Market Analysis with Mike Ermolaev

Welcome to the 20th edition of GoMarket Weekly, brought exclusively to the GoMining community by veteran crypto market analyst and journalist Mike Ermolaev. In this edition, we'll examine the recent value jump in Bitcoin, discover the impact of Ethereum ETFs, as well as explosive opinions from prominent figures like Robert Kennedy Jr., and surprise findings on Bitcoin's ecological footprint.

Bitcoin's Rally Offers Relief to Short-Term Holders

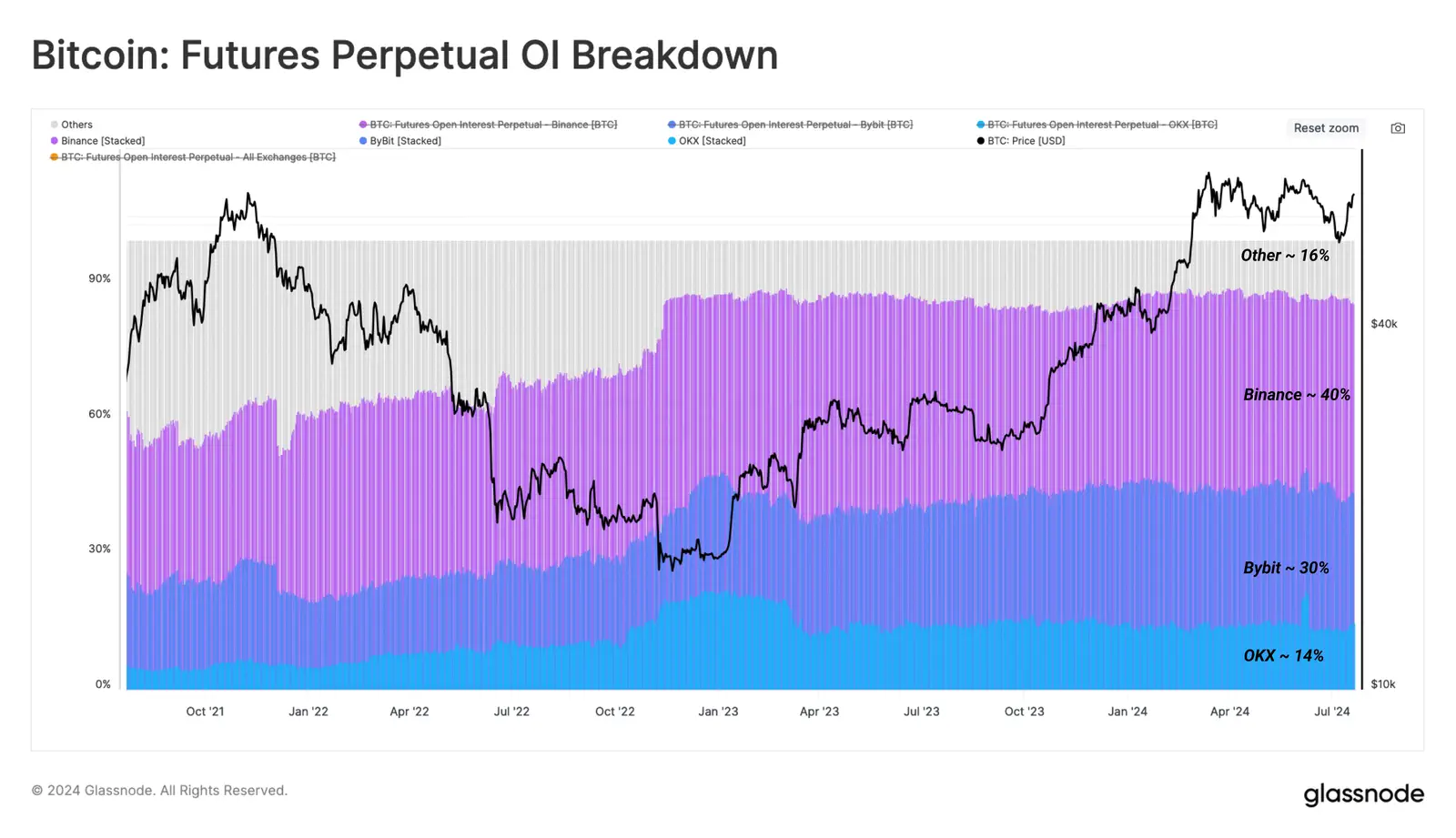

Over the past seven days, Bitcoin was trading within a range за $63,672-$68,175, with the rise above $68k providing significant relief for short-term holders. According to Glassnode, over 75% of their holdings are now in profit. This rebound was marked by increased activity in perpetual futures markets, particularly on Binance, Bybit, and OKX, which collectively account for 84% of the total open interest.

Source: Glassnode

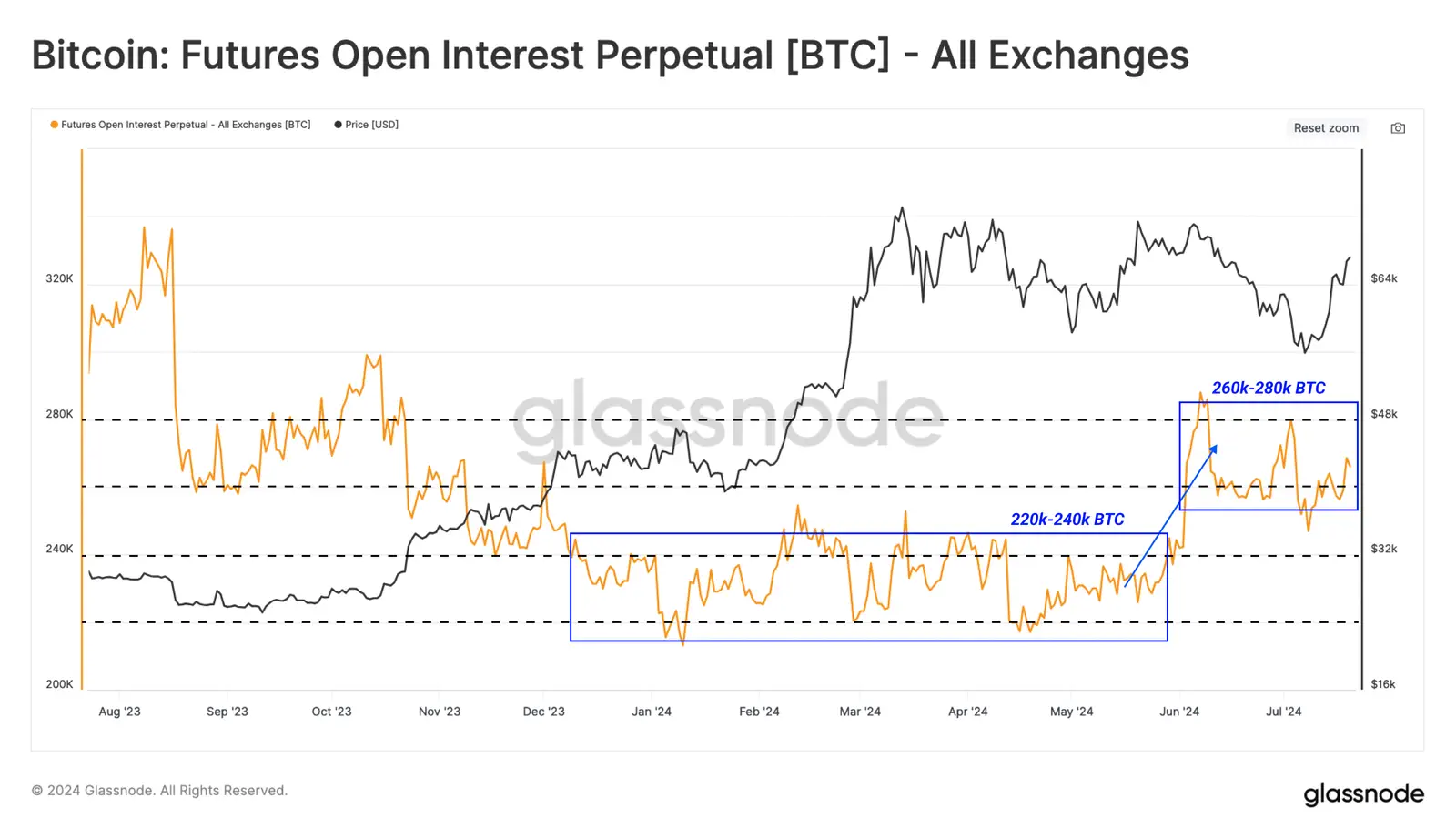

Notably, the open interest surged to the 260k-280k BTC range, highlighting a heightened appetite for speculation since early June. This uptick in price set off a chain reaction of liquidations among over-leveraged long positions, showcasing the extreme sensitivity to bullish shifts.

Despite the positive momentum, the perpetual funding rate remains below the neutral level of 0.01% per 8 hours, indicating a cautious stance among market participants.

Source: Glassnode

Increased Bitcoin Holding by Kraken Users and US BTC Transfer to Coinbase

Meanwhile, CryptoQuant has observed a notable increase in Bitcoin withdrawals from the Kraken exchange following the crediting of balances from Mt. Gox. Lately, the assets people have accumulated are staying in their possession rather than being surrendered to the market. A byproduct of Kraken users' hodling attitude could be a stabilizing force in Bitcoin's market.

Additionally, the US government recently transferred approximately 58.742 BTC, valued at nearly $4 million, to the crypto exchange Coinbase. While this movement raised concerns about potential market impacts, analysts believe that the liquidation of these funds through Coinbase is unlikely to significantly influence the spot price, contrasting with a recent substantial sale by Germany's Saxony state.

Source: ArkhamIntelligence

Influential Figures and Institutional Adoption Fuel Market Optimism for Bitcoin

The Bitcoin 2024 Conference in Nashville kicked off on the 25th of July, drawing attention from across the crypto world. Former President Donald Trump is expected to speak at the event on Saturday, and strong Bitcoin-related statements from him could easily set off a short-lived rally.

A longer-term impact could come from Trump taking the oath of office for the second time. Robert Kiyosaki, a vocal supporter of Bitcoin, speculated on this kind of surge in BTC value in the event of a Trump victory in the upcoming elections.

Donald Trump's presidential campaign has scored a hefty cryptocurrency influx, raising over $4 million from an assortment of digital coins, including the big three – Bitcoin, Ether, and Ripple's XRP – as well as USDC stablecoin and some memecoins, a campaign insider revealed. The "Trump 47" joint fundraising committee, detailed in a Federal Election Commission filing, collected over $118 million from April 1 to June 30. Notable contributors include crypto billionaire twins Tyler and Cameron Winklevoss, who each donated 15.57 Bitcoin. Furthermore, contributors from 12 different states and a range of professions donated.

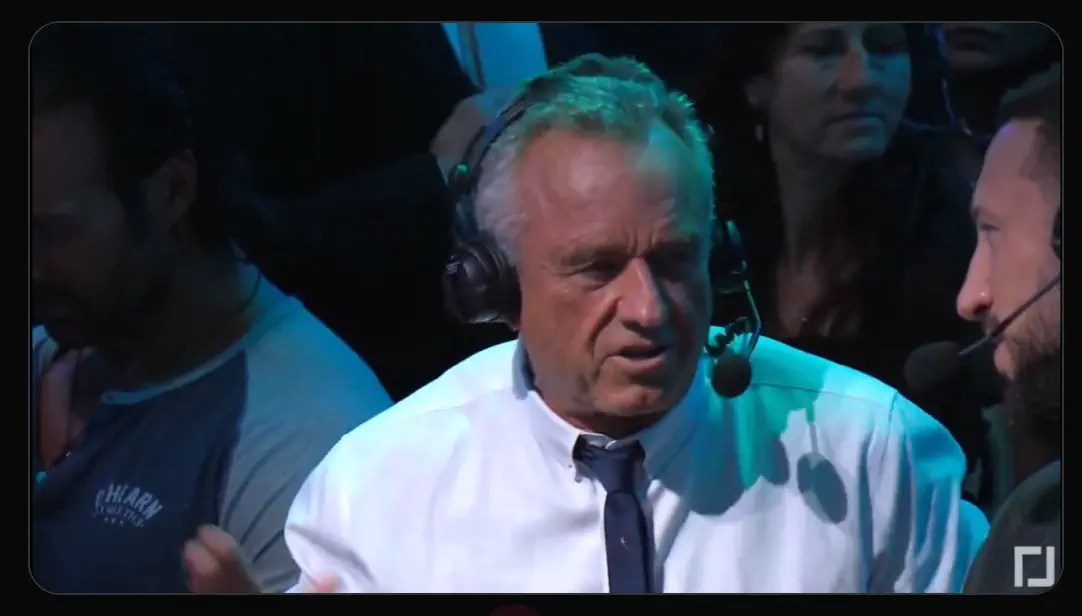

Also, independent candidate for President of the United States, Robert Kennedy Jr., attending the conference, expressed strong support for cryptocurrency: "I am a huge supporter of Bitcoin. I have most of my wealth in Bitcoin. I am fully committed."

Big-name investors and charismatic leaders are jumping on the Bitcoin bandwagon, and institutional players are not far behind. According to BlackRock's Robbie Mitchnick, it's "quite remarkable" that spot Bitcoin ETF investors are taking a page from the long-term investing playbook, with institutions showcasing unwavering confidence in Bitcoin.

A newfound optimism is also sweeping the market as a possible interest rate cut looms, with the chorus of rate-cut advocates just got a lot louder. A former top Fed official is now pushing for a rate reduction next month, a move that could be music to Bitcoin investors' ears.

Institutional Interest in Ethereum Grows with the Launch of ETFs

On Tuesday, U.S. spot Ethereum ETFs started trading following final approval from the SEC. With Ethereum's spot ETFs taking off, investors went all-in, pushing trading volumes past the $1 billion mark. While the demand has been cooling off after the hot start and, as CryptoQuant noted, the "expected market fireworks failed to materialize"—the outlook for Ethereum remains positive.

With Bitcoin's ETF success paving the way, all eyes are on Ethereum, which could soon experience a wave of interest from institutional investors, and with it, a potential resurgence in price to its former heights.

Major market maker Wintermute forecasts that the spot Ethereum ETFs could attract between $3.2 billion and $4 billion over the next 12 months, with a corresponding 24% increase in Ethereum's price. These moderate estimates are supported by Bloomberg's Eric Balchunas and ETF Store President Nate Geraci, who predict inflows of $5-6 billion and about one-third of the demand seen for Bitcoin ETFs, respectively.

Public Institutions Embrace Bitcoin

Public institutions are also increasingly casting a vote of confidence in Bitcoin. Unbound Fund has offered a unique opportunity to acquire Portuguese/EU citizenship by holding €500K worth of Bitcoin. This Golden Visa-eligible fund provides 100% BTC passive holding, using BlackRock ETFs for security and simplicity, and ensures total transparency through BDO audits. With Portugal's investment program in mind, Unbound Fund views Bitcoin as a go-to solution for unrestricted travel and lifestyle choices.

Additionally, Mayor Steven Fulop of Jersey City announced plans to allocate a portion of the city's pension fund to Bitcoin ETFs, similar to the Wisconsin Pension Fund's 2% allocation.

Marathon's $100M Bitcoin Investment and Environmental Benefits in Mining

A further indication of growing confidence in the cryptocurrency's future, Bitcoin miner Marathon has purchased $100 million worth of Bitcoin and plans to adopt a "full HODL" strategy, bringing its holdings to over 20,000 BTC, injecting fresh resources and broadcasting a beacon of optimism.

Moreover, Senator Cynthia Lummis has released a report challenging the Biden administration's proposed mining tax, citing data from the Bitcoin Energy and Emissions Sustainability Tracker. Shattering common myths, the report reveals that a surprising percentage of Bitcoin mining operations – about 52.6% – actually produce zero emissions. As manufacturers innovate, their latest mining hardware models boast greatly improved processing powers while making do with smaller electricity bills.

Conclusion

Bitcoin and Ethereum have been spiking in popularity, attracting both individual investors and deep-pocketed institutions to the fray. Influential voices – from political candidates to major investors and even cities – are driving Bitcoin's path to mainstream acceptance by putting their weight behind digital assets. Don't miss next week's GoMarket Weekly, packed with analysis on these stories and more – get the insider scoop you need to stay ahead.

July 26, 2024