Il mercato delle criptovalute è pieno di storie di breve durata. I token salgono alle stelle grazie all'hype di TikTok, si esauriscono nel giro di una settimana e non lasciano dietro di sé altro che meme e rimpianti. XRP è l'esatto contrario. Non è un giocattolo al dettaglio, non è un meme supportato da un avatar di un cane e non è un altro asset speculativo usa e getta. XRP esiste non grazie all'hype, ma nonostante la sua completa assenza. Negli ultimi anni, XRP ha:

- sopravvissuto a una delle battaglie legali più importanti nella storia delle criptovalute — Ripple vs. SEC,

- si è evoluto in una rete di pagamento a tutti gli effetti di livello infrastrutturale nota come RippleNet,

- si è inserito nella più ampia tendenza di modernizzazione dei pagamenti globali,

- è entrato in programmi pilota per le valute digitali delle banche centrali (CBDC),

- ha sopportato un lungo periodo di scetticismo istituzionale e quello che potrebbe essere definito silenzio bancario,

- eppure è rimasto saldamente nella fascia alta del mercato delle criptovalute per capitalizzazione di mercato.

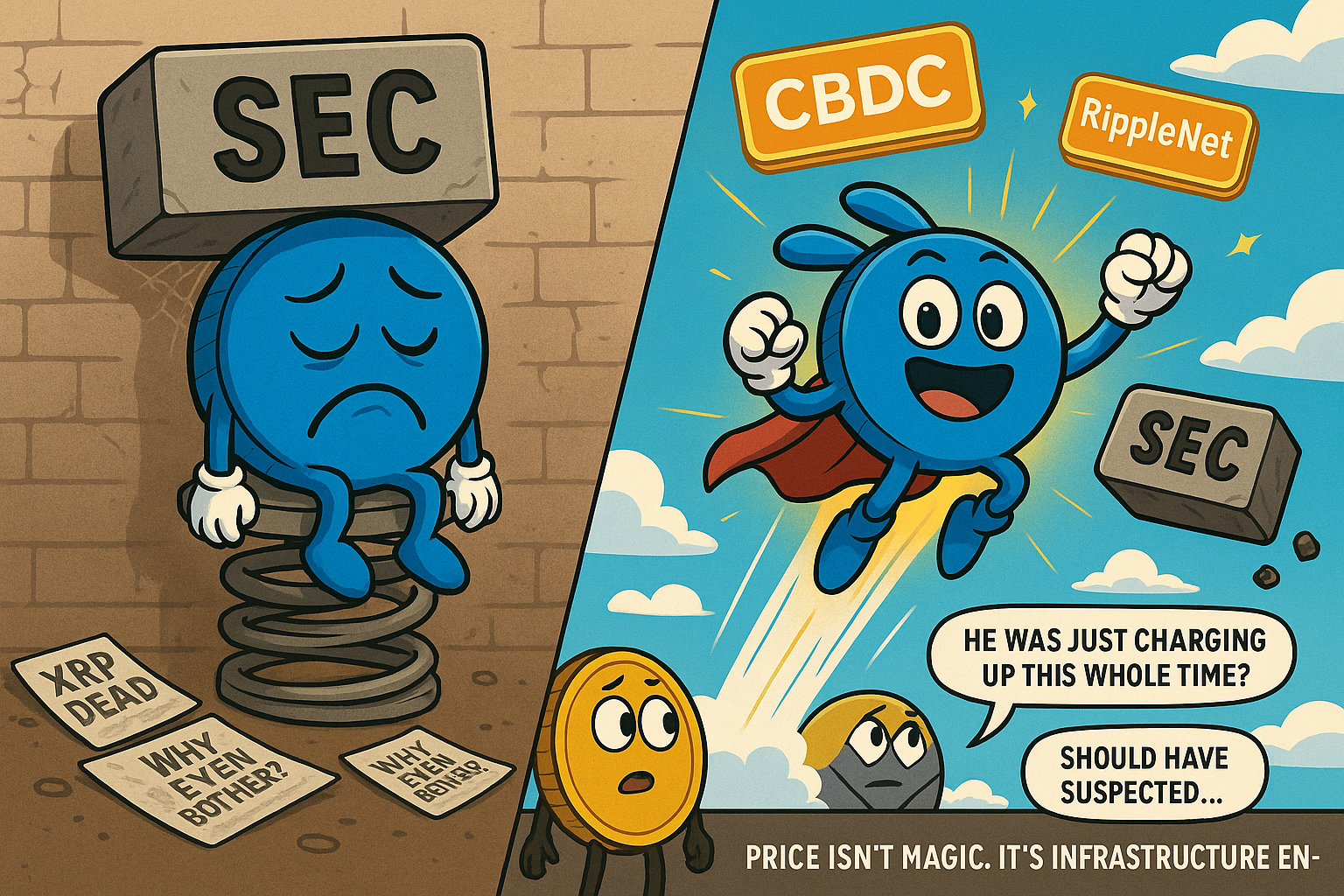

Ed ecco il punto di svolta: nel 2025, XRP ha finalmente superato il suo precedente massimo storico per la prima volta in quasi otto anni. Questo singolo evento ha eliminato il limite psicologico che impediva alle istituzioni di considerare XRP come un serio strumento finanziario. Non si è trattato di un rialzo alimentato dall'hype, ma di un segnale del mercato che il potenziale a lungo represso era stato finalmente liberato.

Fonte: GoMining.com

Molti esperti ritenevano impossibile un nuovo ATH senza la frenesia emotiva del 2017. Eppure XRP lo ha raggiunto in condizioni completamente diverse:

- una struttura di mercato matura,

- concorrenza diretta con Ethereum, Solana e i sistemi di regolamento L2,

- aumento del capitale istituzionale invece che isteria al dettaglio.

Questo è importante. Il superamento dell'ATH non è stato un picco speculativo, ma la prova della tensione accumulata, l'effetto molla compressa. Un asset che per anni è stato definito “in ritardo rispetto agli altri” può, a un certo punto, compiere una mossa che nessun altro token è strutturalmente in grado di compiere.

Questo è precisamente il motivo per cui le 5 migliori e peggiori previsioni sul prezzo dell'XRP per il 2026 coprono un intervallo così ampio, da 0,20 a 15 dollari. Non abbiamo a che fare con una semplice moneta. L'XRP è una scommessa sull'architettura finanziaria. Se Bitcoin è la forma digitale dell'oro ed Ethereum è il livello computazionale del Web3, Ripple sta cercando di diventare il gateway attraverso cui fluiscono i capitali globali, operando sullo stesso terreno che oggi controlla SWIFT.

Nello scenario in cui Ripple ha successo, XRP finisce nel posto che PayPal avrebbe dovuto raggiungere anni fa, ma non ha mai fatto.

Perché le previsioni sul prezzo di Ripple (XRP) non sono congetture

Ripple sta cercando di posizionarsi in un ambito storicamente dominato da SWIFT, Visa e dalle più grandi banche internazionali. Non si tratta di un mercato NFT in cui la popolarità va e viene con le tendenze. Qui contano i fondamentali:

- chiarezza normativa,

- integrazione con i sistemi finanziari esistenti,

- profondità di liquidità,

- velocità di regolamento,

- costi di transazione,

- fiducia istituzionale.

Ripple sta risolvendo un problema che qualsiasi imprenditore che invia denaro all'estero conosce fin troppo bene: il trasferimento di capitali oltre confine è ancora lento, frammentato e incredibilmente costoso. I bonifici bancari funzionano come reliquie degli anni '70, rattoppati con nastro adesivo di conformità e commissioni di intermediari.

Questo è il motivo per cui l'interesse per XRP è aumentato nuovamente alla fine del 2025. Le istituzioni hanno smesso di inseguire l'hype e hanno iniziato a contare i soldi. E quando il capitale reale inizia a misurare l'attrito, la latenza e il rischio di regolamento, la conversazione passa da “Qual è il prossimo meme?” a “Quali reti rimarranno quando la polvere si sarà posata?”

XRP è improvvisamente parte di quella seconda conversazione, quella più matura.

La formula che guida XRP

Il prezzo non è la causa. Il prezzo è l'ombra.

Nessuna infrastruttura → nessuna domanda → nessuna crescita

L'infrastruttura emerge → le transazioni aumentano → XRP richiesto → il prezzo segue

Questo quadro è il motivo per cui XRP attira sia i massimalisti che gli scettici. Gli uni vedono un asset che si prepara a diventare il livello sottostante della liquidità globale. Gli altri vedono un token in attesa di uno scopo.

Entrambe le parti hanno ragione. La differenza sta nel tempismo.

Metriche chiave che muovono XRP

La maggior parte dei nuovi arrivati guarda XRP e pone una domanda: " Perché sta salendo o scendendo?“ I professionisti ne fanno una diversa: ”Quale infrastruttura richiede XRP?"

Il prezzo di XRP non è determinato da tweet, influencer o meme. È determinato dai sistemi che movimentano il denaro. Quando questi sistemi adottano RippleNet, la domanda aumenta. Quando esitano, il prezzo si ferma. Di seguito sono riportati i quattro segnali fondamentali che determinano se XRP crescerà fino a diventare un livello di liquidità globale o rimarrà un relitto di ambizioni non realizzate.

RippleNet e On-Demand Liquidity (ODL) Volume delle transazioni

RippleNet non è un prototipo né un esperimento in fase di sviluppo. È una rete di pagamento completamente operativa utilizzata da banche e società finanziarie per aggirare i sistemi corrispondenti lenti. L'elemento fondamentale in questo caso è l'ODL — On-Demand Liquidity. Invece di detenere conti prefinanziati in diverse giurisdizioni, le istituzioni utilizzano l'XRP come asset ponte, riducendo drasticamente i tempi di regolamento e i requisiti di capitale.

È qui che le cose si fanno interessanti: più transazioni reali passano attraverso RippleNet, più XRP diventa una merce con uno scopo reale, non un token speculativo.

Ripple pubblica regolarmente aggiornamenti sulle transazioni e metriche di adozione. Se questi grafici salgono, la domanda istituzionale si sta formando silenziosamente sotto il radar del commercio al dettaglio: https://ripple.com/insights/

Pensateci in questo modo: ogni punto percentuale del volume dei pagamenti internazionali reindirizzato tramite ODL è una nuova domanda strutturale di XRP. Non è hype. Non è un pump. È domanda.

Tokenizzazione delle attività del mondo reale (RWA)

Se c'è una macro tendenza che ridisegnerà la finanza dal 2025 al 2030, è la tokenizzazione. BlackRock, JPMorgan, Franklin Templeton: tutte stanno digitalizzando buoni del tesoro, obbligazioni, azioni e strumenti del mercato monetario. Quale blockchain useranno questi asset per muoversi tra banche, stanze di compensazione e hub di liquidità?

Qui Ripple ha qualcosa di estremamente raro: una narrativa funzionante con attori istituzionali. L'azienda non sta proponendo “scenari da sogno”, ma sta costruendo binari per strumenti reali già regolamentati nei mercati tradizionali.

Il Nasdaq ha direttamente notato la spinta di Ripple verso l'infrastruttura di tokenizzazione: https://www.nasdaq.com/articles/ripple-pushes-into-tokenization

Se questo settore esplode, XRP cessa di essere un altcoin e diventa il vaso arterioso del movimento finanziario, non un veicolo speculativo. E a differenza della maggior parte dei sogni crypto, questo non richiede l'adozione al dettaglio, ma solo la logica bancaria.

Status giuridico negli Stati Uniti

Nessuna banca costruirà le proprie infrastrutture su un token che può essere dichiarato illegale da un giorno all'altro. Il conflitto legale pluriennale di Ripple con la SEC non è un dramma giudiziario, ma il precedente che definisce se gli asset blockchain possono esistere all'interno della finanza regolamentata.

Le istituzioni statunitensi sono allergiche all'incertezza. Non hanno bisogno di clamore, ma di conformità. Ogni sentenza che chiarisce la natura normativa di XRP elimina il rischio e apre le porte al flusso di capitali attraverso RippleNet.

Tutti i documenti ufficiali relativi al caso e gli aggiornamenti sono disponibili qui:

https://www.sec.gov/litigation

Per i trader, i grafici dei prezzi sono dei segnali. Per le istituzioni, i documenti legali sono il grafico dei prezzi. Se Ripple ottiene chiarezza, XRP passa da “tecnologia interessante” a “infrastruttura finanziaria approvata”.

Capitalizzazione di mercato e profondità di liquidità

La capitalizzazione di mercato non è un trofeo. È una misura di quanto il mercato ritiene che l'asset meriti di esistere. La liquidità è ancora più importante: una banca può entrare o uscire da XRP senza influenzare il prezzo e innescare uno slippage?

Se la liquidità è scarsa, XRP rimane un terreno di gioco speculativo. Se si approfondisce, diventa una valida alternativa ai corridoi SWIFT.

Le metriche in tempo reale sono pubbliche: https://www.coingecko.com/en/coins/xrp

Qui è possibile monitorare:

- volumi di trading nelle 24 ore,

- distribuzione dei detentori,

- performance storica rispetto a Bitcoin ed Ethereum,

- modelli di afflusso/deflusso.

La liquidità è il destino. E la curva di liquidità di XRP è l'unico indicatore affidabile di dove andrà l'adozione istituzionale.

Fonte: GoMining.com

Cosa significa tutto questo?

La maggior parte degli investitori al dettaglio guarda al prezzo. I professionisti guardano alle infrastrutture, perché il prezzo non è altro che il loro riflesso. XRP non sta salendo perché qualcuno lo spera. Sale quando le istituzioni ne hanno bisogno.

Non c'è nessuna magia:

Infrastruttura → Transazioni → Domanda di XRP → Risposta del prezzo

Ripple non vende una moneta. Vende un sostituto delle infrastrutture finanziarie e il prezzo di XRP è semplicemente l'ombra proiettata da tali infrastrutture.

Le 5 migliori previsioni sul prezzo di Ripple (XRP) per il 2026

Per comprendere le previsioni rialziste per XRP, è necessario dimenticare la logica al dettaglio dei cicli dei meme e dei pump guidati dagli influencer. Il prezzo di XRP non è determinato dalle vibrazioni, ma dalla pressione di adozione. Quando nuovi corridoi di pagamento si collegano a RippleNet, la domanda di XRP non cresce gradualmente, ma aumenta a scatti, proprio come la domanda di larghezza di banda cresce quando vengono posati nuovi cavi.

Ecco perché il prezzo odierno vicino ai 2 dollari non è un tetto massimo. È solo un preludio. Di seguito sono riportati cinque scenari realistici di rialzo, ciascuno basato su infrastrutture, regolamentazione e incentivi istituzionali, non su speranze irrealistiche.

Scenario n. 1: 10-15 dollari

La vittoria istituzionale

Questa proiezione sembra scandalosa solo se si pensa all'XRP come a una reliquia del 2017. Le banche non la vedono in questo modo. Vedono una soluzione per i pagamenti transfrontalieri che elimina i colli di bottiglia delle banche corrispondenti, un'inefficienza strutturale che costa miliardi ogni anno.

Ripple non sta proponendo fantasie. Sta già testando l'infrastruttura CBDC in giurisdizioni come Palau, Hong Kong e diversi cluster bancari APAC. Questi progetti pilota non sono semplici presentazioni concettuali, ma prove normative e tecniche per sostituire i corridoi di liquidità simili a SWIFT con binari blockchain.

Se le valute digitali delle banche centrali richiedono un asset intermediario neutrale, il cosiddetto ponte di liquidità, XRP diventa la scelta predefinita. Ethereum è troppo congestionato e costoso, USDT è centralizzato e autorizzato, e SWIFT opera a un ritmo che sembra quello dell'età della pietra finanziaria.

La ricercatrice di asset digitali Linda Jones ha sintetizzato questa idea in modo schietto:

“XRP rimane l'unico token infrastrutturale liquido in grado di operare in un ecosistema bancario senza dipendenza dalla controparte”.

In questo scenario, XRP non schizza alle stelle, ma diventa un'infrastruttura. E le infrastrutture non fanno scalpore. Fatturano ogni transazione per sempre. Questo è ciò che rappresenta un prezzo compreso tra 10 e 15 dollari: non un rialzo, ma uno strato di liquidità globale in produzione.

Scenario n. 2 — 5-7 dollari

Lo standard istituzionale senza rivoluzione

Questo è lo scenario rialzista più moderato e credibile. Non è necessaria una riprogettazione globale della finanza, ma solo chiarezza normativa e riduzione dei timori.

Nel 2024, gli analisti di Finder hanno già pubblicato obiettivi superiori a 2-4 dollari, sostenendo che la risoluzione legale della controversia tra Ripple e SEC non era la fine della storia, ma l'inizio dell'adozione istituzionale.

Se le banche smettessero di considerare XRP un rischio di conformità e iniziassero a considerarlo un livello di efficienza, non diventerebbe “il nuovo Ethereum”, ma il motore della liquidità aziendale.

A 5-7 dollari, XRP passa dall'essere una curiosità di mercato a una voce obbligatoria nei pagamenti transfrontalieri. Non è sexy. Non è appariscente. Ma è irresistibile per i direttori finanziari.

Scenario n. 3 — 3-4 dollari

Il mercato paga il suo debito storico

Questa previsione può sembrare noiosa, ma è radicata nella psicologia del mercato. XRP ha trascorso anni come moneta dalla “promessa non realizzata”, bloccata al di sotto di un ATH fissato in un'era diversa di follia crypto. Ora che l'ATH è stato finalmente superato, il capitale cerca il prossimo ritardatario con affari in sospeso.

XRP è in cima a quella lista semplicemente perché nessun altro token della sua portata è stato soppresso così a lungo con una tesi istituzionale attiva alle spalle.

Questo scenario non richiede l'adozione di CBDC, innovazioni normative o shock macroeconomici. Richiede solo la stessa cosa che ogni ciclo di mercato premia: un grande sottoperformante liquido che improvvisamente si risveglia.

Scenario n. 4 — 2

Il flatline con liquidità

Questo obiettivo di prezzo sembra quasi identico al momento attuale, ed è proprio questo il punto. Gli analisti di Kaiko Research e i trader focalizzati sulla liquidità ritengono che XRP potrebbe stabilizzarsi senza catalizzatori significativi.

RippleNet funziona, le banche sono coinvolte, le battaglie legali sono più tranquille, ma l'adozione non decolla. In questo modello, XRP non è morto, è semplicemente inattivo, in attesa che qualcuno prema l'interruttore istituzionale.

Non è un fallimento. È un'animazione sospesa.

Scenario n. 5 — 1-1,5

Calore lento senza combustione

In questo caso, la rete cresce, le partnership si espandono, ma nessun evento singolo costringe le banche a rendere XRP indispensabile. Pensatelo come un oleodotto perfettamente costruito, tranne per il fatto che la valvola non è stata ancora aperta.

Le istituzioni calibrano i sistemi su tempi geologici. Senza una scintilla aziendale o normativa, XRP striscia piuttosto che correre. Non è ribassista, è potenziale non realizzato.

Fonte: GoMining.com

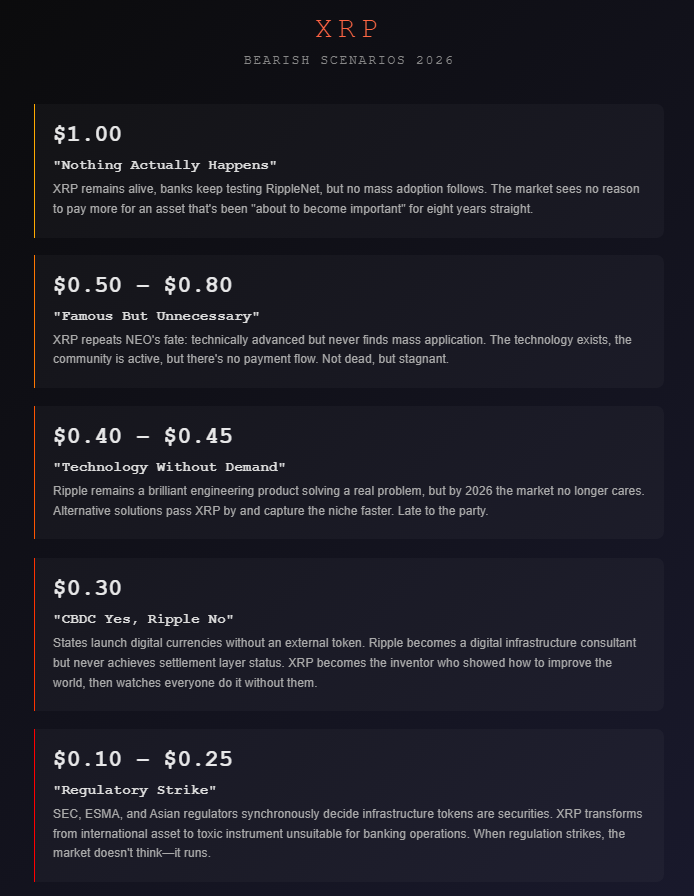

Le 5 peggiori previsioni sul prezzo di Ripple (XRP) per il 2026

Ogni asset ha non solo un sogno, ma anche un'ombra. Per XRP quell'ombra è particolarmente lunga: più alte sono le aspettative, più doloroso è ogni passo falso. Quando si parla delle 5 migliori e peggiori previsioni sul prezzo di XRP per il 2026, di solito ci si concentra sul lato positivo. Ma per comprendere davvero l'asset, è necessario esaminare anche il lato negativo. Non si tratta di profezie o risultati garantiti, ma di mappe di ciò che potrebbe accadere se la storia non andasse come vorrebbe Ripple.

Scenario - 1,00 $ (forse leggermente superiore)

“Non succede nulla”

Questo è il più blando dei risultati negativi: una delusione al rallentatore. XRP rimane molto vivo. Le banche continuano a condurre progetti pilota su RippleNet, si tengono conferenze, vengono diffusi comunicati stampa, ma l'adozione di massa non arriva mai.

In questo mondo il mercato non ottiene un mostro dei pagamenti internazionali. Ottiene invece un cantiere tecnologico: come un ponte su un fiume di provincia di cui tutti parlano, che sembra essere sempre “quasi finito”, ma che nessuno attraversa.

Gli addetti ai lavori a volte lo chiamano modalità di adozione perpetua: non un fallimento, non un successo, solo un progetto che sta sempre per decollare, ma non lo fa mai.

Il prezzo rimane più o meno nella stessa fascia in cui si trovava prima dell'ultimo grande rialzo, intorno a un dollaro. Il mercato semplicemente non vede alcun motivo per pagare di più per un asset che è stato “sul punto di diventare importante” per otto anni consecutivi.

Scenario: 0,50-0,80 dollari

“Famoso, ma non necessario”

Qui XRP ripete il destino di NEO, una moneta tecnicamente avanzata, altamente visibile, ma che non ha mai trovato un'applicazione di massa.

La tecnologia esiste, esiste una nicchia, le comunità sono attive, ma non c'è un vero flusso di pagamenti. L'asset non muore, ma si trasforma gradualmente in un oggetto da museo: tutti ricordano per cosa è stato creato, ma nessuno sa spiegare chiaramente perché sia necessario ora.

Per un investitore a lungo termine questo a volte è peggio di un crollo. Il token sopravvive, ma il capitale non cresce. Non sei rovinato, sei bloccato.

Scenario — $0,40–$0,45

“Tecnologia senza domanda”

Questo è il tipo di scenario ribassista più onesto perché non attacca l'ingegneria di Ripple, ma mette in discussione i tempi.

In questa storia, Ripple offre un prodotto brillante che risolve davvero un problema reale. Ma entro il 2026 il mercato sarà già cambiato. Soluzioni alternative per i pagamenti interbancari, dai corridoi CBDC agli stack bancari proprietari, superano semplicemente XRP e occupano più rapidamente la nicchia.

XRP diventa l'idea giusta al momento sbagliato. È l'ospite che arriva alla festa proprio quando si accendono le luci e la musica si ferma. E i mercati sono notoriamente spietati con chi arriva in ritardo.

Scenario — 0,30

“CBDC sì, Ripple no”

Questo è probabilmente lo scenario più doloroso a livello narrativo, perché mina la scommessa strategica fondamentale di Ripple.

Immaginate che gli Stati lancino le loro CBDC, ma lo facciano senza alcun token esterno nel circuito. Ripple finisce per diventare un consulente e un integratore di infrastrutture, aiutando a progettare le rotaie digitali, ma senza mai ottenere lo status di livello di regolamento.

XRP, in questo caso, diventa la storia dell'inventore che ha mostrato al mondo come risolvere un vecchio problema e poi ha visto tutti gli altri implementare la soluzione senza di lui.

In diversi documenti concettuali sulle CBDC e nelle discussioni pilota, è già possibile vedere questa tendenza: Ripple è menzionata come partner tecnologico, mentre XRP non è affatto richiesto nell'architettura. È un po' come la storia di Kodak: la tecnologia era rivoluzionaria, ma il modello di business non è riuscito a garantirle un posto nel futuro.

Scenario - 0,10-0,25 dollari

“Colpo normativo alla testa”

Questo non è più uno scenario di mercato, ma uno scenario normativo.

In questo caso, la SEC, l'ESMA europea e le principali autorità di regolamentazione asiatiche assumono una posizione coordinata e classificano i token infrastrutturali come titoli. Ripple non sembra più una rete di pagamento matura, ma si trasforma in un caso legale con un token allegato.

La storia del contenzioso Ripple contro SEC è già lunga ed estenuante. Se l'interpretazione finale di quella storia finisce per essere severa, XRP passa da asset globale a strumento tossico che le banche semplicemente non possono toccare. Non perché la tecnologia sia difettosa, ma perché nessuno è autorizzato a usarla in modo sicuro.

Quando la regolamentazione colpisce in questo modo, il mercato non sta lì a discutere di equità. Semplicemente scappa.

Fonte: GoMining.com

Cosa ci dicono realmente questi scenari ribassisti

Tutti questi percorsi riguardano meno i livelli di prezzo esatti e più il contesto. XRP non scomparirà da solo. Può svanire solo se:

- i sistemi che ha ispirato lo superano,

- le autorità di regolamentazione decidono che è ridondante

- e le banche si rendono conto che possono ottenere la stessa efficienza senza di esso.

Fino a quando ciò non accadrà, anche i numeri peggiori rimarranno stress test teorici, non casi base.

Riepilogo

Tutti questi scenari non riguardano realmente i numeri, ma il contesto. XRP non “morirà da solo”. Potrà scomparire solo se:

- i sistemi che ha contribuito a ispirare finiranno per superarlo,

- le autorità di regolamentazione decideranno collettivamente che è inutile

- e le banche si renderanno conto di poter ottenere la stessa efficienza senza di esso.

Fino a quando ciò non accadrà, anche lo scenario più pessimistico rimarrà teorico, non una realtà di mercato.

XRP non è una scommessa sull'hype. È una scommessa sul cambiamento dei corridoi finanziari tra i paesi, e la portata di tale scommessa è paragonabile non al mercato delle criptovalute, ma al sistema finanziario globale stesso.

Se Ripple si assicura l'accesso all'infrastruttura CBDC, ai binari ETF e ai flussi di regolamento transfrontalieri, XRP potrebbe diventare il primo token il cui prezzo non dipende dai trader, ma dai flussi di capitale bancario.

Se ciò non accadrà, rimarrà uno dei progetti più sottovalutati di questo decennio.

Il prezzo attuale di circa 2 dollari non è né un massimo né un ingresso perfetto. È un bivio. Da qui, XRP può:

- trasformarsi in uno strato di liquidità globale → 10-15 dollari,

- diventare uno standard di regolamento aziendale → 5-7 dollari,

- attraversare un ciclo normale e “chiudere il suo debito storico” → 3-4 dollari,

- congelarsi nella sua fascia attuale → 1,5-2 dollari,

- o scivolare gradualmente fuori dalla mappa dei token infrastrutturali fondamentali → sotto 0,50 dollari.

E il punto chiave:

XRP non sale perché “qualcuno ci crede”.

Sale quando viene effettivamente utilizzato.

FAQ

Quali sono le “5 migliori e peggiori previsioni sul prezzo di XRP per il 2026”?

Si tratta di una serie di scenari realistici per Ripple, da XRP che diventa un livello di liquidità globale a casi in cui la tecnologia perde rilevanza a causa della regolamentazione o della concorrenza.

Perché le previsioni di prezzo per XRP sono così distanti tra loro, da 0,20 $ a 15 $?

Perché XRP non dipende dall'hype, ma dall'infrastruttura. Se Ripple si collega alle CBDC e alle reti bancarie, il prezzo può aumentare notevolmente. Se le autorità di regolamentazione chiudono la porta, l'asset perde il suo scopo.

È realistico guadagnare con XRP nel 2025-2026?

Sì, se si considera XRP non come un meme, ma come una scommessa a lungo termine sui canali bancari. Il trading a breve termine è meno efficace in questo caso rispetto al DCA e al lavoro con i cicli di mercato.

Quali metriche chiave dovrei monitorare per capire dove sta andando XRP?

Tre blocchi principali:

– flussi di liquidità istituzionali (ad esempio, Kaiko),

– lo status giuridico di Ripple (SEC e altre autorità di regolamentazione),

– l'utilizzo reale di RippleNet e ODL nei corridoi di pagamento.

Perché le decisioni legali sono così importanti per XRP?

Le banche non investono in asset che potrebbero essere vietati domani. Ogni sentenza positiva nella causa Ripple contro SEC riduce il rischio normativo e apre le porte all'adozione istituzionale.

Cosa succede se le CBDC vengono lanciate senza XRP?

Allora Ripple diventerebbe un consulente infrastrutturale piuttosto che un livello di regolamento. XRP non morirebbe, ma smetterebbe di essere essenziale e il prezzo scivolerebbe verso la fascia inferiore del suo intervallo di previsione.

XRP può davvero scendere a 0,30 $ o meno?

Solo in uno scenario estremo in cui le autorità di regolamentazione lo classificano come titolo e le banche abbandonano i progetti pilota di RippleNet. Si tratta di uno scenario di stress estremo, non di una previsione di base.

Perché il nuovo ATH è così importante per le prospettive di XRP?

Perché ha rimosso la principale barriera psicologica: XRP non è più visto come una reliquia che “non tornerà mai più”. Ha sbloccato la possibilità di un nuovo posizionamento istituzionale.

XRP è davvero in competizione con Ethereum?

Non direttamente. ETH è il livello computazionale del Web3. XRP è un'infrastruttura di regolamento. Risolvono problemi diversi, motivo per cui XRP non ha un pari diretto nel segmento bancario.

Qual è il messaggio principale per un investitore?

XRP non cresce sulla fiducia. Cresce sull'utilizzo. Il prezzo non è un sogno, è una funzione di quanti cancelli finanziari Ripple riesce ad aprire.

Cosa fare dopo

Se sei arrivato fin qui, non stai più scommettendo, stai iniziando a costruire un sistema.

Salvate questo articolo come quadro di riferimento per lavorare con le 5 migliori e peggiori previsioni sul prezzo di XRP per il 2026. Tornateci tra un mese, confrontate i nuovi dati sui flussi degli ETF, il TVL, l'attività on-chain e il prezzo di XRP con gli scenari che abbiamo analizzato qui e vedete verso quale di essi si sta orientando il mercato.

Nei prossimi materiali della Crypto Academy tratteremo:

- come leggere i dati on-chain per Ethereum senza complicare eccessivamente la matematica,

- come i flussi degli ETF rimodellano i cicli di mercato,

- come lo “smart money” (balene, fondi, protocolli) crea tendenze in ETH e altri asset.

Segui la Crypto Academy e accedi al corso sulle criptovalute e sui Bitcoin: rimane gratuito mentre la maggior parte del mercato è ancora in attesa di un “ingresso perfetto”.

Telegram | Discord | Twitter (X) | Medium | Instagram

January 8, 2026