Market Analysis with Mike Ermolaev

Welcome to the 17th edition of GoMarket Weekly, brought to the GoMining community exclusively by Mike Ermolaev, a veteran crypto market analyst and journalist. In this up-and-down crypto ride, we examine the whys behind Bitcoin's drop, put Ethereum's ETF victories under the microscope, and peek into Vitalik Buterin's network improvement proposals. That's not all – expect insider updates on regulatory activity, plus the latest trends in the mining sector. Here we GoMarket!

Bitcoin Sell-Pressure Factors

Over the past week, Bitcoin traded within a range of $53,904 to $59,053, experiencing around 11% decline. This kind of price volatility in the original cryptocurrency stems from a mix of contributing factors. The following details will make things more clear - follow along.

Fed's Cautious Stance, Weak Jobs Data, and Political Uncertainty

First of all, it's evident that Bitcoin is no longer an isolated, fringe asset class that's immune to macroeconomic factors. In fact, the opposite is true; it’s now highly sensitive to broader economic trends, especially the Federal Reserve's interest rate policies.

Initially, market players had been anticipating multiple rate cuts in 2024, but expectations have been scaled back to just one or two. This shift has caused uncertainty and volatility in the market. Minutes released on Wednesday from the Federal Reserve's June meeting revealed that officials believe inflation is moving in the right direction but they need ‘greater confidence’ to start lowering interest rates.

Furthermore, it appears that cracks are emerging behind the curtain of a supposedly strong job market. The latest job openings data came in at 8.14 million jobs open at the end of May, an increase from the 7.92 million job openings in April, while economists had expected the report to show 7.95 million openings in May. This rise didn’t convince market players as increasing weekly jobless claims and a steadily climbing unemployment rate have them on high alert, sensing a deeper problem. Now all eyes are on today's jobs report, and if it’s weaker-than-expected, then it’s likely to heighten this concern even further.

Additionally, uncertainty surrounding the U.S. presidential elections persists. If Biden is replaced, there is considerable speculation that his successor may not be pro-crypto, further contributing to market unease.

BTC Transfers by the German Government

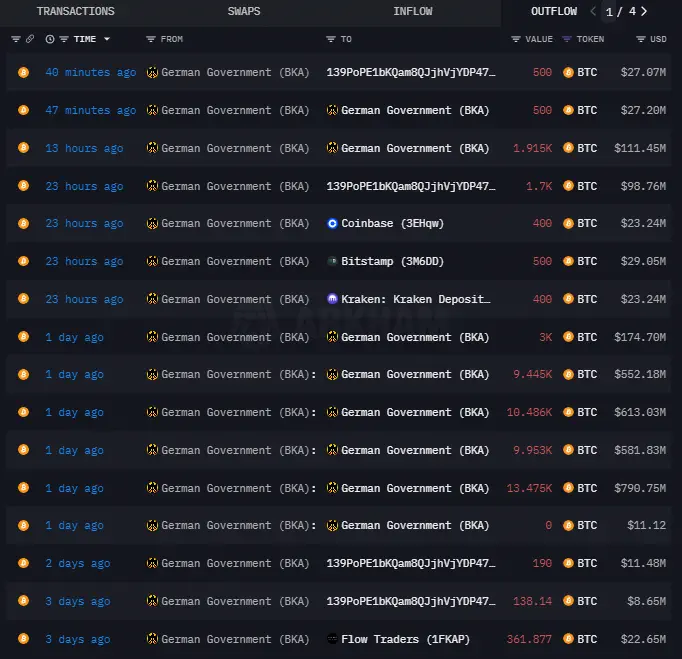

Over the past four days, the German Federal Criminal Police Office (BKA) has cumulatively transferred a significant amount of Bitcoin to various external wallets. Specifically, a total of 3,219.48 BTC valued at approximately $174.17 million was sent to unlabeled wallet address 139PoPE1bKQam8QJjhVjYDP47f3VH7ybVu. Additionally, 732.74 BTC worth around $46.89 million was transferred to Coinbase, 432.74 BTC valued at about $27.84 million was moved to Kraken, and 650 BTC worth roughly $38.41 million was sent to Bitstamp. These substantial transfers have heightened market uncertainty and selling pressure.

Since February 2024, the Bundeskriminalamt (BKA) has held 50,000 BTC and has significantly reduced its holdings in recent months. As of now, its wallet holds 41.774K BTC, valued at approximately $2.26 billion based on the current exchange rate.

Source: Arkhamintelligence.com

Mt. Gox Bitcoin Release

Today, Mt. Gox said it had begun repayments to customers, ending a near decade-long wait for some. The imminent release of up to 140,000 BTC from the world's leading exchange for cryptocurrencies before it went defunct in 2014 has created uncertainty around Bitcoin's supply dynamics. The concern is that if approximately 127,000 creditors decide to sell their repaid tokens, it could significantly increase selling pressure on the market.

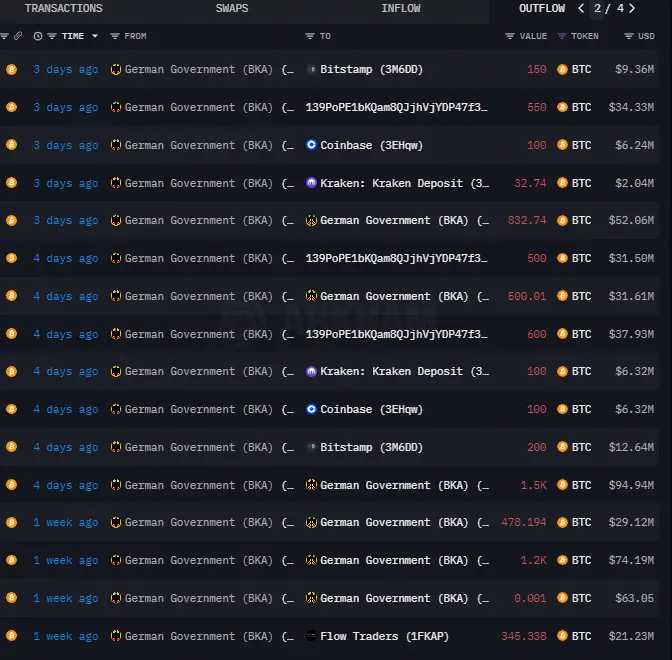

Renewed Sell-Offs by LTHs & Projections of BTC Reaching $100K by Year-End

According to the latest Bitfinex report, after halting profit-taking in early May, Bitcoin holders have resumed their sell-offs. Long-term holders, who had paused selling above $69,000, began realizing profits on their spot holdings again, but at a lower scale. This renewed selling pressure has contributed to market uncertainties. Notably, a critical metric, the Long-Term Holder Spent Output Profit Ratio, indicates a significant return to profit-taking among these holders.

Source: CryptoQuant

Meanwhile, Glassnode analysts noted that despite Bitcoin prices trading down, a significant portion of the market remains profitable, with the average coin holding a 2x unrealized profit. Short-Term Holders, however, are predominantly underwater, with the average coin in loss having an unrealized loss of -$5.3k and a cost basis of approximately $66.1k. The average coin in profit holds an unrealized gain of +$41.3k, with a cost basis of about $19.4k. Volatility measures are heavily compressed, indicating potential heightened volatility ahead. A break above $64k would restore profitability for a significant volume of these coins, likely boosting investor sentiment.

Historically, July has been a profitable month for Bitcoin, returning 9.6% on average after a negative June. Let's wait and see how this plays out this time.

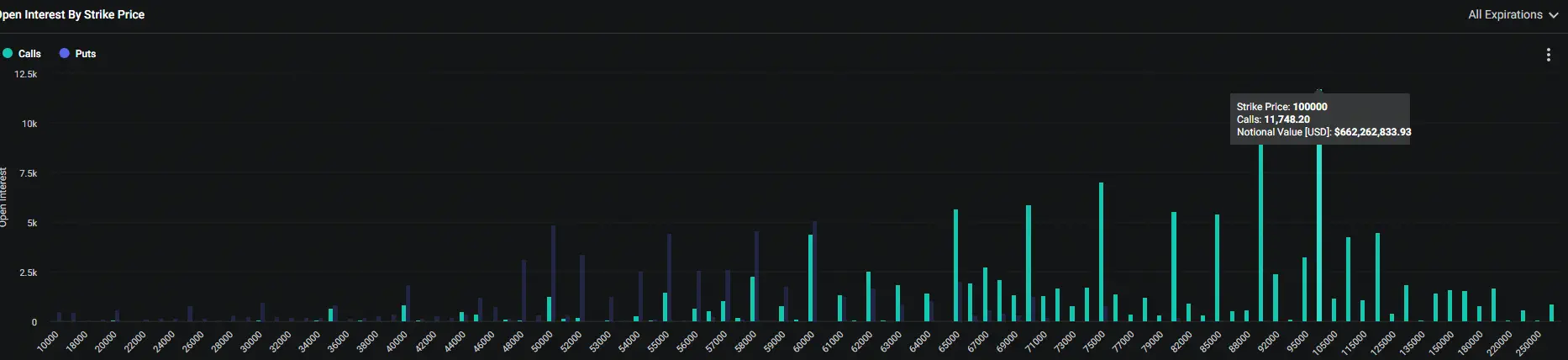

Standard Chartered Bank's Geoffrey Kendrick predicted that Bitcoin could reach a new all-time high in August and potentially hit $100,000 by the US presidential elections in November. This is confirmed by the options market, indicating anticipation of a year-end rally with significant interest in long-term options at the $100,000 strike.

Source: Deribit

Bitcoin ETF Flows Show Positive Sentiment

Between June 28 and July 3, the Bitcoin ETF flow data shows significant activity. According to Farside data, on June 28, the total net inflows across all ETFs amounted to $73 million. The following days saw mixed movements, with July 1 showing substantial inflows totaling $129.5 million, primarily driven by FBTC with $65.0 million and IBIT with $41.4 million.

However, notable outflows occurred on July 2 and July 3, with outflows of $13.7 million and $20.5 million respectively. With $188.3 million in total net inflows, Bitcoin ETFs were clearly popular among institutional investors during this timeframe, reflecting a growing enthusiasm for cryptocurrency.

Upcoming ETH ETF Launch, Vitalik Buterin's Proposal for Faster Transactions

Ethereum traded within a range of $2,858 to $3,512 this past week. Market attention is still heavily focused on the upcoming launch of spot ETH ETFs. They are forecast to see inflows of $1.4–$4.5 billion the next six months, with trading volume ranging from $700 million to $2.4 billion.

Meanwhile, Vitalik Buterin has proposed a new method to accelerate transactions on Ethereum by transitioning from the current epoch and slot mechanism to a single-slot finality (SSF) system. This proposed change seeks to simplify the consensus process and significantly reduce transaction finality times, addressing the complexity and delays present in the current model.

Solana ETF Filings, IRS Crypto Reporting Requirements, and SEC Action Against Consensys

On the regulatory front, 21Shares filed for a Solana-based ETF with the SEC, following a similar filing by VanEck.

Furthermore, the IRS introduced new regulations requiring cryptocurrency brokers to file 1099 forms starting in 2025 and track the cost basis for customers' tokens beginning in 2026.

Non-custodial crypto businesses and DeFi operations will have specific regulations established later this year.

Also, the SEC took legal action against Ethereum software provider Consensys. The complaint alleges that, since January 2023, Consensys has been offering and selling unregistered securities through its crypto-asset staking programs, while also acting as an unregistered broker via its MetaMask Staking service during the same period.

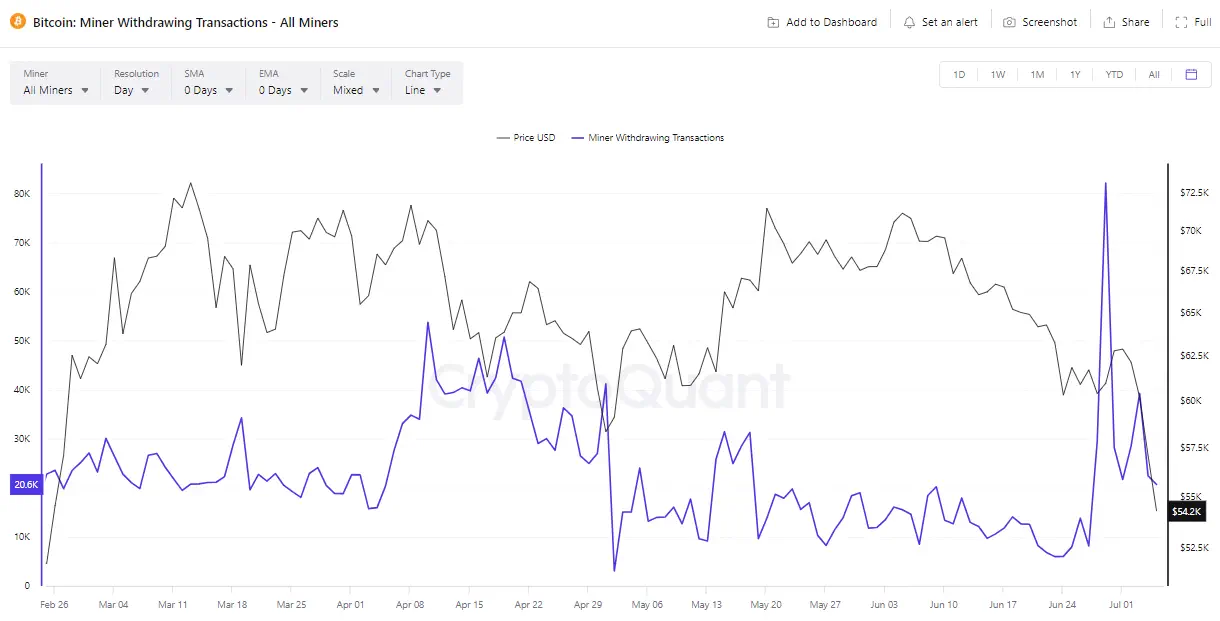

A Decrease in Miner Withdrawals to Reduce Selling Pressure

Bitcoin miner withdrawals have decreased significantly, dropping by approximately 72.68% from the recent peak on June 29, 2024, when withdrawals reached 82,122 BTC, to 22,451 BTC on July 4. The downward trend in miner sales implies a lot less downward pressure on the market, making way for Bitcoin prices to take off in case the market absorbs the remaining supply.

Source: CryptoQuant

Conclusion

Bitcoin and Ethereum's recent stumble can be attributed to several pivotal events in the crypto market, which we’ve dissected in this week's GoMarket Weekly. Bitcoin's value was slammed by the Fed's cautious approach to rate cuts, anemic jobs market, and political drama. The German government’s transfer of around 3K BTC and the Mt. Gox Bitcoin release have further contributed to market volatility. Notably, Bitcoin miner withdrawals have significantly dropped by approximately 72% from the peak on June 29, reducing market selling pressure.

Even so, Bitcoin's future looks promising, with estimates like Standard Chartered Bank's prediction of a $100,000 year-end valuation. Ethereum remains under the spotlight with the anticipation of a spot ETH ETF launch, projected to attract inflows of up to $4.5 billion over the next six months.

Wondering what's going to happen next with these hot cryptocurrency stories? We'll have answers – and more – in our next update, coming your way next week.

July 5, 2024