If you’ve spent at least a couple of weeks reading crypto news, you’ve definitely stumbled across alarming headlines like:

- “Old Bitcoin wallet woke up after 11 years”

- “Dormant whale moves 5000 BTC”

- “2013-era address becomes active again”

These headlines spread across X and Telegram instantly and hit beginners right in the nerves. The reaction is almost physical: “That’s it — a dump is coming. I need to sell before the crash.”

A good recent example: in September 2025, a 2014-era whale wallet with a 1000 BTC balance suddenly moved 500 BTC to a new address.

Source: intel.arkm.com

But here’s the truth: In roughly 70% of cases, these movements are harmless. They’re usually technical migrations, exchange housekeeping, OTC deals, custody reshuffles — or simply someone rediscovering an old seed phrase.

Smart money — the experienced side of the market — never treats such movements as instant danger. They don’t rush to sell. They analyze: What moved? Why? Where? Under what market conditions?

This article is a simple, human-friendly guide for beginners — a complete smart money reaction framework you can follow whenever old wallets “wake up.”

And if you're new to crypto wallets in general, these two guides will help you get the basics:

- How to create your first cryptocurrency wallet — https://gomining.com/blog/how-to-create-your-first-cryptocurrency-wallet

- Types of crypto wallets — https://gomining.com/blog/what-are-the-types-of-cryptocurrency-wallets

Both are great starting points to understand why some wallets are active while others stay silent for years.

What Does “Old Wallet Waking Up” Actually Mean?

An “old wallet” is simply an address that hasn’t moved any crypto for years — often 2, 5, 10, or even more. These wallets typically belong to:

- early Bitcoin miners,

- long-term believers,

- institutions that reshaped custody years ago,

- or regular people who forgot their seed phrase.

When these addresses suddenly make a transaction after a decade of silence, it looks scary. Beginners think:

“If someone held BTC for 10 years and now moves it, they must know something. They’re preparing to sell!”

But movement ≠ selling.

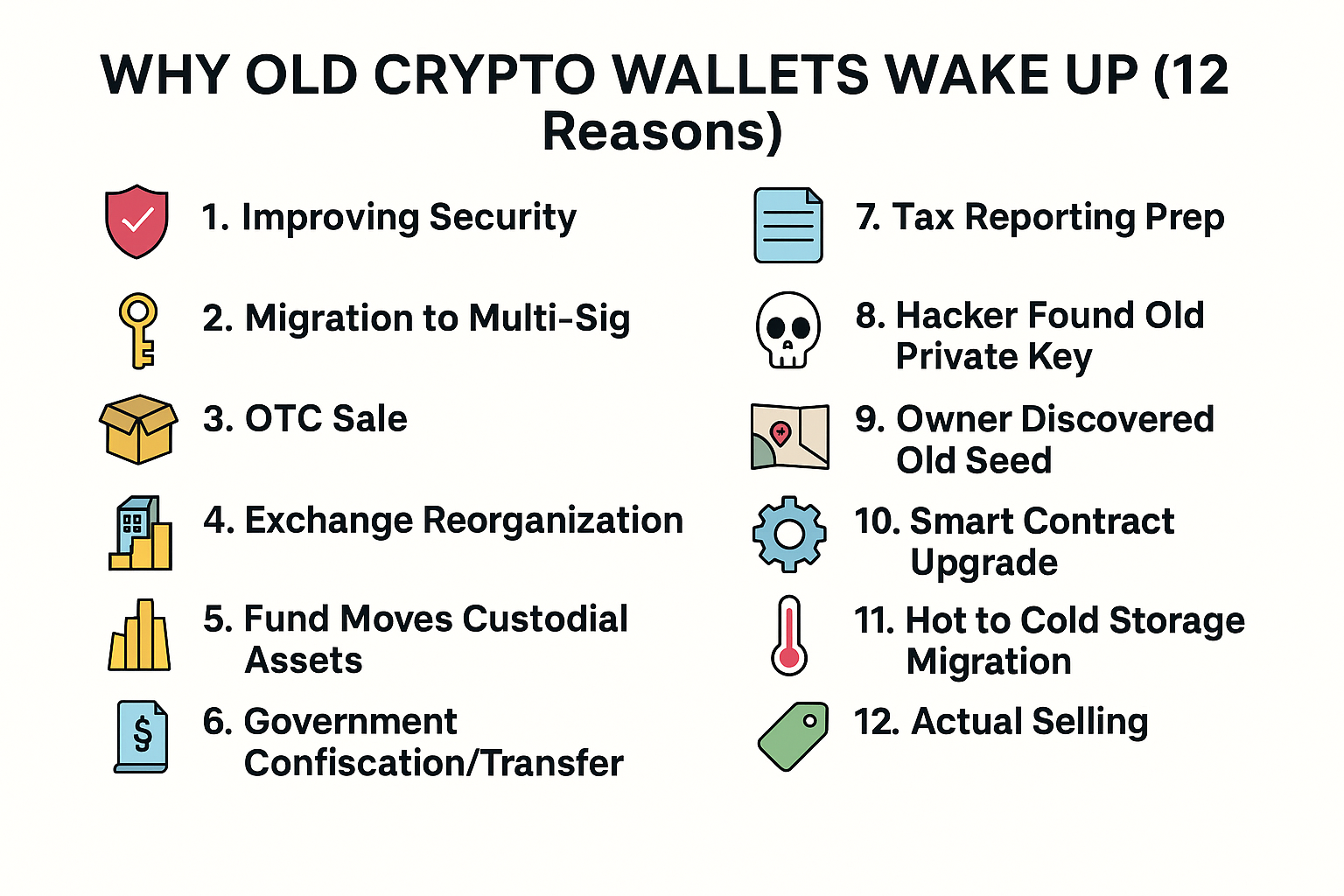

There are at least a dozen reasons why an old wallet might wake up — and most of them have nothing to do with bearish activity.

Why Beginners Panic (and Why Smart Money Doesn’t)

The biggest mistake beginners make is reacting to headlines, not facts. Crypto media often turns routine movements into clickable drama.

A simple technical transfer becomes: “11-year dormant whale awakens — 5000 BTC on the move!” Fear spreads instantly. Beginners imagine a giant red candle and hit “SELL” before even checking what happened.

Smart money does the opposite. They check:

- where the funds went,

- who the address belongs to,

- market context,

- whether exchange inflows increased,

- whether there’s real selling pressure.

They interpret movements through data, not emotion.

Why Smart Money Watches Old Wallets Carefully

Old wallets are like sealed safes or time capsules. They hold signals about: early holders, long-term conviction, supply dynamics, potential structural changes. Smart money doesn’t panic — they investigate.

1. A sentiment signal from long-term holders

If a wallet dormant for 8–10 years suddenly becomes active, it says something about someone who:

- survived multiple bear markets,

- held through 80% corrections,

- didn’t panic during crashes,

- and historically acted rationally.

Such people rarely make impulsive moves. So smart money asks:

- Did they rebalance?

- Are they upgrading security?

- Is this a one-off?

- Was this triggered by a life event?

Movement = signal, not conclusion.

2. Supply dynamics (Bitcoin dormant supply)

One of the most important on-chain metrics is dormant supply — the amount of BTC untouched for more than a year. If dormant supply decreases, it might mean:

- a security upgrade,a custody reshuffle,a transfer to a more modern cold wallet,or (less often) preparations for selling.

Smart money checks the charts through tools like Glassnode Studio and only draws conclusions when there’s a simultaneous spike in exchange inflows.

3. Potential catalysts that are not bearish

When an old wallet moves, smart money evaluates possible scenarios:

- OTC deals (don’t affect price)

- custody maintenance

- exchange wallet reorganization

- government-controlled asset transfers (e.g., seized coins)

- technical migrations

- contract upgrades (ETH)

- recovered seeds

- hacked old keys

- and only lastly — actual selling

Most of these have zero market impact, even though beginners react to them the same way.

4. Blockchain transparency = a superpower

In traditional finance, insider moves become visible after quarterly filings. In crypto, everything is visible within minutes. Smart money uses: exchange inflows/outflows, tagged whale wallets, whale movement dashboards, cluster analysis, on-chain tracing tools (Arkham, Nansen, CryptoQuant).

This transparency is why they rarely panic.

Why Old Wallets Wake Up

When you see a headline like “Bitcoin wallet dormant for 8 years becomes active again”, the first instinct is usually to tense up. It sounds scary — as if someone is about to unload a massive bag on the market.

But in real life, these movements almost always have calm, routine, even mundane explanations. Here are the most common ones — written in human language, without technical overload.

Why Old Wallets Wake Up

1. Security upgrade. Sometimes the owner just wants better protection and moves their coins to a newer or more reliable cold wallet. It’s the crypto equivalent of replacing an old lock with a stronger one — no drama, just common sense.

2. Moving funds into a multi-sig setup. As people grow financially or accumulate more assets, they often switch from a simple wallet to multi-signature storage. It’s a normal step toward better long-term security — using several keys instead of one.

3. OTC sale (off-exchange). Large holders often sell through OTC desks, privately and off the order books. These deals don’t affect the spot price and don’t create volatility on exchanges.

4. Exchange reserve reorganization. Exchanges regularly shuffle coins between their own wallets — cold, warm, internal. It’s pure technical maintenance and has zero market significance.

5. Funds moving assets between custody partners. Institutional holders and funds periodically switch custodians, upgrade infrastructure, or audit their reserves. On-chain it looks like “an old wallet woke up,” but in reality it’s just operational housekeeping.

6. Government transfers after investigations. Sometimes coins move because they were seized, unfrozen, or transferred into government storage. These are not market-driven transactions, and the market usually ignores them entirely.

7. Tax-related movements. In certain countries, people must prove control of an address or record movement of assets for tax reporting. A small “test transaction” may be enough to wake an old wallet.

8. A compromised ancient private key. This does happen — especially with very old wallets from 2011–2014 that were poorly protected. But it’s obvious on-chain: hacked coins usually flow into fresh, suspicious addresses or mixers, not to exchanges for clean selling.

9. Someone finds an old seed phrase. Believe it or not, this is common. People find forgotten USB sticks, notebooks, screenshots, backups — especially when the price pumps and motivation to “look harder” increases.

10. Smart contract or token migration (common on Ethereum). Projects update contracts, migrate tokens, or reorganize liquidity. It’s technical, not emotional, and definitely not a market signal.

11. Moving funds from hot storage to cold storage. Owners may simply decide they want stronger long-term protection and move coins into deep cold storage. It’s a safety move, not a selling move.

12. Actual selling — the rarest case. Yes, real selling is possible — but it happens far less often than people assume. And smart money never guesses. They wait for confirmation:

- are coins flowing onto exchanges?

- is exchange inflow rising?

- is there visible spot selling pressure?

Only when these signals align does it become a real market event.

Smart Money Checklist — What Beginners Should Do When an “Old Wallet Wakes Up”

When a headline pops up saying an old wallet just became active, smart money doesn’t panic and doesn’t rush to sell. They follow a clear, calm sequence of checks. Beginners should learn to do exactly the same.

Step 1 — Check Where the Funds Went. This is more important than the amount.

- To a centralized exchange → potentially bearish. People usually transfer coins to exchanges when planning to sell.

- To a cold wallet → neutral or even bullish. It usually means long-term storage.

- To a multi-sig wallet → a pure security upgrade.

- To an OTC address → no effect on market price at all.

Imagine a truck carrying gold: What matters is not that it’s moving, but where it’s going.A jeweler’s shop? (selling). A new vault? (routine transfer)

Step 2 — Identify Who Owns the Wallet. Use simple on-chain tools: Arkham, Nansen, Glassnode, Breadcrumbs. And check:

- Is it an exchange?

- A fund?

- An early miner?

- A government-tagged address?

- A hacked wallet?

The destination address is more important than the sender. It shows the intent behind the move.

Step 3 — Evaluate the Size of the Transfer Relative to Market Liquidity. Smart money doesn’t panic because of numbers alone — they look at scale.

- Below $1M → irrelevant for BTC/ETH.

- $1M–10M → notable, but rarely a threat.

- $10M–100M → can create pressure depending on context.

- $100M+ → always check exchange inflows.

Step 4 — Check the Market Environment. A big transaction means nothing without macro context. Smart money always checks:

- major news

- funding rates

- open interest

- fear & greed index

- macroeconomic conditions

- ETH/BTC dominance shifts

- liquidity conditions

A wallet movement without context is like a headline without the article — looks scary, but you don’t know the story.

Step 5 — Don’t Trade Out of Panic. Panic-driven trades are usually the most expensive ones. Beginners lose money not because “whales are moving” but because they rush to sell before understanding what actually happened.

Smart money does the opposite: They pause, check the data, and wait for confirmation instead of acting on fear.

Step 6 — Look for Confirming Signals. After a large transaction, the question is: Does it actually affect the market? Smart money checks:

- exchange inflows

- growth in spot selling volume

- whale distribution patterns

- inflow alerts from CryptoQuant / Nansen / Glassnode

- pressure on order books

If these signals don’t appear → it’s noise, not danger.

Step 7 — Only Act When Selling Is Confirmed. If the data shows: large inflows to exchanges, real selling pressure, rising spot volume, order book weakening. Smart money:

- reduces exposure,

- tightens stop-losses,

- decreases leverage,

- reallocates part of the portfolio into stablecoins (USDT / USDC),

- waits for volatility to calm down.

They act after confirmation, not after headlines.

Tools Beginners Should Learn

These aren’t “pro-level” tools — they’re actually simple, beginner-friendly, and easy to use:

- Whale Alert — https://whale-alert.io

- Arkham Intelligence — https://platform.arkhamintelligence.com

- Glassnode Studio — https://studio.glassnode.com

- CryptoQuant — https://cryptoquant.com

- LookIntoBitcoin — https://www.lookintobitcoin.com

- Nansen — https://www.nansen.ai

And if you're also exploring mining or asset management, GoMining has helpful sections:

👉 https://gomining.com/collections👉 https://gomining.com/calculator

Real Examples — How Smart Money Reacted

The examples below show the difference between panic and analysis.

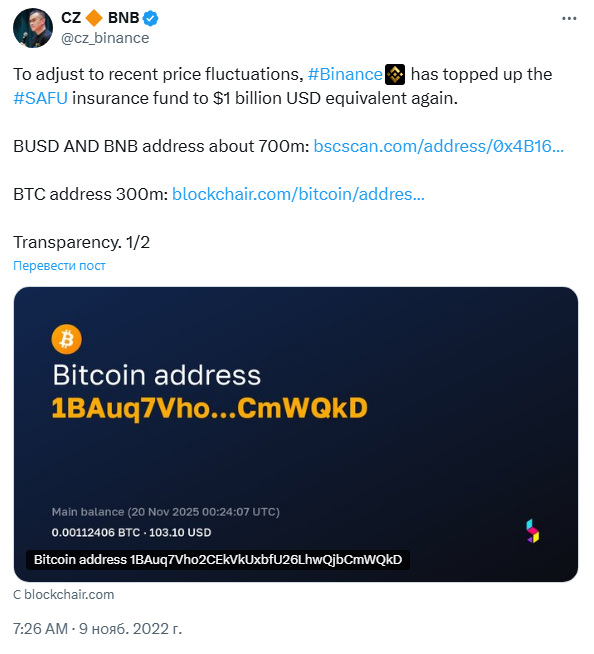

Example 1 — Binance SAFU Wallet Rebalancing ($1B in 2022)

Binance moved roughly $1 billion in BTC, BNB, and BUSD into their SAFU insurance wallets — a massive on-chain transaction that terrified beginners.

The exchange’s CEO warned users about the upcoming fund transfer

Novices thought: “Binance is moving liquidity! Something is wrong!”

Smart money knew: This was an internal SAFU rebalance — the wallet addresses are public, and the funds were moved inside Binance’s own custody system, not to exchanges.

No inflows → no selling → no risk.

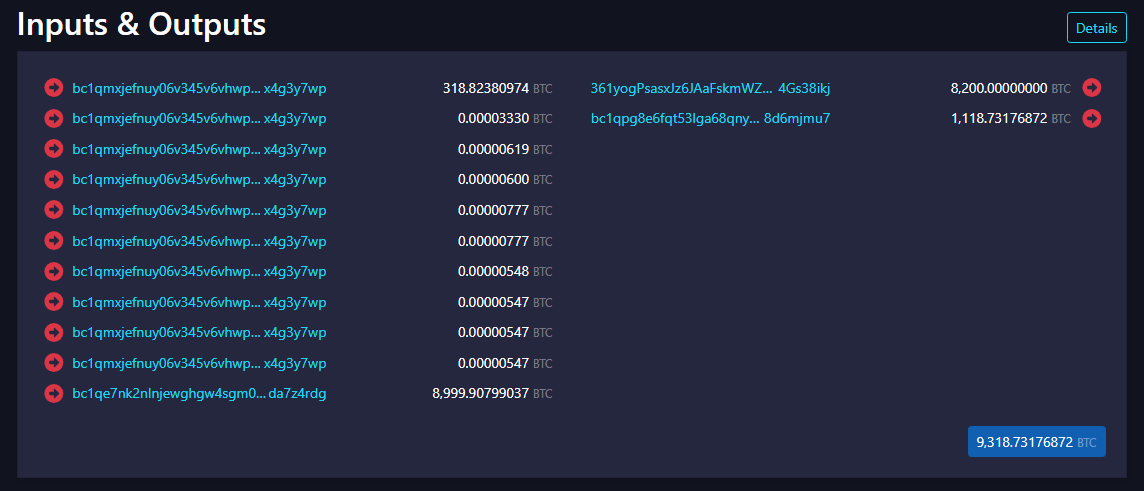

Example 2 — Silk Road Seized Coins (2023)

The U.S. government transferred thousands of BTC connected to the Silk Road case.

Beginners panicked: “Governments will dump everything!”

Smart money checked the destination: The coins went to government custody, not to exchanges.

Source: mempool.space

Market impact → zero. Price didn’t move at all.

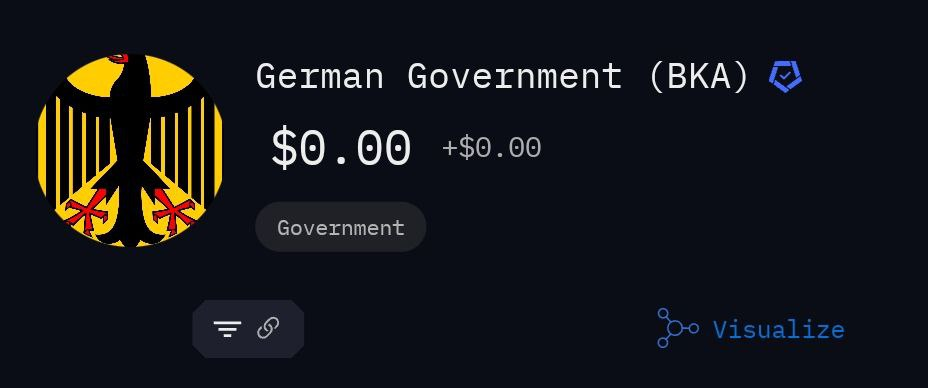

Example 3 — German Police Transfers (50 000 BTC, 2024)

In 2024, authorities in Saxony began moving ~50 000 BTC seized in various investigations.

At first glance, it looked like a mega-whale preparing to nuke the market.

Novices: “Government selling everything — BTC will crash!”

Smart money: Checked Arkham/Nansen → almost all transfers were going into custodial government-controlled addresses, not onto exchanges.

Later, some coins did reach CEXs, and smart money tracked those inflows. But the selling was slow and gradual, not a single dump.

Market reaction: Small dips on days with high inflows. Stabilization once transfers slowed. No catastrophic sell-off.

Conclusion: Even tens of thousands of BTC don’t matter unless they hit exchanges.

Smart money reacts to data, not emotions.

Common Mistakes Beginners Make

Beginners in crypto repeat the same mistakes — not because they lack intelligence, but because the market constantly triggers fear and overreaction. Here are the most common pitfalls:

1. Selling out of fear

A scary headline appears — beginners rush to “save their money,” while smart money simply watches and analyzes.

2. Thinking any movement = selling

If a wallet wakes up, beginners assume it’s a dump. In reality, the majority of these movements have nothing to do with market selling.

3. Ignoring the destination address

Beginners look at the sender but rarely check where the coins actually went. Destination is everything.

4. Looking only at the price chart

They ignore on-chain metrics, whale behavior, liquidity, and exchange flows — the real signals behind the market.

5. Confusing OTC with exchange transfers

OTC transactions don’t affect the market, but newcomers often mistake them for big sell-offs.

6. Reacting to Twitter/X panic

One loud post can scare thousands of people. Smart money waits for data, not influencers.

7. Trading emotions instead of facts

This is the fastest way to lose money. Without proper analysis, the market becomes a casino.

Smart Money’s Golden Rules

These are the core principles that keep professionals calm while everyone else panics.

1. “Where coins move matters more than how much moves.”

Even 10,000 BTC doesn’t matter if it goes into cold storage.

2. “Exchange inflows are the real signal.”

Selling happens through exchanges — not through cold wallets, multi-sig wallets, or custody reshuffles.

3. “OTC ≠ selling on the open market.”

OTC trades are invisible to spot price. Beginners constantly misunderstand this.

4. “The only time mild panic is understandable: if a Satoshi-era wallet actually moves.”

And even then — no reason to assume selling.

5. “Context is more important than any single transaction.”

Macro, liquidity, funding, news — all of this shapes the meaning of any on-chain movement.

6. “Always wait for confirmation.”

Smart money never reacts to the first signal — they wait for the data to line up.

Conclusion — Old Wallets Waking Up Are Signals, Not Threats

When you see headlines about “ancient wallets waking up,” that’s not a reason to panic or dump your holdings. It's simply an on-chain signal, one of many that appear in the everyday life of blockchain networks. Smart money uses these events to better understand:

- long-term holder behavior,

- supply dynamics,

- whale activity,

- market structure,

- and potential catalysts.

Beginners, on the other hand, often misinterpret such signals and make emotional decisions. Now you know how to avoid that.

The core idea is simple: Signals are only useful when properly interpreted. Movement alone means nothing. Data, context, and confirmation — that’s where smart money lives.

Sign up and get access to free (for now) GoMining course on crypto and Bitcoin mining.

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ:

1. What does “an old wallet woke up” actually mean?

It means a Bitcoin or crypto address that stayed inactive for years suddenly made a transaction. That’s all. Movement doesn’t automatically mean selling.

2. Why do these headlines scare beginners so much?

Because they’re written to trigger emotion: big numbers + dramatic wording → instant panic. In reality, most of these movements have zero market impact.

3. Should you sell when an old wallet moves?

No. Not before checking the basics. In 7 out of 10 cases, old wallets move for technical or routine reasons that have nothing to do with dumping.

4. How can I tell whether the movement is dangerous or harmless?

Check one thing first: where the coins went. Cold wallet = neutral. Multi-sig = securityOTC = no effect on pric.Exchange inflow = only case worth watching.

5. Is a whale movement always bearish?

Not at all. Whale transactions can be bullish, neutral, or irrelevant. Only confirmed exchange inflows signal potential selling pressure.

6. How do I check who owns a wallet?

Use beginner-friendly tools:

- Arkham Intelligence

- Nansen

- Glassnode

- Breadcrumbs

They label exchange wallets, fund wallets, miner wallets, hacked wallets, and government-controlled addresses.

7. What if the transaction is huge — like 5000 BTC?

Size alone means nothing. Smart money cares about direction, not magnitude. A giant transfer into cold storage is safer than a small inflow to Binance.

8. How do I know if this is a hack?

Hacks look messy on-chain:

- coins get split into many small pieces,they move through mixers,

- they get routed through “dirty” addresses.

Clean, simple transfers → usually not a hack.

9. What mistakes do beginners make during whale movements?

The same ones over and over:

- panic selling,

- reacting to social media instead of data,

- confusing OTC with market selling,

- ignoring destination addresses,

- trading emotions, not evidence.

10. What’s the safest beginner strategy when old wallets wake up?

Always follow this order:

- Check the destination

- Check exchange inflows

- Check overall market context

- Wait for confirmation

- Only then consider acting

Never the other way around.

11. Are Satoshi-era wallets moving something to worry about?

It’s rare — and it is a special case. But even then, the rule stays the same: If coins don’t hit exchanges, nothing changes for the market.

12. What’s the most important lesson smart money teaches here?

Old wallets waking up are signals, not threats. Data > headlines. Context > emotions. Confirmation > assumptions.

December 3, 2025