Bitcoin isn’t just digital cash — it’s the secret weapon helping startups move faster, go global, and break the rules (the smart kind).

Summary points:

- Bitcoin gives founders speed, access, and control - no banks required.

- It’s powering new ways to raise capital, reach customers, and build trust.

- What started as a digital rebellion is now the backbone of startup innovation.

Okay, imagine money that doesn’t sleep, doesn’t need permission, and doesn’t get stuck in Monday morning bank queues. That’s Bitcoin. It runs on a blockchain — a shared public ledger that keeps every transaction transparent and tamper-proof. No banks, no gatekeepers, just code and consensus.

For startups, this is game-changing. Blockchain for startups unlocks a new way to build, fund, and grow — you can send and receive payments instantly, raise capital from anywhere, and manage assets without the friction of old-school finance.

Bitcoin isn’t a “maybe one day” thing — it’s here, it’s working, and it’s already funding, powering, and inspiring startups around the world. The startup blockchain movement is reshaping how innovation happens, one block at a time.

The Good, the Bad, and the Blockchain

Bitcoin isn’t perfect — but damn, it’s powerful. It’s money with no middlemen, no borders, and no closing hours. Let’s unpack it.

“Bitcoin is not just a currency; it’s a catalyst for change.” — Jack Dorsey, Block

Jack Dorsey gets it — Bitcoin’s bigger than price charts. It’s a shift in how we think about money, ownership, and freedom online. For Gen Z, it’s not just about investing; it’s about building a system that actually fits our digital lives.

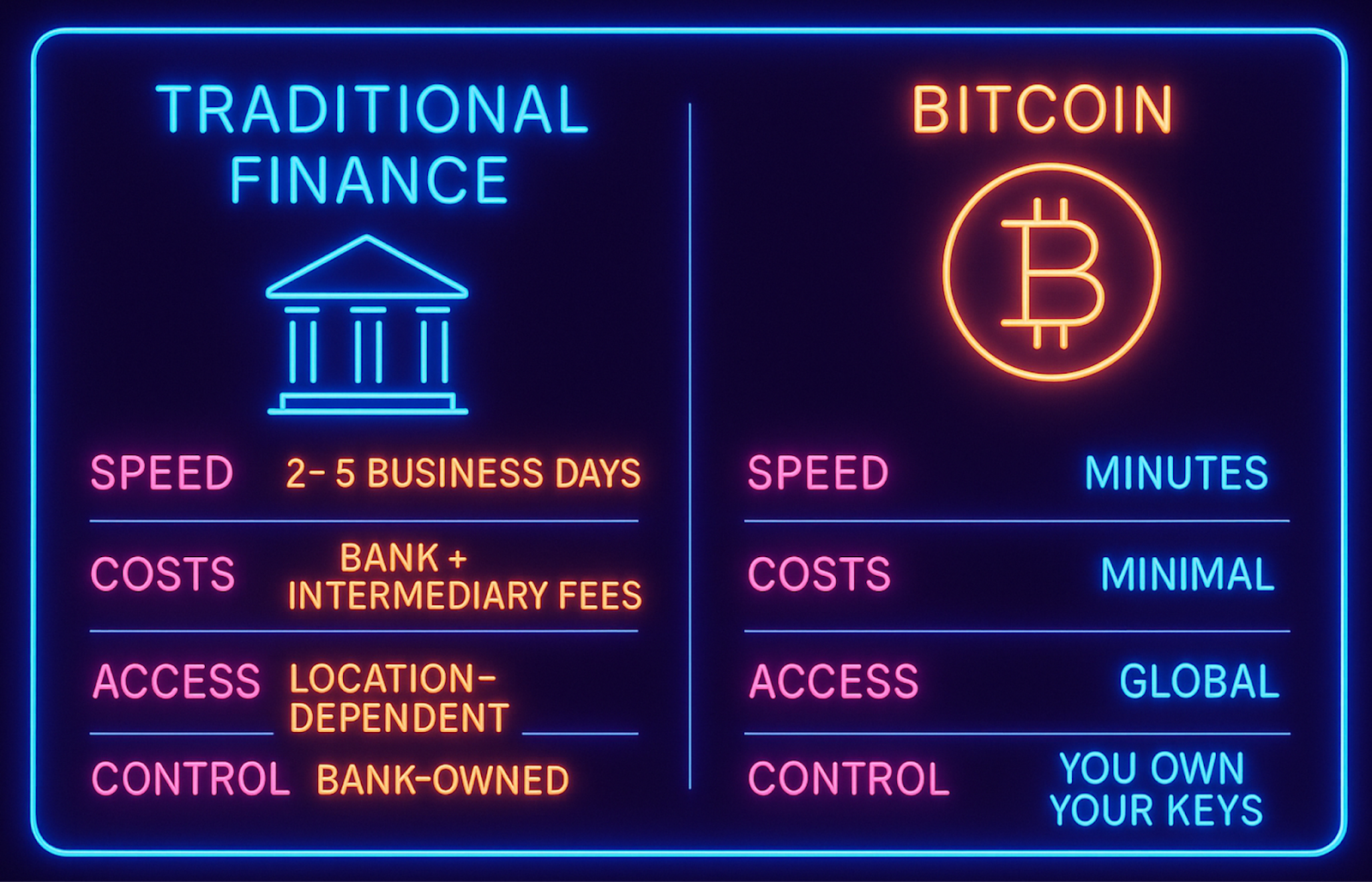

🤩 The Upside

Bitcoin’s global by default — anyone, anywhere can send or receive it, no questions asked. Forget waiting three days for a bank transfer; BTC moves in minutes. No middlemen, no FX fees, no “sorry, it’s a public holiday.” Every transaction lives forever on the blockchain, open for anyone to verify. It’s money that doesn’t need permission.

⚠️ The Trade-offs

But it’s not all smooth sailing. Bitcoin’s price moves fast — sometimes too fast. Regulation’s still playing catch-up, and not everyone’s ready to accept crypto in their day-to-day. It’s early, it’s experimental, and it’s not for the faint of heart.

Still, here’s the thing: the old money system moves at snail speed, with hidden fees and middlemen at every step. Bitcoin moves at internet speed — global, open, and in your control. You hold the keys, you make the rules.

How Startups Are Actually Turning a Profit with Bitcoin

Alright, let’s talk alpha.

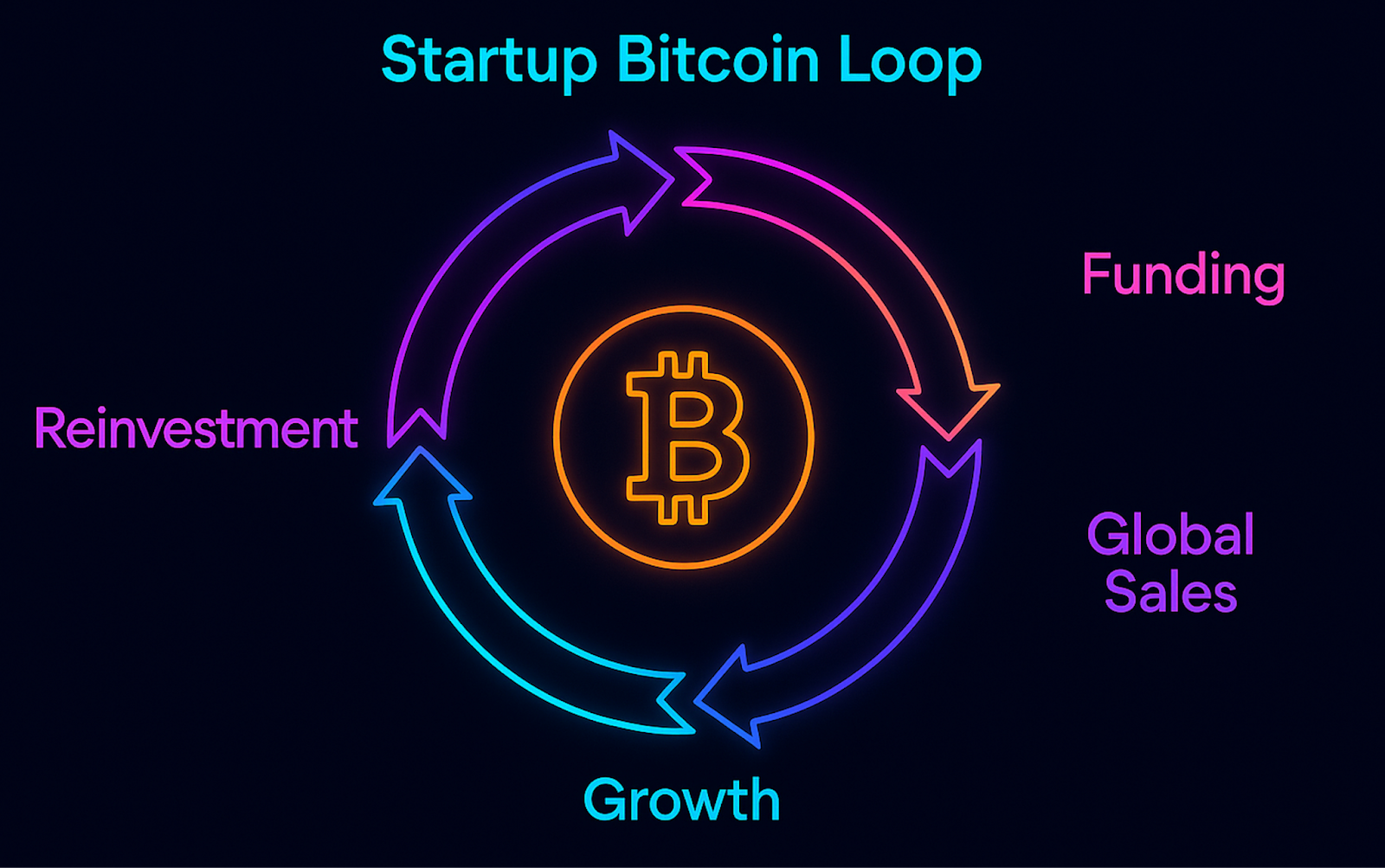

1️⃣ Fundraising — The Web3 Way

Forget waiting months for a VC reply. With Bitcoin, you can crowdfund directly from your community — globally, transparently, instantly.

Startups are now using Bitcoin-powered crowdfunding and tokenized assets to raise funds with smart contracts handling distribution automatically.

It’s like Kickstarter, but turbocharged and on-chain.

2️⃣ Running Lean — No Borders, No Banks

Pay freelancers in Brazil, get customers in Japan, all in Bitcoin.No FX rates, no waiting for SWIFT transfers, no awkward “wire received next Thursday” emails.

3️⃣ Build On the Shoulders of a Giant

Bitcoin’s tech is open-source, meaning anyone can build on it — from DeFi apps to Web3 services. It’s like having access to the internet’s backend in 1995.

Startups Doing It Right

Overstock.com became one of the first major retailers to accept Bitcoin — and gained a loyal crypto community. It’s a strong example of a startup-booted crypto strategy that connects innovation with real customer adoption.

BitPay built the tools that make crypto payments easy, now supporting thousands of startups and helping shape the next generation of cryptocurrency in business.

In Kenya and Nigeria, founders are using Bitcoin for payroll and crowdfunding, skipping outdated banking systems entirely. And platforms like GoMining let you earn Bitcoin without the mining setup drama. It’s mining-as-a-service — you plug in, get rewards, and reinvest them into your business, showing exactly how to start up a cryptocurrency the smart way.

The Future of Bitcoin and Startup Innovation

Bitcoin started by shaking up finance — now it’s reshaping how startups think: faster, flatter, and freer.

By 2030, it won’t just be a store of value; it’ll be the backbone connecting DAOs, tokenized assets, and real-world finance — the bridge between legacy systems and what comes next.

For founders with hustle, Bitcoin isn’t just an investment. It’s infrastructure. It’s the new rails for building without permission, without borders, and without middlemen.

This isn’t a fad — it’s the internet of money becoming the operating system for innovation.

For startups bold enough to build on it, Bitcoin is more than a bet.It’s freedom — pure creation, powered by code and community.

FAQs

Q: Can startups raise funds with Bitcoin?

A: 100%. Many already do via BTC payments or tokenized crowdfunding. Fast, global, and community-driven.

Q: Is Bitcoin a VC killer?

A: Nah. It’s a sidekick. Bitcoin gives liquidity, VCs give mentorship. Together — power combo.

Q: How can a small business use Bitcoin?

A: Accept it as payment, pay suppliers, or hold it as a hedge. Modern SaaS tools make it plug-and-play.

Q: What if Bitcoin’s price drops?

A: Use payment processors that convert BTC to stablecoins instantly. No stress.

Q: Why should I care right now?

A: Because every innovation wave starts quietly — until it doesn’t. Bitcoin’s shaping the next decade of entrepreneurship.

October 28, 2025