Crypto is reshaping how governments think about money, power, and control — sometimes willingly, sometimes not.

In a nutshell 👇

- Cryptocurrencies challenge how governments control money, tax citizens, and regulate financial activity.

- While Bitcoin threatens old-school power structures, it also inspires innovation — like central bank digital currencies (CBDCs).

- The relationship between crypto and government finance isn’t war — it’s a complicated dance of power, freedom, and adaptation. And as we look toward the future of cryptocurrencies in the global financial system, that dance is only getting more intricate.

Alright, time for some baby steps — literally.

Fiat money: That’s the cash your government says has value (like dollars, euros, or yen). It works because people believe it does.

Central banks: These are the money printers. They decide how much money exists, interest rates, and inflation targets.

Cryptocurrency: A digital currency that lives on the blockchain. It’s not controlled by any government — just math, code, and consensus.

Blockchain: Think of it as a public notebook that records every transaction ever made. You can read it, but you can’t cheat it.

CBDC (Central Bank Digital Currency): The government’s “official” crypto version of your money, designed to keep control but look cool doing it.

How Cryptocurrencies Challenge Government Systems

Traditional finance runs on control. Central banks adjust money supply to keep economies steady — but Bitcoin changed the rules. Its supply is capped at 21 million, no exceptions. That means no one, not even a government, can print more when times get tough.

Tax collection also gets tricky. It’s simple when money flows through employers and banks. But peer-to-peer payments and crypto wallets make it harder to track and tax income. So regulators are tightening Know-Your-Customer rules and ramping up blockchain monitoring to keep up.

And regulation? That’s even messier. Traditional finance is built on borders and institutions. Crypto isn’t. The result is a global patchwork of laws that struggle to fit a system designed to be borderless.

This is part of how crypto affects the economy — by pushing governments to rethink how they manage money, collect taxes, and maintain trust in a world where control is no longer guaranteed.

Bitcoin acts like a rebel currency. It doesn’t care about borders or inflation targets. When people adopt it, governments lose grip over money supply and capital flow. For example, if enough people move wealth into Bitcoin, traditional policies like “printing money to fight inflation” stop working.

Taxation & Revenue

Tracking crypto is tough. It’s anonymous enough to make governments sweat, but transparent enough to trace if you know what you’re doing. Tools like Chainalysis now help governments follow the money — because yes, Uncle Sam also learned blockchain.

Financial Regulation

The wild west is being fenced in. Governments enforce KYC (Know Your Customer) and AML (Anti-Money Laundering) laws on exchanges. The U.S. goes heavy on compliance, Europe builds structured frameworks, and Asia — well, it’s split between bans (China) and innovation (Singapore). This regulatory evolution mirrors the future of cryptocurrency trading and the stock market, where traditional and digital assets increasingly overlap.

Positive Impacts

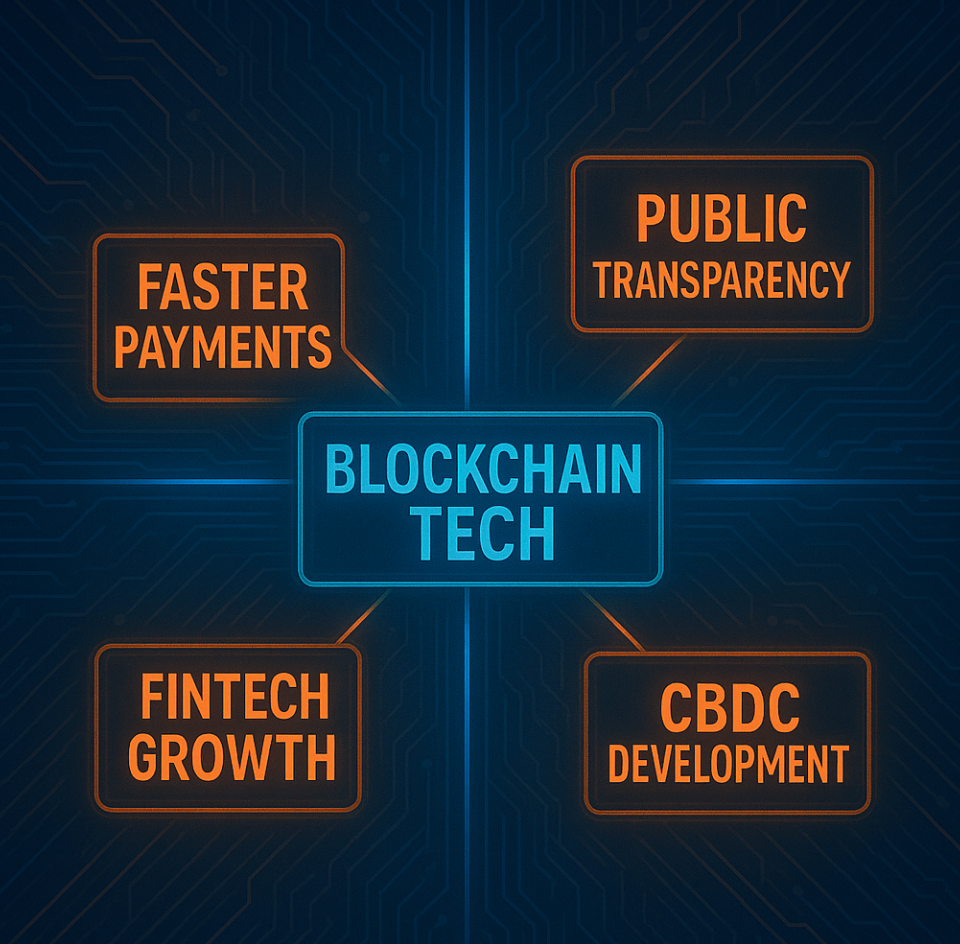

Not all doom. Crypto’s pushing governments to modernize:

- Blockchain for public finance: Imagine transparent budgets with no corruption gaps.

- Faster global payments: Goodbye, SWIFT fees and multi-day transfers.

- Economic innovation: New startups, jobs, and fintech sectors.

- CBDCs: The state’s answer to Bitcoin—same tech, different purpose.

These advancements suggest that the future of cryptocurrencies might not be about rebellion, but collaboration — where crypto and government systems evolve together.

Risks & Challenges

From losing monetary control to market chaos, crypto comes with its own pitfalls. Governments can’t print Bitcoin in a recession, prices can swing wildly on a single tweet, and cybercrime thrives through hacks, scams, and ransomware. Even national security takes a hit as decentralized systems can slip past sanctions.

Alright, time to get your strategic mindset involved — responsibly, of course. The crypto space isn’t just about hype and headlines; it’s a landscape of innovation, risk, and opportunity. Whether you’re investing, building, or advising, every move carries its own balance of potential and uncertainty.

Long-term crypto holding means betting that Bitcoin or Ethereum will eventually replace parts of traditional finance. It’s a medium-risk strategy — the classic buy and HODL approach for those who believe in the long game.

On the infrastructure side, crypto compliance startups and CBDC integration consulting are paving the way for collaboration between governments, banks, and blockchain systems. Think Chainalysis, TRM Labs, or digital finance advisors — lower risk, but big on long-term impact.

Then there’s speculative trading, where participants play short-term market swings — often driven by sentiment and volatility. It’s high risk and high intensity, demanding both discipline and timing.

“Crypto doesn’t destroy government finance—it forces evolution. The winners are those who learn both languages: code and compliance.” — Elena Park, Blockchain Policy Analyst, MIT Digital Currency Initiative

Elena’s point captures the reality perfectly — success in this new era isn’t about rejecting traditional systems, but about understanding and bridging them. The real innovators are those who can speak both the language of blockchain technology and the logic of regulation.

At the end of the day, it’s not crypto vs. government — it’s both trying to figure out the same thing: how money should work in a digital world. The smartest players aren’t picking sides; they’re building bridges. Code and compliance might sound boring together, but that’s exactly where the next wave of innovation lives.

Frequently Asked Questions

1. How does Bitcoin affect government control of money?It weakens it. Bitcoin operates outside the central banking system, meaning governments can’t inflate or devalue it.

2. Can governments ban cryptocurrencies completely?They can try, but like the internet, crypto finds ways around. Bans only push it underground.

3. Do cryptocurrencies reduce tax revenues?Initially yes, due to anonymity—but with blockchain tracking tools, this gap is closing.

4. How are countries regulating crypto differently?The U.S. uses strict financial compliance laws, the EU focuses on harmonized regulation (MiCA), while Asia ranges from bans (China) to support (Japan, Singapore).

5. What role do CBDCs play?CBDCs are government-backed digital currencies that use blockchain tech to modernize traditional money—basically, crypto with control.

6. Can cryptocurrencies strengthen government systems instead of weakening them?Absolutely. Blockchain can make government finance more transparent and efficient.

7. Will global adoption of crypto change international finance?Yes. It could reshape power balances, reduce U.S. dollar dominance, and create a new global digital economy.

November 7, 2025