The crypto market has become more complex, but also more transparent. In 2025, tools aren't just websites and charts; they're your decision-making levers. This article is not a review for the sake of a review, but a practical guide on How to use the best crypto tools at all levels: from first steps to advanced analysis.

Why do we need tools at all?

Crypto is data. Without tools, you can't see trends, risks, or opportunities.In 2025, an investor without access to on-chain analytics is like a trader without a chart. Even basic tools offer an advantage if used systematically." — Maria Lee, analyst at CME Crypto InsightsThe tools allow you to:

- Track TVL, volumes, fee yield

- Analyze tokenomics, unlock charts

- Compare DeFi protocols, DEX, staking

- See on-chain activity and addresses

- Build profit and risk scenarios

If you're just starting out in crypto, there are several easy-to-use platforms that are a great place to start. CoinMarketCap And CoinGecko— these are reference books on coins: price, volume, capitalization, everything is in plain sight.TradingView It's a great tool if you want to look at charts, trends, and play with indicators. And if you're already on the exchange, Binance, Bybit or OKX, it also has built-in analytics, signals and statistics

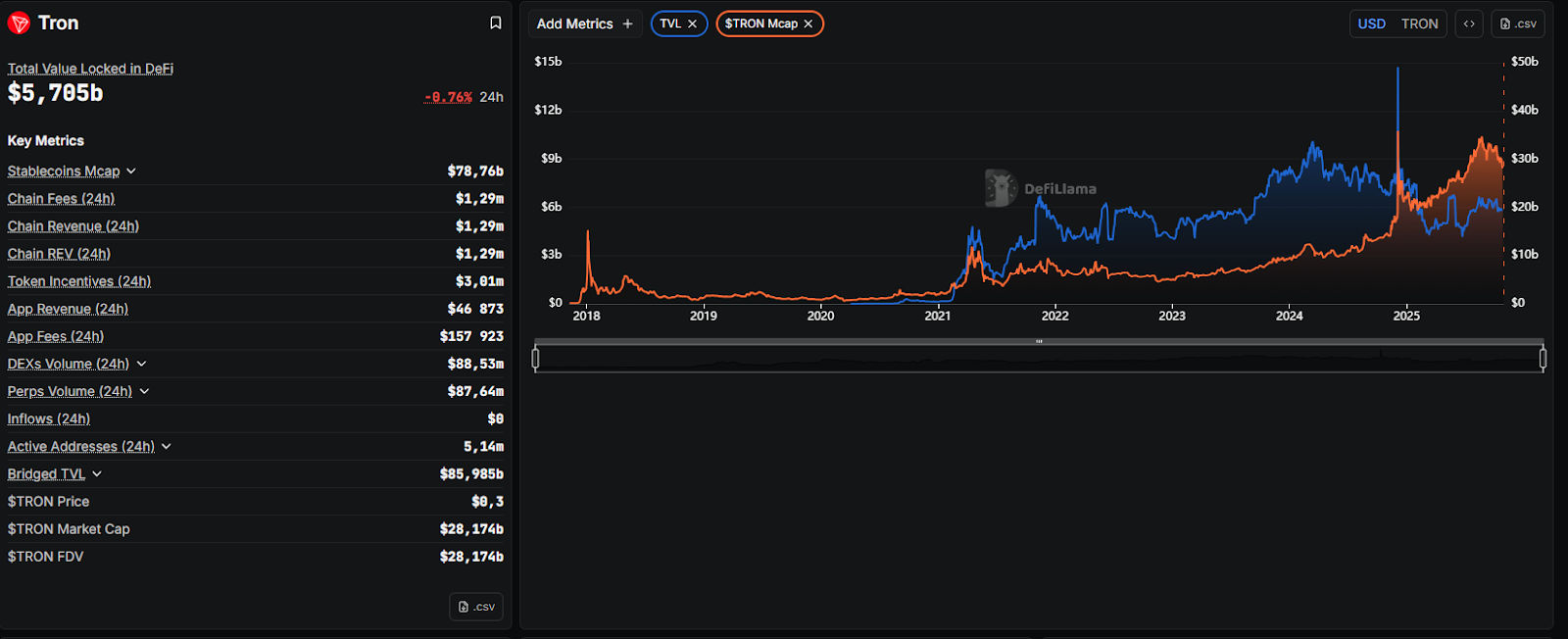

Once you've mastered the basics and want to dig a little deeper, more powerful tools appear. DeFiLlama shows how much money is locked in protocols, so you can compare and see the dynamics. TokenUnlocks helps to understand when and how many tokens will be unlocked, useful for assessing price pressure. А Dune Analytics is a construction kit: you can create your own dashboards, view on-chain activity, everything is customizable.

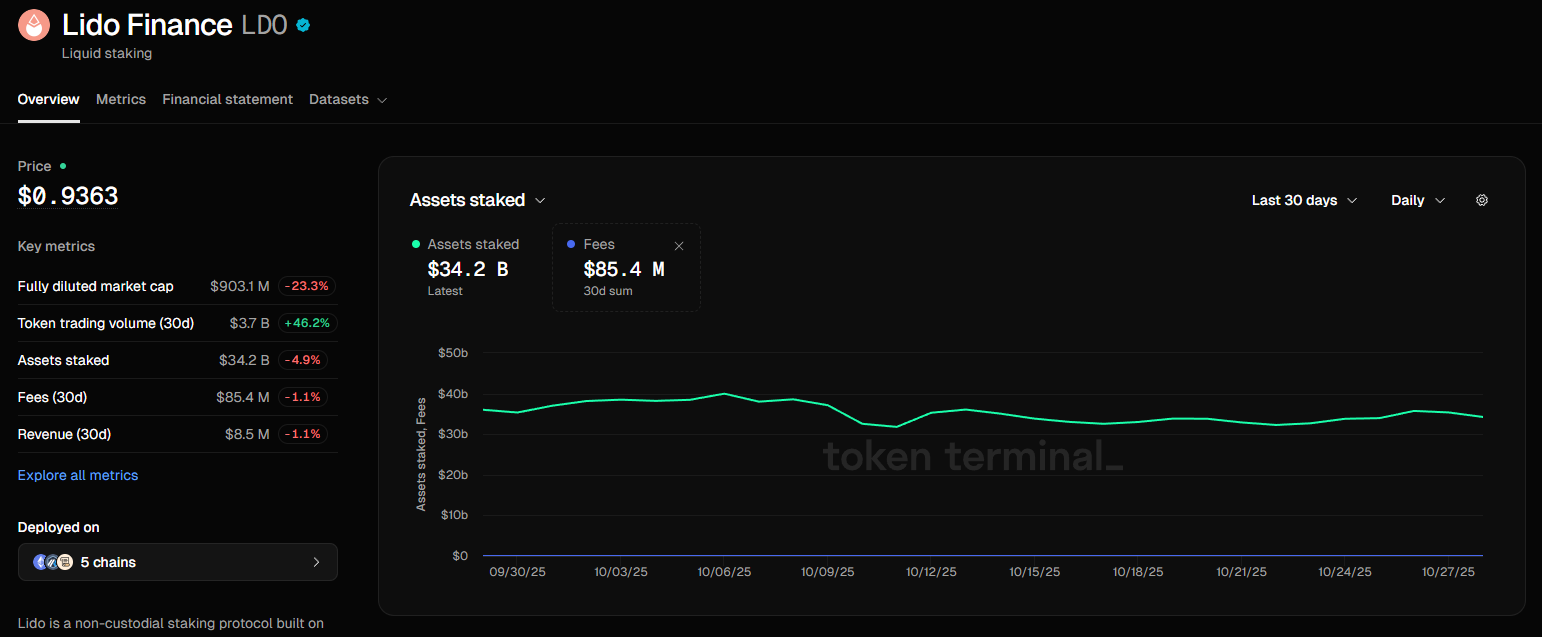

If you're already confident in DeFi and want a more detailed picture, advanced tools will come in handy. Nansen shows how major addresses are moving and where capital flows. Token Terminal This is already a fundamental analysis: income, commissions, protocol efficiency. And Messari Pro Like Bloomberg for crypto: reports, comparisons, reviews, everything for those who view the market from an institutional perspective.

"Tools like Nansen and Token Terminal allow you to not just look at the price, but understand where it comes from. This is a fundamental shift in the approach to crypto investing."

— Alexey Gromov, CTO of DeFi platform LayerOne

How to use tools for profit?

View and research MC/TVL filtering by projects via DeFiLlama and Token TerminalMarket cap and TVL are basic metrics that help understand a project's market value and the actual amount of funds locked up. Essentially, they're a fundamental metric, just like the price chart.

Source: defillama.com

Fee yield modeling — via Token Terminal and Messari

Source: tokenterminal.com

Fee yieldThis is a metric that reflects how much revenue the protocol receives from fees (e.g., exchange, lending, staking, etc.) in terms of token or capitalizationThis is analogous to a profitability indicator in traditional finance, such as earnings yield or dividend yield.

Fee yield modelingThis is an attempt to predict how the protocol's profitability will change.Tokenomics and unlock risks through Tokenomist, which allows you to estimate future unlock volumes, understand when new tokens will enter the market, and predict price pressure in advance—all of which are critical for making investment decisions.

Source: tokenomist.ai

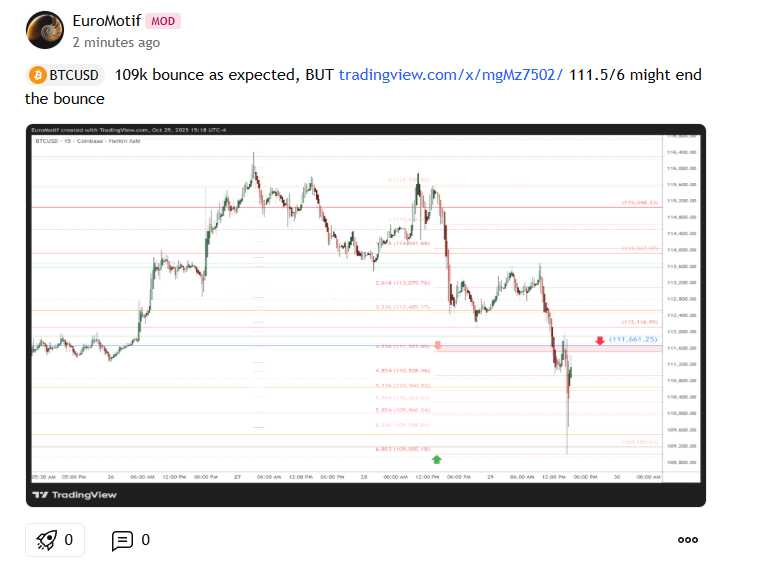

Whale activity and outflows via Nansen, mediabots and pages (WhaleAlert)

Source: x.com

Growth scenarios Through Dune and TradingView, where anyone can share their perspective: be it a price chart, on-chain activity, or metric forecast. These are platforms where analytics become public and discussed.

Source: tradeview.com

General trends 2025–2026

- Institutional shift: ETF products require transparency and the instruments become the standard.

- DeFi segmentation: protocols with provable yield receive a premium.

- Regulatory adaptation – analytics helps filter compliant assets.

How to choose your tool stack for Crypto Analysis

FAQ

1. What are the best crypto tools — from beginners to advanced? This is a set of tools covering the entire spectrum — from basic platforms such as CoinGecko and TradingView to advanced solutions such as Nansen and Token Terminal. As part of Legalbet Crypto Academy 2025, we consider them as the basis for decision-making in the market conditions of 2025–2026.

2. How do the best crypto tools—from beginners to advanced—affect the crypto market? They are setting a new standard for transparency: from on-chain data to fee yield. Thanks to such tools, investors have a better understanding of the dynamics of bitcoin, ethereum, defi, and staking, which means that the market is becoming less chaotic.

3. How to use data from the best crypto tools for analysis – from beginners to advanced? Compare TVL, market cap, unlock charts, fee yield, and address activity. This allows you to build profit and risk scenarios — this is how the crypto 2025 guide works, turning data into decisions.

4. What tools help track the best cryptocurrency tools, from beginners to advanced?For beginners CoinMarketCap, TradingView, BinanceFor advanced users DeFiLlama, TokenUnlocks, Nansen, Token TerminalIt's all part of the ecosystem.best crypto tools — from beginners to advanced explained.

5. What are the risks associated with the best crypto tools—from beginners to advanced?The main risk is misinterpretation. Without understanding tokenomics,market trends And stablecoinsEven the best tools can lead to erroneous conclusions. It's also important to keep in mind that not all platforms provide equally accurate data.

6. What do analysts say about the best crypto tools for beginners and advanced users in 2025?Analysts note that by 2025, tools will become an integral part of the strategy. As stated in Description Learn how the best crypto tools work from beginners to advanced and how to use this knowledge to make profitable decisions in 2025.

7. What mistakes do beginners make when learning the best crypto tools—from beginners to advanced?They confuse visualization with analysis. They look at charts but don't understand.blockchain- mechanic,staking- risks orTVL-structure. Also often ignoredon-chain data, relying only on price.

8. How do best crypto tools—from beginners to advanced—relate to ETFs and DeFi?Tools help filter DeFi- protocols that meet the requirements of ETF Products: transparency, profitability, sustainability. This is the key to institutional acceptance.

9. Is it possible to make money using the best crypto tools, from beginners to advanced users?Yes, if you use them systematically: build models, track fee yield, analyze unlock schedule and apply crypto 2025 guide as a basis for portfolio decisions.

10. What are the forecasts for 2026?Growth in tools integrated with AI, mining, staking And market trends Protocols with provable profitability and transparent tokenomics will be valued higher - and it is precisely best crypto tools — from beginners to advanced will help you see it first.

Subscribe and get access to the still-free crypto course from beginner to advanced investor! https://academy.gomining.com/courses/bitcoin-and-miningTelegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided «as is», all claims are verified with third-parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

November 7, 2025