 2025? First, look at TVL to assess real demand, then compare MCAP to TVL (MCAP/TVL ratio) and check FDV and unlock schedule. Use DCA and diversification to enter, don't just focus on high nominal returns.

- What additional metrics are useful to consider alongside TVL, FDV, and MCAP? Node and pool load, provider revenues, large holder behavior, current token distribution, developer activity metrics, and corporate partnerships.

- Is it possible to make money by focusing on these metrics?Yes, provided you conduct a comprehensive analysis: combine metrics with an assessment of tokenomics, market cycles, and the paying demand scenario. Simply following one indicator often leads to mistakes.

- What mistakes do beginners most often make when working with these metrics? Choosing projects based on a single figure (only TVL or only high rates), ignoring FDV and unlock schedules, not checking data sources, and not diversifying risks.

- How do these metrics affect the cryptocurrency market as a whole?They shape perceptions of the real economy of projects: TVL growth increases confidence, high FDV can restrain capital inflows, and widespread use of metrics makes markets more structured and transparent.

- What do experts predict for these metrics in 2026? Analytics are expected to become more in-depth: dynamic coefficients will appear, AI tools will take into account TVL time patterns and unlock events, and regulators will pay attention to token distribution when assessing risks.

- Where can you follow updates and indicators for TVL, FDV, and MCAP? Official project dashboards, on-chain data aggregators, analytical company reports, and developer repositories. For practical application and simplified monetization of computing resources, you can contact GoMining — we have ready-made tools for earning money and transparent reporting.

To strengthen your foundation, start with the basics: subscribe to GoMining Academy and get access to the free course → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing in this article constitutes financial advice or investment recommendations. Content is provided "as is"; all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

November 12, 2025