Read this article to understand how Blockchain technology behind Bitcoin and many other cryptocurrencies works at a basic level. In this article we’ll explain what Blockchain is, what it has to do with cryptocurrencies, how it helps to prevent finance monopoly and why it powers today crypto instead of banks. This article will help you make informed investment decisions in 2025–2026.How blockchain works at a basic level

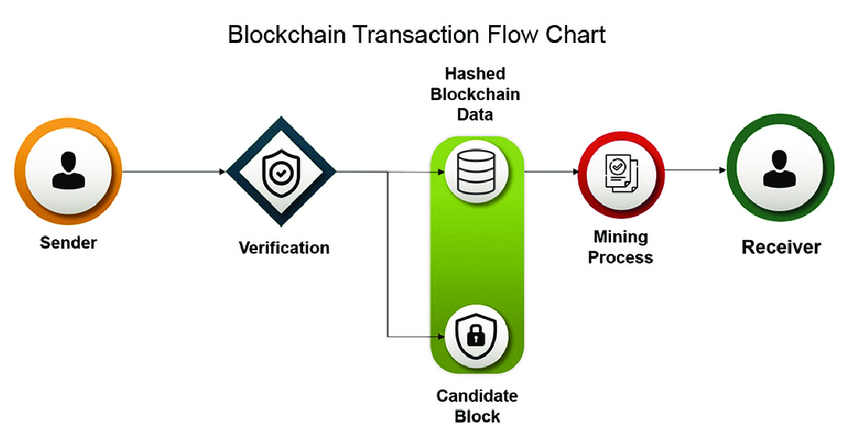

Source: ResearchGate

- Transaction formation. The user creates a transaction (fund transfer or smart contract call) and signs it with a private key. The signature confirms authorship and prevents forgery.

- Distribution across the network. The signed transaction is sent to the network and enters a pool of unconfirmed transactions. Network nodes receive and verify the transaction.

- Block validation and assembly. Miners (in proof-of-work, POW networks) or validators (in proof-of-stake, POS networks) assemble transactions into a block and achieve its confirmation according to the consensus rules.

- Adding a block to the chain. The accepted block is attached to the previous block, forming a chain. The deeper the block is in the chain, the higher the probability of its final immutability.

- Finalization and distribution. Information about the new block is distributed across the network; nodes update their copies of the ledger.

This sequence provides three key properties: integrity (data cannot be falsified without significant cost), transparency (history is accessible to participants), and censorship resistance (no single point of failure).

"A fully peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution." — Satoshi Nakamoto

Key blockchain components and their roles

Cryptography (keys and signatures). Ensures that only the owner of the private key can initiate a transaction from their wallet.

Transaction pools and mempools. Temporary storage of unconfirmed transactions, from which miners/validators select transactions for a block.

Consensus. A mechanism for coordination between nodes, allowing the network to reach a unanimous decision on which transactions are considered valid. In blockchain, consensus ensures the integrity of the ledger without central control.

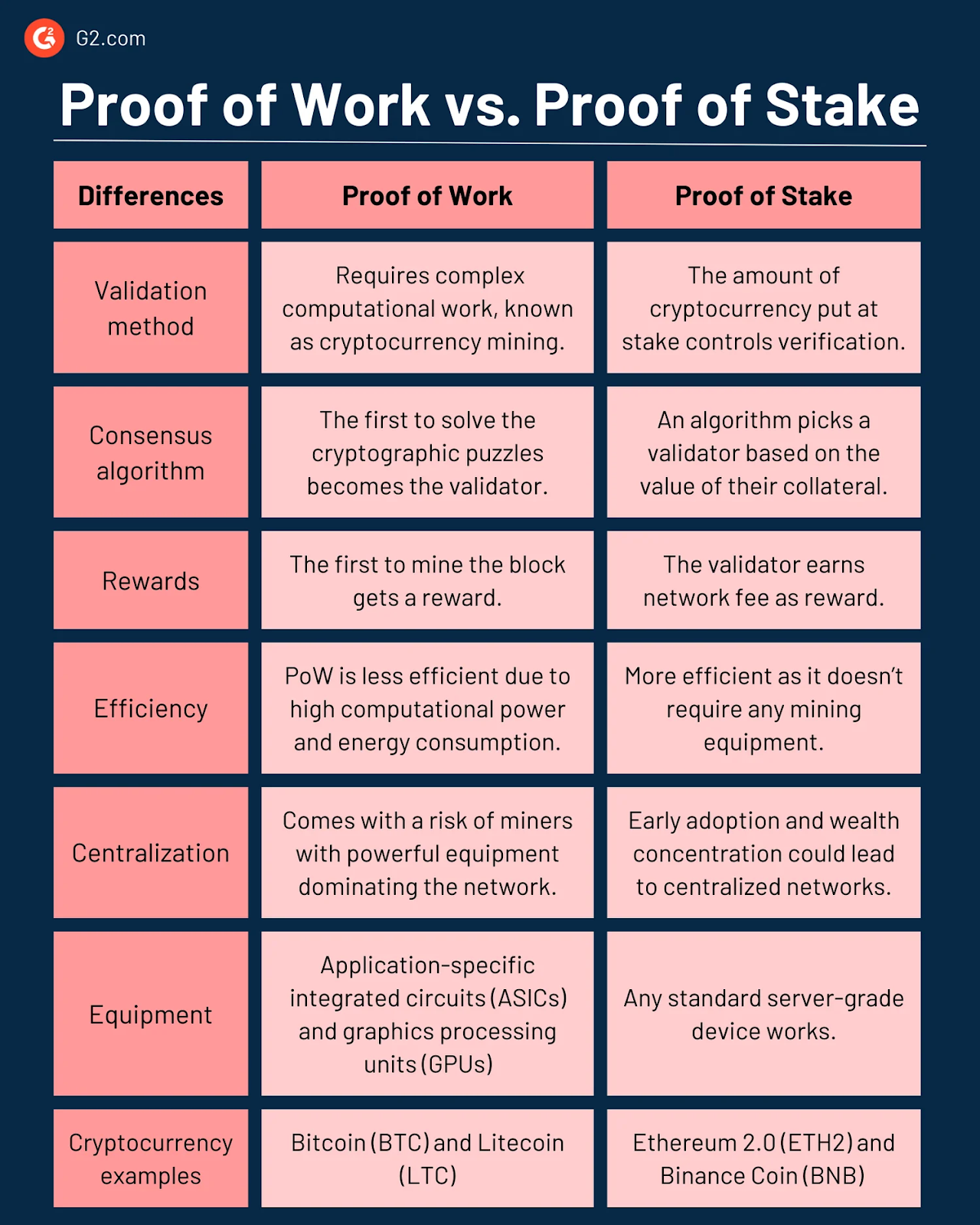

Consensus mechanism. Determines how the network selects the next block: proof of work (PoW), proof of stake (PoS), and hybrid schemes. Security, speed, and energy consumption depend on the mechanism.

Source: g2.com

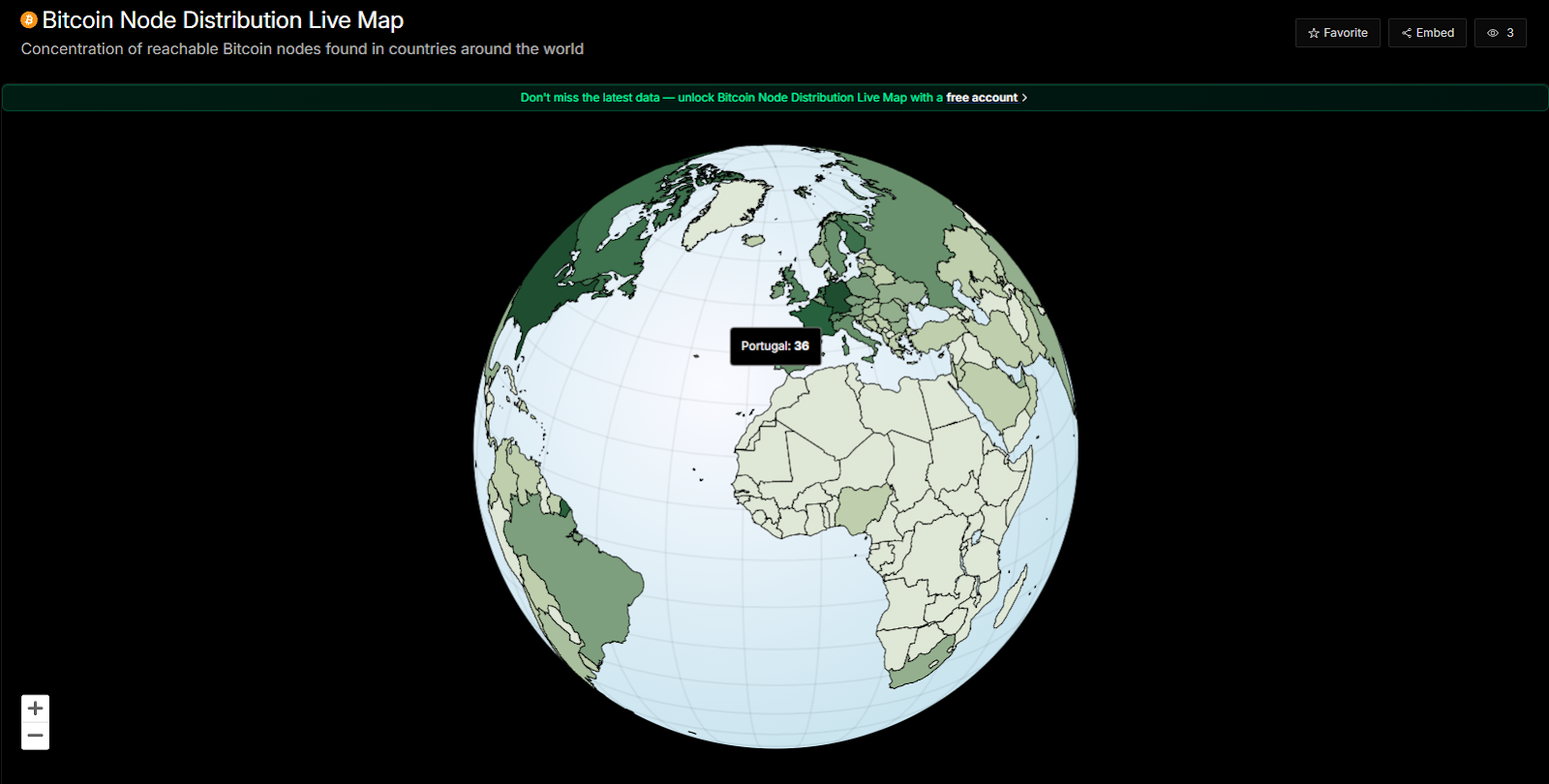

Nodes. Store copies of the ledger and verify the correctness of blocks; the more independent nodes, the higher the decentralization.

Smart contracts. Programs executed on the blockchain (in networks that support them) automate agreements and business logic.

Block. A structural unit of a blockchain containing a set of confirmed transactions, technical data (time, hash of the previous block), and service information. Blocks are linked together to form a continuous chain.

Commission. A fee for conducting a transaction. In proof-of-work networks (e.g., Bitcoin), the commission depends on the network load and can be high. In proof-of-stake (PoS) networks, the commission is usually fixed and set by the protocol; the transaction is executed regardless of its priority.

Coin and token. A coin is the basic unit of account in a blockchain (e.g., BTC in Bitcoin, ETH in Ethereum). Tokens are digital assets created on top of a blockchain; they can represent any value, from in-game items to stablecoins and memecoins. Transactions on the network are paid for in coins.

Blockchain explorers. Online tools for viewing the state of the network: transactions, blocks, addresses, and contracts. They allow you to check the status of a transfer, study wallet activity, and analyze data in real time. Examples of these sites include blockchain, Etherscan, and Tronscan.

Hash. A unique digital fingerprint of data obtained using a cryptographic function, or, in simpler terms, a receipt for a completed transaction. In blockchain, a hash is used to identify transactions and blocks, as well as to verify the integrity of information. Even the slightest change in the input data completely changes the hash, making it virtually impossible to forge.

Real advantages of blockchain

Transfer of value without intermediaries. Blockchain allows assets to be transferred directly between network participants, excluding banks, payment systems, and other intermediaries. This reduces costs, speeds up settlements, and makes transfers accessible even where traditional infrastructure is lacking.

Immutability of history. Records in the blockchain are protected by cryptography and linked to each other. Attempting to change a past transaction would require rewriting the entire chain, which is virtually impossible. For auditing, accounting, and proving the origin of assets, this provides a level of trust that is difficult to achieve in centralized systems.

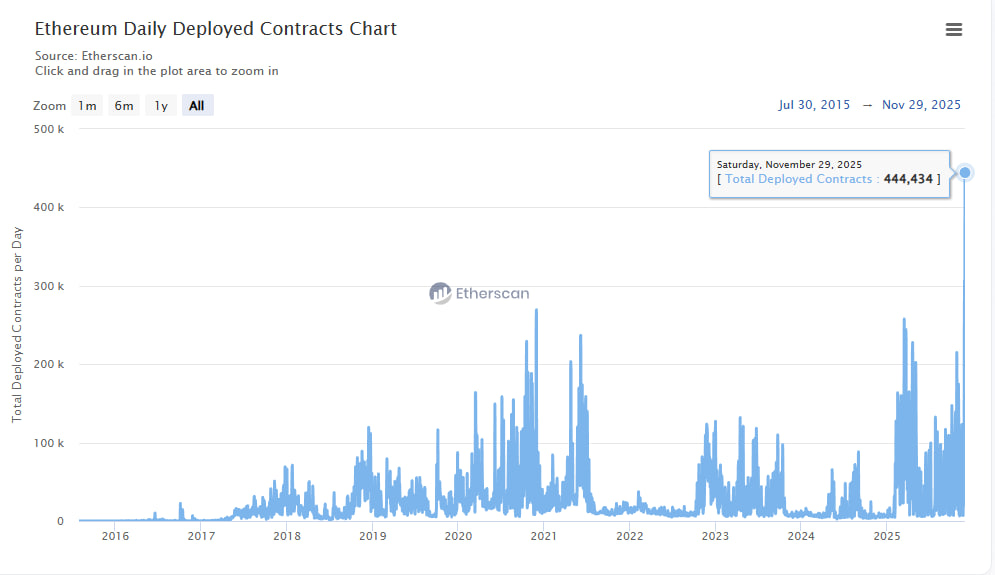

Automation through smart contracts. Networks that support smart contracts allow you to create programs that automatically execute the terms of a transaction. This simplifies the launch of decentralized applications (DeFi, DAO, NFT platforms), reduces the risk of human error, and makes business logic transparent.

Source: etherscan.io

New economic models. Blockchain paves the way for asset tokenization (digital equivalents of stocks, real estate, art), the creation of distributed markets, and decentralized organizations. This allows for the formation of new forms of ownership and management, where rules are set by code rather than bureaucracy.

Globality and sustainability. Blockchain works the same anywhere in the world, and its decentralized architecture protects against censorship and single points of failure. Even if some of the nodes fail, the network will continue to function.

Source: newhedge.io

"Blockchain is a shared, immutable digital ledger that allows transactions to be recorded and assets to be tracked across a business network." — IBM

Risks to consider in 2025–2026

- Protocol attacks and vulnerabilities. Although high computing power makes a 51% attack expensive, vulnerabilities in the code or centralized control points remain a risk.

- Economic risks of mining. A drop in miner profitability (hash price) could lead to shutdowns and short-term price pressure.

- Regulatory changes. Prohibitions, restrictions, or new requirements for exchanges and service providers can dramatically change liquidity.

- Network congestion and high fees. During periods of peak demand, transactions become expensive and slow.

- Infrastructure centralization. The concentration of mining, nodes, or validators in a geographic or corporate sense increases systemic risks.

A practical guide to applying blockchain knowledge

- If you are a user: check fees and confirmation times before transferring; use trusted wallets and keep your private keys safe.

- If you are a developer or business: choose a network based on security, transaction costs, and the availability of development tools; test smart contracts on a test network.

- If you are an investor: analyze not only the price, but also on-chain metrics (outflows/inflows, long-term holder behavior), as well as mining economics and institutional flows.

- If you want to participate in securing the network: evaluate the reward model, payback period, and operational risks; for mining, consider the cost of electricity and the availability of equipment.

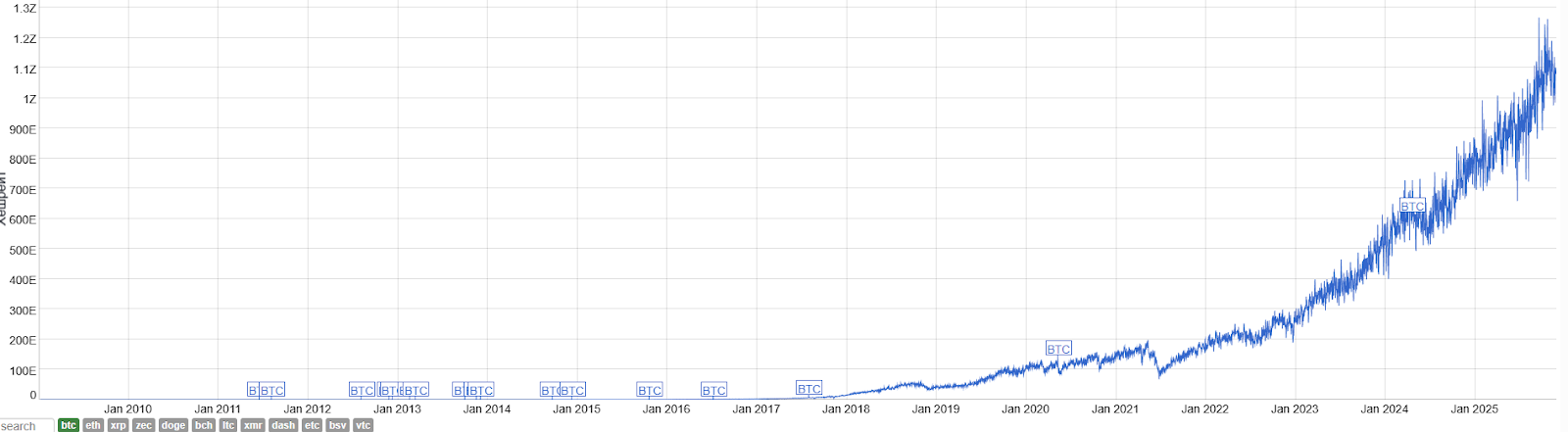

Source: bitinfocharts.com

Three practical scenarios for using blockchain

Payments and transfers: use networks with low fees and fast confirmations; for micropayments, choose second-layer solutions or specialized blockchains.

Value storage: for long-term storage, choose the most secure and decentralized networks; diversify storage and use cold wallets.

Decentralized applications (DeFi): In the DeFi ecosystem, users can not only use services, but also earn income: provide liquidity on decentralized exchanges, participate in token farming and staking, and use credit protocols. Before choosing a platform, it is important to evaluate TVL (total value locked), developer activity, and tokenomics stability — these indicators determine reliability and potential profitability.

Conclusion

Blockchain is like a large open book where all transactions are recorded. Each new entry is added to the end, and it is impossible to change or delete old ones. Thanks to this, anyone can check the history of transfers, and the system remains honest and protected from counterfeiting. At a basic level, it enables the direct transfer of value. In 2025–2026, when evaluating blockchain projects, it will be important to consider not only the price of the asset, but also security metrics, the behavior of network participants, and the economics of rewards. Blockchain networks, especially proof-of-work networks, are protected by miners — participants who provide computing power and confirm blocks. If you want to participate in supporting the network and earn income in Bitcoin, but are not ready to buy and maintain equipment, GoMining offers cloud mining: renting computing power with transparent statistics on BTC accruals, automatic payments, and a convenient personal account.

What GoMining offers:

- Rent power without buying equipment.

- Daily accruals in bitcoins and profitability reports.

- Options for withdrawing and selling accrued BTC through integrated services.

Subscribe and get access to GoMining's free course on crypto and Bitcoin

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

1. How does blockchain work at a basic level? Blockchain records transactions in sequential blocks: each transaction is signed with a private key, verified by nodes, combined into a block, and added to the chain. It is impossible to change past records without control over a significant part of the network, which makes the system secure and transparent.

2. How does blockchain work in cryptocurrency? In cryptocurrencies, blockchain acts as the main registry: it stores the history of transfers, ensures the security of assets, and confirms ownership of coins. Without blockchain, neither Bitcoin nor other digital currencies would be possible — it is blockchain that guarantees trust between participants without intermediaries.

3. What are the advantages of blockchain? The main advantages are decentralization, transparency, immutability of data, and protection from censorship. Blockchain allows value to be transferred directly, reduces the risk of fraud, and opens up opportunities for automation through smart contracts.

4. How can this knowledge be put into practice? Understanding the basics of how blockchain works helps you securely store and transfer cryptocurrency, choose reliable networks for investment, and assess risks and fees. 5. What metrics are associated with the basic operation of blockchain? Key metrics: hash rate and difficulty (for proof-of-work networks), stake distribution (for proof-of-stake networks), fees and transaction confirmation times, on-chain flows (inflows and outflows to exchanges), long-term holder activity, and total value locked (TVL).

6. Is it possible to earn money from blockchain at a basic level? Yes, through participation in mining or staking, investing in cryptocurrencies, and launching applications on smart contracts. Profitability depends on the price of the asset, network metrics, and macroeconomic conditions.

7. What mistakes do beginners make when working with blockchain at a basic level? Common mistakes include ignoring fees and confirmation times, storing private keys in an unreliable manner, attempting to "guess" the market without analyzing metrics, trusting unverified projects, and lacking a plan of action.

8. How does blockchain at a basic level affect the cryptocurrency market? Blockchain sets the foundation for the market: it ensures transaction transparency, asset security, and the possibility of new financial instruments. It is thanks to blockchain that Bitcoin, DeFi, and NFTs exist.

9. What do experts predict for the basic functioning of blockchain in 2026? Predictions include growth in institutional participation, the development of Layer 2 solutions, lower fees, and the expansion of blockchain applications in the real sector — from finance to logistics.

10. Where can I follow updates on various blockchains? The best sources are the official blogs of major networks (Bitcoin Core, Ethereum Foundation), Glassnode and CryptoQuant analytics (on-chain metrics), BitInfoCharts (hash rate and fees), CoinDesk and Cointelegraph (news and forecasts).

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided "as is", all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

A clear guide to "How Blockchain Works": basic principles, key components, practical applications, security metrics, and risks for 2025–2026.

December 25, 2025