Cryptocurrency mining is no longer a “garage hobby”—it has evolved into a highly competitive, capital-intensive industry where potential returns come with systemic risks. If you’re considering mining as an investment in 2025–2026, remember one core idea:

You are not buying devices — you are buying a complex production asset whose profitability depends on dozens of variables: BTC price, energy costs, regulation, technology cycles, and operational discipline.

The strongest miner is not the one with the highest terahash, but the one with the strongest risk management model.

Below is a comprehensive breakdown of the seven key risk areas in mining — from legal and financial to cybersecurity, physical infrastructure, energy, tech obsolescence, and human error. Each section explains what the risk is, why it matters, metrics to watch, and what to do in practice.

Risk 1: Regulatory Uncertainty and Restrictive Policies

Mining can quickly become unprofitable — or even illegal — when laws or regulatory requirements change. We’ve already seen how fast the landscape can shift: in 2021, China imposed a sweeping ban on crypto mining and trading, essentially shutting down the local mining industry overnight (see Reuters coverage).

Why This Matters in 2025–2026

The key regulatory focus now is environmental transparency and ESG reporting. In the EU, the MiCA framework does not ban Proof-of-Work mining, but requires companies to publicly disclose energy consumption and environmental impact in white papers and on their websites (source: European Parliament).

This increases compliance costs, but rewards miners operating with a green energy mix.

Other regions demonstrate “regulatory whiplash.” For example, Kazakhstan increased taxes, licensing requirements, and electricity tariffs for miners after energy shortages, allowing mining only through approved pools and exchanges (IMF report). Result: regulatory risk premium on electricity and operational limitations.

In the U.S., policymakers proposed the DAME tax — a tax of up to 30% on miners’ electricity usage — which, even without implementation, shows the direction and potential influence of energy-policy on mining.

What to Monitor

- New legislation on crypto energy usage, ESG disclosures, and possible PoW restrictions

Source: bidenwhitehouse.archives.gov

- Not only existing laws — but draft proposals 12–24 months ahead

- Energy-regulation agendas published by government agencies and financial institutions

What to Do

- Choose stable, transparent jurisdictions with low regulatory volatility and no active anti-PoW agenda

- Conduct legal due diligence before CAPEX, including licensing, taxation, and ESG reporting obligations

- Treat ESG as a strategic advantage — track and communicate your renewable energy share to gain investor/banking support

Risk 2: Financial Volatility and Declining Profitability

Mining income (in fiat terms) is extremely sensitive to BTC price and network difficulty, while expenses (electricity, staff, maintenance) remain fixed and denominated in fiat. One sharp drop in BTC or spike in difficulty can push miners into negative margins.

Why This Matters in 2025–2026

Following the 2024 halving, the key profitability metric — hashprice (revenue per PH/day) — dropped to historic lows of ~$45–50/PH/day, with dips even lower (Decrypt analysis). This heavily compresses margins, especially for older or less energy-efficient fleets.

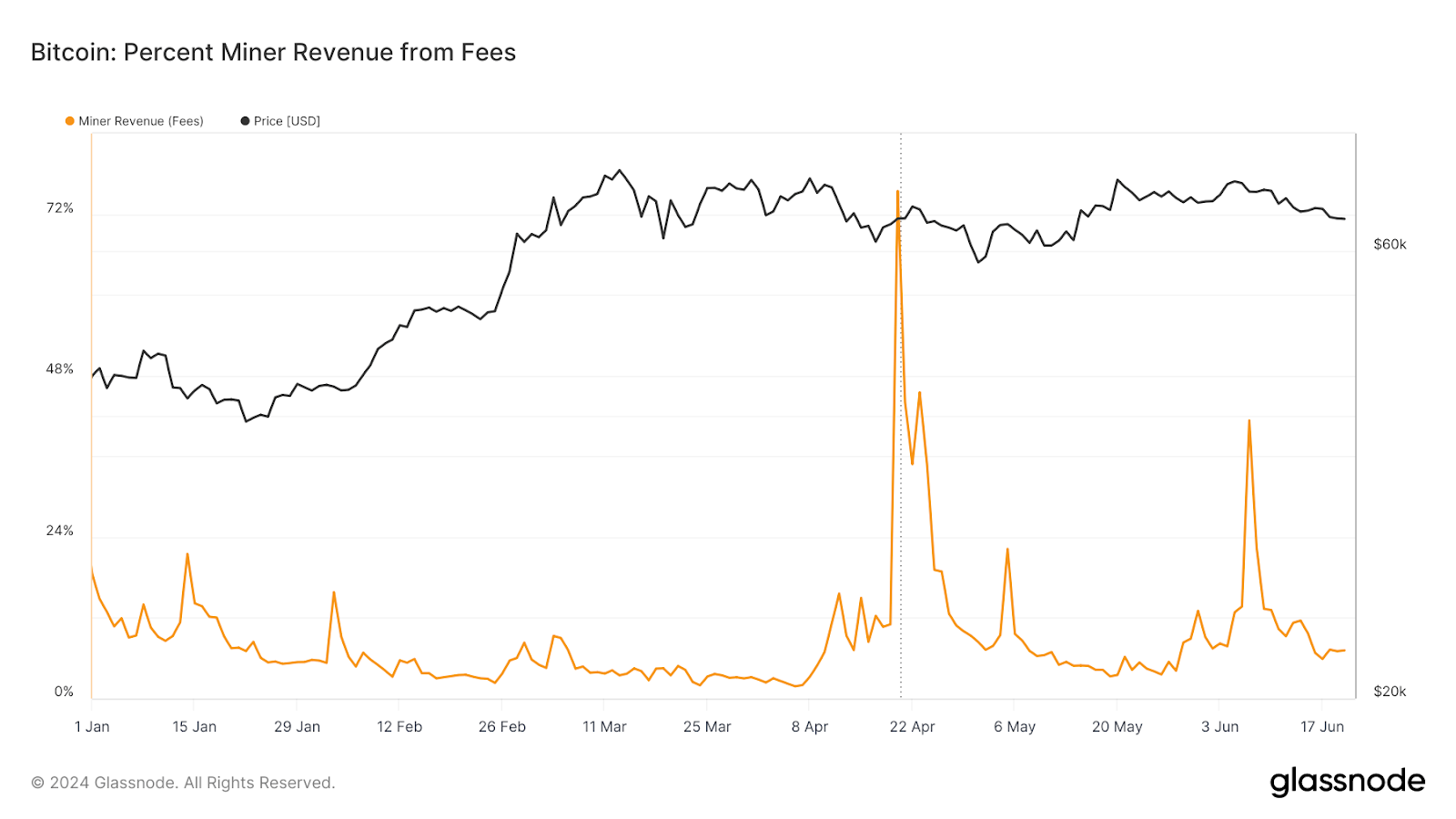

At the same time, temporary spikes in transaction fees (Ordinals / Runes) increased miner revenue, but such boosts are not stable long-term drivers.

Hashrate continues climbing, and network difficulty repeatedly hits new highs — meaning the same fixed block rewards are split between more terahash.Industry research by Hashrate Index and Glassnode confirms: only the most efficient miners with low energy costs survive.

Metrics to Watch

- Hashprice ($/PH/day) vs. hashcost (operating cost per PH/day) (If hashprice < hashcost — you are mining at a loss)

- Network hashrate and difficulty trends (weekly/monthly)

- Share of transaction fees in miner revenue — spikes ≠ a new norm (Hashrate Index weekly review, CryptoSlate fee dominance analysis):

Source: santiment.net

What to Do

- Calculate break-even under pessimistic price/difficulty scenarios using tools like WhatToMine

- Use DCA-out — periodically sell a portion of mined BTC to cover fiat expenses

- Consider hedging via regulated futures (e.g., CME Bitcoin Futures)

- If using cloud mining, ensure transparent on-chain payout history and operator credibility

Risk 3: Cybersecurity Threats and Software Vulnerabilities

In mining, the biggest threat often isn’t hardware — but cyberattacks. Anything connected to funds or remote access becomes a target: wallets, mining pools, firmware, and management dashboards.

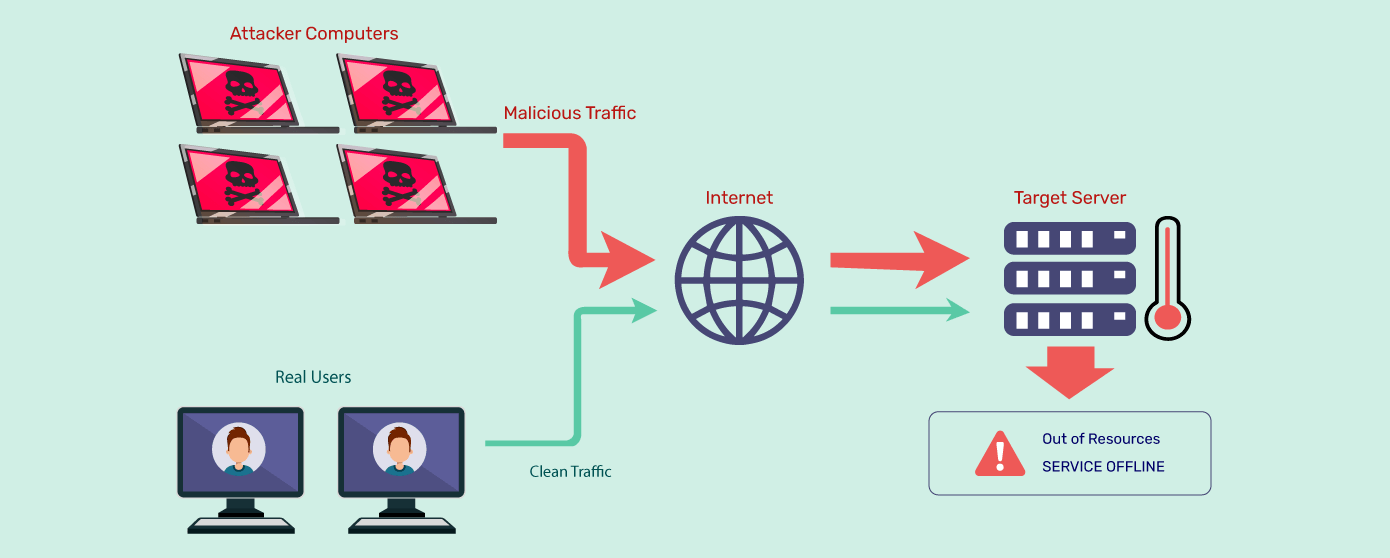

Recent years brought real incidents: • Pools and wallet services froze withdrawals or faced liquidity issues, leaving users unable to access funds • Mining pools and farms suffered DDoS attacks, taking operations offline • “Clipboard malware” (clippers) replaced wallet addresses, redirecting payouts • Cryptojacking malware hijacked hashpower, secretly mining for attackers

These are not “scare stories” — they are everyday risks.

Key Cases & Research

- Poolin liquidity freeze (2022) — Poolin temporarily suspended withdrawals to “stabilize liquidity,” exposing the risk of keeping funds inside a pool. (Official Medium)

- DDoS attacks on mining infrastructure — studied in depth in 2023–2025 academic research:MDPI Electronics (search: mining pool DDoS): https://www.mdpi.com/journal/electronicsResearchGate case reviews: https://www.researchgate.netScienceDirect technical studies: https://www.sciencedirect.com

Source: sysops.host

- Cryptojacking & clippers — subtle theft of hashpower or address substitution • Ledger Academy • Darktrace case on Laplas Clipper: https://darktrace.com/blog • MassJacker research (CyberArk): https://www.cyberark.com/resources • Ongoing threat reports on Binance Square: https://www.binance.com/en/square

What to Do

1. Operational Security for Funds & Access

- Store large amounts in cold wallets (offline hardware wallets)

- Use multisig for important transactions or configuration changes

- Never store seed phrases on phones/cloud — keep offline, with backups in separate secure locations

2. Infrastructure Protection

- Separate networks for miners, office devices, and exchange access

- Apply firmware & software updates on time (most breaches exploit outdated systems)

- Restrict external access — use VPN and allow-list IP rules for admin portals

3. Pool Selection

- Choose pools with transparent payouts, reputation, and proven uptime

- Have a tested failover pool in case your primary pool goes down

4. Monitoring & Threat Detection

- Use HIDS/NIDS to detect suspicious network or system behavior

- Monitor config changes: wallet addresses, router settings, miner configs

- Protect against clippers: always verify first and last characters of wallet addresses before sending

Risk 4: Physical Security, Fire Hazards & Hardware Degradation

Mining generates a lot of heat, dust, and electrical load. Poor wiring, faulty PSUs, lack of filtration, and no maintenance procedures are common causes of fires. Container-based farms are also targets for theft, and ASICs run 24/7, degrading fast and losing resale value.

What to Do

1. Treat the Facility Like a Mini Data Center, Not a “Garage with a Power Strip”

- Use industrial-grade electrical and cooling infrastructure. ASICs are essentially industrial heaters + high-load devices. The electrical system must be built for sustained high consumption: dedicated circuits, breakers, and RCDs.

- Fire safety is non-negotiable. Install smoke and temperature sensors, and automated fire suppression (gas or powder systems rather than a basic household extinguisher).

- Proper power feeds and airflow. Electrical wiring must follow a professional design, with adequate ventilation and cooling. This reduces fire risk, overheating, and downtime.

2. Physical Security — Protect Against People, Not Only Hackers

- Controlled access only. Use access control (badges, keys, logs) to record who enters and exits the premises.

- CCTV matters. Cameras inside and outside with recorded logs protect against theft, sabotage, and insider incidents.

3. Plan Hardware Replacement 12–18 Months Ahead

- ASICs age quickly — plan upgrades early. Technology improves and difficulty rises. If you don’t plan ahead, your equipment will turn into a space heater instead of a revenue generator.

- Goal: recover investment before hardware becomes unprofitable. Typical target: 1–1.5 years. If ROI goes beyond that, the purchase was poorly timed.

Risk 5: Energy Crises & Environmental Pressure

Mining converts electricity into cryptocurrency — so the entire business model depends on cheap energy and regulatory attitudes toward environmental impact.

If electricity prices rise or authorities tighten restrictions, mining can become unprofitable very quickly. Meanwhile, public and government scrutiny of “green mining” is increasing.

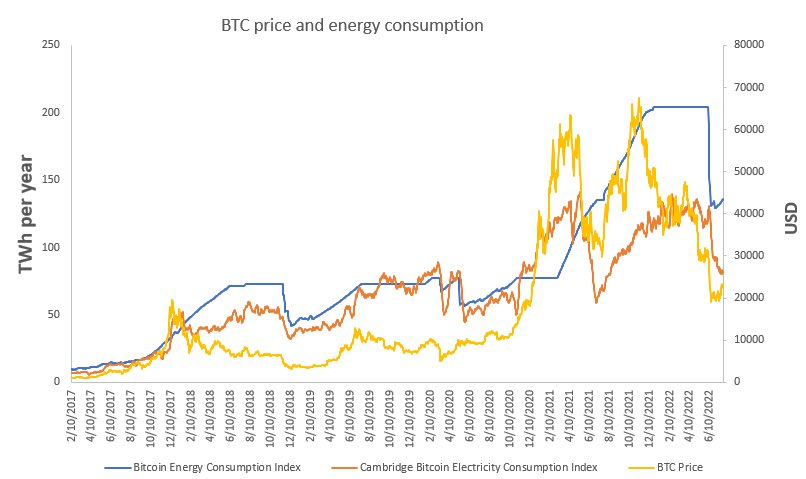

For context, the Cambridge Bitcoin Electricity Consumption Index (CBECI) tracks Bitcoin’s energy usage and environmental footprint (CBECI).

Source: ccaf.io/cbnsi/cbeci

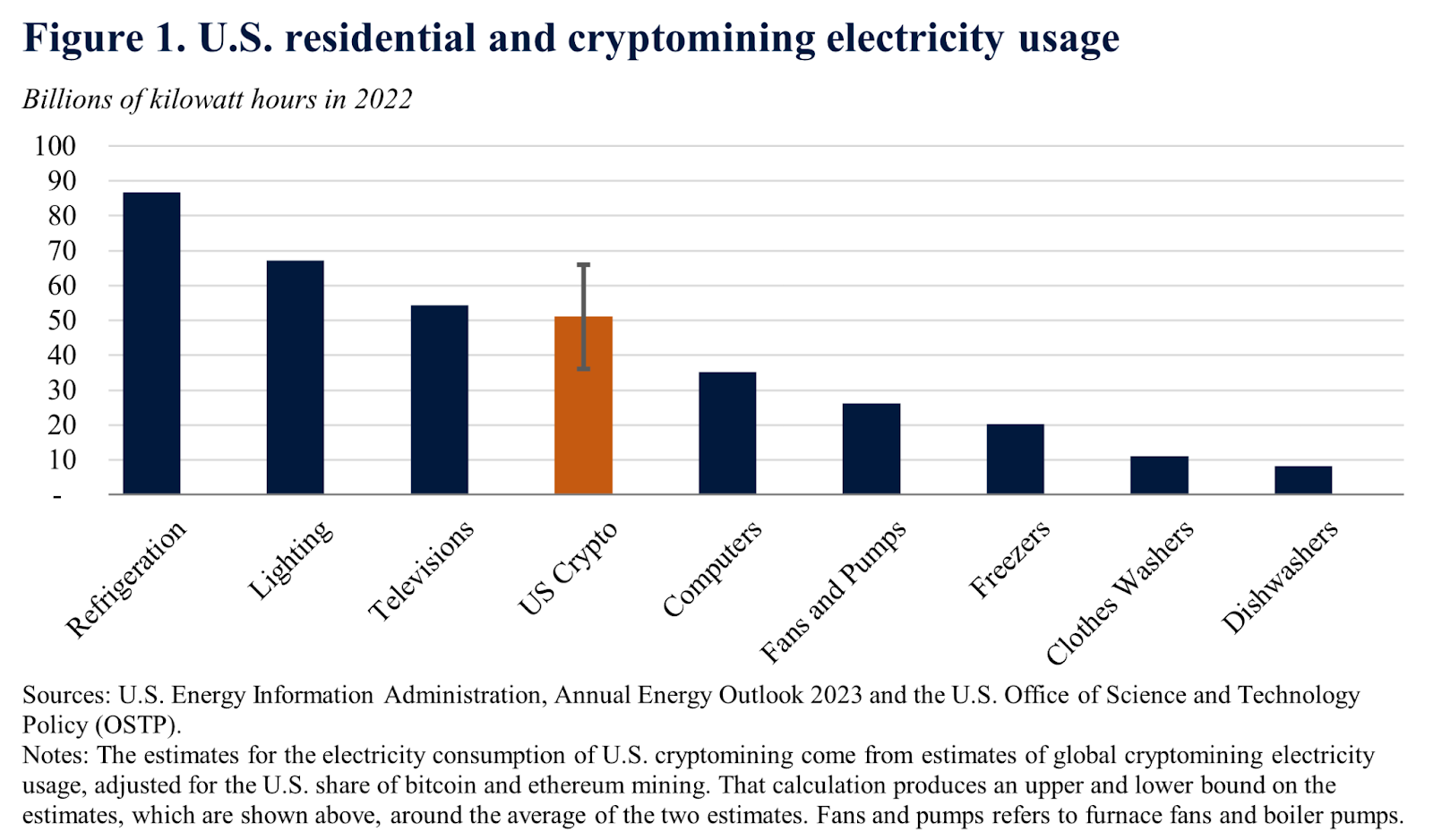

In the U.S., the Energy Information Administration (EIA) published analysis in 2024 estimating crypto mining’s share of national energy consumption and grid impact. At a government level, the White House released a report on environmental effects of mining (water, noise, e-waste), which was widely summarized in financial media.

2025–2026 Trends

- Flexible Load Management: Miners increasingly act as “flexible consumers” — absorbing excess power and shutting down during peak demand.

- Flare Gas Mining & On-Site Generation: Mobile data centers running on flare gas reduce methane emissions and offer low-cost power. Examples: Crusoe’s “Digital Flare Mitigation” model and its expansion into AI-powered clean data centers (Crusoe, CarbonCredits overview).

- Public Miners Deploying Their Own Generation: Marathon Digital (MARA) and others are piloting micro-data centers powered by excess natural gas (coverage: Reuters; confirmed in MARA’s 10-K filings).

What to Do in Practice

1. Lock In Energy Costs with Long-Term PPAs

- Long-term Power Purchase Agreements help fix energy prices for years, protecting from price swings.

- You can forecast mining economics without “energy surprises.”

2. Use Hybrid Energy Models

- Combine grid power with on-site generation (e.g., solar) to reduce bills and boost energy independence.

- Deploy mobile mining units near hydro/wind sites or surplus energy zones for ultra-low-cost power.

3. Leverage ESG as a Competitive Advantage

- ESG isn’t just marketing — it affects access to capital. If you document your renewable energy share and low carbon footprint, it becomes easier to secure partnerships, banking, and investor support.

- Communicate results: publish energy mix stats, improvements, and sustainability efforts. From 2025 onward, “green mining” receives priority in grants, partnerships, and institutional deals.

Risk 6: Technological Obsolescence & Poor Investment Timing

In mining, hardware becomes outdated fast. You may buy a “top model” today only for a new generation to launch months later. The key metric is efficiency, measured in Joules per terahash (J/TH) — the lower this number, the more energy-efficient and profitable the device.

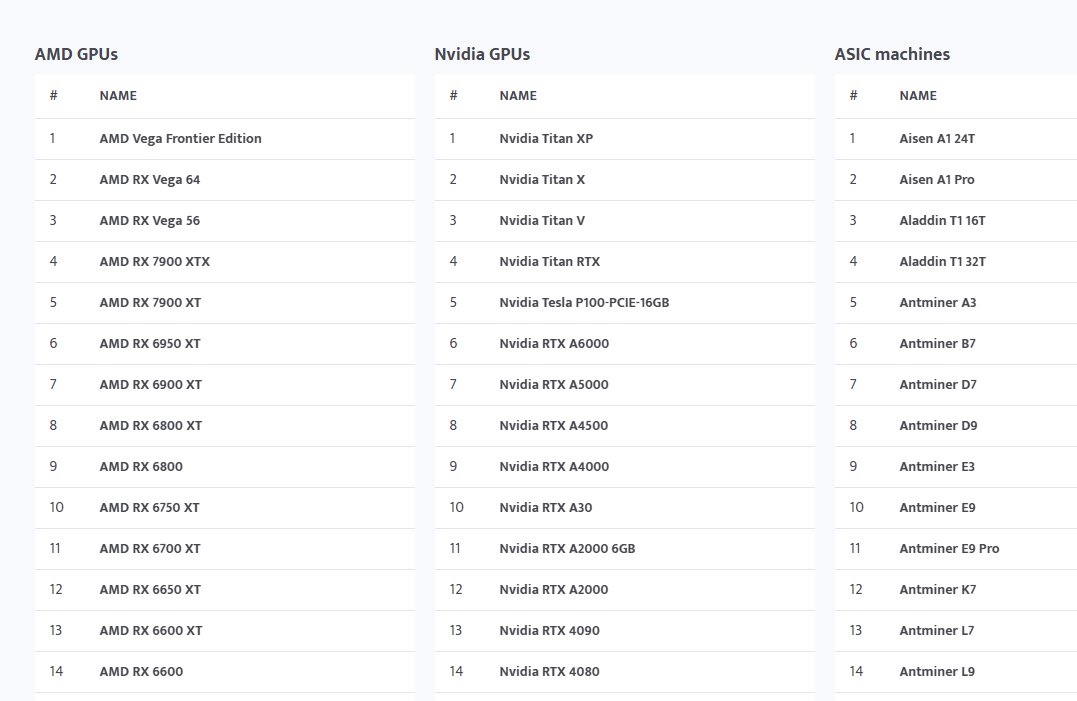

You can compare ASIC models and efficiency on platforms like Minerstat:

Source: minerstat.com/hardware

If your fleet is less efficient than newly released models, profitability shrinks — and older machines are the first to go negative when difficulty rises or hashprice drops.

A major example of tech shock: when Ethereum switched from PoW to PoS on September 15, 2022, thousands of GPU miners lost their primary source of income overnight. Hardware prices crashed, and revenue collapsed. While Bitcoin is unlikely to abandon PoW, the efficiency race never stops — and energy-hungry machines are shut down first during margin compression.

What to Do in Practice

- Track Manufacturer Roadmaps Monitor announcements from Bitmain (https://www.bitmain.com) and MicroBT (https://www.microbt.com). Avoid buying gear at the end of a product cycle when the next generation is already teased — waiting a few months may save your ROI.

- For GPU Mining — Diversify Algorithms If using GPUs, avoid depending on a single PoW coin or algorithm. One “Ethereum-style” shift can erase profitability overnight.

- Strict ROI Discipline Calculate ROI in bear-market conditions, not optimistic ones. Simple rule: if ROI exceeds 24 months under conservative assumptions — reconsider. Better skip a deal than hold hardware that only heats the room.

Risk 7: Operational Errors & Human Factor

Even with the best ASICs and cheap electricity, human error can ruin profitability. Mining involves many precise steps — firmware updates, tuning, wallet management, vendor selection. One wrong click, link, or setting can burn equipment or lose funds.

Typical Mistakes by Newcomers

- Incorrect firmware or aggressive overclockingTrying to “squeeze more” often backfires — reduced hashrate, overheating, and chip failures. Repair costs usually exceed any extra revenue hoped for.

- Wallet and key mismanagementMost losses happen not from hacking but from negligence: wrong address, lost seed phrase, phishing, or malware.For basic wallet safety, see Ledger Academy.Real-world attack example: Laplas Clipper malware, analyzed by Darktrace.

- Blind trust in “cloud mining”If a service lacks transparent on-chain payout history, proof of capacity, or a verifiable team — it’s a lottery. Many cloud mining offers without transparency are structured to absorb deposits, not share revenue. However, there are also well-known companies like Gomining, where you can earn without making any initial investment.

How to Reduce This Risk

- Create a simple runbook (operations manual) Write down clear procedures for firmware updates, overheating response, outage handling, and suspected DDoS scenarios. When rules are written down — fewer mistakes happen during stress.

- Educate your team on cyber hygiene A minimal level of awareness about phishing, malware, link safety, and verifying wallet addresses prevents more losses than any antivirus.

- Choose reliable partners only Work with mining pools that have a track record of payouts, uptime, support, and liquidity reserves. Lower yield but higher safety beats “+5% APY” with a high risk of collapse.

FAQ: Common Questions About Mining Risks

1) What is “Top 7 Risks of Cryptocurrency Mining: From Legal to Physical”?It’s a framework outlining seven categories of risks — legal, financial, cyber, physical, energy-related, technological, and operational — that together determine a mining operation’s resilience and profitability.

2) How do these risks show up in real mining operations? They directly impact ROI, break-even timelines, and your hardware lifecycle. Example: falling hashprice + rising difficulty = margin compression (see Hashrate Index dashboard).

3) What are the main pros and cons of mining?Pros: potential high returns, direct access to BTC at “production cost,” contribution to network security.Cons: volatility, dependency on energy and regulation, fast hardware obsolescence, and high capital requirements.

4) How should this guide be used in 2025?As a checklist: each risk includes metrics and procedures (legal due diligence, PPAs, ROI modeling, hedging, runbooks, anti-DDoS/anti-clippers).Key sources to follow: MiCA, EIA, CBECI.

5) Which metrics should miners monitor regularly?

- Hashprice / network difficulty / hashrate (see Hashrate Index)

- Energy prices & renewable share in your mix

- Fleet efficiency (J/TH)

- % of transaction fees in miner revenue (Glassnode provides insights)

6) Is mining still profitable in 2025–2026? Yes — but “easy money” is gone. Profitability now requires: • low-cost energy, • efficient hardware, • strong risk management. Use DCA-out to cover fiat costs, and hedge volatility (e.g., CME Bitcoin Futures).

7) What are the most common mistakes beginners make?Buying outdated hardware, ignoring energy costs, assuming “BTC price will go up anyway,” zero hedging, storing seed phrases on their phone, trusting non-transparent cloud mining schemes.

8) How does mining affect the broader crypto market?Through supply issuance, miner selling behavior, and network security costs — plus periodic fee spikes during on-chain hype cycles (see Glassnode insights).

9) What do experts expect in 2026? More institutional players, on-site energy generation, modular data centers, integration with AI workloads, and consolidation/M&A among miners (see developments from MARA and Crusoe).

10) Where to follow reliable updates? Glassnode Insights, Hashrate Index, CBECI, EIA/OSTP reports, CME derivatives research, and institutional digests (e.g., Coinbase weekly research).

Conclusion

Mining in 2025–2026 is a survival marathon where the winner isn’t the one with “the loudest fans,” but the one with the most disciplined risk management model. Think like a lawyer (jurisdiction, compliance), like an energy expert (PPAs/generation), like a security engineer (cyber/physical), and like a financial strategist (break-even, DCA-out, hedging). Prioritize efficiency (J/TH) and “green” energy, plan hardware upgrades in advance, and have B–C–D scenarios ready for regulatory or market shocks. Diversify, hedge — and regularly reassess your assumptions.

And to make sure you don’t miss the fundamentals, start with the basics: subscribe to Crypto Academy and get access to the free course “Crypto: From Beginner to Advanced Investor” → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

November 5, 2025