Cloud computing in the crypto industry is no longer an experiment but has become the infrastructure foundation for Web3, DeFi, neural networks, and distributed applications. This article explains why you should pay attention to these projects, provides a clear algorithm for evaluating projects, and offers practical steps for those who want to use or invest in cloud solutions in 2025–2026.Examples of large global companies providing cloud solutions that do not have their own tokens and are not directly related to cryptocurrencies.

Source: wezom.com.

What are cloud computing projects in crypto

The idea is simple: projects can be divided into several types — services for storing files without a central server, platforms where you can rent other people's computers and video cards for calculations, services that help launch and manage blockchain nodes and participate in network support by freezing tokens, and platforms for collecting and preparing data for training artificial intelligence. Each project usually has its own token — an internal currency that is used to pay for services, reward those who provide resources, and sometimes make decisions about the development of the network.

Computing projects in cryptocurrency

- DeFi hosting and storage of related information directly on the blockchain;

- file storage over the network and fast content delivery like CDN (file servers);

- training and inference of AI models on conventional and video processors;

- streaming data processing for oracles and analytics.

Why this is important in 2025–2026

- Institutional investors and developers are demanding alternatives to centralized clouds for reasons of reliability, independence, and cost.

- The connection with DeFi and smart contracts allows for new ways of earning money — paying for computations, renting and leasing power against collateral, and selling computations as a service in the form of tokens.

- As many blockchain networks transition to more scalable solutions, demand for off-chain computing is growing.

Below are detailed descriptions of such projects and examples of where they can be applied.

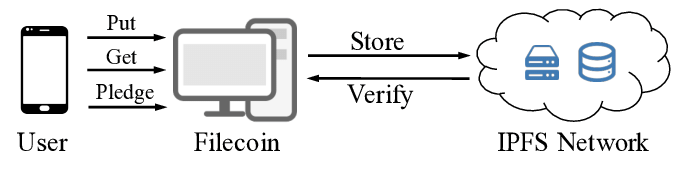

Filecoin — decentralized storage for large amounts of data (FIL token)

A network for long-term and archival data storage, focused on the contractual obligations of storage providers. Suitable for large archives, backups, CDN-like solutions, and projects that need guaranteed data preservation in a distributed network. The economy is based on FIL: storage fees, provider rewards, and penalties for unavailability.

Who this solution is suitable for: archival platforms, media corporations, projects with a high demand for decentralized storage, and dApp developers who want to store "heavy" data outside of a centralized cloud.

Storj — P2P storage (STORJ token)

A distributed storage network focused on easy integration with existing cloud workflows: S3 API compatibility, client libraries, and an emphasis on encryption.Why it's useful: business-oriented scenarios where privacy and compatibility with existing integrations are important. Storj encrypts data at the sender, distributes fragments across nodes, and provides recovery.

Source: storj.io

Who this solution is suitable for: small and medium-sized businesses, developers who need an alternative to centralized cloud without reworking their infrastructure, and projects with data encryption requirements.

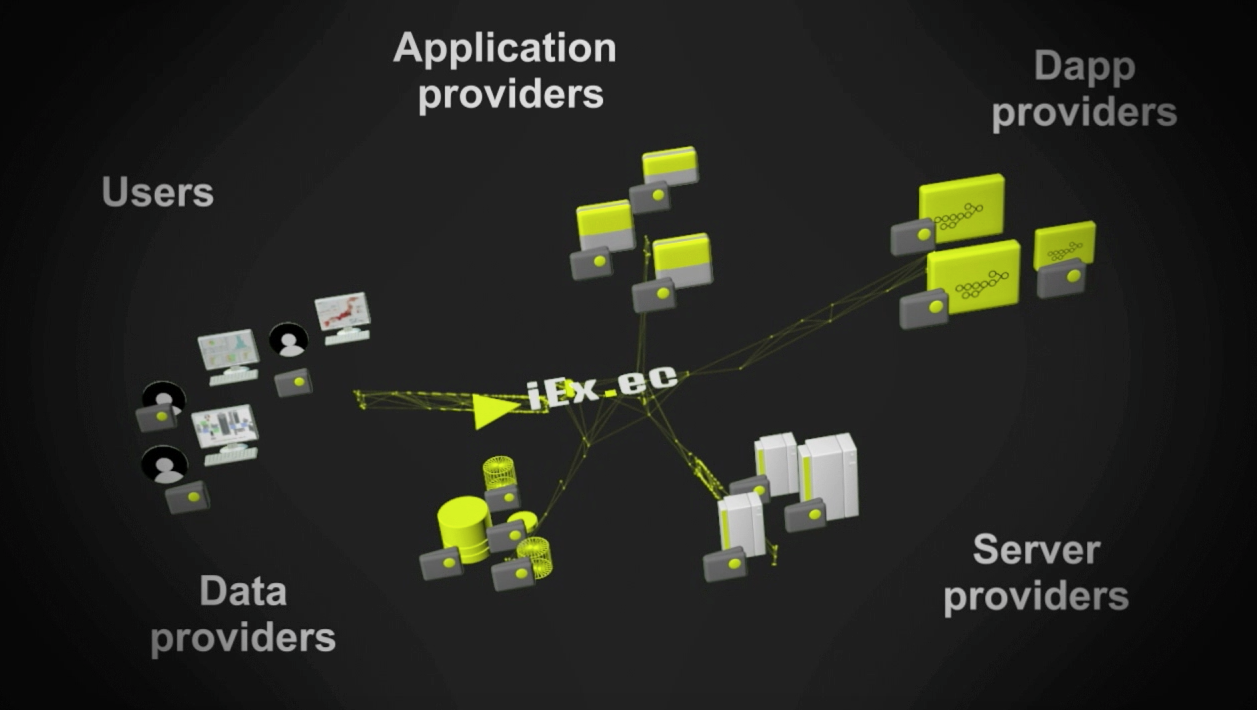

iExec (RLC) — a marketplace for off-chain computing and confidential tasks (RLC token)

A marketplace platform for performing tasks outside the blockchain: it takes on heavy or private computations — data processing, calculations for smart contracts, and running models in a secure environment.

This is convenient when you need to do sensitive work outside the network, but then record the verifiable result in the blockchain. Technically, the platform organizes the execution of tasks, links and records the results in smart contracts, uses secure environments for confidentiality, and payment mechanisms for payment and performance guarantees.

Source: medium.com

Suitable for companies, banks, research centers, and projects that need to maintain data confidentiality while having provable, reliable results."Our goal is to provide developers with the tools and infrastructure to build and launch decentralized applications that prioritize data privacy and secure computing." — From the iExec roadmap for 2025

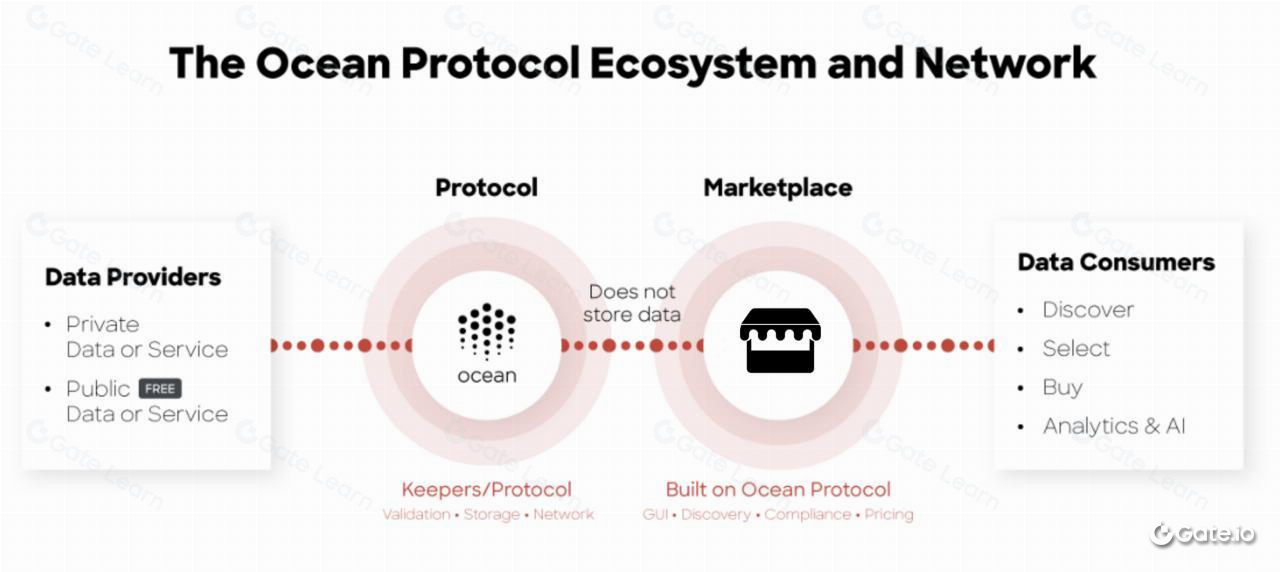

Ocean Protocol — data marketplace (OCEAN token)

Ocean Protocol is a platform where people and companies can post, sell, and buy data. It does not provide powerful servers for computing, but it makes it easy to find data and securely transfer it to where it will be processed. With Ocean, you can put a dataset up for sale, configure who pays for what, and link payment to the actual use of the data.

Source: Gate.comThis is useful for teams that train AI models or analyze data and want to legally and transparently access other people's datasets.

Why it's not easy to compile a "top" list

As you can see, the projects listed above offer completely different solutions: some specialize in long-term file storage (Filecoin, Siacoin), others focus on business integration and ease of use (Storj), others create infrastructure for nodes and staking (Ankr), and still others create marketplaces for computing and data (iExec, Ocean). Because of these differences, it doesn't make sense to rank them as "better/worse" — the right "top" depends on your task: storage, model training, node hosting, or data monetization.

If your goal is to generate income from computing power, it is important to first determine the use case, assess the paying demand, and evaluate the tokenomics of a specific project. And if you want to simplify the path to revenue and avoid technical and operational complexities, there is a practical solution — contact GoMining: we help monetize computing resources through proven infrastructure, transparent reporting, and ready-made products so that you can earn income without managing nodes and hosting.

Forecast for 2026

Key trends: further integration of cloud computing with DeFi and AI, stricter compliance and transparency requirements. Platforms that focus on developer convenience and real payment cases will win.

"In 2026, Web3 cloud computing networks will become a bridge between AI developers and DeFi applications: real demand and corporate integrations will determine which platforms survive" — Delphi Digital, Infrastructure Forecast, October 2025.

Conclusion and alternative to independent integration

Cloud computing projects in crypto are an evolution of infrastructure that will allow more complex and resource-intensive applications to be launched without being tied to large centralized providers. GoMining provides ready-made solutions for mining: they take care of purchasing and deploying equipment, launching and round-the-clock monitoring, maintenance and updates, protection against downtime and security issues, as well as preparing reports and payments to owners. These services are used by private miners, companies, and projects that do not want to manage the technology and infrastructure themselves but want to earn income from mining or staking. Simply put, GoMining turns the technically complex part into a turnkey service with support and transparent financial reports.

FAQ

- What are the top cloud computing projects to watch in 2026? This is a group of projects and platforms that provide remote computing resources and distributed storage — for example, GPU/CPU rental, file storage, model launch, and data markets. They combine technical services with their own internal currency (tokens) and serve as infrastructure for Web3 applications, AI tasks, and DeFi integrations.

- How do these projects work in the cryptocurrency ecosystem?Providers offer their resources (servers, disk space, graphics cards), consumers order work through smart contracts or protocols and pay with tokens or fiat, and the results are sometimes recorded on the blockchain for transparency; tokens are often used for payment, incentives, and project management.

- What are the advantages and risks of such cloud projects? Advantages: you can access computing power without making large purchases of equipment, the system is stable and provides new ways to earn money from data and computing. Risks: legal restrictions on data and payments, possible centralization of suppliers, technical incompatibility, and the risk that tokenomics will not survive low demand.

- How can we use the capabilities of these projects in 2025? Define the task (storage, rendering, hosting, AI training), compare prices for services from different projects, start with small tasks, and add caching and local processing to reduce paid calls; investors should look at real paying demand, not just marketing.

- What metrics are important when evaluating cloud crypto projects? Look at the number of paid tasks, GPU/CPU utilization, provider revenues, node load, supplier concentration, the presence of corporate pilots, and tokenomics transparency (when tokens are issued, capitalization, etc.).

- Is it possible to make money on these projects? Yes: by contributing resources and receiving payment, investing in tokens of real projects, participating in computing marketplaces, or providing services (storage, computing). Success depends on real commercial demand and a sustainable revenue model.

- What mistakes do beginners make when trying to make money on cloud computing in crypto? Common mistakes include buying tokens solely for speculation without checking demand; not testing services in real-world conditions; underestimating the cost of data transfer and storage; ignoring legal risks; and failing to diversify between projects.

- How do these projects affect the cryptocurrency market? They bring real use cases for tokens (paying for computing and data), reduce the role of pure speculation, and make on-chain analytics important for assessing commercial demand, while strengthening the Web3 infrastructure in the long term.

- What do experts predict for these projects in 2026? They expect growth in hybrid models (partly centralized, partly decentralized), more corporate integrations, dynamic pricing, and the use of AI for task distribution; at the same time, there is a growing focus on regulation and data protection.

- Where can you follow updates on the top cloud computing projects in crypto? Read official blogs and project releases, check out reports and dashboards with demand metrics, check GitHub, read industry research and case studies; for a practical entry with minimal operational tasks, you can consider ready-made services such as GoMining, which take care of equipment management and reporting, providing you with only income.

To strengthen your foundation, start with the basics: subscribe to GoMining Academy and get access to the free course → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing in this article constitutes financial advice or investment recommendations. Content is provided "as is"; all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

November 12, 2025