Smart contracts have become the foundation of the modern crypto industry: they power tokens, decentralized exchanges, staking, NFTs, games, DAOs, cross-chain bridges, and even certain crypto-ETF solutions. Yet, for a beginner, this often feels complicated and “too technical.” It’s important to understand one thing: a smart contract is not an abstract concept — it is a program that may contain both fair logic and hidden mechanisms that can block or drain your funds without return.

The goal of this article is to explain in simple terms what a Smart Contract is, what types exist, and how to learn to read them at a basic level and check them for safety — even if you have zero programming experience. You will get a clear checklist of what to look at, as well as tools that will help you avoid the most common scam schemes in 2025–2026.

1. What Is a Smart Contract in Simple Terms?

The idea behind smart contracts emerged long before cryptocurrencies. Back in 1994, cryptographer and legal scholar Nick Szabo introduced the concept of “digital contracts” — automated agreements executed without intermediaries. He compared them to vending machines: you insert a coin, and the mechanism delivers a drink, with no cashier and no need to “trust” the seller.

Source: fon.hum.uva.nl

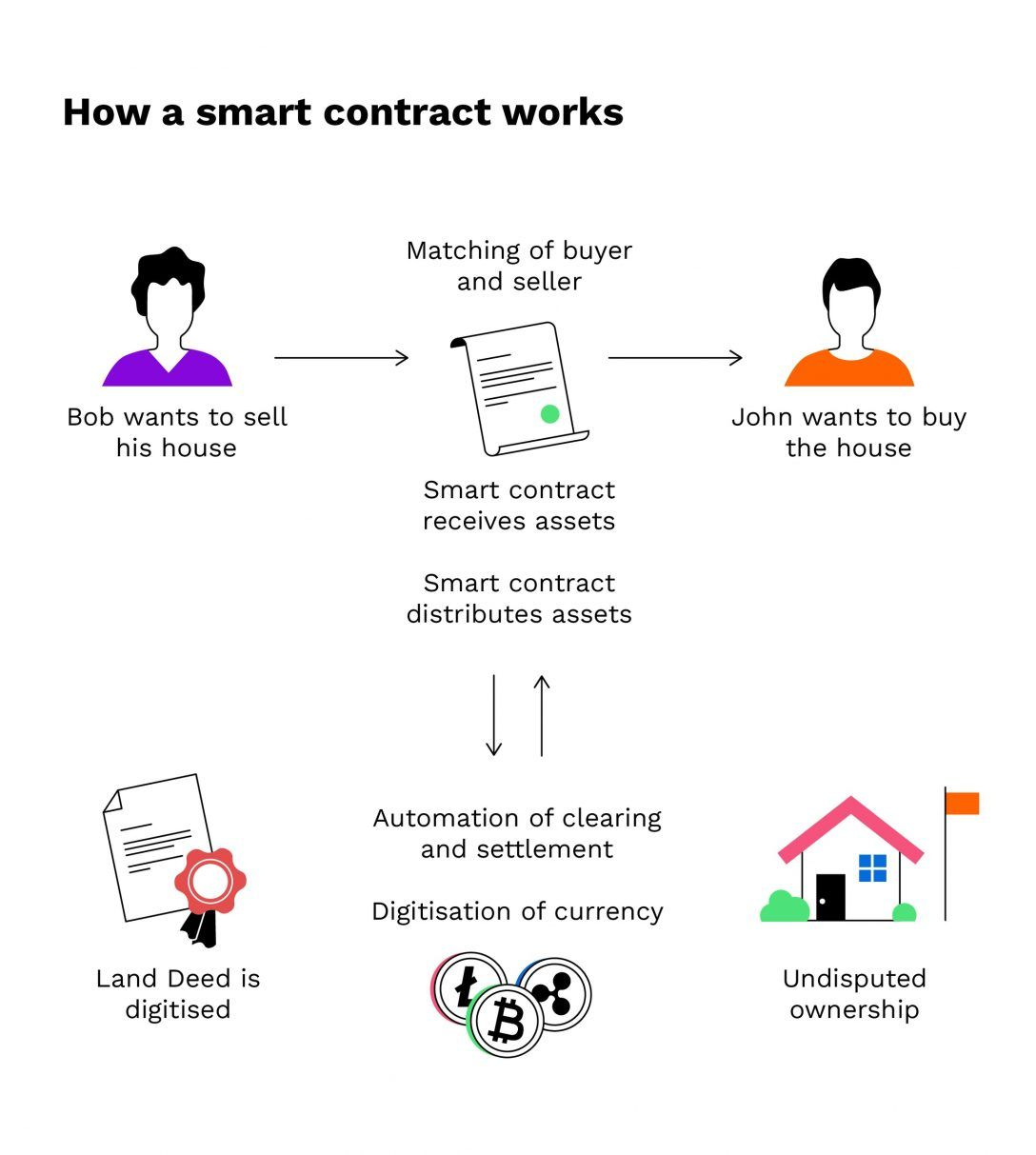

However, this idea was impossible to implement in practice — until blockchain appeared. The first network that enabled smart contracts to operate in the real world was Ethereum. In 2015, Vitalik Buterin and the Ethereum team launched a platform where these “automatic agreements” could be programmed and executed directly on-chain, without servers or middlemen.To put it as simply as possible:

A Smart Contract is a program on a blockchain that automatically executes the rules written in its code.

Once a contract is deployed to the network, changing it becomes extremely difficult: it works exactly as written in the code — not as the project “promised” in marketing. This is the foundation of trust: the rules are transparent, equal for everyone, and cannot be altered “after the fact.”

To visualize how it works, imagine the same vending machine example. There are preset conditions — you insert a coin or make a payment — and the defined action executes immediately, without human involvement. The only difference is that a smart contract deals not with drinks, but with crypto assets, digital rights, voting, or access to services.

It is important to remember: the blockchain has no “undo button” and no support team that will refund your money if you click the wrong button. If you interact with a smart contract without understanding what it does, you risk losing your funds with no possibility of reversal. This is why basic reading and checking of a contract before interacting with it is a matter of safety, not technical curiosity.

2. Where Smart Contracts Are Used in 2025

Today, smart contracts are no longer a niche technology “for developers,” but the invisible backbone of most services in the crypto world. They enable finance without banks, games without publishers, digital assets without notaries, and entire online communities without leaders.

If you have ever clicked Swap, Stake, bought an NFT, or participated in a DAO vote — you have already interacted with a smart contract, even if you didn’t know it.

Below are the most common areas of use.

2. Where Smart Contracts Are Used in 2025 (continued)

1. DeFi (Decentralized Finance)

Smart contracts enable people to lend, exchange, and invest crypto assets directly with each other — without banks or brokers. This is the foundation of DeFi, and it’s exactly how DEXs like Uniswap and staking protocols operate.

• Uniswap — https://uniswap.org

• DeFi overview on DeFiLlama — https://defillama.com

Key actions powered by smart contracts: • Token swaps (Swap) • Staking • Liquidity pools • Lending and borrowing

2. NFTs and Digital Ownership

NFTs are not “just pictures,” but unique digital assets whose ownership rules are defined by a smart contract. It determines how NFTs are created, transferred, used, and what royalties the creator receives.

• What is an NFT (Ethereum explainer): https://ethereum.org/en/nft/

In 2025, NFTs are increasingly used not only for art, but also for gaming assets, ticketing, memberships, and digital rights.

3. DAOs — Decentralized Autonomous Organizations

A DAO functions like an “online company without a CEO.” A smart contract stores the treasury, while decisions are made by member voting.

• DAO explained: https://ethereum.org/en/dao/

DAO contracts set the rules for: • how funds are spent • who has the right to vote • how decisions are approved

4. Tokens and Stablecoins

Every token is essentially a set of rules stored inside a smart contract — defining who owns the asset, how many tokens exist, whether new tokens can be issued, what fees apply, and who controls the contract.

Stablecoins like USDC, USDT, and most others across Ethereum, Solana, and other networks operate through smart contracts.

• Token structure example (ERC-20 standard): https://ethereum.org/en/developers/docs/standards/tokens/erc-20/

In other words, if you hold any token — you are interacting with this type of smart contract.

5. Blockchain Infrastructure

These contracts don’t directly manage user funds but are essential for the whole crypto ecosystem to function. Think of them as the “infrastructure services” that provide connectivity, security, and coordination.

They include:

• Oracles — deliver real-world data to the blockchain (e.g., price feeds). The leading provider is Chainlink: https://chain.link • Cross-chain bridges — enable transferring assets across different networks (e.g., LayerZero, Wormhole) • Multisig wallets — require multiple signatures to approve critical transactions. A popular solution is Gnosis Safe: https://safe.global • DAO contracts — handle treasury and governance for decentralized organizations. More about DAOs: https://ethereum.org/en/dao/

These smart contracts ensure trust, security, and coordination in ecosystems without a centralized authority.

3. Main Types of Smart Contracts

To avoid confusion, it’s helpful to divide smart contracts into four clear categories. Each of them has its own “responsibility zone” in the blockchain. If you understand the basics of these four types, you’ll already be able to navigate around 80% of the smart contracts an average user encounters.

1. Token Contracts (e.g., ERC-20)

This is the most common type of smart contract. It defines the rules for how a cryptocurrency token works on a network — essentially, the “constitution” of that asset.

A token contract sets: • how many tokens exist (total supply) • who owns them (balances of addresses) • whether new tokens can be created (mint) or destroyed (burn) • whether transfer fees apply • who controls the contract and its settings

The ERC-20 standard created for Ethereum became the global foundation for most altcoins and stablecoins.

Official ERC-20 documentation: https://ethereum.org/en/developers/docs/standards/tokens/erc-20/

In other words, if you hold any token — you are interacting with this type of smart contract.

2. NFT Contracts (ERC-721 and ERC-1155)

If ERC-20 describes “regular coins,” NFT contracts define the rules for unique digital items — art, music, in-game assets, tickets, certificates, etc.

The difference between the two dominant standards:

• ERC-721 — every token is unique (one item = one NFT)• ERC-1155 — allows issuing both unique NFTs and semi-fungible items (e.g., 1,000 identical gaming items)

Official NFT explanation from Ethereum: https://ethereum.org/en/nft/

An NFT contract defines: • what the asset is • who owns it • how it can be transferred • what royalties the creator receives on resale

3. DeFi Contracts

These are contracts that manage users’ funds. They form the core of Decentralized Finance (DeFi) — an ecosystem where people can exchange, invest, borrow, and lend without banks or intermediaries.

Typical examples of DeFi contracts: • DEX (decentralized exchanges), e.g., Uniswap: https://uniswap.org • Liquidity pools — where users provide assets to earn yields • Staking and farming • Lending and borrowing (e.g., Aave, Compound)

DeFi is where most hacks and scams occur — because it holds user funds and protocol liquidity.

Useful resources to monitor DeFi safety and metrics:• DeFiLlama (TVL and protocol analytics): https://defillama.com• Token Terminal (revenue and metrics): https://tokenterminal.com/explorer

4. Infrastructure Contracts

These contracts don’t handle your funds directly, but without them the blockchain ecosystem would not function. They act as the “technical backbone” — enabling cross-chain communication, governance, data flow, and security.

They include:

• Oracles — bring external data to the blockchain (e.g., prices). Leading provider: Chainlink — https://chain.link • Bridges — transfer crypto assets across chains (e.g., LayerZero, Wormhole) • Multisig contracts — require multiple confirmations to approve a transaction. Widely used solution: Gnosis Safe — https://safe.global • DAO contracts — govern the treasury and decision-making of decentralized organizations. More on DAOs: https://ethereum.org/en/dao/

4. How to Read a Smart Contract If You’ve Never Seen Code Before

Understanding how smart contracts work is accessible to anyone — even without programming knowledge. The key is knowing where to look and what to pay attention to. Your main entry point will be blockchain explorers, which act as a public registry of all transactions and contract code.

To begin, you will need several specialized online services that provide interfaces for interacting with blockchain data and reviewing contracts:

- Etherscan (Ethereum): the primary explorer for the largest smart-contract network. https://etherscan.io

- BscScan (BNB Chain): the equivalent explorer for the BNB Chain ecosystem. https://bscscan.com

- Honeypot.is (Honeypot check): a tool that simulates buying and selling a token to determine if it is a “honeypot” — a token you can buy but cannot sell. https://honeypot.is

- Token Sniffer (Risk scan): an automatic code-analysis service that detects potential risks and similarities to known scam patterns. https://tokensniffer.com

By following these steps, you can get a basic understanding of any token and its contract:

Opening a Contract in a Blockchain Explorer

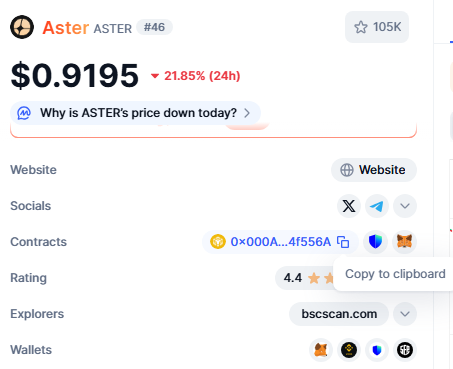

First, you need to find the smart contract address of the token you want to check (usually available on CoinMarketCap, CoinGecko, or the official project website).

• Paste the address into the search bar of the appropriate explorer (Etherscan, BscScan, etc.):

Source: coinmarketcap.com

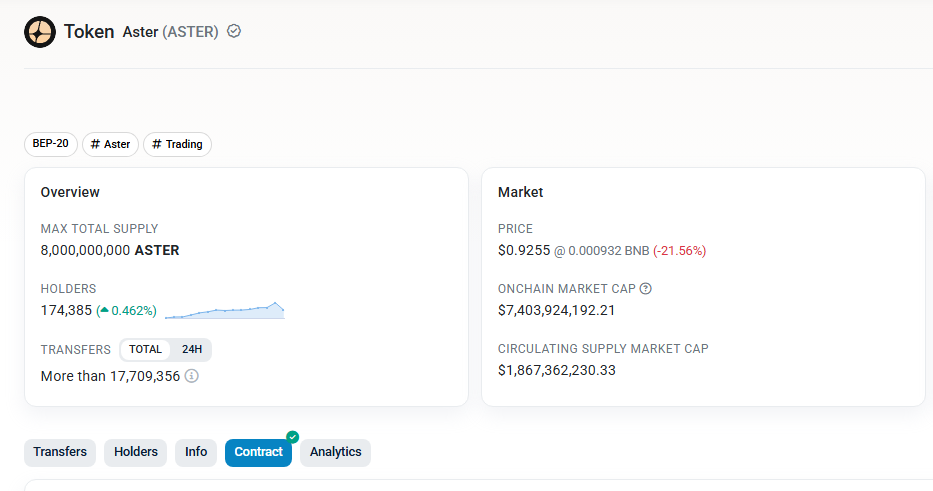

Example token address page: https://bscscan.com/token/0x000Ae314E2A2172a039B26378814C252734f556A

Source: bscscan.com

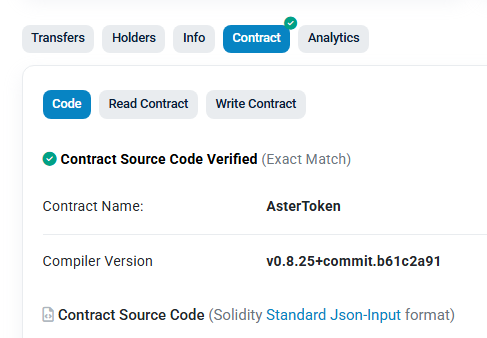

Go to the “Contract” Tab

Once you open the token page, find and switch to the “Contract” tab. This is where the underlying code and interaction interface are stored.

Check Code Verification

Make sure the contract code is verified (you will see a green checkmark or “Contract Source Code Verified”):

Source: bscscan.com

What this means:Developers have submitted and published the source code that was compiled into the bytecode deployed on-chain. If the code is not verified, you only see unreadable bytecode — a major red flag, as there is no way to review how it works.

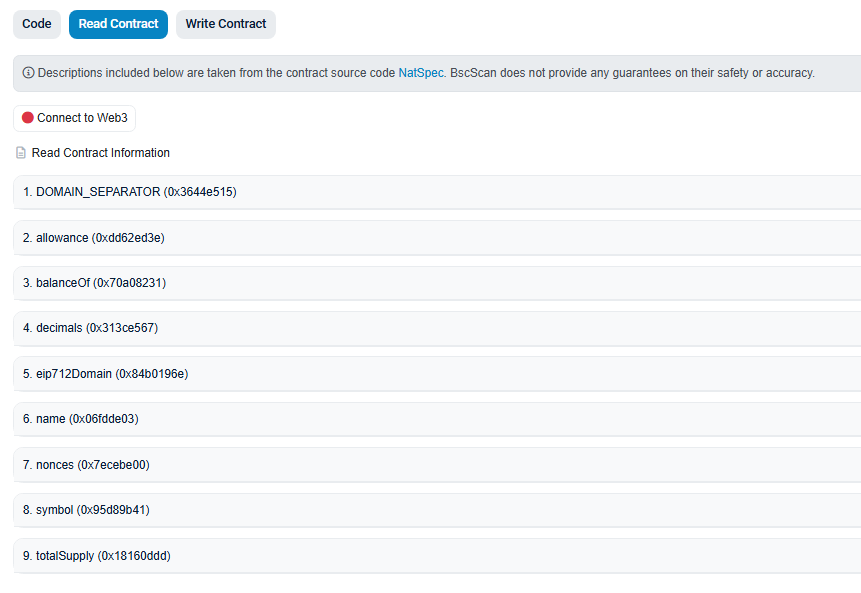

Explore the “Read Contract” Section

This tab displays public variables and functions you can view without executing a transaction.

Source: bscscan.com

What to pay attention to: • totalSupply — total number of tokens • balanceOf — balance of any address (you can paste a wallet address) • name and symbol — token name and ticker • owner — this one is critical — shows which address controls the contract

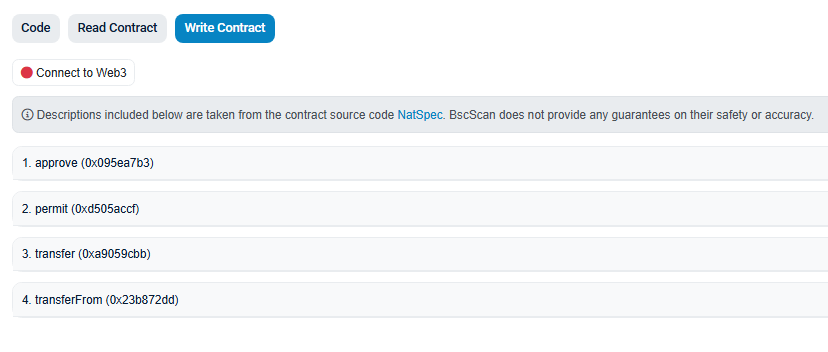

Explore the “Write Contract” Section

This tab lists functions that can change data on-chain — meaning they require a transaction (for example, transfers or burning tokens).

Source: bscscan.com

What to look for:

• Owner-related functions — look for functions like: setTaxes, setMinters, setBlacklist, mint. If present, it means the owner has high-risk privileged control — a sign of centralization.

• transfer / transferFrom — standard token transfer functions.

• To use these functions, you must connect your wallet (e.g., MetaMask).

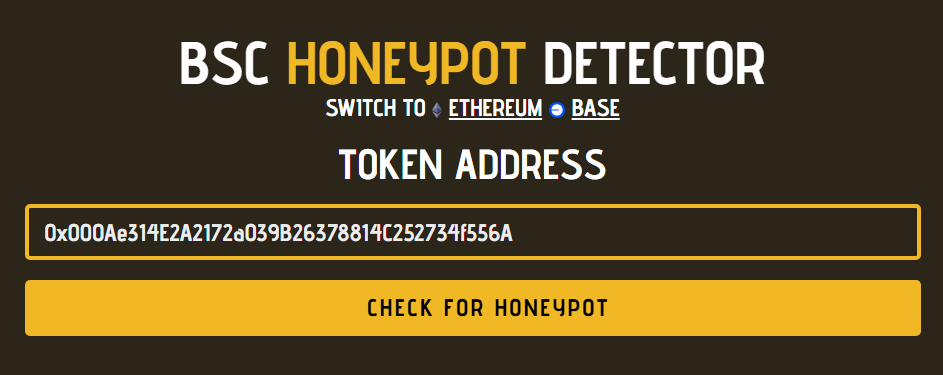

Check for a Honeypot

This is one of the most important steps to protect your funds:

• Go to: https://honeypot.is• Paste the token contract address

Source: honeypot.is

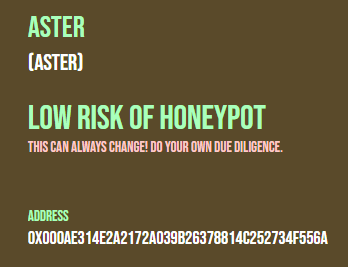

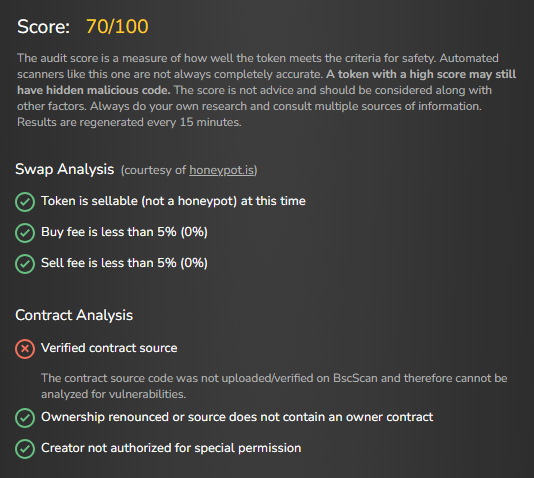

Result:The tool will show if the token can be successfully sold. If selling fails due to hidden code restrictions — it’s a honeypot, a scam:

Source: honeypot.is

Additional Scan With Token Sniffer

• Go to: https://tokensniffer.com• Paste the contract address

Source: tokensniffer.com

Token Sniffer will analyze the code and assign a score (e.g., 40/100), highlighting detected risky functions (high taxes, trading freeze, liquidity control).A low score = serious warning.

Key Takeaways

✔ Verified Code — always check this. Unverified code = blind trust = high risk. ✔ Owner Privileges — if the owner can change fees, mint new tokens, or blacklist addresses — the risk is high. ✔ Honeypot Test — if a token fails on Honeypot.is, do not buy it. Guaranteed loss.

In the blockchain world, trust must be replaced with verification. Using these tools, you can make safer decisions even without being a programmer.

5. Where to Look for Dangerous Elements in the Code

Below are the types of functions most commonly used in scam contracts. If you detect any of these — treat the project with extreme caution.

1) Full Owner Control of the Contract

If the owner has the ability to change fees, block users, or mint new tokens — this is a major risk.

Example code:

function setTax(uint256 _newFee) public onlyOwner

function blacklist(address _user) public onlyOwner

function mint(uint256 amount) public onlyOwner

function pause() public onlyOwner

Such functions allow the owner to instantly raise fees to 90%, freeze withdrawals, or “mint” tokens for themselves — crashing the price and draining liquidity.

2) Blacklists and Freezing of Trading

If the contract allows restricting operations for specific addresses, the owner can block selling of the token.

function blacklist(address _user) public onlyOwner

function setTrading(bool _enabled) public onlyOwner

This is often used for market manipulation — preventing holders from selling while the team exits liquidity.

3) Honeypot (You Can Buy, But Cannot Sell)

These tokens appear fully functional but when attempting to sell, the transaction fails — or a 99% tax is applied.

This can be checked in 5 seconds using: https://honeypot.is

4) Hidden Token Drain Through “Approve”

Some contracts abuse the Approve mechanism to gain full access to your tokens.

Approve is a transaction you sign (paying gas) to give another contract or address permission to spend a specific amount of your tokens on your behalf — for example, when using a DEX, liquidity pool, or NFT marketplace.

Example: You want to swap 1,000 ABC tokens on Uniswap. Before Uniswap can take those tokens and give you another asset, you must approve Uniswap to spend your ABC.

The problem arises when you grant approval to a malicious or unsafe contract.

1. Requesting Full Access (Infinite Approval)

Instead of requesting permission for $100 or a specific token amount, many contracts default to requesting approval for the maximum possible amount (often shown as a huge number like 2²⁵⁶ − 1 — effectively infinite).

Consequence: You are granting that contract full and unlimited access to all tokens of that type — both current and future.

2. “Stealth Drain” Scenario

If you grant unlimited approval to a malicious contract, it can later execute a transferFrom function and move all your tokens to the scammer’s wallet — at any moment, without warning.

This can happen days, weeks, or even months after your initial approval — long after you forgot you interacted with that contract.

If you have ever granted unlimited approval to a suspicious or inactive contract, you should revoke it. This requires a small gas fee.

Tools to revoke approvals:

Etherscan Token Approval Checker (Ethereum):Shows all active approvals you’ve granted and lets you revoke them:https://etherscan.io/tokenapprovalchecker

Revoke.cash or Approved.zone:User-friendly tools to check approvals across many networks and revoke risky permissions:https://revoke.cashhttp://approved.zone

Always check who you are granting approval to — and for how much.

6. How to Understand in 60 Seconds Whether a Contract Is Trustworthy

A quick checklist:

✔ The contract is verified✔ The owner does not have excessive control rights✔ Fees cannot be changed to extreme levels✔ The token is not a honeypot✔ Liquidity cannot be instantly withdrawn

If even one of these points raises concerns — the risk is high.

7. Why It’s Important to Check Smart Contracts

Carelessness may lead to:

• funds being frozen • inability to sell a token • token balance being drained • liquidity being pulled by the developer • losing access to your assets

The most common scams include: honeypots, rug pulls, hidden mint, hidden fees, owner privilege abuse, Approve-drain contracts.

8. Can You Make Money by Understanding Smart Contracts?

Yes — even basic knowledge gives you an advantage:

• choosing safer projects for staking and DeFi • offering surface-level contract reviews for friends or clients • selecting promising tokens early that have transparent, fair logic • understanding when the risk is not worth it — and where the upside potential is higher

9. FAQ

What is a smart contract in simple terms? It’s a program on a blockchain that automatically executes the rules written in it.

Why should I read a smart contract? To avoid losing funds and to understand what will happen when you click “Approve” or “Stake.”

Do I need to be a developer to read a contract? No. The basic checks described above are enough for an initial evaluation.

What mistakes do beginners make? They trust contracts without checking them, grant “Approve for all,” ignore the owner’s privileges, and don’t check for honeypots.

Conclusion

Smart contracts are not a “scary technical topic,” but rather the logic that controls your money in crypto. If you understand the basic principles, know how to check a contract, review the owner’s permissions, and identify key risks — you are already far more protected than the average newcomer. It only takes 5–10 minutes of checking to avoid losing your funds.

To build a strong foundation, start with the basics: subscribe to Crypto Academy and get access to the free course “From Zero to Advanced Crypto Investor” → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

November 7, 2025