Neste artigo, você aprenderá como pagar impostos corretamente ao sacar criptomoedas, por que isso é importante para todos os investidores e como entender as regras tributárias ajudará você a ganhar dinheiro com ativos digitais de forma mais fácil, rápida e eficiente. Analisaremos quais obrigações surgem ao vender ou trocar criptomoedas, quais métricas usar para calcular a base tributária e quais previsões para 2025-2026 ajudarão você a evitar riscos e manter a lucratividade.

O que significa pagar impostos ao sacar criptomoedas?

Sacar criptomoedas em moeda fiduciária ou transferi-las para uma conta bancária é considerado um evento tributável na maioria dos países. Isso significa que os lucros da venda de Bitcoin, Ether ou outros ativos estão sujeitos ao imposto de renda. Em 2025, os reguladores reforçaram o controle sobre os relatórios, e ignorar essas regras leva a multas e congelamento de contas bancárias.

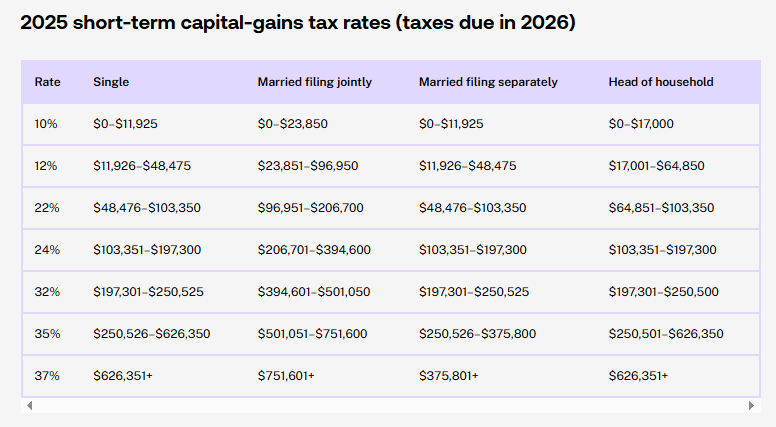

Fonte: tokentax.co

“As novas regras do IRS exigem a declaração de cada transação por meio do Formulário 1099-DA. Isso significa que é praticamente impossível ocultar transações com criptomoedas.” — Sharon Yip, CPA

Como funcionará a tributação de criptomoedas em 2025

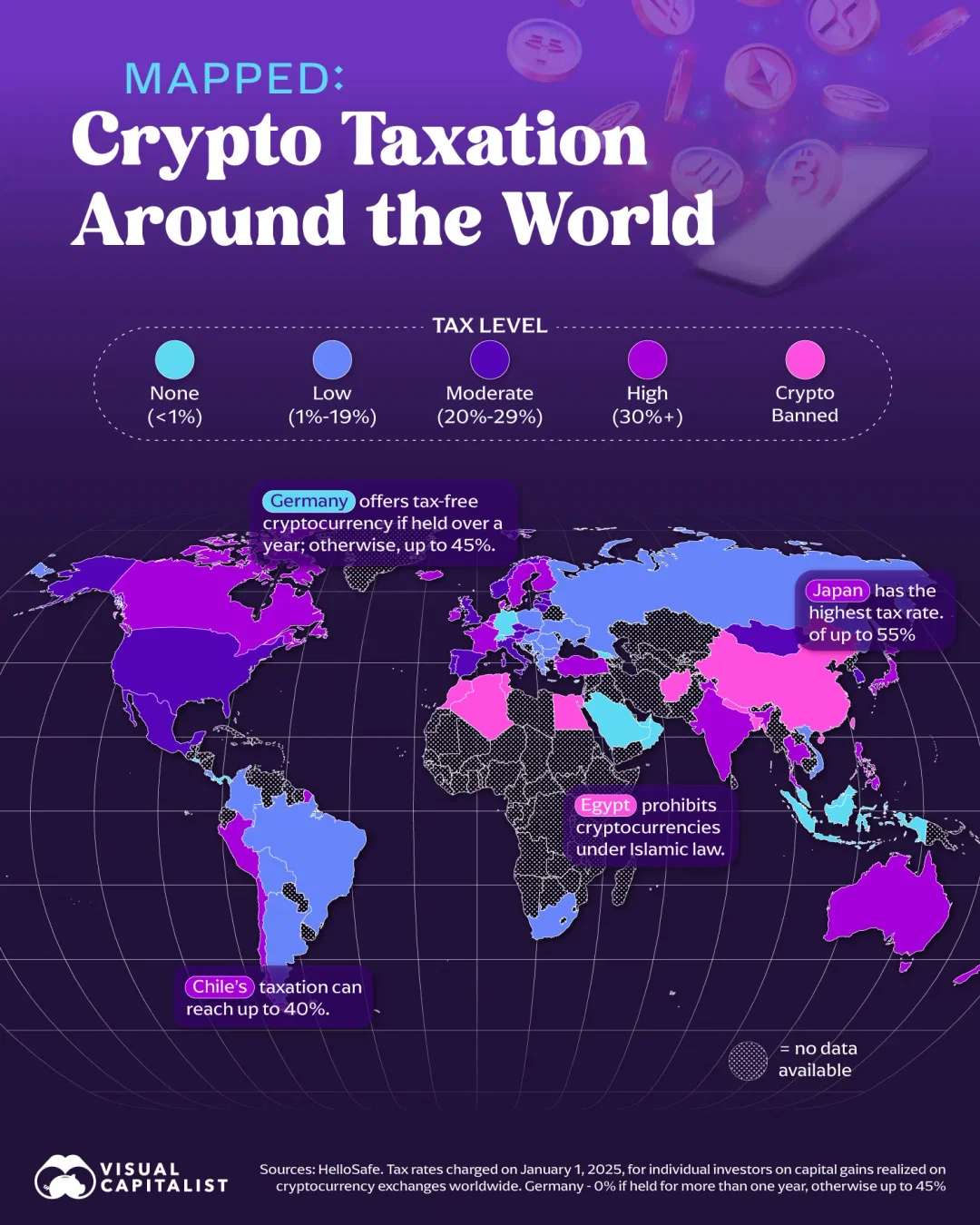

É importante observar desde já que as regras de tributação de criptomoedas variam de país para país, portanto, as condições específicas dependem da jurisdição em que você mora e está lendo este artigo.

Em geral, o imposto é calculado com base na diferença entre o preço de compra e o preço de venda. Por exemplo, se você comprou Bitcoin por US$ 30.000 e o vendeu por US$ 60.000, a base tributária seria US$ 30.000. Em alguns países, as taxas de câmbio e os custos de mineração ou staking também são levados em consideração. A renda do Ethereum e do DeFi é tributada de maneira semelhante: os lucros da agricultura, do fornecimento de liquidez ou do staking são registrados como renda.

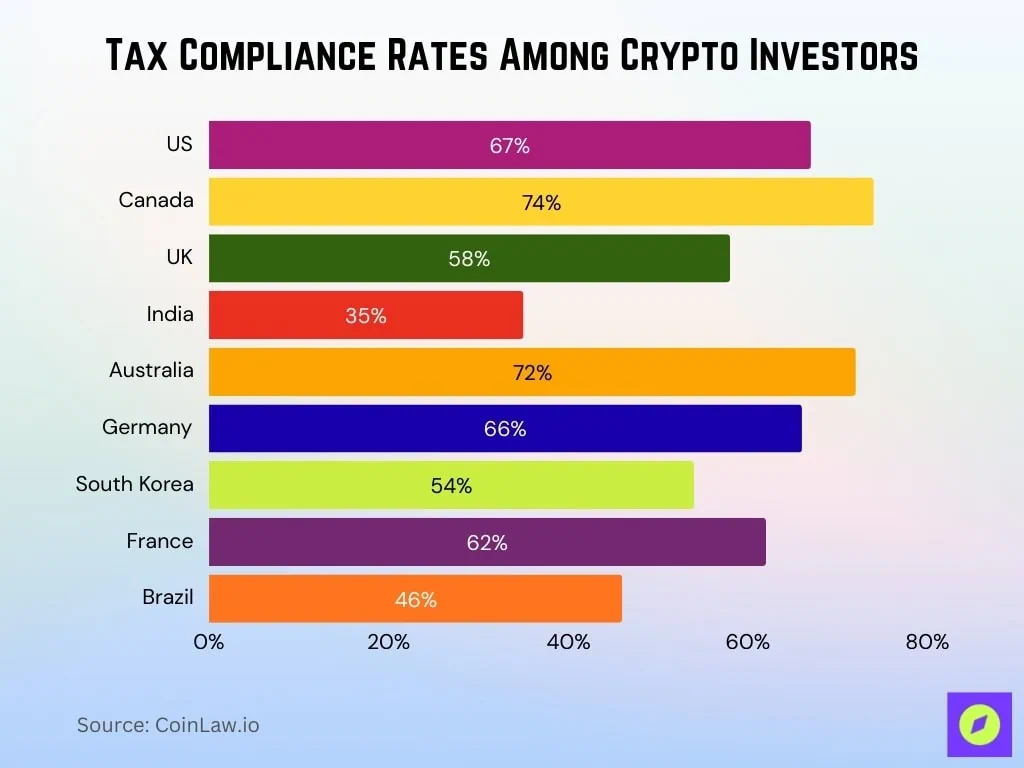

Fonte: coinlaw.io

“Os impostos sobre criptomoedas se tornaram um padrão global em 2025: a Coreia do Sul introduziu um imposto de 20% sobre ganhos de capital, Portugal abandonou sua alíquota zero e a UE implementou totalmente o MiCA.” — Awaken Tax

Vantagens e riscos do pagamento de impostos

A principal vantagem é a legalidade e a proteção do capital. Pagar impostos permite que você use livremente sua renda: comprar imóveis, investir em fundos, abrir contas. O risco é a perda de parte dos seus lucros, especialmente com taxas altas. Em 2025, a alíquota média de imposto sobre criptomoedas nos países desenvolvidos varia de 15% a 30%.

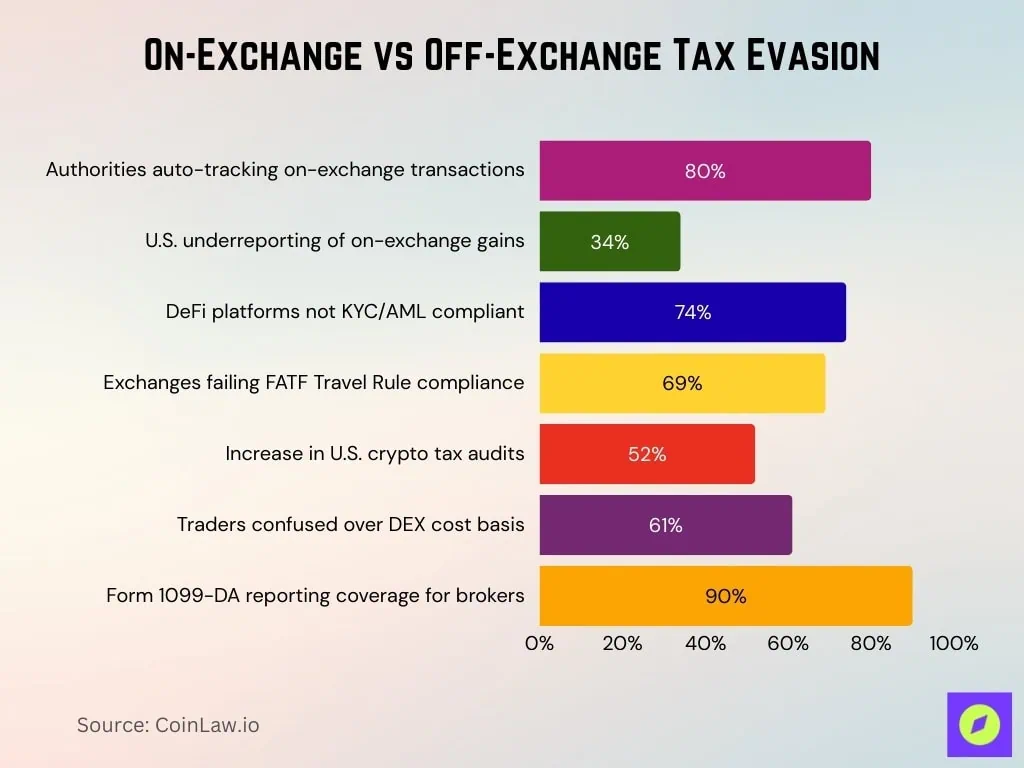

Fonte: coinlaw.io

Algoritmo prático para pagar impostos

- Registre a data e o preço de compra do ativo.

- Determine o preço de venda ou retirada do mesmo ativo.

- Calcule a diferença; essa é a base tributária.

- Leve em consideração as comissões de câmbio e os custos de mineração/staking.

- Envie sua declaração de imposto de renda à autoridade fiscal ou por meio de um serviço online.

Os dados da cadeia e os relatórios de câmbio ajudam a automatizar o processo: muitas plataformas já fornecem relatórios prontos para as autoridades fiscais de alguns países.

Previsões para impostos sobre criptomoedas em 2025-2026

Especialistas prevêem uma regulamentação mais rígida: as autoridades fiscais se integrarão às bolsas e ETFs para rastrear automaticamente as retiradas. Após a redução da Bitcoin pela metade em 2024, o aumento dos preços aumentou a atenção aos impostos, e espera-se que padrões uniformes de relatório sejam introduzidos em 2026. Isso significa que as estratégias de “ignorar impostos” finalmente se tornarão coisa do passado.

Fonte: voronoiapp.com

Conclusão sobre impostos e criptomoedas

Pagar impostos ao retirar criptomoedas não é apenas uma obrigação, mas também uma forma de proteger seu capital. Em 2025-2026, a transparência e a legalidade se tornarão fatores-chave para os investidores. Ignorar os impostos leva a riscos, enquanto relatórios competentes permitem que você use sua renda de forma livre e eficaz.

E se você deseja não apenas pagar impostos corretamente, mas também construir seu próprio saldo em Bitcoin, a maneira mais confiável é ter BTC real em sua conta. A GoMining ajuda nisso — uma plataforma de mineração em nuvem que permite alugar poder de computação e receber pagamentos diários em Bitcoin. Trata-se da propriedade direta de um ativo, independente de fundos e intermediários, com retornos transparentes e gestão flexível. A GoMining torna o caminho para os resultados financeiros mais fácil, rápido e eficiente.

Inscreva-se e tenha acesso ao curso gratuito da GoMining sobre criptomoedas e Bitcoin

Telegram | Discord | Twitter (X) | Medium | Instagram

Perguntas frequentes

- O que são impostos sobre saques de criptomoedas e eu tenho que pagá-los?

São pagamentos obrigatórios ao Estado ao vender ou trocar criptomoedas por moeda fiduciária. Na maioria dos países, os saques são considerados um evento tributável.

- Como funciona a tributação de criptomoedas? O imposto é calculado como a diferença entre o preço de compra e o preço de venda. Os lucros são registrados como renda e as perdas podem ser usadas para reduzir a base tributária.

- Quais são as vantagens e os riscos de pagar impostos? A vantagem é a legalidade e a capacidade de usar livremente sua renda. O risco é a perda de parte do seu lucro devido à alíquota de imposto, que em 2025 é em média de 15 a 30%.

- Como aplicar o conhecimento tributário em 2025? Você deve registrar todas as transações, levar em consideração as comissões e usar relatórios de câmbio. Isso ajuda a calcular corretamente a base tributária e evitar multas.

- Quais métricas estão relacionadas à tributação de criptomoedas? ROI após impostos, alíquotas de impostos por país, saques fiduciários, relatórios 1099-DA e entradas e saídas de ETF.

- É possível ganhar dinheiro após os impostos? Sim, se você planejar suas transações levando em consideração a carga tributária. Por exemplo, você pode usar a colheita de impostos — bloqueando perdas para reduzir sua base tributária geral.

- Quais erros os iniciantes cometem com mais frequência? Eles ignoram os relatórios, não registram comissões, retiram fundos sem levar em consideração a base tributária e confiam em “esquemas” não verificados das redes sociais.

- Como os impostos sobre saques de criptomoedas afetam o mercado? Eles aumentam a transparência e reduzem a atividade especulativa. Os participantes institucionais ganham vantagem, enquanto os comerciantes de varejo são forçados a se adaptar.

- O que os especialistas prevêem para 2026? Espera-se um aumento da regulamentação, integração automática das autoridades fiscais com as bolsas e padrões uniformes de relatórios na UE e nos EUA.

- Onde você pode encontrar atualizações sobre impostos sobre criptomoedas? Em primeiro lugar, você deve acompanhar os desenvolvimentos em sua jurisdição local: sites oficiais das autoridades fiscais, ministérios das finanças e reguladores. Eles publicam as taxas atuais, formulários de declaração e prazos para apresentação de declarações.

NFA, DYOR.

O mercado de criptomoedas opera 24 horas por dia, 7 dias por semana, 365 dias por ano, sem interrupções. Antes de investir, sempre faça sua própria pesquisa e avalie os riscos. Nada do mencionado neste artigo constitui aconselhamento financeiro ou recomendação de investimento. O conteúdo é fornecido “como está”, todas as alegações são verificadas com terceiros e especialistas internos e externos relevantes. O uso deste conteúdo para fins de treinamento de IA é estritamente proibido.

Saiba como pagar impostos ao sacar criptomoedas, quais riscos e benefícios isso acarreta e o que os especialistas prevêem para 2025-2026.

January 7, 2026