The Bitcoin network has recently crossed an unprecedented threshold, 1,000 exahash (EH/s) or 1 zetahash (ZH/s). This milestone highlights the network’s remarkable growth and resilience, yet it comes at a challenging moment for miners. Miner margins are under pressure from record-high difficulty and shrinking transaction fee income. Fees have historically been only a small share of miner revenue, but their decline highlights broader shifts in on-chain demand..

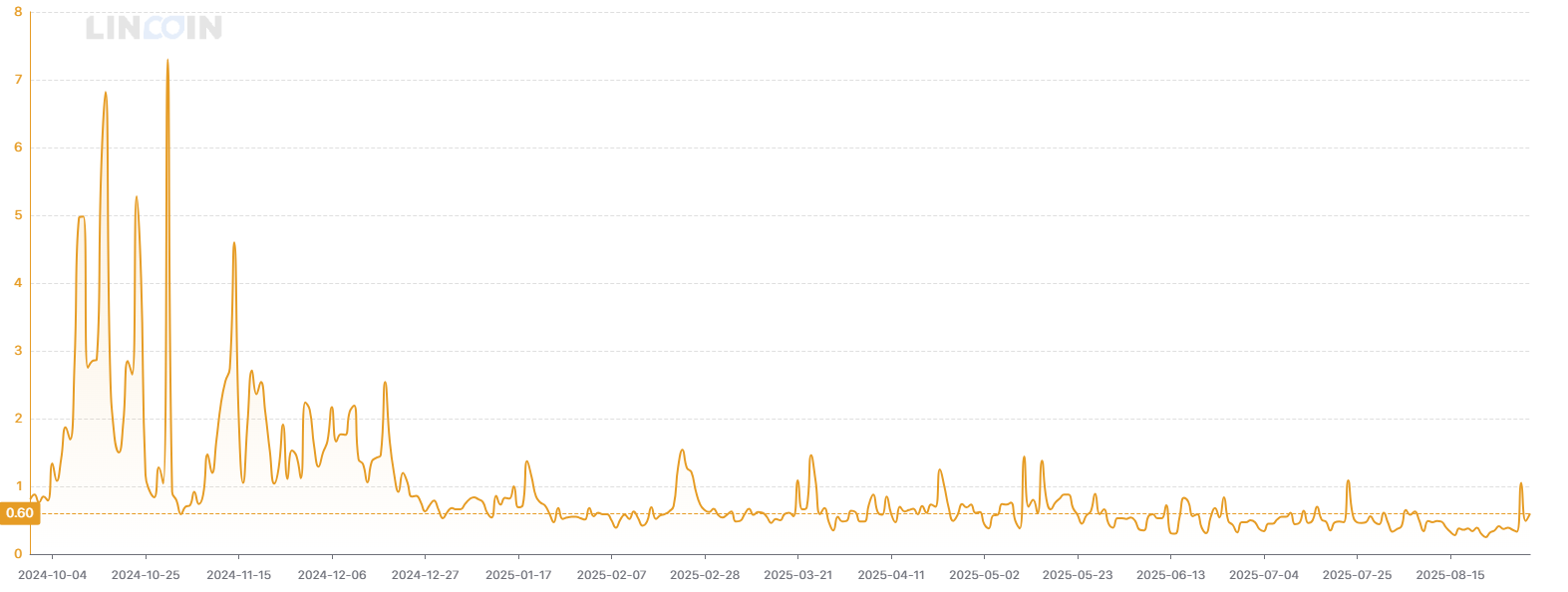

For most of 2025, transaction fees have accounted for less than 1% of total block rewards, the lowest share in years. This “fee drought” has left miner revenues almost entirely dependent on Bitcoin’s price. One of the clearest signs of this trend is the rise of so-called “free blocks”, those mined with an average fee rate of just 1 sat/vbyte or less. These were virtually absent in 2024 but now no longer are an exception, underscoring the collapse in competition for scarce blockspace.

Transaction Fees Below 1% of the Total Block Reward Throughout Most of 2025 (Source: Lincoin Lens)

Why has on-chain activity slowed, and what explains the sharp decline in fees? In this piece, we’ll explore five key structural shifts that have shaped Bitcoin’s base-layer demand as the network matured. We’ll also outline five scenarios that could reignite transaction activity and restore fee pressure in the future.

5 Key Developments Impacting On-chain Activity

1. ETFs

Spot Bitcoin ETFs have become a major channel for institutional exposure. By June 11, U.S. spot ETFs had surpassed $1 trillion in cumulative trading volume, less than 18 months after launch. Although physically backed, these funds concentrate coins with a few custodians such as Coinbase Custody. Once acquired, coins are usually placed in cold storage and rarely moved. Most activity then shifts to traditional markets, where ETF shares trade hands without requiring blockchain transactions. ETFs generate large bursts of on-chain demand when custodians buy Bitcoin to match inflows, followed by low-frequency settlements. They broaden access to Bitcoin but contribute little ongoing demand for block space.

2. Derivatives

Derivatives platforms — from CME to crypto-native venues like Deribit — let traders gain exposure without moving coins on-chain. Contracts are often cash-settled in dollars (CME) or collateralized in BTC but netted internally (Deribit, BitMEX). Billions in value can trade daily with minimal blockchain impact. Derivatives improve liquidity and price discovery, but shift most trading activity off-chain, with the base layer used mainly for collateral settlement or fund transfers.

3. Speculative Flows and Alternative Blockchains

Speculative activity around memecoins, NFTs, and inscriptions has migrated to faster, cheaper blockchains such as Solana and Polygon. These ecosystems cater to high-volume experimentation, attracting users who prioritize speed and cost. As a result, much of the grassroots demand for Bitcoin block space — once driven by Ordinals and BRC-20 tokens — has moved elsewhere.

4. Lightning Adoption

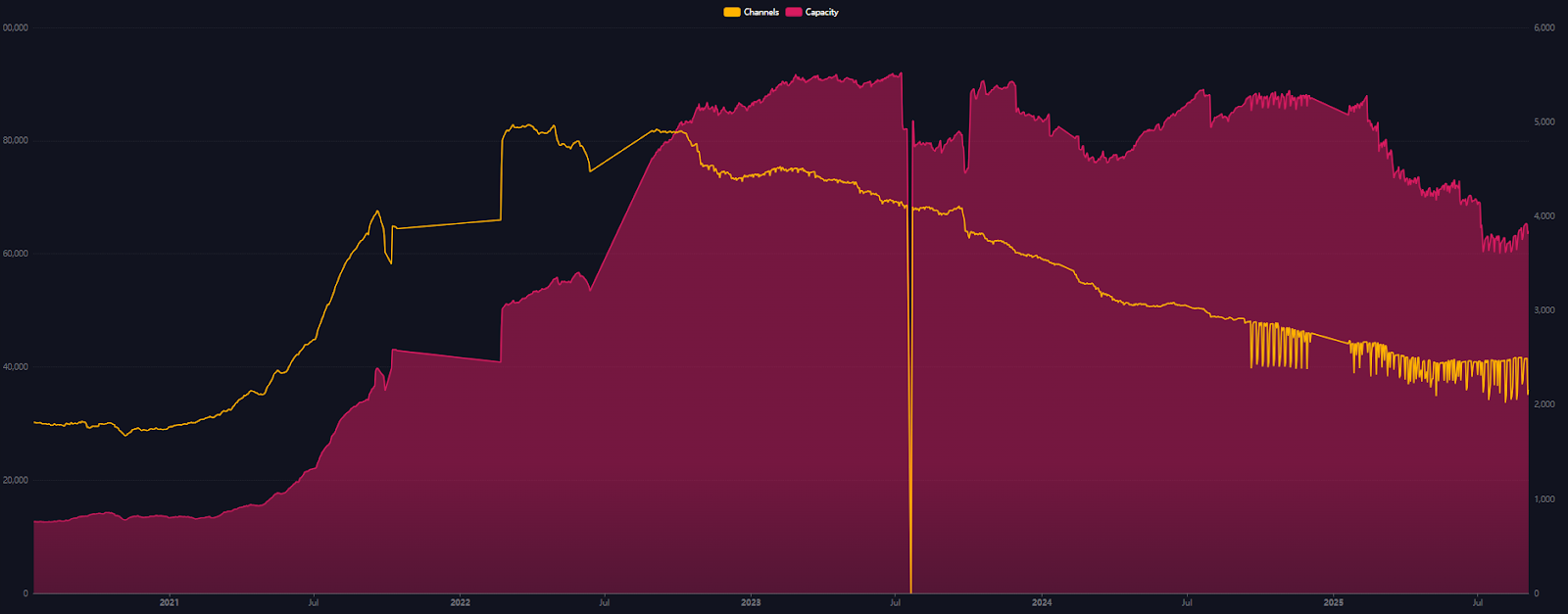

The Lightning Network moves small, frequent payments off-chain, using Bitcoin only to open, close, or rebalance channels. As adoption grows, payments that might have occurred on-chain shift to Lightning, reducing base-layer demand and keeping fees low during periods of weak congestion.

There are Currently Over 40,000 Lightning Channels with a Capacity of Almost 4,000 BTC (Source: Mempool.space).

5. Bitcoin-Backed Loans

Bitcoin-backed lending allows holders to unlock liquidity without selling coins. Centralized lenders (e.g., Ledn) typically require BTC deposits into custodial wallets, where coins remain idle while loans are managed off-chain. On-chain activity occurs mainly at initiation, repayment, or liquidation. By contrast, on-chain lending protocols (e.g., Sovryn, DLC-based systems) require base-layer transactions to post and release collateral, and for liquidations. While still niche, these generate recurring blockchain demand tied to the loan lifecycle.

5 Key Scenarios That Could Boost Transactions

1. Return of Ordinals to Bitcoin

Although speculative flows have migrated to faster chains, “minted on Bitcoin” still carries a premium. Collectors value Bitcoin inscriptions for their permanence and cultural cachet, much like fine art provenance. This could draw projects back during future hype cycles, sparking re-mint waves or bridging existing collections to the base layer for final settlement. If Bitcoin remains the ultimate settlement chain for digital artifacts, these rotations could create recurring bursts of transaction demand.

2. Volume Spikes at Market Tops

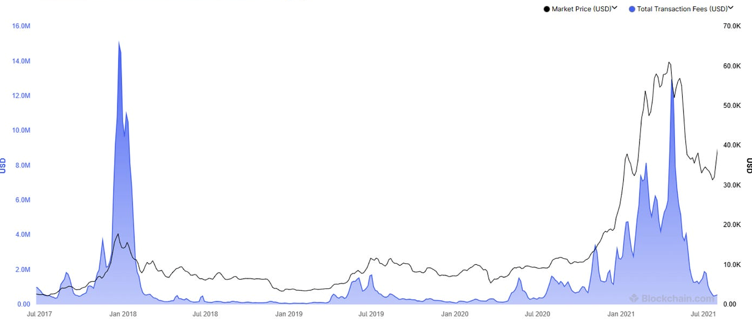

Bitcoin’s cyclical nature means that trading activity tends to surge near market tops. As liquidity thins, exchanges must rebalance wallets more frequently, arbitrage trader push coins across platforms, and traders rush to settle positions. In 2017 and 2021, such dynamics caused fee spikes as users paid premiums for block space. A repeat of a heated market towards a cycle top could temporarily reverse today’s fee drought, rewarding miners during periods of speculative frenzy.

Transaction Fees Spiking During Parabolic Phases in 2017 and 2021 (Source: Blockchain.com).

3. Proof-of-Reserves 2.0

The idea of continuous, on-chain Proof-of-Reserves would transform custodian transparency. Instead of one-off audits, exchanges would anchor reserve attestations directly to Bitcoin, perhaps monthly or even weekly. Public “challenge windows” would allow users to test inclusion, forcing custodians to respond in real time. For Bitcoin, this creates a steady baseline of predictable activity, with additional surges whenever customers audit or dispute published data.

4. Compliance Data Anchoring

Governments and regulators may increasingly demand cryptographic audit trails. Anchoring hashed records of invoices, KYC verification, or settlement receipts on Bitcoin offers a tamper-proof but privacy-preserving method. Adoption by exchanges, payment providers, or even traditional banks could create a consistent layer of compliance-driven transactions. Even small “data fingerprints” at scale, repeated across global financial institutions, could add up to meaningful demand.

5. Self-Custody Waves Under Stress

Periods of economic stress — currency collapses, hyperinflation, or capital controls — often lead to mass withdrawals from exchanges into self-custody wallets. For example, users in Turkey, Argentina, and Nigeria have historically turned to Bitcoin as local currencies faltered. Such events can create intense regional shocks that spill into global blockspace demand, with users competing to move funds quickly across borders. These waves could generate short-lived but dramatic fee spikes, underscoring Bitcoin’s role as a monetary escape valve.

Together, these scenarios highlight how bursts of activity — whether cultural, financial, regulatory, or geopolitical — could restore fee pressure on the base layer. While current conditions favour low-fee “free blocks,” the network’s future remains dynamic, with multiple pathways for transaction demand to rebound.

How Miners Could Survive With Low Transaction Fees

A strong fee market was always expected to gradually replace the block subsidy, but if today’s fee drought continues into the next halving, miners will face unprecedented pressure. By 2028, block rewards will drop to just 1.5625 BTC, leaving margins razor-thin and likely pushing operators to rethink the traditional “mine and hold” model.

One survival strategy is vertical integration: forming partnerships with energy producers, or expanding into the manufacturing of ASICs, containers, and cooling systems. Owning more of the value chain allows miners to reduce costs and capture efficiencies that pure-play operators can’t match. But integration is capital-intensive, meaning only the largest or best-capitalized players will pursue it.

For most miners, the more realistic path is diversification of revenue streams. This trend has already begun and will become essential in the next halving epoch. Opportunities include monetizing waste heat, providing grid services such as demand response, offering complementary services like site buildouts, O&M, and equipment repairs, and hedging revenues through hashrate derivatives or structured products.

If fees remain persistently low, long-term resilience may depend less on raw hashing power and more on creativity, diversification, and integration - the ability to build sustainable businesses around the mining operation itself.

Why Low Fees Don’t Tell the Whole Story

It’s important to recognise that transaction fees, while part of the revenue mix, are still a relatively small component compared to block rewards. Their relative weight grows after each halving, not because fees will suddenly dominate, but because block subsidies fall. This dynamic creates a natural shakeout: miners with higher costs or less efficient operations may be forced to exit, while those running more efficient fleets or securing cheaper power capture a larger share of the pie. In that sense, low-fee environments can reinforce the competitive advantages of well-run operators.

The fee drought ultimately underscores that miner returns are shaped by the interplay of halvings, efficiency, and demand cycles - rewarding those best positioned to adapt. For allocators, the opportunity lies in backing miners positioned to turn fee droughts and halvings into competitive advantages.

Nico Smid – Research Analyst, GoMining Institutional.

September 18, 2025