Price forecasts are not instructions for action, but rather superficial information for decision-making. In 2025–2026, there were more sources of forecasts, but also more spam: it is possible to separate useful signals from advertising noise if you know where and how to look. This article provides a practical algorithm for finding forecasts, explains what data and metrics are important, and points out the main risks of using predictions in the cryptocurrency market.

Where to find cryptocurrency price forecasts

- Analytical reports from centralized exchanges and services

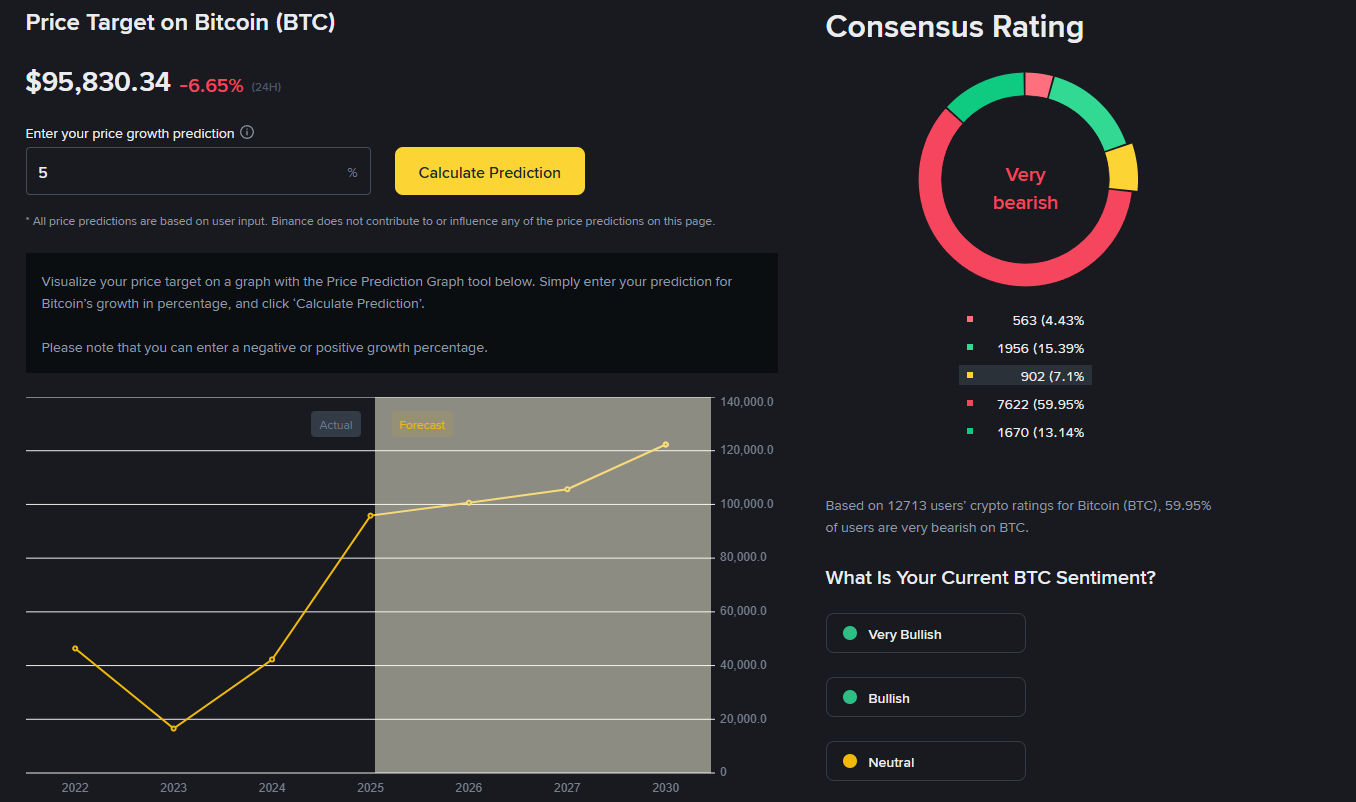

Source: binance.com

The research departments of exchanges publish structured reports and scenarios for major assets. These are useful for understanding institutional approaches to risk assessment and growth scenarios.

- Price and metric aggregators

Source: coinmarketcap.com

Platforms that collect market data, TVL, capitalization, and liquidity charts. They quickly provide a picture of the market and give access to historical data for backtesting hypotheses.

- On-chain analytics and dashboards

On-chain services show inflows/outflows from exchanges, whale movements, distribution by address, and network activity. This data often explains why prices change and provides warnings before they are visible on the chart.

- Reports from analytics companies and research groups

In-depth reports on tokenomics, demand patterns, and technology applicability. Useful for medium- and long-term scenarios.

"Every time, Bitcoin traded calmly before making a powerful rebound," said a CryptoQuant analyst.

- Data on DeFi protocols and ecosystem metrics

TVL, number of active addresses, trading volume within protocols — reflect the real usefulness of the project, which is important when assessing long-term potential.

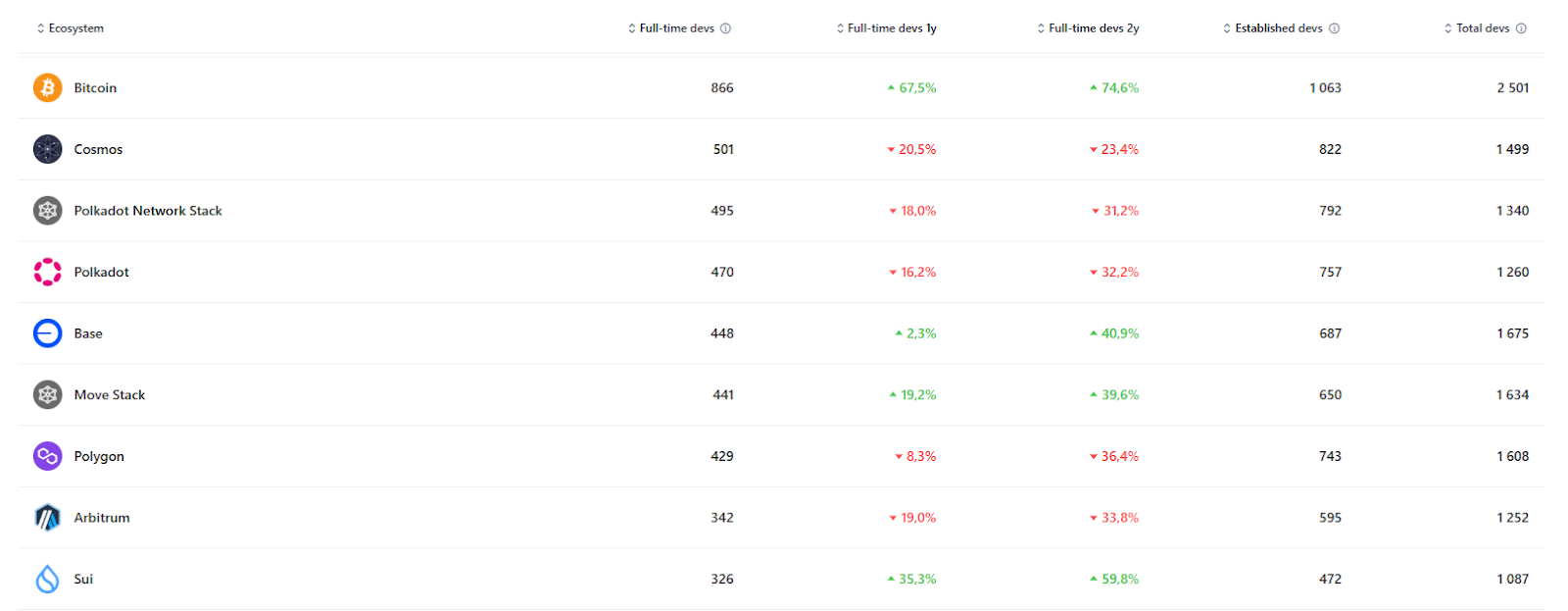

- Public repositories and GitHub activity

An often underestimated source: developer activity, commit frequency, and pull request pools signal the pace of product development.

Source: developerreport.com

- Media and thematic publications

Professional publications and industry blogs provide context and interviews, but they already interpret the data — use them as a source of hypotheses, not facts.

Source: bloomberg.com

- Social signals and expert discussions

Source: x.com

Twitter/X, thematic channels, forums. They can indicate sentiment, but require filtering due to fake recommendations and manipulation.

"We don't expect cryptocurrency to rise above $125,000 in 2025," says ShapeShift analyst Houston Morgan.

A practical algorithm for finding and verifying forecasts

- Start with a price aggregator and key metrics to get a basic picture (price, volume, capitalization, TVL).

- Compare market data with on-chain metrics — is there an inflow of funds to exchanges or, conversely, an outflow to cold wallets?

- Open analytical reports (exchanges, research groups) — look for methodology and scenarios, not just a single numerical forecast.

- Check development activity and roadmaps on GitHub and official channels.

- Compare several independent forecasts and determine the range of scenarios (optimistic/base/pessimistic).

- Assess the drivers of the forecast: macroeconomics, regulatory changes, product launches, token unlock schedules, insights into institutional demand.

- Decide how much capital you are willing to allocate to the scenario (risk management, DCA, stop levels).

- Update your assessment regularly: new data often adjusts forecasts more than analytical moves.

Practical scenarios for using forecasts

- Short-term trading: combine technical analysis and on-chain signals (inflows/outflows).

- Medium term: focus on actual demand (TVL, activity) and unlock schedules.

- Long-term investments: rely on the project roadmap, tokenomics, and real-world application of the technology.

Risks and limitations

- Forecasts do not guarantee results: they depend on assumptions.

- Manipulation and false signals on social media.

- Rapid changes in the regulatory environment in key jurisdictions.

- External shocks (macroeconomics, stock market crashes).

- Non-transparent tokenomics and hidden unlock schedules.

Checklist before trusting a forecast

- Is there a methodology behind the forecast and are the assumptions disclosed?

- Is the key data confirmed by on-chain metrics?

- Is there independent confirmation (do multiple sources paint a similar picture)?

- Is the forecast specific to a particular scenario, or is it a general optimistic/pessimistic thesis?

- Are the risks and possibility of alternative outcomes indicated?

Trends for 2025–2026 and what to expect from future forecasts

- The growing role of on-chain analytics in short-term decisions.

- Increased use of AI to generate dynamic forecasts and scenarios.

- Greater attention from institutional investors to transparent tokenomics and unlock schedules.

- Increased requirements for verifiability of sources and methodologies.

Conclusion and practical tip

Price forecasts are a useful tool, but they should be treated as a set of scenarios rather than as gospel. Collect data from several independent sources, compare the market picture with on-chain metrics, and manage risk through DCA and diversification. If you want to generate income but don't want to collect and verify data yourself, you can consider ready-made infrastructure solutions and services for monetizing computing power — for example, contact GoMining: ready-made products, transparent reporting, and operational support will help you focus on strategy rather than routine.

FAQ

- What are cryptocurrency price forecasts? These are scenarios and estimates of future cryptocurrency prices. They can be based on exchange analytics, on-chain data, research company reports, and behavioral signals.

- How does the cryptocurrency price forecast search work? It is based on collecting information from various types of sources: metric aggregators, exchange reports, on-chain dashboards, GitHub repositories, and social signals. The data is then compared, filtered, and used to build scenarios.

- What are the advantages and risks of price prediction signals? Advantages: the ability to evaluate scenarios in advance, identify demand signals, and enter or exit a position in a timely manner. Risks: predictions can be erroneous, manipulative, or outdated; it is important to verify sources and methodology.

- How to use price forecasts in 2025? Compare market and on-chain metrics, consider token unlock schedules, monitor developer activity and institutional interest. Use forecasts as a guide, not a guarantee.

- What metrics are related to price predictions? TVL, FDV, MCAP, trading volumes, inflows/outflows from exchanges, wallet activity, whale behavior, unlock schedules, GitHub activity, macroeconomic indicators.

- Is it possible to make money using price predictions? Yes, if you use them as part of a strategy: combine them with risk management, DCA, diversification, and tokenomics analysis. The main thing is not to rely on a single source and not to act impulsively.

- What mistakes do beginners make when working with forecasts? They blindly believe one source, do not check the methodology, ignore risks, do not take unlock schedules into account, confuse marketing with analytics, and do not use on-chain data.

- How do price forecasts affect the cryptocurrency market? They shape expectations, influence the behavior of retail and institutional investors, can increase volatility, and trigger trends, especially if they come from authoritative sources.

- What do experts predict for 2026? The growing role of on-chain analytics, the integration of AI models into forecasting, increased requirements for transparency of methodologies, institutional demand for proven scenarios, and a decline in the role of "noise" sources.

- Where can you follow updates on price forecasts? On the websites of Cointelegraph, CoinDesk, Binance Research, Delphi Digital, Messari, Glassnode, in exchange reports, on-chain dashboards, official project blogs, and verified analyst accounts on X/Twitter.

Subscribe and get access to a free course on crypto from beginner to advanced investor! https://academy.gomining.com/courses/bitcoin-and-miningTelegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided "as is", all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

A comprehensive guide on where to find cryptocurrency price predictions, how analytics sources work, what data and metrics to consider, and how to use predictions to make decisions and earn income in 2025–2026.

November 17, 2025