Bitcoin’s momentum surged in July, fuelled by powerful tailwinds from regulation and capital markets. With fresh all-time highs and over $150 billion locked in Bitcoin ETFs, institutional demand is accelerating faster than ever before. Major legislative wins—like the “Big Beautiful Bill” and the GENIUS Act—have reshaped the U.S. policy landscape, giving mining companies unprecedented clarity and tax advantages.

Meanwhile, mining giants continue to scale aggressively. Keep reading to discover why July marked Bitcoin’s next major leg up—and how GoMining is uniquely positioned to compete with the industry's largest public miners.

Regulatory Wins Build Bullish Momentum for Bitcoin and Miners

From a regulatory standpoint, July was a notably bullish month for the digital asset space, especially for Bitcoin mining. Two key developments stood out.

On July 4th, President Trump signed the “Big Beautiful Bill,” restoring 100% bonus depreciation for business property. This is a major win for the capital-intensive Bitcoin mining industry, allowing miners to fully deduct the cost of ASICs, cooling systems, and infrastructure in the year they’re placed in service. The result: improved cash flow, faster ROI, and easier reinvestment into new hardware. The bill also includes 100% depreciation for production-related real estate, benefiting companies building mining facilities in the U.S. However, it phases out federal tax credits for wind and solar projects after 2027, posing a potential challenge for renewable-focused miners and potentially raising power costs in green energy-heavy regions. Overall, the bill favours Bitcoin miners, particularly those scaling operations or manufacturing domestically.

Another bullish signal came with the signing of the GENIUS Act, marking a significant shift in U.S. crypto policy. The Act establishes the nation’s first federal regulatory framework for dollar-backed stablecoins, recognizing them as legitimate financial instruments. This brings clarity to a vital part of the digital asset ecosystem and unlocks institutional adoption, capital inflows, and regulatory certainty. While the Act focuses on stablecoins, its broader implications are positive for Bitcoin and mining. A supportive stance on crypto fosters a more favourable environment for digital assets, encourages infrastructure investment, and strengthens Bitcoin’s position as a complementary asset to the U.S. dollar. Trump’s framing of crypto as “good for the dollar, good for the nation” underscores this alignment.

Bitcoin Price in Discovery Mode

From a price perspective, July was a bullish month for Bitcoin, with BTC breaking into new all-time high territory. Bitcoin opened the month around $107,000 and surged an impressive 15% in less than two weeks, briefly topping $123,000 before stabilizing near the $120,000 level. The month closed at $115.600, marking a solid $8,600 or 8% gain for July.

Bitcoin Price in Discovery Mode (Source: TradingView).

Towards the end of July, broader macro developments added to market optimism. The U.S. finalized a major trade agreement with the EU and Japan and delayed planned tariffs on China by another 90 days. Both President Trump and European Commission President Ursula von der Leyen called the deal as the “biggest trade deal ever,” noting that the U.S. and EU together represent 44% of global GDP.

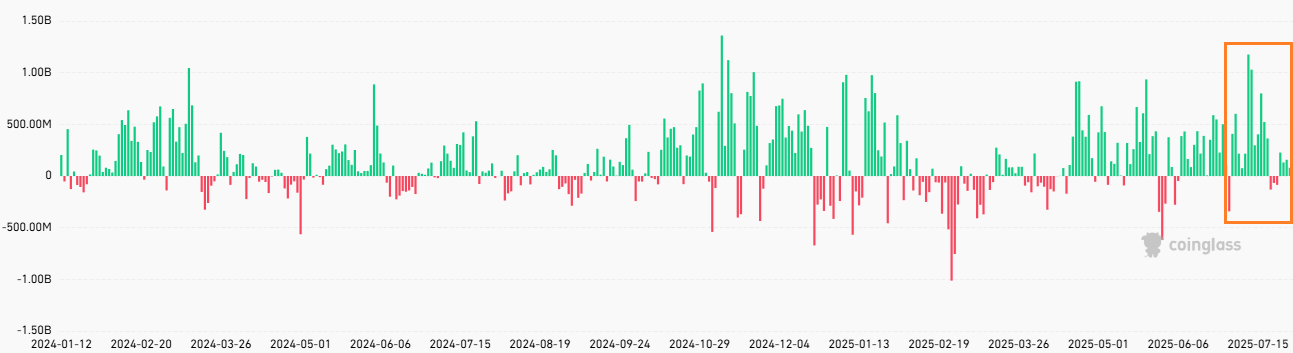

Bitcoin ETFs Drive Price Surge and Sustain $150 Billion Milestone

Bitcoin’s push to new all-time highs was largely fueled by strong spot ETF inflows. On July 10th and 11th, we saw the first two days of 2025 with over $1 billion in net inflows. July 10th alone recorded a yearly high of $1.18 billion—making it the second-largest daily inflow since Bitcoin ETFs launched in early 2024. The record for largest single-day was $1.37 billion on November 7, a few days after the 2024 presidential election

July Witnessed Record ETF Inflows (Source: Coinglass).

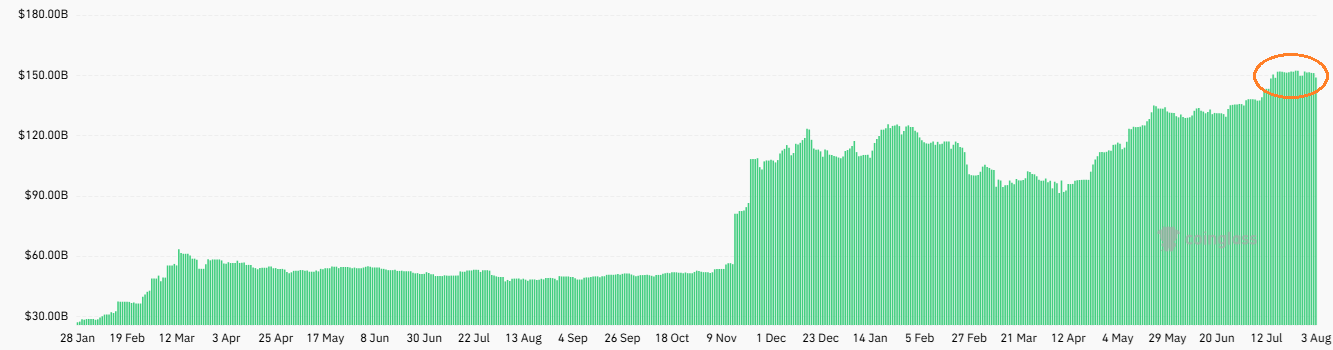

Additionally, assets under management (AUM) for U.S. spot Bitcoin ETFs surpassed the $150 billion mark for the first time on July 15th and have stayed above this significant milestone over 14 days. This sustained level highlights growing investor confidence and increased mainstream adoption of Bitcoin as a digital asset.

Bitcoin ETF AUM Surpassing the $150B Mark in July (Source: Coinglass).

In July, BlackRock’s Bitcoin ETF, IBIT, hit a major milestone—surpassing $80 billion in assets under management (AUM) and holding over 700,000 BTC. Since its launch in January 2024, IBIT has consistently outpaced all other U.S. Bitcoin ETFs, and in some cases, even outperformed BlackRock’s own legacy funds. In just 18 months, it has captured more than 55% of all Bitcoin held by U.S. spot ETFs.

The growth has been staggering. On July 3rd, IBIT held 698,919 BTC. Just days later, a net inflow of over 1,500 BTC pushed it past the 700,000 mark. By the end of the month, its holdings had grown to 738,010 BTC. IBIT is now not only the largest Bitcoin ETF by AUM but also one of BlackRock’s top-performing funds overall.

IBIT ranks as the third highest revenue-generating ETF in BlackRock’s 1,197-fund lineup. Its dominance is clear: with a 56% market share—more than double that of Fidelity’s FBTC (just over 200,000 BTC) and Grayscale’s GBTC (around 182,000 BTC)—IBIT also leads in trading volume, regularly accounting for 80% of daily Bitcoin ETF volume.

As capital flows into ETFs, interest in the underlying infrastructure, particularly mining, continues to rise

Corporate Bitcoin Treasury Buying Shows No Signs of Slowing

Corporate Bitcoin accumulation remains relentless, with Michael Saylor’s Strategy continuing to lead the charge. On July 14, the company’s holdings surpassed 600,000 BTC following the purchase of 4,225 BTC—funded through all four of its active at-the-market (ATM) offerings. This marked the first time Strategy deployed its entire ATM suite, raising $472.3 million through sales of MSTR common stock and three preferred stock series: STRK, STRF, and STRD. Just days later, the company priced a separate $2.47 billion IPO for its Variable Rate Series A Perpetual Stretch Preferred Stock (STRC), at $90 per share—well above its original $500 million target. STRC pays a variable monthly dividend, initially yielding 9% annually on a $100 stated value, with limited downside adjustments, adding another lever to fund future Bitcoin acquisitions.

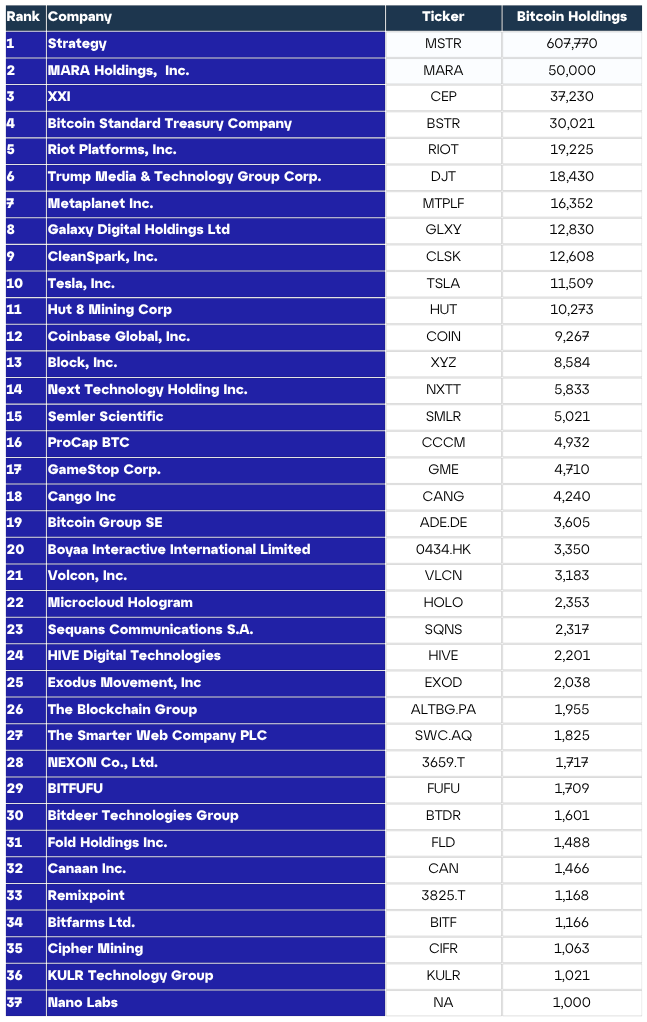

Outside of Strategy, other corporations are also ramping up their Bitcoin exposure. MARA Digital now holds the largest Bitcoin position among all mining firms and ranks second overall. Trump Media has quickly climbed to the number six spot, holding 18,430 BTC. The company recently unveiled a Bitcoin treasury strategy, allocating $2 billion into Bitcoin and related securities—making up two-thirds of its $3 billion in liquid assets.

In total, more than 100 public companies now collectively hold 955,711 BTC. At the current pace, that number could cross the 1 million BTC threshold within the next three months. Of those companies, 37 already have over 1,000 BTC on their balance sheets, underscoring the growing role of Bitcoin as a strategic treasury asset among corporations.

37 Publicly Traded Companies Hold over 1,000 BTC (Source: BitcoinTreasuries).

Network Hashrate Rebounds and Keeps Margins in Check

After experiencing the sharpest hashrate drop in years last month, Bitcoin’s mining network is now bouncing back—fully recovering to all-time high levels. A severe heatwave across North America in late June forced many miners offline, causing the network hashrate to plunge 15.6% to 802 EH/s. This disruption triggered Bitcoin’s steepest difficulty adjustment (-7.48%) since China’s mining ban in 2021. But as temperatures eased in July, previously curtailed miners began coming back online. As a result, the 7-day average hashrate has rebounded to 950 EH/s, after which it retraced to 909 EH/s at the close of the month. The network hashrate was 882 EH/s at the start of the month, resulting in a recovery of 27 EH/s MoM.

Hashrate Recovering to ATH Levels (Source: Lincoin Lens).

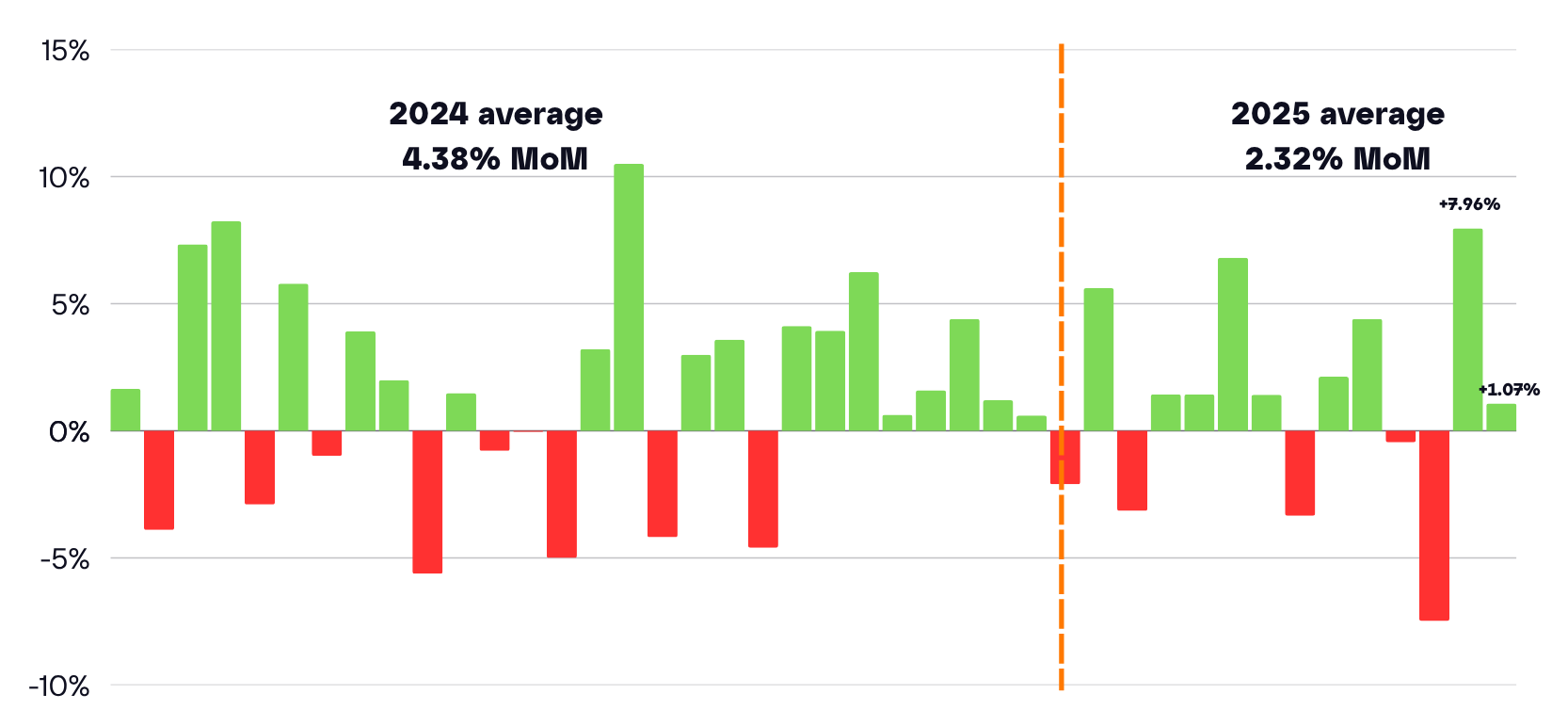

The hashrate recovery triggered two consecutive difficulty increases in July: a significant 7.96% rise on July 12th, followed by a smaller 1.07% increase on July 25th. The first adjustment was especially notable—marking the largest upward move in nearly a year. As a result, network difficulty has reached a new all-time high of 126.27 trillion.

Two Consecutive Difficulty Increases in July (Source: Digital Mining Solutions).

Hashprice—the daily revenue a Bitcoin miner earns per petahash per second (PH/s)—is primarily determined by four factors: the block subsidy, transaction fees, network difficulty and the price of Bitcoin. The -7.48% downward difficulty adjustment at the end of June combined with BTC’s surge to new highs in early July pushed hashprice up to $64/PH/day, the highest level year-to-date. However, as BTC price stabilized around $120,000, the 7.96% upward difficulty adjustment brought hashprice back below $60/PH/day. The most recent adjustment on the 25th was minor, only 1.07%, and had little impact on hashprice.

Hashprice Reaching the Highest Level of 2025 (Source: Lincoin Lens).

Rising Mining Giants

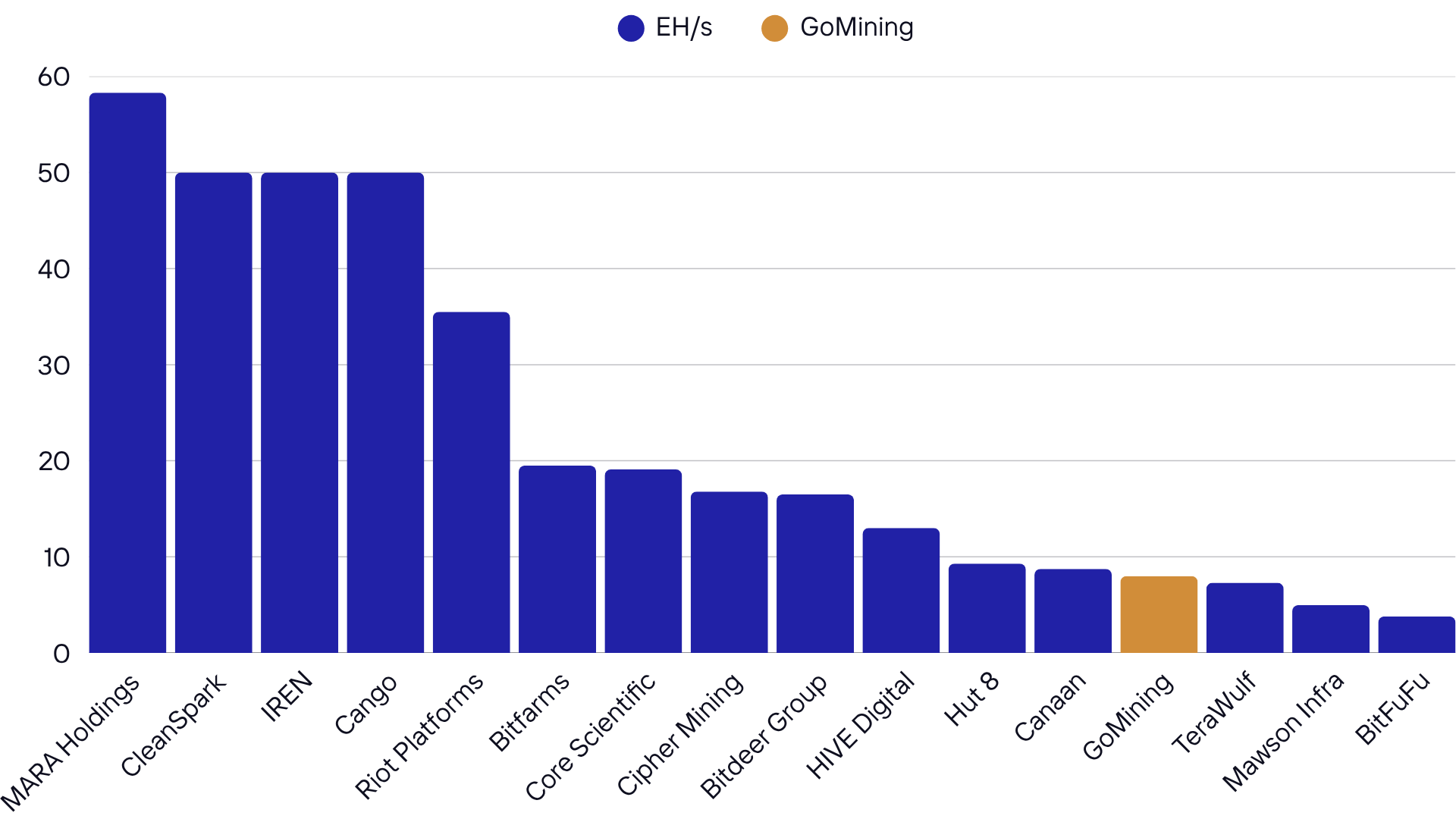

The industrial Bitcoin mining landscape is rapidly consolidating, with a few public companies now dominating global hashrate. Cango and IREN are the latest to break into the elite +50 EH/s club. In just 18 months, IREN has scaled from 5.6 to 50 EH/s by energizing over 600MW of infrastructure. Cango, meanwhile, finalized its acquisition of 18 EH/s from Antalpha at the end of June, pushing its total to 50 EH/s at the start of July. They now stand shoulder-to-shoulder with industry leaders MARA Digital and CleanSpark—four public mining giants that together operate over 208 EH/s. This represents nearly 60% of the hashrate controlled by public miners and over 20% of Bitcoin’s total network hashrate.

HIVE Digital Technologies, although a tier below, has quickly grown into the +10 EH/s club announcing 13 EH/s online in July and plans to reach 25 EH/s by Thanksgiving 2025—fully funded and powered by hydro-based infrastructure in Paraguay. There are now a total of 10 publicly traded miners with an installed hashrate of over 10EH/s.

In this increasingly consolidated environment, GoMining stands out as one of the few private mining companies with the scale, efficiency, and ambition to compete with these publicly traded mega miners—offering qualified investors structured access to Bitcoin’s compute layer via the GM Alpha Blocks Fund.

—

Nico Smid – Research Analyst GoMining Institutional.

*This post is for informational purposes only and does not constitute an offer or solicitation to buy or sell any investment product.

August 5, 2025