Quando as pessoas procuram o preço futuro da Solana, não estão à procura de um “número mágico”. Elas querem entender duas coisas: por que a SOL pode valer mais (ou menos) em um ou dois anos e como usar esse conhecimento em uma estratégia, em vez de uma loteria.

A Solana sempre resistiu a julgamentos em preto e branco. Por um lado, é uma rede com enorme rendimento, taxas insignificantes, atividade DeFi em alta e um aumento meteórico na liquidez de stablecoins — o suficiente para garantir a segunda posição por TVL entre todas as blockchains. Por outro lado, carrega uma cicatriz visível: interrupções na rede, um histórico de mania especulativa em torno de tokens meme, volatilidade elevada e uma reputação mais próxima do “risco agressivo” do que do “ouro digital”.

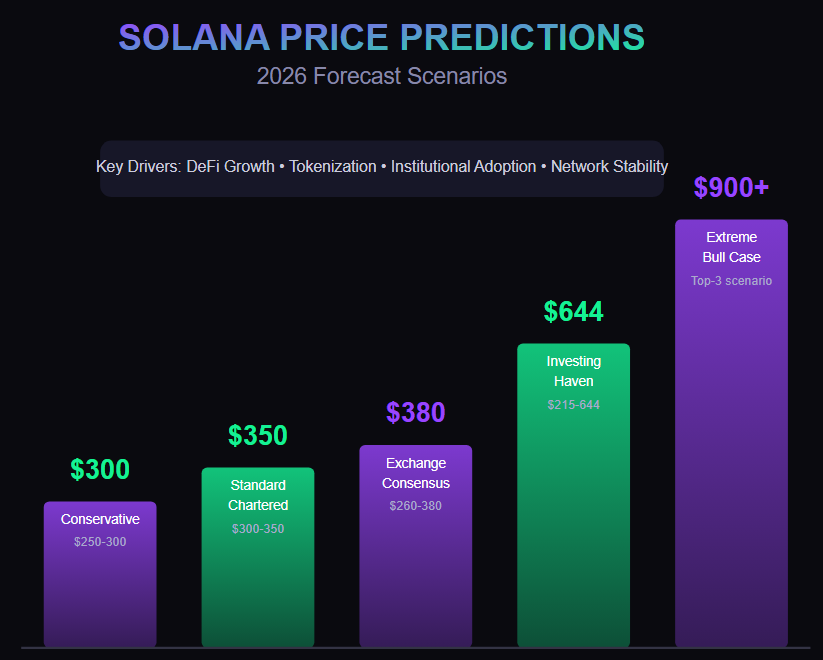

É por isso que qualquer top 5 das melhores e piores previsões de preço da Solana para 2026 não deve ser tratado como verdade absoluta. Não se trata de um número exato — são faixas de cenários:

- O que acontecerá se a rede continuar se expandindo?

- E se o crescimento desacelerar?

- E se os reguladores, os rivais e a fadiga do mercado atacarem todos ao mesmo tempo?

Neste guia, detalhamos:

- as forças reais que moldam o preço da Solana até 2025-2026,

- cinco previsões otimistas e cinco pessimistas,

- e como um novato pode usar essas projeções para construir um plano, em vez de perseguir a meta de outra pessoa.

O que determina o destino da Solana em 2025-2026

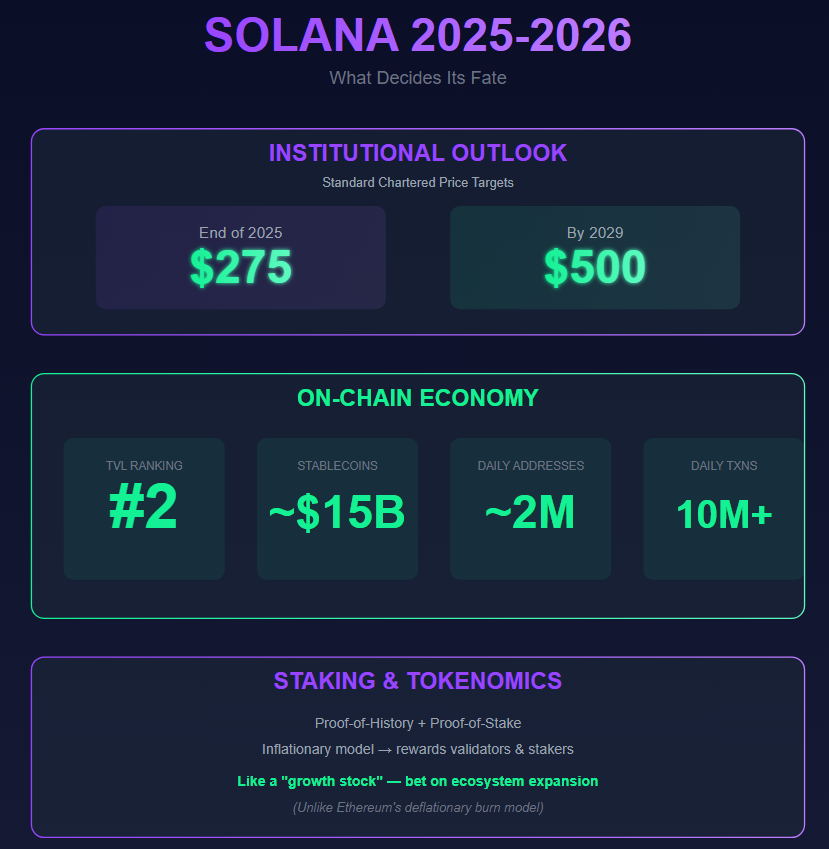

Atores institucionais e previsões dos principais bancos

A Solana não é mais um playground para experimentos. Quando o Standard Chartered publica um relatório afirmando que a SOL pode chegar a US$ 275 até o final de 2025 e US$ 500 até 2029, não se trata de um trader aleatório gritando no Twitter — é a posição de um banco global.

Jeffrey Kendrick, chefe de pesquisa de ativos digitais do banco, explica a lógica: a Solana se beneficia da atividade explosiva dos usuários — particularmente no segmento de negociação impulsionado por memes — e demonstrou que a rede pode suportar um enorme rendimento com taxas mínimas. Mas ele também enfatiza que essa força pode se tornar um passivo: se a Solana continuar sendo um playground impulsionado por memes, seu potencial de crescimento será limitado. O valor sustentável requer estruturas DeFi sérias, staking, tokenização de ativos e aplicativos de nível de infraestrutura. Simplificando:

- Se a Solana continuar sendo apenas um mecanismo de negociação de memes → pista limitada

- Se a Solana se tornar um ecossistema completo de DeFi, RWA, staking e camada de aplicativos → a avaliação se expande dramaticamente

DeFi, stablecoins e a economia on-chain da Solana (SOL)

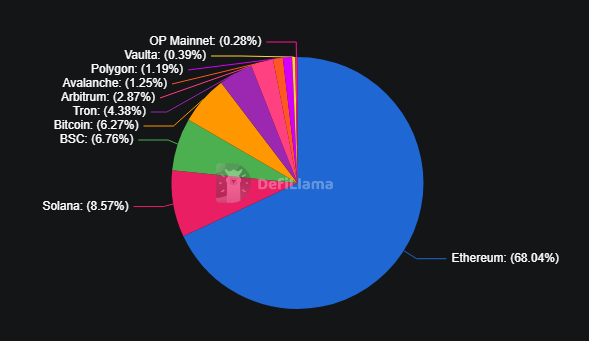

A história dos preços da Solana não se resume apenas ao hype do mercado — trata-se de métricas reais e visíveis, todas verificáveis através do DeFiLlama:

- A Solana é a segunda em TVL entre todas as redes

Fonte: defillama.com

- A capitalização de stablecoins na Solana é de cerca de US$ 15 bilhões, crescendo a taxas mensais de dois dígitos

- Endereços diários ativos chegam a cerca de 2 milhões de usuários

- Transações: dezenas de milhões por dia

- Os volumes DEX e as negociações perpétuas agora chegam a bilhões de dólares diariamente

Este não é mais um ecossistema de brinquedo — é um ambiente financeiro funcional: bolsas, mercados de empréstimos, staking, derivativos, NFTs e projetos DePIN. Quanto mais capital e atividade econômica a rede retém, mais fácil se torna justificar metas de avaliação mais altas em qualquer previsão para 2026.

Staking e Solana (SOL) Tokenomics

Da perspectiva de um investidor, a SOL oferece um conjunto de incentivos claros:

- Um consenso híbrido de Prova de Histórico + Prova de Participação

- Rendimentos atraentes de staking que podem superar as taxas de poupança tradicionais

- Um modelo de emissão inflacionário, em que a nova oferta vai para validadores e stakers — e deve ser compensada pelo crescimento do ecossistema para evitar pressão sobre os preços

Ao contrário da mecânica deflacionária de queima da Ethereum, a Solana se comporta mais como uma aposta em ações de alto crescimento:

- Se a rede acelerar → a inflação é irrelevante

- Se o crescimento estagnar → a inflação se torna perceptível

Riscos: interrupções e concorrentes

Não se pode falar sobre a Solana sem abordar o elefante na sala: interrupções na rede.

Em fevereiro de 2024, a mainnet da Solana ficou parada por quase cinco horas devido a um problema no programa legado, exigindo que os validadores coordenassem uma reinicialização da rede. Interrupções anteriores também ocorreram antes. Nenhum fundo foi perdido, mas a reputação foi prejudicada — alguns fundos veem a Solana como tecnologicamente impressionante, mas cheia de riscos.

Ao mesmo tempo, a concorrência se intensifica:

- A Ethereum absorve fluxos institucionais e continua sendo a principal camada de liquidação DeFi

- As redes ETH L2 estão melhorando rapidamente em termos de custo e experiência do usuário

- Novas L1s estão entrando em cena, prometendo velocidade e escalabilidade

Isso explica por que as previsões da Solana para 2026 abrangem um espectro tão amplo — de extremamente otimistas a muito cautelosas.

Cinco cenários otimistas para a Solana em 2026

Vamos à parte que todos secretamente procuram — os números que os analistas estão dispostos a colocar na mesa.

Cenário do Standard Chartered: Solana como vencedora do próximo ciclo

Nos relatórios de pesquisa do banco, a Solana é apresentada não como uma L1 especulativa, mas como uma candidata favorita para a infraestrutura central no próximo ciclo DeFi. Os números são explícitos:

- US$ 275 até o final de 2025

- US$ 500 até 2029

O banco não especifica diretamente o valor para 2026, mas a trajetória deixa pouca ambiguidade:

- Se SOL se aproximar de US$ 250–US$ 280 no final de 2025

- E tiver como meta US$ 500 até 2029...

então a faixa de 2026–2027 naturalmente ficará em torno de US$ 300–US$ 350.

Nesse cenário, a Solana não é mais o “cassino meme rápido”. Ela é:

- um mecanismo DeFi comprovado,

- uma economia de staking

- e uma plataforma com casos reais de adoção.

Não é uma garantia — é um sinal de validação: um banco global está disposto a considerar a Solana um concorrente legítimo para relevância estrutural de longo prazo.

InvestingHaven: US$ 215 a US$ 644, com um impulso no melhor cenário para US$ 900

Os analistas da InvestingHaven traçam uma faixa mais ampla:

- Mínimo em torno de US$ 215

- Resistência crítica perto de US$ 644

- Melhor cenário: até US$ 900 por SOL

A lógica deles é direta: se a Solana continuar expandindo seu ecossistema na velocidade atual — DePIN, tokenização de ativos, estruturas de jogos, integrações fintech — o teto se estende muito além da “zona conservadora de US$ 300 a US$ 400”. Se a Solana amadurecer e se tornar uma das três principais plataformas em capitalização de mercado, os investidores estarão dispostos a pagar muito mais do que os múltiplos atuais.

Previsões de câmbio e algorítmicas: US$ 260–US$ 380 como o corredor de alta em funcionamento

Um conjunto de plataformas e agregadores produz níveis de consenso semelhantes:

- Changelly, citando DigitalCoinPrice, projeta uma faixa em torno de US$ 260–US$ 380 até o final de 2026, com valores médios próximos a US$ 300

- A Binance reforça esses números, referenciando avaliações entre US$ 215 e US$ 644 provenientes dos mesmos conjuntos de dados

Isso não é exagero — é um sentimento agregado que forma uma base moderadamente otimista: se nada mudar, se o crescimento continuar em um ritmo sensato, US$ 250–US$ 400 se tornará um habitat natural de preço para a SOL até 2026.

Cenário de crescimento moderado para um mercado maduro: US$ 250–US$ 300 como o “caso normal”

As previsões da CoinCodex, CryptoPredictions e outras pintam um quadro mais calmo:

- O mercado de criptomoedas está amadurecendo

- A Solana continua sendo uma L1 líder

- Mas sem especulações em nível de mania

Nesses modelos, US$ 250-US$ 300 em 2026 não parecem uma meta irreal, mas uma avaliação razoável — supondo que a atividade sustentável da rede e os rendimentos decentes das apostas continuem a sustentar o ecossistema.

O campo extremamente otimista: Solana a US$ 1.000 e além

No extremo oposto do espectro estão as narrativas mais ousadas — frequentemente repetidas em colunas de traders, mídia de criptomoedas e feeds sociais:

- Se a Solana se consolidar como a plataforma dominante para novos aplicativos, tokenização e integração em escala de varejo, então um preço acima de US$ 1.000 em poucos anos deixará de parecer ficção científica

Até mesmo a análise da Binance sugere níveis de US$ 900 até 2027 em suas projeções mais otimistas.

Este não é um plano financeiro pessoal — é o teto teórico em condições ideais:

- macro alinhado,

- adoção exponencial

- e sem falhas catastróficas na rede.

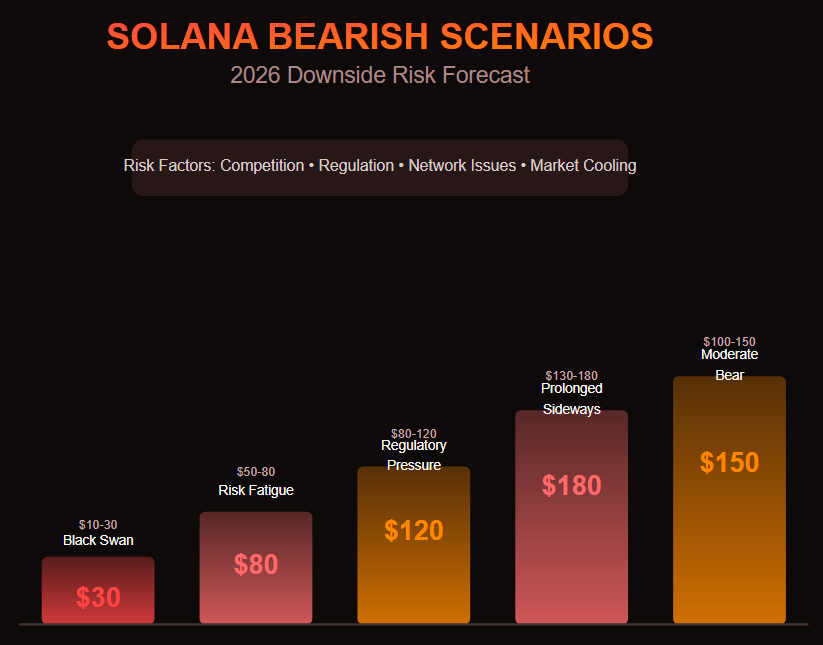

Cinco cenários negativos para a Solana em 2026

Agora vamos inverter o gráfico. Os mesmos dados — uma perspectiva diferente.

Cenário moderadamente pessimista: US$ 100–150

Se nos basearmos em avaliações conservadoras, vários analistas e modelos de corretoras sugerem que a Solana pode se encontrar na faixa de US$ 100–150 até 2026, especialmente se:

- o crescimento do TVL estagnar,

- o apetite do mercado pelo risco diminuir e

- o interesse institucional permanecer seletivo em vez de decisivo.

Por exemplo, a previsão da Changelly coloca o limite inferior para SOL em 2026 em aproximadamente US$ 110–140 sob premissas macroeconômicas neutras ou pessimistas. A Traders Union projeta um resultado semelhante, mostrando US$ 100-130 como a zona em que a Solana se estabilizará se a liquidez da DeFi estagnar. Isso não é um colapso — é a versão “ativo interessante sem impulso inovador” da história, em que a Solana continua sendo uma L1 relevante, mas perde o prêmio vinculado a narrativas de crescimento agressivo.

Faixa lateral estendida: US$ 130-180

Outra possibilidade: a Solana simplesmente fica presa em um amplo canal lateral. Isso acontece se:

- as taxas do Federal Reserve e as condições de liquidez global permanecerem restritivas,

- nenhum novo fator de crescimento importante surgir

- e a base de usuários existente já estiver precificada, sem novo influxo de demanda.

Nesse caso, projeções como “US$ 130–180 até 2026” parecem totalmente realistas: a rede está funcionando, mas os investidores não a recompensam mais com um múltiplo de expansão. A Solana se torna uma posição estável, mas pouco inspiradora — nem um grande sucesso nem um fracasso.

Pressão regulatória e ventos contrários macroeconômicos: US$ 80–120

Se a pressão regulatória se intensificar — particularmente contra produtos de staking e de rendimento — ou se o apetite global pelo risco entrar em colapso, a Solana pode cair rapidamente abaixo dos limites psicológicos.

Esse cenário se torna plausível se:

- o lançamento dos produtos spot da Solana for negado ou adiado,

- as bolsas centralizadas enfrentarem um escrutínio mais rigoroso,

- ações judiciais e manchetes sobre conformidade dominarem a narrativa

Nessas condições, uma faixa de US$ 80–120 é mais do que alarmismo — é um cenário funcional de baixa, em que os fundamentos são ofuscados por choques políticos.

Fadiga de risco em meio à concorrência: US$ 50–80

Uma versão mais severa da mesma ideia:

- novos participantes L1 e L2 igualam ou superam as vantagens da Solana em termos de experiência do usuário, escalabilidade e custo de transação

- os investidores se cansam das manchetes sobre interrupções na rede e optam por infraestruturas mais seguras

- os principais protocolos migram a liquidez e o TVL para ambientes concorrentes

Se isso se alinhar com um arrefecimento mais amplo do mercado, a Solana flutuando em direção a US$ 50-80 se torna viável — especialmente se o capital de varejo se esgotar mais rapidamente do que a demanda institucional estiver disposta a entrar.

Choque sistêmico: US$ 10–30 em um evento Black Swan

O cenário final de risco de cauda raramente aparece em relatórios brilhantes, mas sempre existe dentro de modelos de risco profissionais:

- uma interrupção prolongada e grave,

- uma exploração no nível do protocolo que mina a confiança ou

- restrições rígidas à negociação ou staking de SOL nas principais jurisdições

Sob essa combinação, uma avaliação de US$ 10–30 deixa de parecer hipotética e começa a se assemelhar a uma reavaliação do mercado em pânico. A probabilidade é baixa, mas ignorá-la seria irresponsável.

Como um novato deve trabalhar com essas previsões

É aqui que as coisas ficam sérias. O erro mais comum dos novatos é escolher uma previsão atraente e construir um plano inteiro em torno dela. A lógica geralmente é assim:

“Um banco disse US$ 275 → então vou apenas comprar e esquecer.”

Profissionais nunca operam dessa maneira.

Os fundos não buscam um único número “correto” — eles definem intervalos, atribuem probabilidades e preparam ações para cada resultado. Essa é a diferença entre um participante do mercado e um apostador.

Construa sua própria faixa

Para a Solana, você pode construir três camadas de trabalho:

Cenário base

Com base em previsões moderadas da Changelly, DigitalCoinPrice e Binance Analytics, um corredor de US$ 250–300 até 2026 parece uma linha de base justificada se a rede crescer de forma constante e o mercado evitar choques estruturais.

Cenário otimista

Se a tese do Standard Chartered se concretizar — Solana mantém o impulso da DeFi, as stablecoins aprofundam sua presença e novos produtos institucionais entram no mercado —, então uma faixa de US$ 300 a US$ 400+ se torna realista. O grupo mais ousado até mesmo espera US$ 500 e mais.

Cenário pessimista

Se o mercado se cansar de ativos de alto beta, os reguladores apertarem o controle sobre staking e exchanges, e a Solana enfrentar outra onda de incidentes desagradáveis, a zona de observação racional muda para US$ 80–150.

Em seguida, vem a pergunta adulta: Qual probabilidade você atribui a cada cenário e qual é o seu plano de ação em cada caso?

Transforme previsões em ações concretas

Em vez de perguntar:

“O SOL chegará a US$ 500?”

pergunte:

“O que farei se a Solana estiver no topo, no meio ou na base da faixa?”

Exemplos:

Cenário 1 — O preço cai para US$ 80–120...

mas as métricas da rede continuam melhorando.

O TVL permanece estável, a liquidez das stablecoins cresce, novos protocolos são lançados.

Este não é o fim da Solana — é uma oportunidade estruturada de DCA para aqueles que acreditam nos fundamentos de longo prazo.

Cenário 2 — O preço dispara para US$ 350–400+...

mas os fundamentos ficam para trás.

O TVL estagna, as receitas do protocolo não aumentam, as métricas de atividade se estabilizam.

Este não é um momento para correr atrás do trem. É um aviso para realizar lucros parciais ou, pelo menos, evitar a média de compra baseada no FOMO.

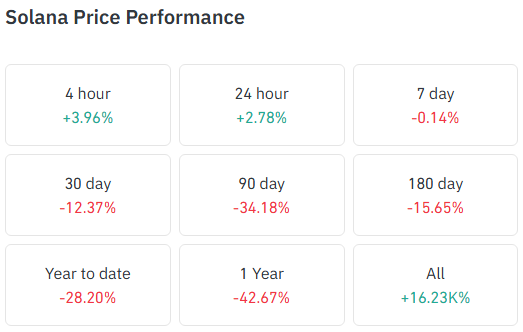

Pare de viver das opiniões dos outros — use dados

Para permanecer racional, acompanhe os números, não as manchetes:

- CoinGlass → clusters de liquidação, taxas de financiamento, mudanças na relação long/short

Fonte: coinglass.com

- DeFiLlama → TVL da Solana, fluxos de stablecoins, receitas do protocolo, participação da DeFi

- Ferramentas on-chain como Nansen → monitore se grandes carteiras e fundos estão acumulando ou distribuindo SOL

Esses painéis são atualizados diariamente. Seu perfil de risco deve evoluir com eles — não com o tweet de outra pessoa.

Como isso se conecta ao Bitcoin, Ethereum e ao ciclo do mercado

Analisar a Solana isoladamente não funciona. A criptomoeda se comporta como um organismo de liquidez interconectado.

- O Bitcoin, após a redução pela metade em 2024, define o ritmo de todo o mercado. Historicamente, 12 a 24 meses após a redução pela metade levam a novos máximos ou a uma fase de distribuição prolongada.

- Ethereum continua sendo a camada de infraestrutura de referência. Alguns analistas argumentam que Solana está “alcançando” ou até mesmo ultrapassando-a em métricas selecionadas — mas com uma exposição beta muito maior.

O ciclo normalmente se desenrola assim:

- Bitcoin acorda

- Ethereum e grandes altcoins de infraestrutura seguem

- Em seguida, vêm redes de alto beta, como Solana

Este é o modelo mental fundamental:

SOL quase sempre se move de forma mais agressiva do que o mercado — para cima e para baixo.

Resumo

As previsões de preço da Solana para 2026 não são uma competição para ver quem consegue gritar o número mais alto. Elas são uma tentativa de mapear como uma rede — que agora hospeda traders de memes, construtores, desenvolvedores e capital institucional — pode se comportar sob diferentes regimes de mercado.

- Os casos otimistas mostram o que acontece quando o TVL se expande, as stablecoins se multiplicam e as aplicações reais chegam.

- Os casos pessimistas nos lembram que interrupções na rede, pressão regulatória, concorrência e fadiga não são riscos abstratos — eles são forças reais que suportam cargas.

Um investidor racional não escolhe uma previsão e se apega a ela. Em vez disso, ele: observa toda a gama, testa sua tolerância emocional, elabora planos para alta, estagnação e baixa e só então pressiona comprar ou vender.

Nessa estrutura, as previsões deixam de ser adivinhação e se transformam em uma arquitetura de decisão.

Perguntas frequentes

Quais são as “5 melhores e piores previsões de preço da Solana para 2026”?

Um conjunto selecionado dos cenários de preço da SOL mais discutidos para 2026 — de US$ 250–300 no caso base a US$ 400+ no campo otimista e US$ 80–150 na visão pessimista. O ponto é a variação, não um único número.

Como essas previsões são usadas em criptomoedas?

Fundos e investidores disciplinados aplicam a análise de cenários: eles se preparam para o crescimento, a estagnação e o declínio — e sabem o que farão em cada caso.

Qual é a vantagem dessa abordagem?

Ela elimina ilusões. Em vez de esperar pela sorte, você opera com um mapa: um plano otimista, um plano básico e uma contingência pessimista.

Quais são os riscos?

Apaixonar-se por um cenário. Todas as previsões dependem de suposições sobre taxas, regulamentação, tecnologia e sentimento. Mude as suposições — quebre o número.

Quais métricas são importantes para a Solana em 2025-2026?

TVL, oferta de stablecoins, endereços ativos, volume de transações, receitas do protocolo, participação da Solana no DeFi e fluxos de capital através de bolsas e pontes. A maior parte disso está disponível no DeFiLlama e em outros painéis.

É possível ganhar dinheiro com essas previsões?

Você lucra não com o número da previsão, mas com a volatilidade: entradas estruturadas (DCA), realização inteligente de lucros e a capacidade de ler o esgotamento e o pânico do mercado.

Erros típicos de novatos?

Acreditar em um número bonito, apostar tudo em um preço, ignorar o cenário pessimista ou negociar com base em emoções em vez de métricas.

As previsões afetam o preço?

Sim — manchetes e relatórios bancários podem influenciar o varejo e os traders. Mas o valor a longo prazo depende do uso real e da retenção de capital.

O que os especialistas esperam da Solana até 2026?

Uma importante L1 de alta velocidade com um ecossistema forte e riscos elevados. As previsões mais equilibradas ficam entre US$ 200 e US$ 300 em um cenário base e US$ 300 a US$ 400+ em um cenário otimista, enquanto menos de US$ 150 reflete uma desvalorização real, não imaginária.

Onde acompanhar as atualizações?

Pesquisas bancárias, relatórios de corretores, análises da Binance, DeFiLlama, painéis on-chain, anúncios de atualizações, relatórios de interrupções e notícias de parcerias. As previsões são atualizadas trimestralmente — os dados da cadeia são atualizados todos os dias.

O que fazer a seguir

Se você chegou a este ponto, não está mais apostando — está construindo uma estrutura.

Salve este artigo como seu manual do Solana. Revisite-o em um mês. Compare os novos fluxos de ETF, o TVL atualizado e a trajetória do Ethereum com esses cenários — veja para qual deles a realidade está se encaminhando.

Nas próximas edições da Crypto Academy, vamos detalhar:

- como ler os dados on-chain do Ethereum sem matemática de nível de doutorado

- como os fluxos de ETF remodelam os ciclos do mercado

- como o “dinheiro inteligente” — baleias, fundos e protocolos — impulsiona as tendências no ETH e além

Inscreva-se na Crypto Academy e desbloqueie o curso sobre criptomoedas e Bitcoin — ainda gratuito enquanto a maioria das pessoas espera pela “entrada perfeita”.

Telegram | Discord | Twitter (X) | Medium | Instagram

January 8, 2026