Why did Bitcoin drop again? Let's look at all the triggers for price movement

The White House has stated that Donald Trump has “put an end to the Biden administration's war on the crypto industry.”They also emphasized that Changpeng Zhao's pardon was considered with the utmost seriousness and went through a full legal process involving the Justice Department and White House lawyers.They specifically noted:

• Donald Trump does not personally know CZ and has no ties to him.

• The decision was not made for personal reasons.

• According to the White House, Zhao was “unfairly punished” by the previous administration.

In connection with the observed decline in prices:

There were no significant negative statements or comments from Donald Trump — BTC's movement most likely followed the stock market, which showed a correction of about 1%. Following Bitcoin, altcoins also continued to decline.

The reason for the stock market correction was apparently overheating: new all-time highs (ATH) were recorded almost daily, and from a technical point of view, such dynamics inevitably led to a short-term “cooling.” However, given the current trends, it can be assumed that this decline is temporary.

As a result, an unfavorable correlation is emerging: when the stock market rises, cryptocurrencies react weakly, but when stock indices fall, the digital asset market shows a synchronous decline.

Source: DeCenter

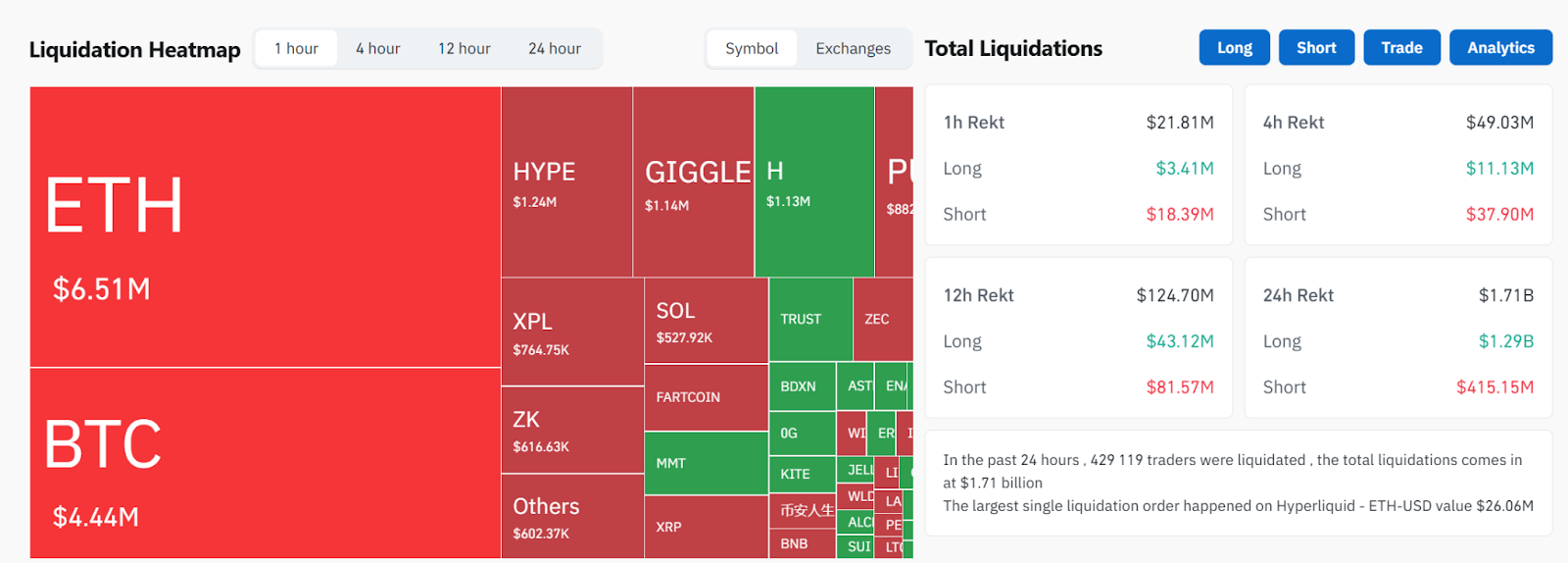

05.11.25:Over the past 24 hours, 438,407 traders were liquidated, with a total liquidation amount of $1.72 billion.

The largest single liquidation order occurred on Hyperliquid - ETH-USD for $26.06M.

Source: Coinglass.co

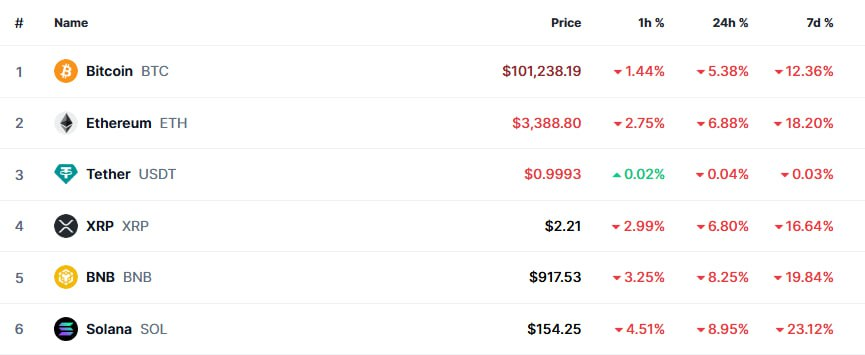

Source: Cryptorank.io

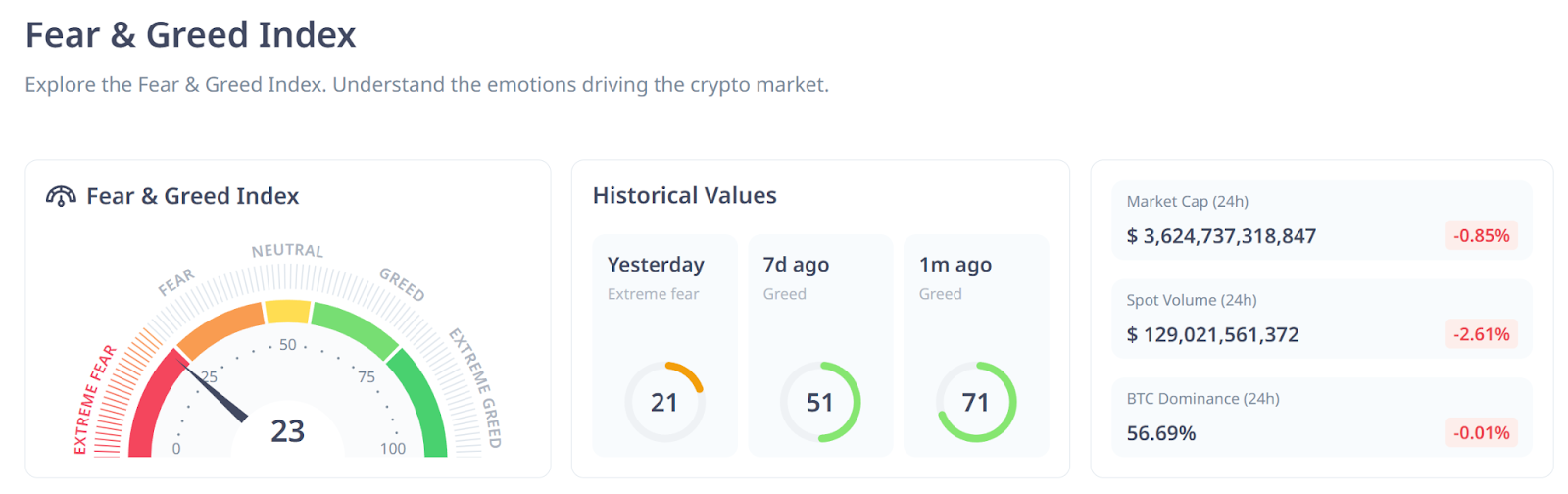

The Fear and Greed Index has fallen to 21 — extreme fear.

Expert opinions:

1. If Bitcoin fails to stay above $100,000, the price could drop to $72,000 — CryptoQuant.

After a record liquidation of $20 billion on October 10, demand for cryptocurrency has weakened significantly — spot purchases are declining, outflows from ETFs continue, and BTC is trading at a discount on Coinbase. The Bull Score index has fallen to 20 out of 100, signaling a strongly bearish market sentiment.

However, analysts note that the $100,000 level is more psychological in nature: record inflows into Bitcoin ETFs, growth in corporate balance sheets, and the possible end of the Fed's QT policy could be drivers of recovery.

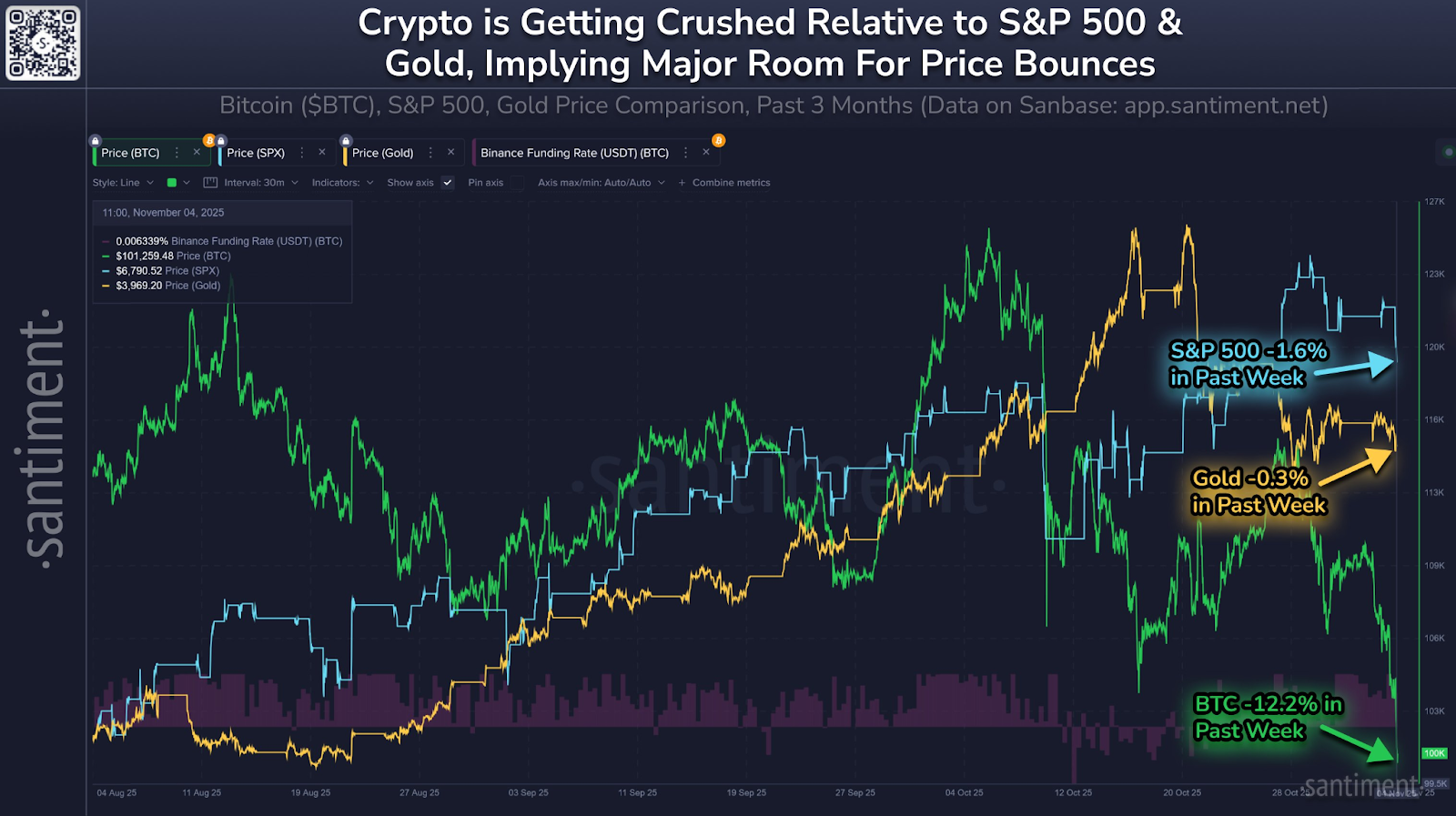

2. Analysts at Santiment report that Bitcoin is oversold. Over the week, BTC fell by -12.2%, while the S&P 500 lost only -1.6%.

Such a divergence may indicate a short-term capitulation — since the beginning of 2022, Bitcoin and the S&P 500 have been steadily maintaining a correlation with each other.

Historically, such phases are often followed by a strong rebound, especially if the stock market begins to recover.

Source: Santiment

3. Wintermute, one of the world's largest crypto market makers, on the state of the crypto market at the moment:

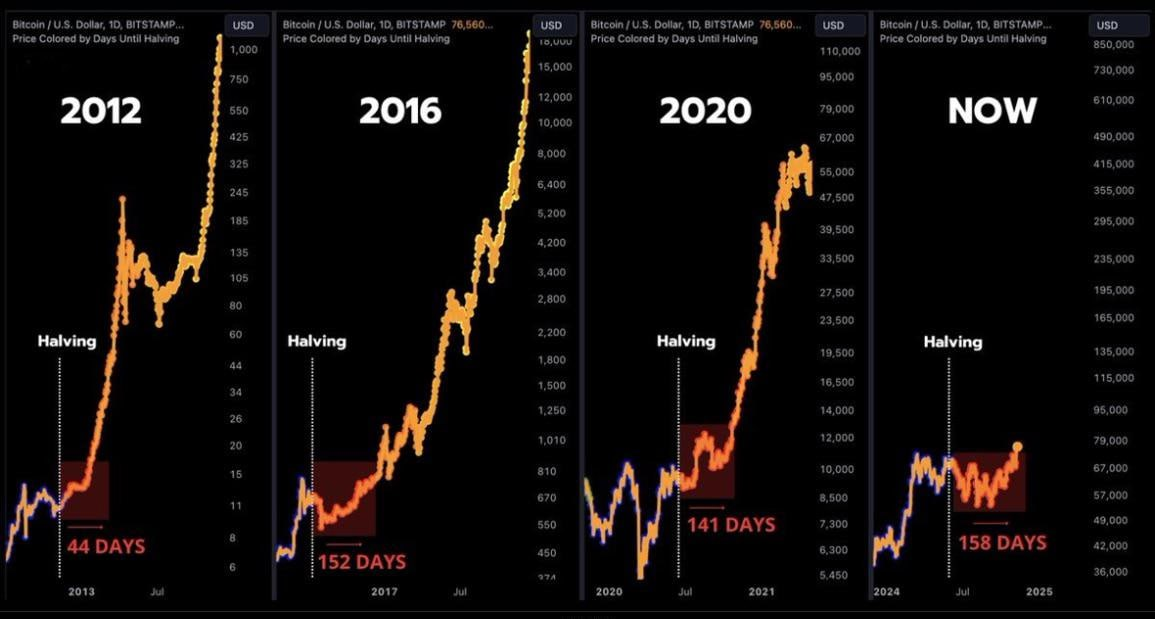

- The 4-year cycle theory is outdated, and now the main factor affecting the price is liquidity.

- The market structure remains healthy, excessive leverage has been eliminated, and volatility is under control.

- The recovery of the crypto market still depends on the resumption of inflows into ETFs and purchases by companies of crypto for their balance sheets.

- In the context of expanding global liquidity and lower interest rates by global central banks. Most of the new capital is going into stocks and the AI sector, rather than crypto.

Source: Incrypted

So you don’t miss the fundamentals, start with the basics: subscribe to Crypto Academy and get access to the free course “Crypto: From Zero to Advanced Investor” → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

November 7, 2025