Monthly Market Update – August 2025: Consolidation Amid Favourable Policy Shifts and Market Volatility

August has been a month of milestones and shifting dynamics across Bitcoin markets and mining. President Trump’s executive order opened the $8.7 trillion 401(k) system to Bitcoin, potentially unlocking one of the largest inflows of retirement capital into digital assets. At the same time, ETF outflows, Fed signals, and whale moves stirred volatility, while corporate treasuries like Strategy continued to demonstrate long-term conviction with five years of consistent accumulation. On the mining side, network hashrate consolidated just below record highs, but miner revenues faltered as hashprice was rejected at $60/PH/day and transaction fees offered no relief. Meanwhile, Proto -the ASIC division of Jack Dorsey’s Block- entered the hardware race with a bold rethinking of miner design, challenging the industry’s reliance on disposable cycles.

Trump Opens the 401(k) Floodgates for Bitcoin

On August 7th, President Trump signed an executive order authorizing Americans to allocate a portion of their 401(k) retirement savings into Bitcoin and other digital assets. The directive instructs the Labor Department and related agencies to expand the definition of what qualifies as a “permissible asset” within retirement plans. By doing so, the White House has effectively unlocked the $8.7 trillion 401(k) system for tax-deferred Bitcoin exposure, a development that could permanently reshape the relationship between retirement savings and digital assets.

Up until now, fiduciary constraints and federal regulatory interpretations have kept Bitcoin largely out of employer-sponsored retirement accounts. This order removes those barriers, making it possible for millions of American workers to gain exposure to Bitcoin through their existing 401(k) structures. For investors, this means direct access to BTC within a tax-advantaged account, bypassing the friction of self-directed IRAs or brokerage workarounds. For the broader market, it represents one of the largest potential inflows of capital ever opened to Bitcoin.

The implications are profound. At a minimum, this change amplifies the role of spot ETFs by providing a direct channel for retirement plans to allocate capital into them. Beyond ETFs, it redefines what constitutes a “safe” retirement portfolio in the eyes of regulators, employers, and Wall Street. This may prove more impactful for Bitcoin’s long-term trajectory than a typical market cycle., as this potentially opens access to trillions in retirement wealth for Bitcoin.

ETF Outflows, Fed Signals, and Whale Moves

Bitcoin’s Spot ETF market opened August with turbulence, recording the second-largest daily outflow in history, $812.3 million on August 1. This sell-off briefly pushed BTC below $112,000. The market, however, rebounded after President Trump’s executive order allowing Americans to allocate 401(k) retirement funds into Bitcoin and other digital assets. Renewed ETF inflows lifted Assets Under Management (AUM) back above $150 billion. Bitcoin marked a new all-time high of around $124,500 on August 14 only to drop down to $117,000 the next day in a sharp pullback that unsettled markets.

One week later, Bitcoin saw another rally after the Federal Reserve hinted at possible interest rate cuts, climbing from under $112,000 to above $117,000. The move proved short-lived as BTC lost momentum again, this time falling below $110,000 as profit-taking intensified. Large holders used these levels to exit positions, with one whale offloading 24,000 BTC (worth $2.7 billion) in a single weekend transaction, triggering a $4,000 price drop. That same entity still controls 152,874 BTC, valued at over $17 billion.

From a technical perspective, Bitcoin ended August within a price range that has repeatedly acted as resistance over the past year. Turning this band into support would be a strong bullish signal.BTC began August near $113,000 and around $108,000, a 3.8% decline.

BTC Price Testing an Area of Previous Resistance (Source: TradingView).

Strategy Marks Five Years of Bitcoin Accumulation

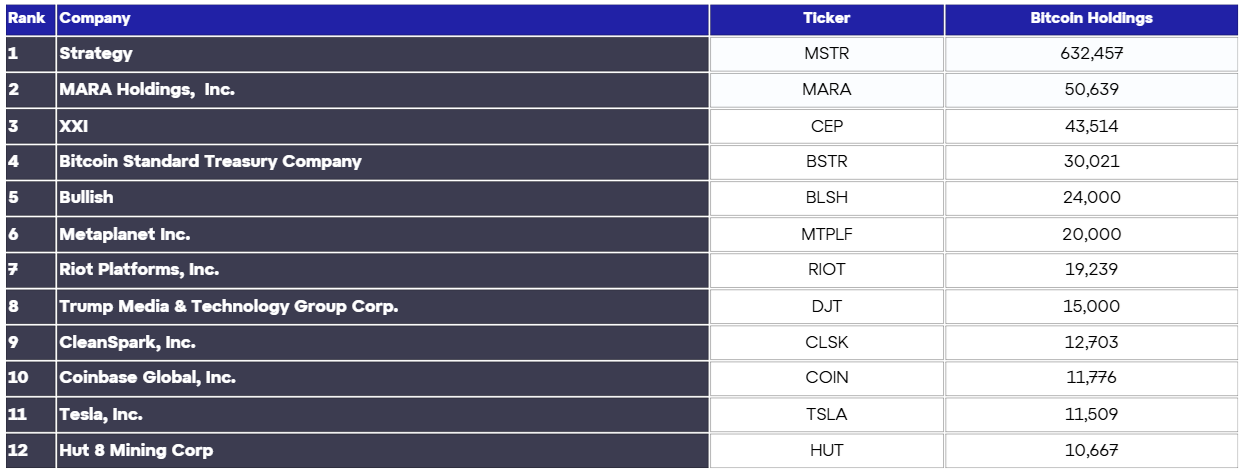

August marked five years since Strategy made its first Bitcoin purchase. Today, the company holds 632,457 BTC—around 3% of the total Bitcoin supply—cementing its position as the dominant player among the 152 public companies with Bitcoin treasuries. In fact, public firms collectively hold 989,107 BTC, of which nearly two-thirds (64%) sits on Strategy’s balance sheet.

On August 25, Strategy Inc. (NASDAQ: MSTR) announced the acquisition of an additional $357 million in Bitcoin, lifting its total holdings to roughly $70 billion at current market prices. The purchase was financed through the sale of common stock—the first such issuance in nearly a month—alongside proceeds from its SRTK, STRF, and STRD preferred stock offerings. These preferred instruments raised approximately $47 million but carry associated dividend obligations and other commitments.

The move comes shortly after Strategy signaled a revision of its newly implemented equity issuance policy, which had restricted the company from selling common stock when its shares traded below a set valuation. The adjustment provides the firm with greater flexibility to raise capital for ongoing Bitcoin accumulation.

Public Traded Companies Holding over 10,000 BTC (Source: Bitcointreasuries).

Hashrate Sets Another Record High

Bitcoin’s network hashrate opened the month with a new all-time high of 969 EH/s before a sharp correction pulled the 7-day average below 900 EH/s. The rebound that followed fell short of setting another record, and the network hashrate consolidated for 10 days before hitting a new record high of 981 EH/s at the closure of the month. between. With U.S. summer curtailment programs winding down, the network looks well-positioned for another push higher into the 1,000 EH/s (1 Zeta Hash).

Hashrate Continues to be Volatile (Source: Lincoin Lens)

Miner Revenues Rejected at $60 Hashprice

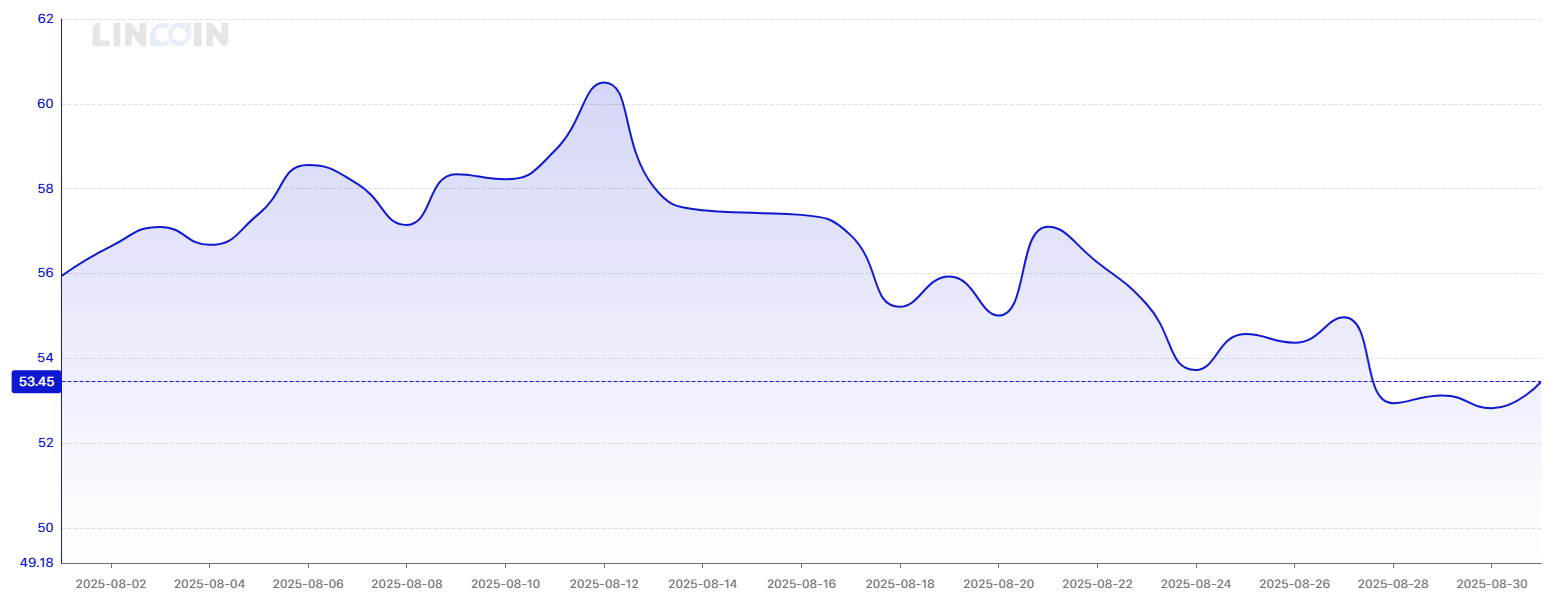

The combination of sliding BTC prices and two modest difficulty increases (+1.42% and +0.20%) kept miner earnings under pressure in the second half of August. Hashprice briefly recovered above $60/PH/day but was quickly rejected, tracking Bitcoin’s downward move. By month-end, hashprice closed at $53/PH/day, marking a 5.4% decline compared to July.

Hashprice Declined 3$/PH/Day MoM (Source: Lincoin Lens)

Transaction Fees Did Not Offer Relief

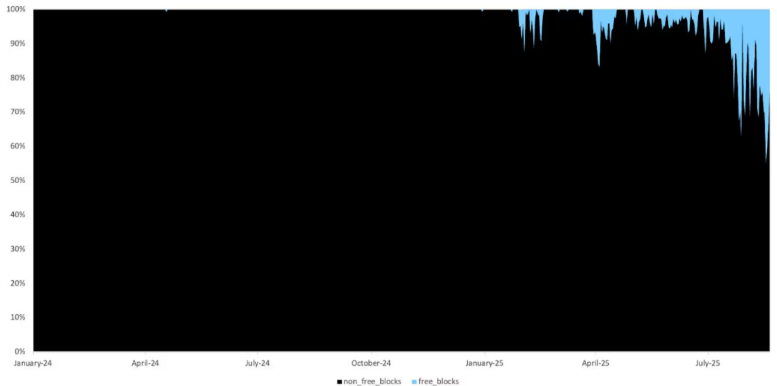

According to research article by Galaxy the median daily fees have plunged over 80% since April 2024, fueling the rise of “free blocks” (1 sat/vbyte or less). Once rare, these now represent a meaningful share of daily production, underscoring weak competition for blockspace. Nearly half of blocks don’t reach full capacity, and most pending transactions clear instantly at minimal cost. While this benefits users with cheap UTXO consolidation and low-cost transfers, it erodes miners’ long-term incentives.

Part of the demand shortfall comes from shifting user behaviour. ETFs and derivatives reduce onchain settlement, while speculative flows—memecoins, NFTs—are migrating to faster, cheaper chains such as Solana. If this structural shift persists, Bitcoin could increasingly serve as a settlement layer without sufficient settlement demand to sustain miners.

Increasing Percentage of Free Blocks in 2025 (Source: Galaxy Research).

Proto: Redefining Bitcoin Mining Hardware

On August 14, Proto—the ASIC division of Jack Dorsey’s Block—introduced Rig. This modular Bitcoin mining system was unveiled at Core Scientific's facility in Georgia. The launch marks a departure from the industry’s entrenched three-year cycle of disposable hardware. Instead of scrapping entire units, Proto is betting on durability and modularity, enabling miners to treat rigs as long-term infrastructure.

At 819 TH/s, Rig is the most powerful air-cooled miner available today, second overall only to Bitmain’s hydro-cooled S21e XP Hyd (860 TH/s). Its 14.1 J/TH efficiency makes it the second most efficient air-cooled system on the market, trailing Bitmain’s S21 XP (13.5 J/TH). Each machine consumes 12,000W through three 4,000-watt PSUs—fanless and cooled by board airflow. Out of the box, Rig is immersion-ready.

Its nine modular 3nm hashboards are designed to be swapped rather than scrapped. Different generations of hashboards can coexist in a single chassis, meaning miners can upgrade incrementally instead of replacing entire fleets. Tool-free fan and hashboard replacements take less than 90 seconds, minimizing downtime and preventing costly revenue losses. Even the PSU and control board are field-repairable, while dynamic diagnostics and predictive maintenance streamline operations further. At 9.4 kW per foot, Rig is the most space efficient air-cooled miner in the market.

In a multi-billion-dollar market long dominated by Bitmain (~75% share), Proto’s Rig represents real competition. With MicroBT gaining traction, Canaan reviving demand, and new entrants like Bitdeer and Auradine scaling up, the mining hardware market is entering a period of transition.

9 Hashboard Rig by Proto (Source: Proto)

August 2025 highlighted a market in transition, caught between policy shifts, treasury accumulation, and miner economics under pressure. While price action and fees offered little immediate relief, the structural trends shaping Bitcoin’s future—from institutional flows to hardware innovation—remain firmly in motion. As the industry consolidates, the stage is set for the next wave of decisive moves that could redefine both markets and mining.

Nico Smid – Research Analyst GoMining Institutional.

September 2, 2025