While some are guessing when "Bitcoin will moon again," others are already taking action — because they know how to read the market. Not through Telegram channel signals, but through data that truly reflects capital sentiment.

In the crypto industry, the ability to distinguish between bull and bear phases is not just academic knowledge, but a practical skill that determines who sells in panic and who buys the bottom.

In this article, we'll break down how to identify trends, which indicators to rely on, and why the market behaves differently in 2025–2026 than before.

Why the Old Rules No Longer Work

The classic formula — "buy after the halving, sell at the peak" — has stopped working as effectively. In 2024, after the launch of spot ETFs, the market became slower, heavier, and more institutional.

Funds like BlackRock and Fidelity don't chase "alts of the day" — they enter systematically and distribute capital over months. The result: fewer sharp crashes, but also fewer "10x gains" in a week.

This is a new cycle: prolonged, with multiple mini-waves and extended consolidation phases.

"Retail traders still react emotionally, but smart money moves based on fundamental data. This is the key difference in the new institutional era," notes Lyn Alden, macro analyst and author of Lyn Alden Investment Strategy.

What a Bull Market Looks Like in Practice

A bull cycle is not just rising prices. It's an entire ecosystem of signals.

Prices rise, but not "on air": trading volume increases, the number of active addresses grows, TVL in DeFi expands, and exchanges record net outflows—coins move to cold wallets because investors aren't planning to sell.

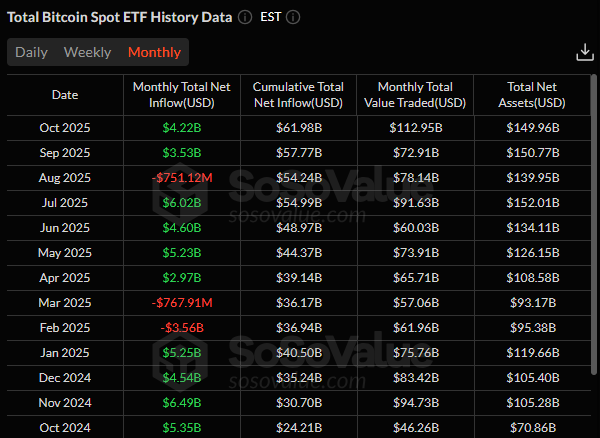

In October 2025, the market demonstrates exactly this picture:

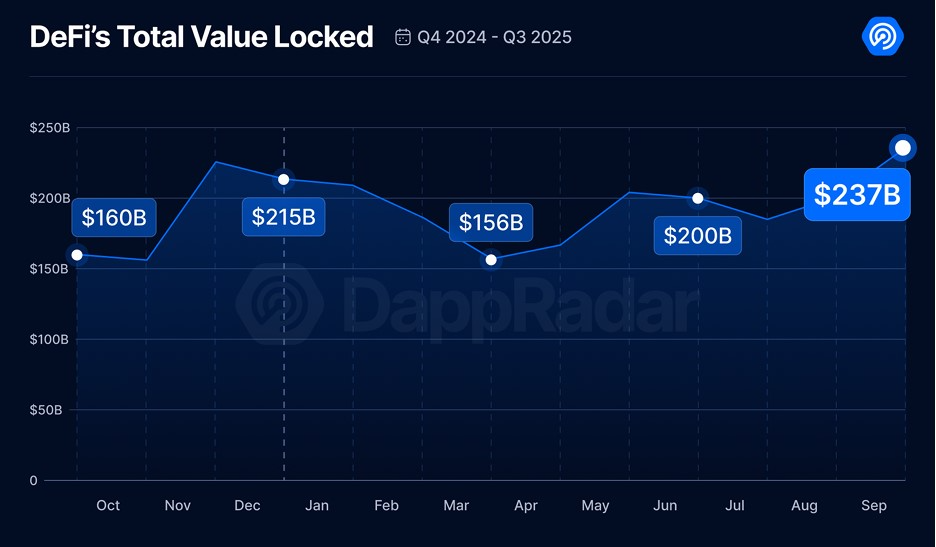

According to DappRadar, TVL in DeFi reached a record $237 billion (Q3 2025), demonstrating an unprecedented influx of institutional capital:

- Stablecoin capitalization hit a historic $314 billion (October 2025) — this is "dry powder" for future purchases.

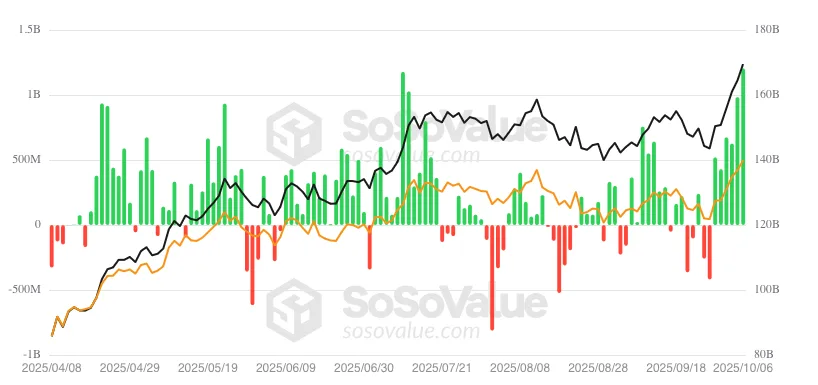

- Inflows into spot ETFs continue — for example, BlackRock IBIT received $3.5 billion in the first week of October 2025, setting a record among all ETFs:

- Bitcoin updated its all-time high, reaching $126 080 (October 6, 2025)

All these indicators form a stable foundation — not a "pump," but structural upward pressure.

How to Understand When a Bear Phase Begins

A bear market rarely comes suddenly — it doesn't start with a price drop, but with participant fatigue.

TVL freezes, outflows from exchanges turn into inflows — people start moving coins to sell.

The Fear and Greed Index drops from "greedy" 80+ to 40–30, and social media fills with talk about "taking profits."

In such moments, it's important not to fall for the illusion that "just a bit more — and back up."

History shows: when the Greed index stays high for more than three months, the market is overheated.

And if this is accompanied by rising open interest in derivatives and positive funding rates — the market is already on the verge of being "over-leveraged."

"Investors often confuse correction with reversal. But reversal is always confirmed by capital outflows — from ETFs, from DeFi, from liquid coins," notes macro analyst and author of Lyn Alden Investment Strategy.

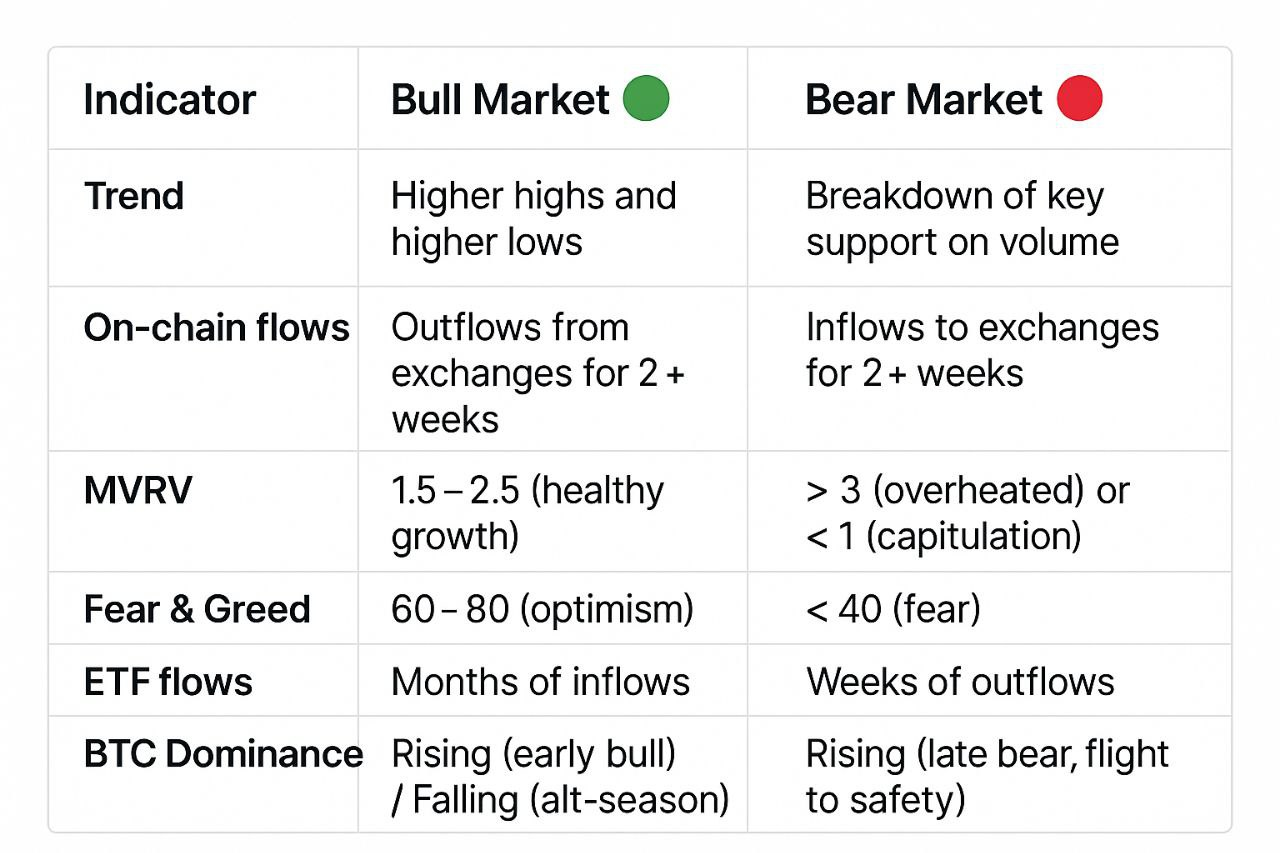

Six Key Signs of Market Phase

1. Trend Structure

- Bull: series of higher highs and higher lows

- Bear: opposite dynamics, support broken on volume

2. On-Chain Flows

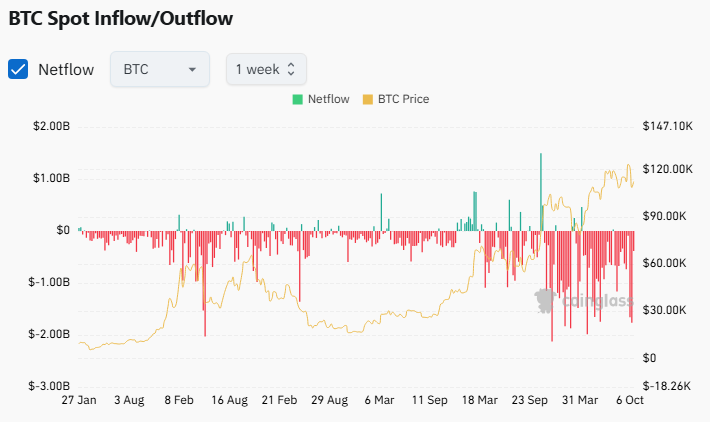

- Net outflows—bullish signal

- Net inflows—bearish

Where to check: CoinGlass Exchange Flows:

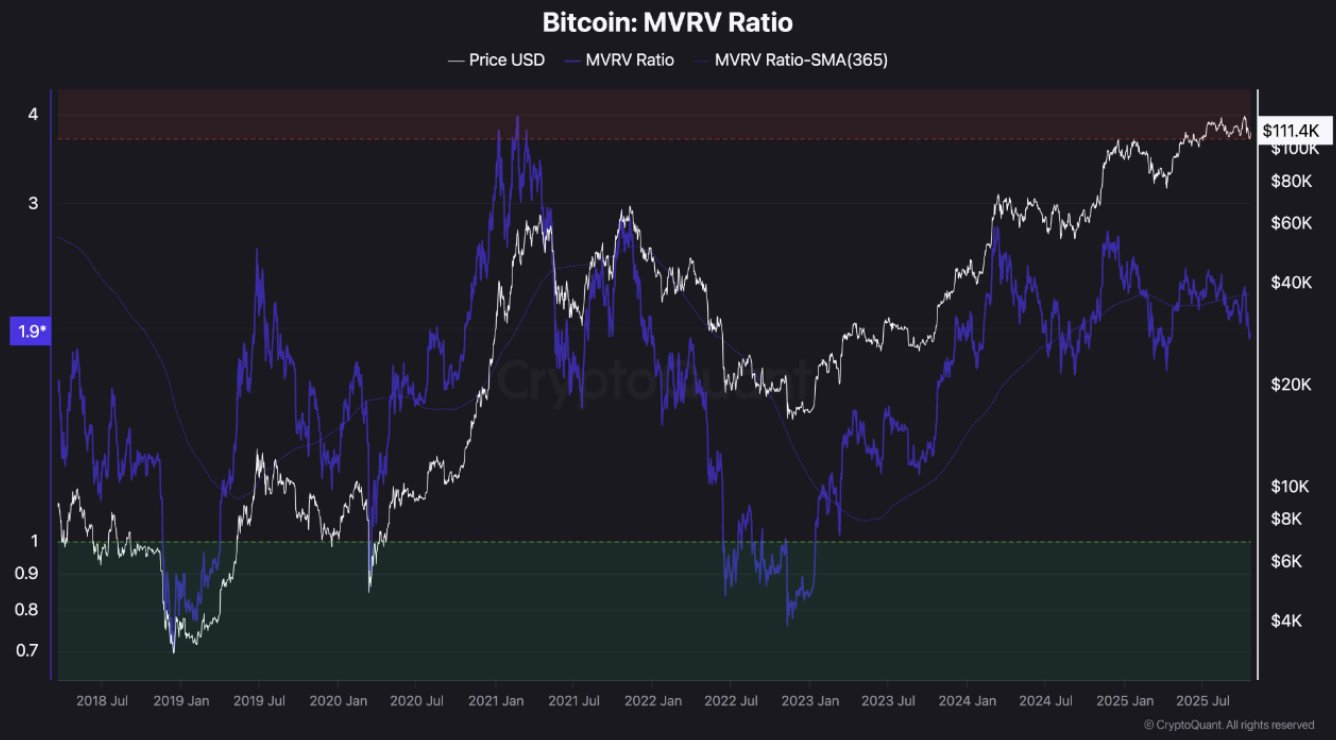

3. MVRV Coefficient

- 3—market overheated

- < 1—accumulation phase

- Where to check: CoinGlass Exchange Flows

4. Fear & Greed Index

- < 20—"fear," often the bottom

- 75—"greed," time to take some profits

Where to check: Alternative.me Fear & Greed Index:

5. ETF Flows

- Months of net inflows → institutions building positions

- Weeks of outflows → caution, consolidation

Where to check: SoSoValue:

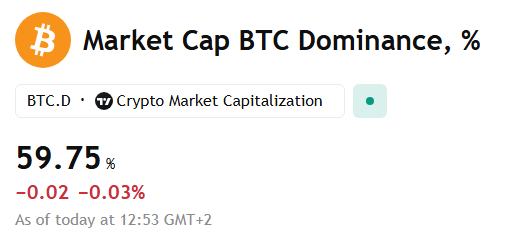

6. BTC Dominance

- Rising Bitcoin share—early bull or late bear

- Falling—alt season and typically the end of bull phase

Where to check: TradingView BTC Dominance:

Want to dive deeper into crypto? Subscribe and get access to the still-free course on crypto from zero to advanced investor → https://academy.gomining.com/courses/bitcoin-and-mining

How to Use This for Your Strategy

1. Build Your Personal Data Dashboard

TradingView + Glassnode + CoinGlass + DeFiLlama — that's enough to see real dynamics.

Free tools:

- TradingView — charts and technical analysis

- Glassnode Studio (бесплатная версия) — on-chain metrics

- CoinGlass — exchange flows, funding rates

- DeFiLlama — TVL in DeFi protocols

- Alternative.me — Fear & Greed Index

- Farside Investors — ETF flows

2. Watch for "Signal Convergence"

When 4 out of 6 indicators turn bullish, increase your market exposure. When the opposite—take profits.

3. Apply DCA Discipline

Invest equal amounts regularly, but adjust frequency: more during fear, less during euphoria.

4. Have an Exit Plan

Take some profits at each portfolio doubling—it's boring, but it works.

5. Avoid the "Noise"

Social media always lags: if TikTok says "everyone's buying," you're probably already mid-cycle.

6. Use Staking or Cloud Mining for Passive Income

During market consolidation, staking allows you to earn income while holding. Ethereum, Solana, Cardano—popular options with 4-8% annual yields.

Cloud mining is also more relevant than ever, for example from Gomining, where you can earn even without investments.

Checklist: How to Understand Which Phase the Market Is in Right Now

Bull Market (4+ signs):

- ✅ BTC rising, updating local highs

- ✅ Net outflows from exchanges 2+ weeks

- ✅ TVL in DeFi growing 10%+ per month

- ✅ Fear & Greed Index above 60

- ✅ ETFs recording capital inflows

- ✅ BTC dominance rising (early bull) or falling (alt season)

Bear Market (4+ signs):

- ❌ Price breaking key supports on volume

- ❌ Net inflows to exchanges 2+ weeks

- ❌ TVL in DeFi falling or stagnating

- ❌ Fear & Greed Index below 40

- ❌ ETFs losing capital for weeks

- ❌ MVRV above 3 (overheated) or below 1 (capitulation)

Common Beginner Mistakes in Market Analysis

1. Looking Only at Price

Price is the consequence, not the cause. Capital, volumes, on-chain metrics—that's what predicts movement. BlackRock IBIT manages nearly 1,000,000 BTC—their decisions move the market.

2. Ignoring Institutional Flows

If ETFs are dumping positions for 3 weeks straight and you're buying the "dip" — you're going against the trend.

3. Confusing Correction with Reversal

-20% in a bull market is normal. Reversal is confirmed by structural changes across all metrics, not one red day.

4. Following the Crowd on Social Media

When TikTok screams "buy alts," it's usually too late. Smart money enters in silence, exits in euphoria.

5. Not Taking Profits

"Just a bit more" turns into -60% from peak. Take profits in portions—that's discipline, not weakness.

50/50 Rule: At each portfolio doubling, take 25% profit, hold the rest.

6. Neglecting Risk Management

Even in a bull market, don't put all funds in one asset. Diversification between Bitcoin, Ethereum, DeFi tokens, and stablecoins reduces risks.

Recommendation: 40% BTC, 30% ETH, 20% top-10 altcoins, 10% stablecoins.

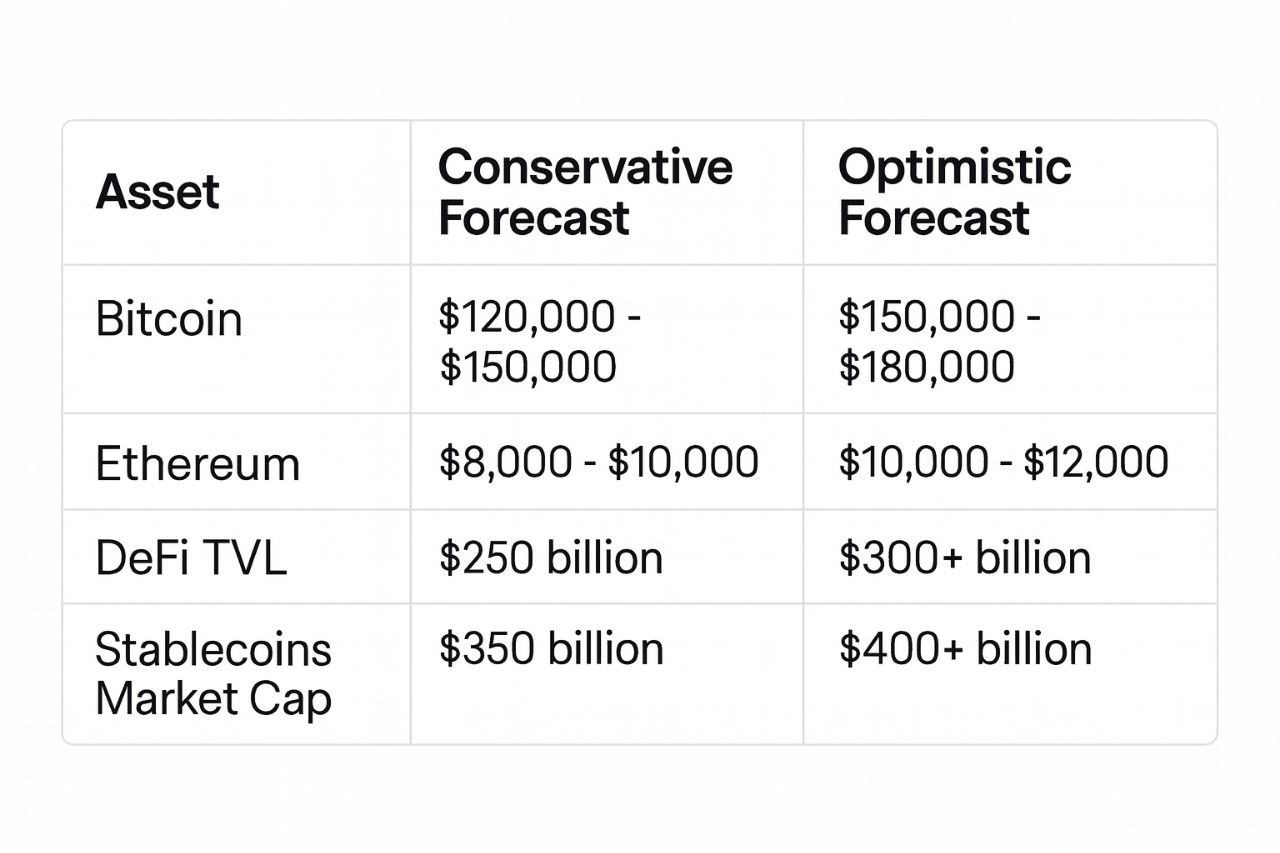

Why 2025–2026 Is a Special Cycle

The main variable is the ETF effect.

Institutional players have created a liquidity cushion that prevents prices from crashing as deeply as before.

Even if the Fed tightens policy again, demand for Bitcoin remains stable: it has become part of fund, bank, and pension portfolios.

This makes the current cycle less volatile but more prolonged.

Peak values may linger until early 2026, and correction may stretch out without becoming a crash.

An additional factor is the development of mining infrastructure and growth in Bitcoin network hashrate. After the 2024 halving, miners optimized operational costs, which stabilized the network and reduced selling pressure.

What to Expect Next

If the trend continues, Bitcoin could test the $120 000–150 000 range by Q4 2025.

Ethereum — up to $10,000, and total DeFi TVL may exceed $200 billion.

However, after the euphoria period, the market will cool down as usual.

The key is not to look for an "eternal bull."

The market breathes in cycles, and the investor's task is to understand the rhythm, not guess when the final chord will sound.

Conclusion

Recognizing a bull or bear market is not a matter of luck, but a matter of discipline.

Monitor structures, on-chain metrics, and institutional flows, and you'll be able to act coolly when others react emotionally.

And to not miss the fundamentals, start with the basics: subscribe to Crypto Academy and get access to the free course "Crypto from Zero to Advanced Investor" → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

October 28, 2025