Learn how to stop your crypto portfolio from becoming an emotional rollercoaster. Here’s how to spread risk, stay sane, and actually enjoy the ride.

Summary Points

- Diversification is non-negotiable in crypto — it keeps your portfolio alive when markets turn and helps when balancing crypto risks.

- Mix Bitcoin, Ethereum, stablecoins, and a few high-conviction altcoins to balance risk and upside.

- Focus on five to ten quality assets; too many coins create noise, not safety.

- Rebalance regularly and keep stablecoins ready for new opportunities.

- Use smart tools — DCA, index funds, portfolio trackers — to automate discipline.

- Add passive income streams like GoMining to earn steady BTC while holding long-term positions.

Why Everyone Goes All In (and Why You Shouldn’t)

If you’re new to crypto, it’s easy to fall for the one. Maybe it’s Bitcoin — the OG, the safe name. Or maybe it’s that coin everyone on X won’t shut up about. Either way, going all in feels bold… until it doesn’t.

The problem? Crypto doesn’t play nice. It’s volatile, emotional, and occasionally feral. One tweet, one exploit, one new meme — and the charts start dancing like it’s Friday night.That’s why diversification isn’t just for TradFi boomers. It’s a survival skill for modern investors.

The Baby-Step Breakdown (Crypto Terms Without the Headache)

Let’s strip it down:

- Diversification: Fancy word for not putting all your eggs in one basket.

- Portfolio: The collection of all your coins — your digital zoo.

- Volatility: The up-and-down mood swings of crypto prices.

- Stablecoin (USDT, USDC): Your safety blanket. Doesn’t moon, doesn’t crash. Just vibes around $1.

- Altcoin: Anything that isn’t Bitcoin — from Ethereum to that AI token your mate swears by.

- Rebalancing: Every so often, check your mix. If one coin’s taking over, trim it back.

It’s just like a game of soccer: BTC and ETH are your captains, stablecoins are your defense, and smaller tokens are your forwards — risky, exciting, but unpredictable. In short, a diversified crypto portfolio is a happy one.

Why Diversification Actually Matters

Crypto doesn’t move in straight lines — it swings, crashes, and rebounds on a whim. One coin pumps, another collapses, and the whole market can flip mood in a weekend. Diversification keeps you from getting wrecked when that happens.

A solid mix of Bitcoin, Ethereum, stablecoins, and a few high-conviction alts spreads risk across different parts of the market. When one sector drops, another might hold steady or climb. It’s not about playing safe — it’s about staying liquid, calm, and ready to act.

As blockchain analyst Elena Karpova puts it,

“Diversification in crypto is like wearing a seatbelt — you don’t think about it until you need it.”

That’s the point. No one cares about diversification in a bull run — but when things reverse, it’s the only thing between you and a 70% drawdown. The seatbelt doesn’t make you faster; it just makes sure you survive the crash.

Reality Check

The history’s already written.In 2018, single-coin holders watched their portfolios vanish when Bitcoin tanked.In 2021, investors who held a mix of BTC, ETH, DeFi, and NFT plays saw broader gains while others chased hype.By 2022, everyone took hits — but those with diversified portfolios bounced back first because they had stablecoins to deploy and multiple narratives working for them.

The takeaway’s simple: your portfolio’s resilience matters more than timing the market.Diversification doesn’t stop volatility — it just makes it survivable. And in crypto, survival is the real edge.

Turning Knowledge into Profit

So, how do you actually use this?

1. Automate with Index Funds & ETFs

They give you a ready-made basket of assets. No spreadsheet headaches, no 3 a.m. “should I sell?” moments.

2. DCA (Dollar-Cost Averaging)

Buy a fixed amount of crypto every week or month. Smooths volatility. Stops you from panic-buying tops or rage-selling bottoms.

3. Hold Some Dry Powder (Stablecoins)

When everyone’s screaming on CT, you’ll have liquidity to swoop in on discounts.

4. Add a Passive Income Stream

Here’s where GoMining changes the game:

You don’t need to buy mining rigs, rent warehouses, or pay insane electricity bills.With GoMining, you can earn daily BTC rewards straight to your wallet — no setup, no stress.

It’s a clean, beginner-friendly way to turn part of your diversified portfolio into steady Bitcoin income. Think of it as mining made simple — for the next-gen investor.

Spreading your money across different assets isn’t just smart — it’s survival. Go all in on one or two, and yeah, you might catch a moonshot… or get absolutely wrecked when things swing the other way.

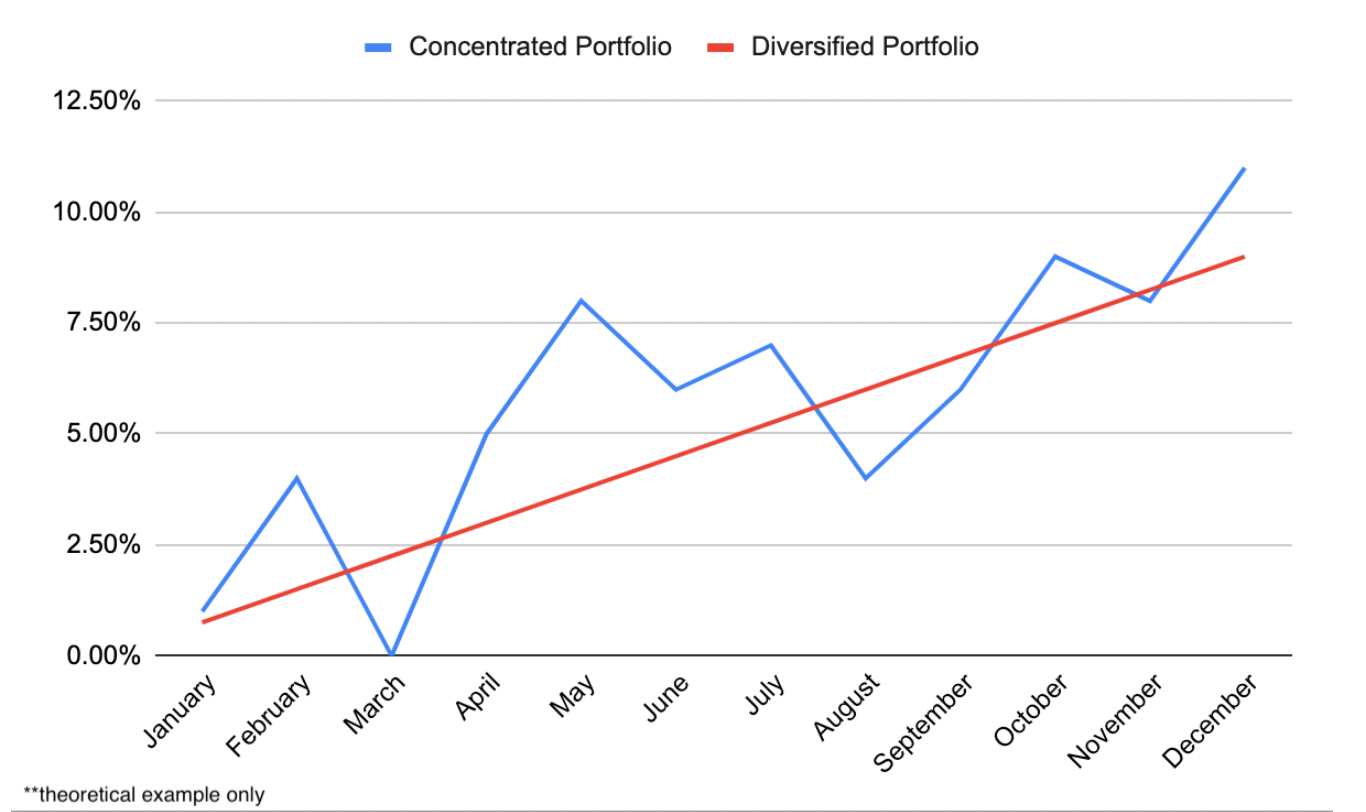

Diversifying smooths out those wild ups and downs — some assets dip, others rise, and together they keep your portfolio moving steadily upward. It’s not as exciting as a single lucky bet, but as the chart below shows, it’s how you build real, long-term gains without losing your mind (or your balance).

FAQ

Q: Is diversification boring?No — it’s how you survive long enough to enjoy the fun parts.

Q: How many coins is enough?Usually between 5–10. Enough variety to spread risk, not so many you forget what you own.

Q: Do stablecoins still matter in 2025?Absolutely. They’re your dry powder, your calm in chaos.

Q: Can diversification kill my upside?It can reduce lotto ticket wins, but it also saves you from total wipeouts. Fair trade.

Q: I’m new — what’s my move?Start simple: BTC, ETH, a stablecoin. Add exposure slowly. Think balance, not bravery.

November 5, 2025