Exposure (Risk Level) — This is the total size of your long (buy) or short (sell) position.

Simply put, it is how «open» you are in the market for a particular asset. For example, if you bought $1,000 worth of shares, your exposure to that asset is $1,000.

Source: GoMining.com

Types of exposure

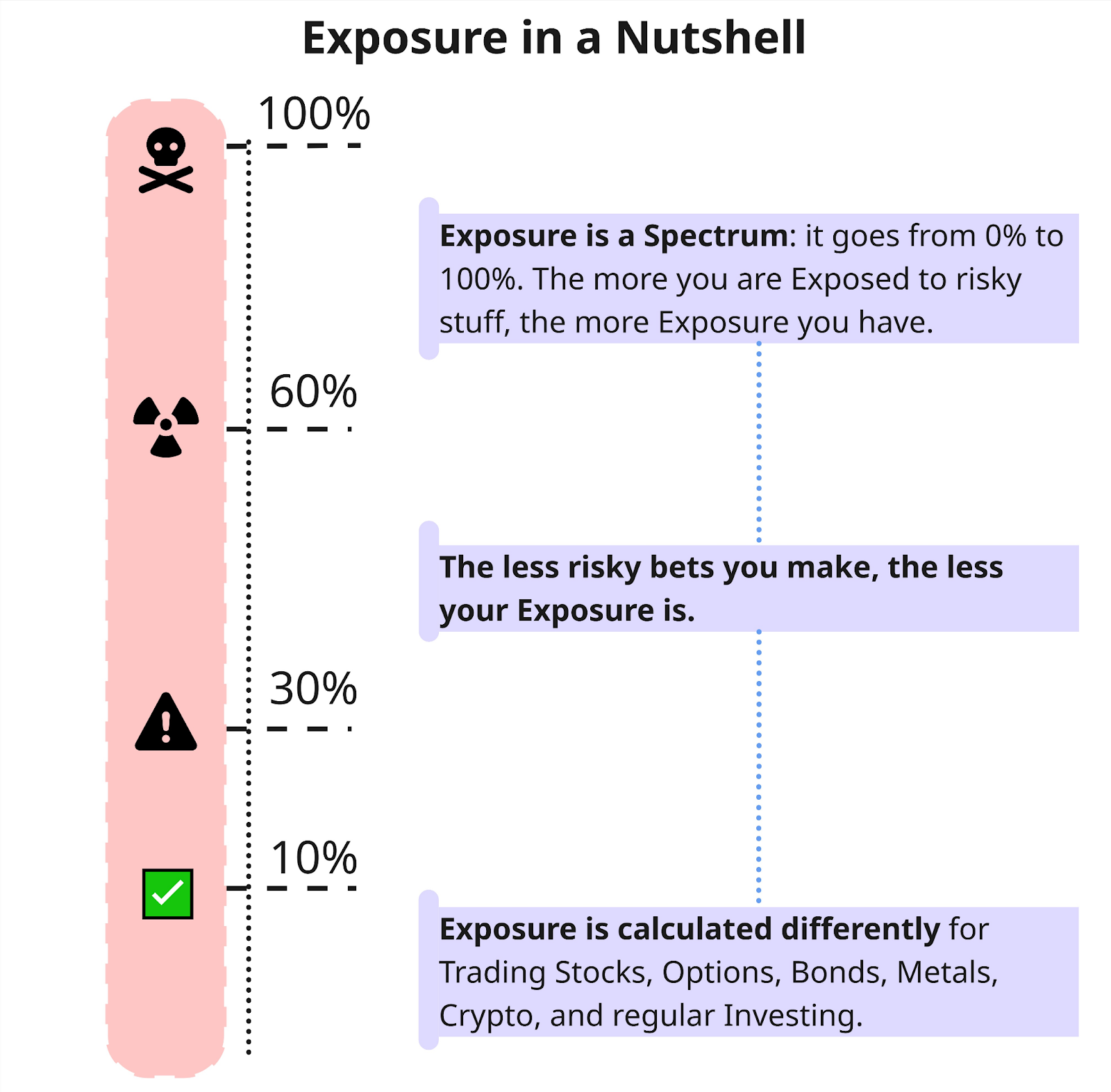

Exposure varies and is not always obvious. Understanding its types helps to assess risks more accurately and not overestimate the degree of portfolio diversification.

1. Long exposure. Occurs when an asset is purchased. In this case, the portfolio gains from price increases and loses from price decreases.

2. Short exposure. Occurs when an asset is sold short — here the risk is in the opposite direction, and losses occur when prices rise.

In addition to direction, it is important to consider the scale of the risk.

1. Gross exposure. Shows the total volume of all open positions, regardless of direction.

2. Net exposure. Reflects the difference between longs and shorts and helps to understand in which direction the portfolio as a whole depends on the market.

Even with shorts, the risk can remain high if the gross exposure is large.

How exposure differs from profit and loss

Exposure is neither profit nor loss. It is an indicator of the scale of risk.

Profit and loss depend on how much the price of an asset has changed. Exposure, on the other hand, shows how much this price affects the overall result. The greater the exposure, the stronger any market movement will affect the result.

That is why exposure management is considered a basic element of risk control.

Exposure as a basic element of risk management

Exposure is one of the key indicators of risk management. It shows how much capital is actually dependent on market movements at a given moment.

It is important to note that portfolio exposure can change over time even without opening new trades. When the price of an individual asset rises, its share increases and it begins to have a greater impact on the overall result.

In such situations, risk becomes more concentrated and the portfolio becomes less balanced. Regular exposure assessment helps to identify such imbalances in a timely manner and maintain control over risks.

Exposure and leverage

When using leverage, exposure can significantly exceed the amount of own funds. This is often misleading: the deposit appears small, but the market actually affects a much larger amount of capital.

For example, with 5× leverage, a position of $5,000 creates exposure for that amount, even if only $1,000 of your own funds are invested. In such conditions, even a small price movement can significantly affect the outcome of the trade.

Therefore, when working with leverage, it is important to assess the actual exposure rather than the size of the deposit.

Hidden exposure

Hidden exposure occurs when the risk is not obvious at first glance. This may be due to high asset correlation, dependence on a single market, or the use of derivative instruments.

Most often, such exposure manifests itself in moments of sharp volatility, when several positions simultaneously begin to move against expectations. It is in such situations that a portfolio may show unexpected drawdowns.

Understanding hidden exposure helps to identify vulnerabilities in advance.

Exposure and market volatility

When volatility is high, even moderate exposure can lead to significant fluctuations in results. During such periods, the impact of position size increases and errors in risk management become more noticeable.

Exposure control allows you to adapt to changing market conditions and avoid excessive risk concentration during unstable periods.

Total portfolio exposure

Exposure can be considered not only for a single position, but also for the entire portfolio. If several assets depend on the same market factor, the actual exposure may be higher than it seems at first glance.

For example, positions in different altcoins often have a high correlation with Bitcoin. Formally, there are several assets, but the real exposure may be concentrated in one market direction.

Assessing aggregate exposure helps to understand how vulnerable the portfolio is to sharp market movements.

Why it is important to control exposure

Exposure is directly related to risk. An overly large position in a single asset can lead to significant losses even with a small price movement.

Controlling exposure allows you to:

1. Limit the impact of a single trade on your entire portfolio;

2. Reduce the risk of sharp drawdowns;

3. Better understand where the risk is concentrated.

Common mistakes when working with exposure

One common mistake is to assess risk based solely on the number of positions rather than their total exposure. Several small trades can create greater risk than one large trade if they depend on a single factor.

Another mistake is not reviewing exposure over time. As prices rise, an asset can take up a larger share of the portfolio, even if no new trades have been opened.

Regular exposure assessment helps to keep risks under control.

In conclusion

Exposure is a basic concept in trading and portfolio management. It shows how much capital is currently exposed to the market, regardless of the direction of the trade.

Understanding and controlling exposure helps to assess risks, especially when using leverage and working with multiple assets. It is one of the key tools that allows you to maintain control over your portfolio in a volatile market.

Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-miningNFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided «as is», all claims are verified with third-parties, credible sources and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited. Use of content for AI citations is allowed only with explicit links to the original article being quoted on GoMining.com website. Telegram | Discord | Twitter (X) | Medium | Instagram

January 5, 2026