ETFs absorb supply, corporate treasuries top 1M BTC, and Bitcoin enters the Zetahash era.

In September, Bitcoin’s price action tested key support levels while the broader environment shifted in favor of risk assets. The Fed delivered its first rate cut in nine months, signaling looser financial conditions that have historically benefited Bitcoin. ETF inflows also rebounded, pushing demand above the pace of newly mined supply and reigniting institutional momentum. Corporate Bitcoin treasuries surpassed the 1 million BTC milestone, alongside news of the first major treasury M&A deal in the works. On the mining front, American Bitcoin’s volatile Nasdaq debut drew headlines, while the network hashrate crossed 1 zetahash for the first time, driving difficulty to new all-time highs. Overall, September highlighted both consolidation and expansion, reinforcing Bitcoin’s evolution into an institutional and industrial-scale asset.

BTC Support Levels Hold

On September 1st Bitcoin marked the lowest price seen since early July($107,000). BTC tested the zone that acted as resistance earlier this year and for now has turned this level into support. The 200-day SMA, currently near $105,000, has yet to be retested, and as long as price holds above it, the broader bull market structure remains intact.

Mid-month, the Fed delivered its first rate cut in nine months, trimming 25 bps in what Chair Powell called a “risk management cut.” Markets expected the move, but it still signalled looser financial conditions—historically associated with support for Bitcoin and other risk assets.

Volatility persisted, however, with the largest daily liquidations since June on September 22nd, knocking BTC down 3.1% before further declines in the days that followed. Even so, Bitcoin closed the month higher, and with falling yields, rising liquidity, and a dovish Fed, the macro environment continues to support the bull market despite near-term uncertainty.

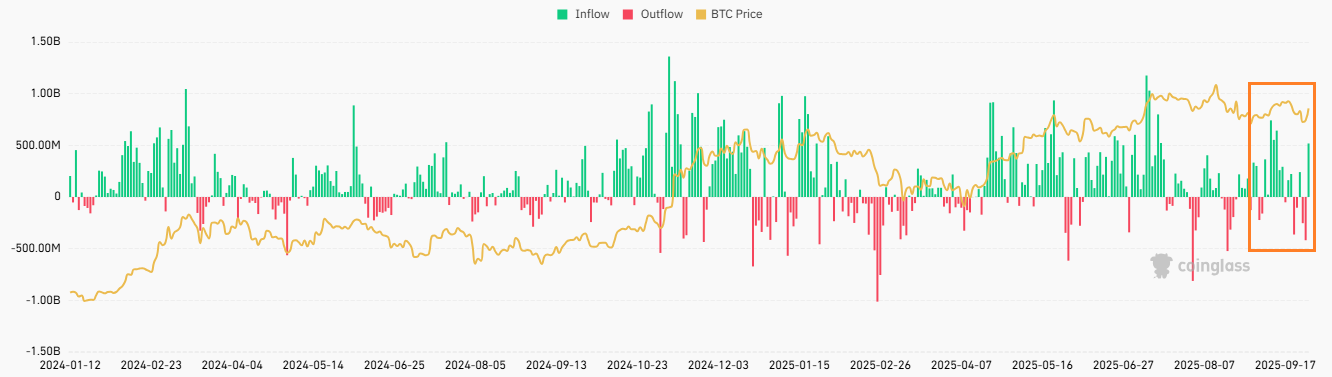

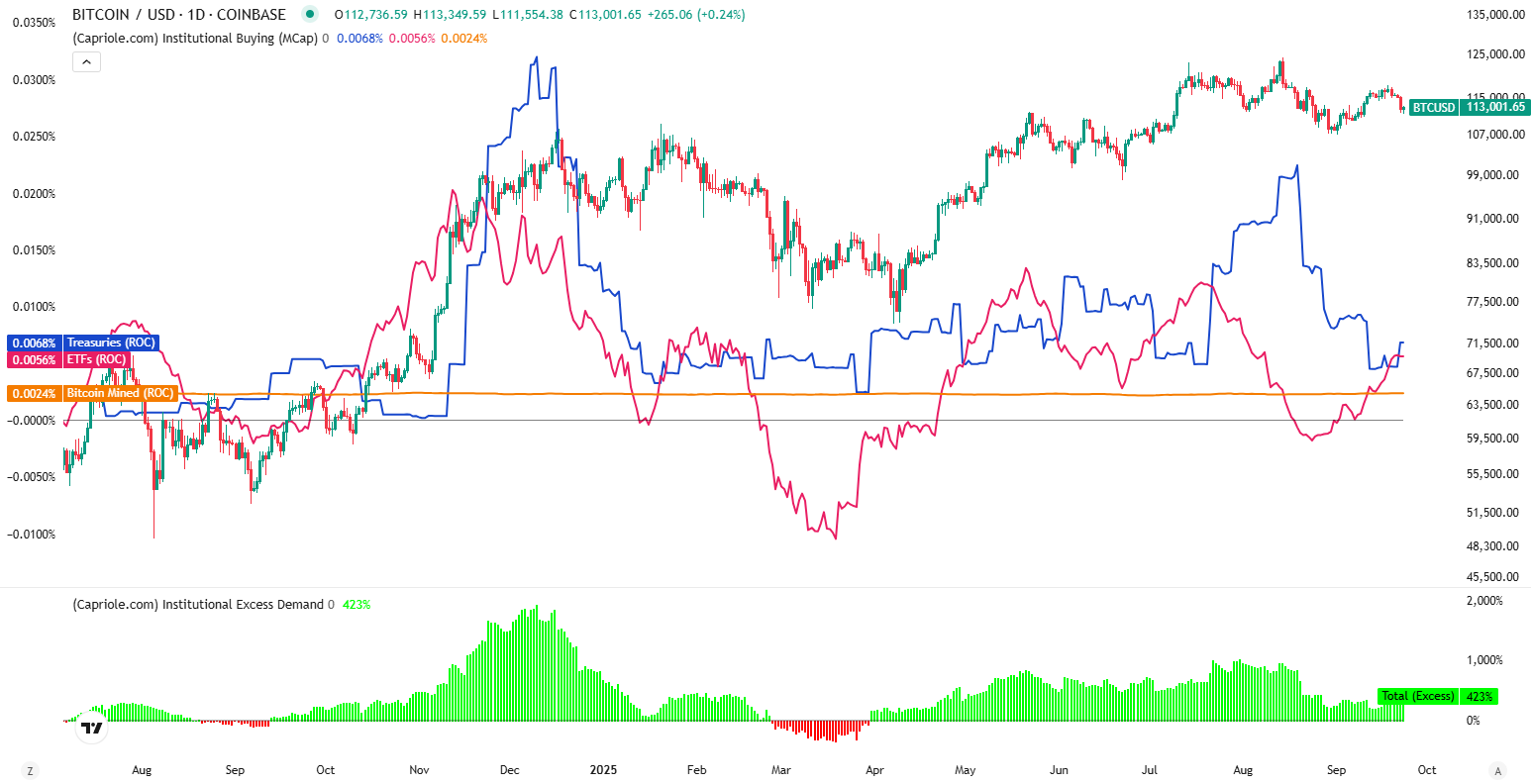

ETF Inflows Recover and Demand Surpasses New Bitcoin Issuance

After a shaky August that saw the second-largest outflows since launch, spot Bitcoin ETFs rebounded in September. On September 11th, ETFs logged a monthly high of $741.5 million in net inflows, the biggest daily increase in two months. This pushed total assets under management (AUM) back above the $150 billion, and just $3 billion shy of a new record high. BlackRock’s IBIT and Fidelity’s FBTC continue to lead the pack, solidifying their role as institutional on-ramps.

The recent resurgence in ETF inflows has pushed daily demand above Bitcoin’s entire new supply. Since the April 2024 halving, each block produces 3.125 BTC, and with about 144 blocks mined per day, total issuance stands near 450 BTC. When ETF purchases outpace this 450 BTC threshold, they absorb all freshly mined coins and signal renewed demand pressure on circulating supply.

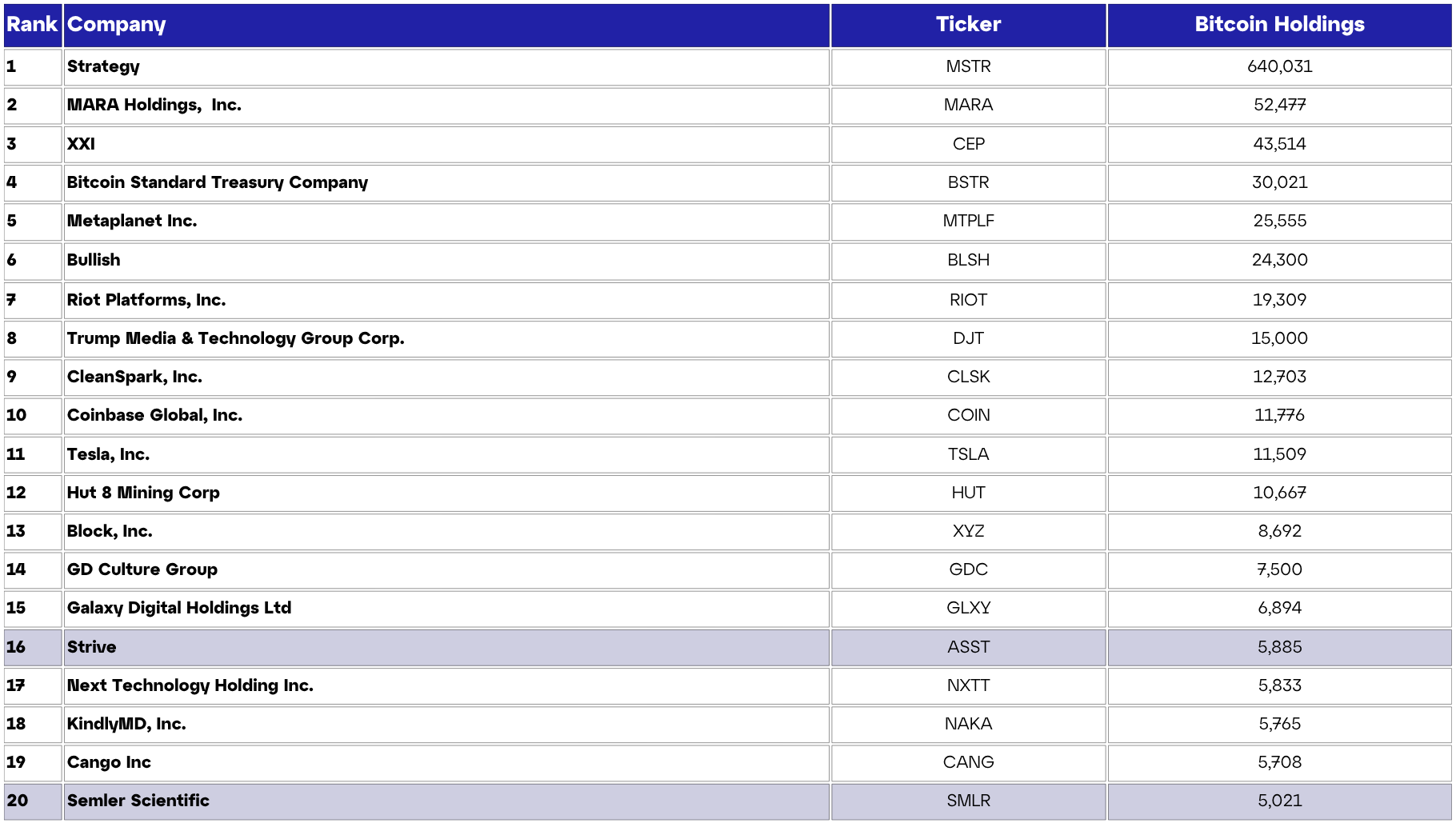

Corporate Bitcoin Treasuries Cross 1 Million BTC

Corporate Bitcoin adoption has reached a milestone: the top 100 public companies now hold over 1,000,000 BTC on their balance sheets, evidence of Bitcoin’s deepening institutionalization.

Yet 2025 tells a two-part story. The first half saw aggressive corporate accumulation, but momentum has moderated in H2. Purchases continue, though at smaller sizes and with fewer new entrants. In August, just 3.7K BTC were added versus peak months of 134K BTC.

The slowdown raises questions: are institutions pausing after early-year buying sprees, or is this a lull before the next wave, possibly triggered by rising BTC prices in Q4? The chart above shows a potential turn around might occur as the decline go stopped in its tracks mid September. For miners, investors, and treasury managers, corporate adoption remains a critical signal of future demand-side support.

Strive to Acquire Semler Scientific in $1.3B All-Stock Deal

Strive Inc., the Bitcoin-focused asset manager backed by Vivek Ramaswamy, is set to acquire Semler Scientific in an all-stock transaction worth about $1.3 billion. The deal values Semler at $90.52 per share—a 210% premium—through an exchange of 21.05 Strive Class A shares for each Semler share.

The merger, approved by both boards and subject to closing conditions, comes alongside a major Bitcoin purchase by Strive: 5,816 BTC for $675 million at an average price of $116,047. Combined with Semler’s 5,000 BTC holdings, the new entity will hold over 10,900 BTC, placing it 12th among public companies, just ahead of Hut 8.

American Bitcoin ($ABTC) Debuts with Extreme Volatility

At the start of September American Bitcoin (Nasdaq: ABTC), backed by Eric and Donald Trump Jr., made its public market debut last week following a stock-for-stock merger with Gryphon Digital Mining (GRYP). The transaction combines Gryphon’s proprietary mining capacity with American Bitcoin’s infrastructure footprint, creating a new publicly traded miner with both scale and high political visibility.

Trading began with fireworks. Shares surged nearly 100% at the open, reaching $14.00 versus Gryphon’s prior close of $6.90. The sharp rally triggered four volatility halts within the first 90 minutes of trading.

The episode highlights two dynamics. First, investor appetite for mining equities remains evident, particularly when coupled with high-profile backers and narratives beyond raw hashrate. Second, the debut underscores the risks: while public listings can elevate visibility and capital access, they also expose miners to heightened volatility and rapid shifts in market sentiment.

Bitcoin Enters the Zetahash Era

For the first time in history, Bitcoin’s network hashrate has reached the 1 zetahash per second (ZH/s) milestone. In practical terms, this means miners worldwide are performing 10²¹ hashes every second—that’s one sextillion, or 1,000,000,000,000,000,000,000 individual calculations per second securing the network.

The scale of this achievement comes into sharper focus when viewed in context: at the start of 2020, the network had just crossed 100 exahash per second (EH/s). In a little over five years, hashrate has multiplied by a factor of ten. This exponential growth reflects not only technological progress in ASIC design and deployment but also the industrialization and maturity of Bitcoin mining as an essential piece of global digital infrastructure.

Difficulty Climbs to Record Levels

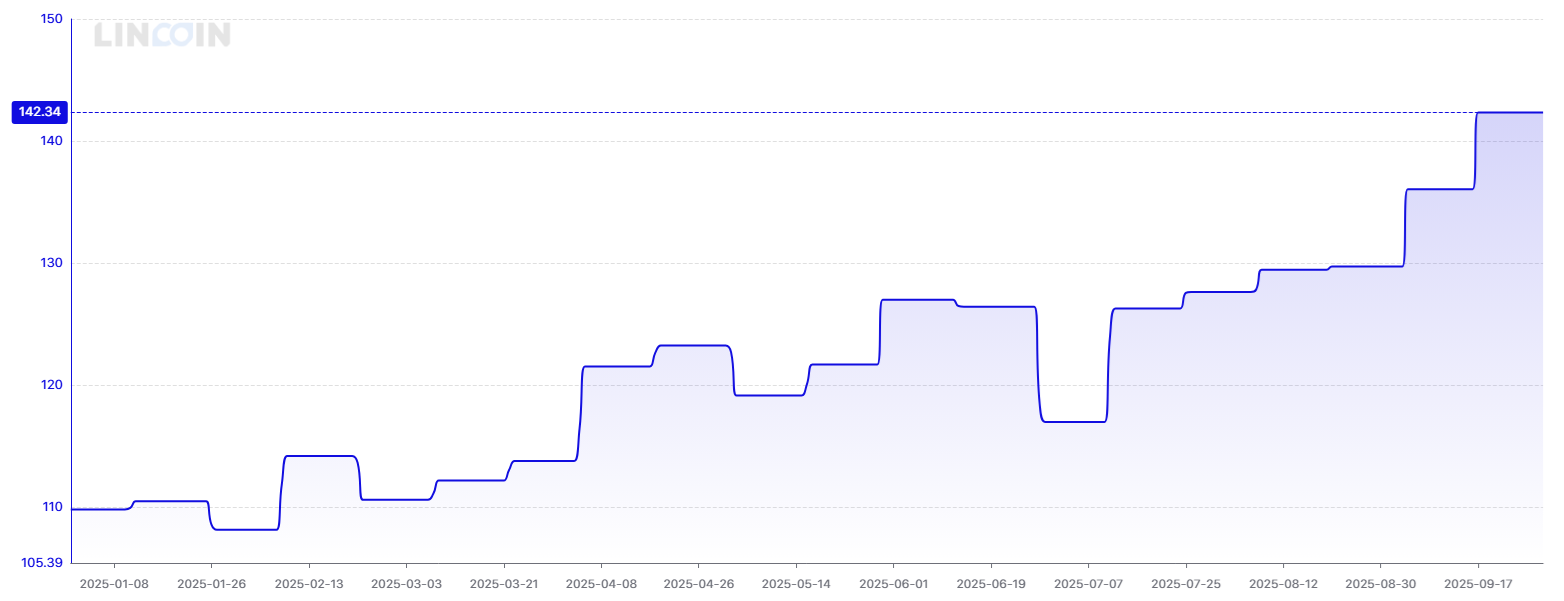

The surge to the 1 ZH/s milestone has been mirrored by a sharp increase in mining difficulty, which reached a new all-time high of 142.34 trillion in September. In the past month we witnessed two upward adjustments, 4.89% and 4.63%. Difficulty adjusts automatically to ensure block production time remains steady. So far in 2025, difficulty is up nearly 30%, a testament to the massive capital investment flowing into mining hardware and infrastructure.

Bitdeer Unveils SEALMINER A3 Series

Bitdeer has introduced the SEALMINER A3 Series, its latest generation of self-developed Bitcoin mining rigs built on the A3 chip. The lineup spans both air- and hydro-cooled designs, delivering 240–690 TH/s across four models:

- A3 Pro Hydro – 660 TH/s at 12.5 J/TH

- A3 Hydro – 500 TH/s at 13.5 J/TH

- A3 Pro Air – 290 TH/s at 12.5 J/TH

- A3 Air – 260 TH/s at 14 J/TH

The release puts Bitdeer in direct competition with Bitmain’s Antminer S21 XP (270 TH/s at 13.5 J/TH), currently regarded as the efficiency benchmark. The air-cooled units adopt a compact “shoebox” form factor, while the hydro models are built in a 2U server design optimized for dense racking. All machines retain Bitdeer’s low-noise features. Mass production is scheduled to begin between late September and early October.

Meanwhile, Bitdeer continues scaling its existing fleet. The company has now energized 4.1 EH/s of A1 rigs and 27.8 EH/s of A2 rigs across facilities in the U.S., Norway, and Bhutan. August alone saw 7.8 EH/s of new A2 machines deployed, lifting realized hashrate 40% month-over-month and boosting production to 375 BTC, a 33% increase from July.

Looking ahead, Bitdeer is developing the SEAL04 chip, targeting a potential efficiency breakthrough near 5 J/TH. The next-generation SEALMINER A4 is expected to operate in the 5.5–6 J/TH range, a leap that would reset industry standards. To support this roadmap, Bitdeer is also expanding its U.S. manufacturing capacity, underscoring its ambition to become a top-tier competitor in the mining hardware market.

Taken together, September’s developments reinforce Bitcoin’s dual identity as both a macro-sensitive asset and an industrial-scale network. Corporate treasuries and high-profile acquisitions highlight the continued institutional embrace of Bitcoin, even as the pace of buying has moderated. At the same time, the network itself has entered the zetahash era, with difficulty and hardware innovation driving mining into new territory. As Q4 approaches, the balance between macro liquidity, institutional adoption, and technological progress is setting the tone for a quarter which historically has experienced a bullish seasonality for Bitcoin.

Nico Smid – Research Analyst GoMining Institutional.

September 30, 2025