ETF funds (Exchange Traded Funds) have become one of the main instruments for institutional and retail investors in cryptocurrency. In 2025, their importance grew: pension funds, insurance companies, and banks entered the market through ETFs. Understanding how to choose your ETF helps reduce risks and increase your returns.

"ETFs give investors access to cryptocurrencies through familiar exchange mechanisms, lowering barriers to entry." — CoinDesk

What are ETFs and why are they needed?

Crypto ETFs are exchange-traded funds that provide exposure to digital assets (BTC, ETH) or baskets of assets (DeFi indices, multi-asset products). The principle is simple: ETF is a share of the fund on the exchange, and the fund manager ensures that the price of the share corresponds to the value of the underlying asset, taking costs into account.

Types of ETF funds

- Spot ETFs: the fund holds real coins (e.g., BTC or ETH) through a custodian; the price tracks the spot market as closely as possible.

- Futures ETFs: the fund holds derivatives and calculates the profit or loss for the investor upon expiration of the futures contract.

- Index/thematic ETFs: a basket of assets or protocols (DeFi index, "large caps," mixed strategies).

Key roles in the ETF Fund structure

- Fund manager: responsible for strategy, rebalancing, and disclosure.

- Custodian: stores coins (for spot) or provides derivative settlements; examples in crypto are large regulated custodial providers.

Where Spot Crypto ETF are traded

- Traditional exchanges: NYSE, Nasdaq, Cboe BZX. The instrument is bought/sold through regular brokers, available for DCA strategies, margin trading (depending on the broker), and portfolio integration.

Source: coinglass.com

The crypto ETF market: who is behind them, their connection to BTC/ETH, and how this affects the price

In 2024–2025, the spot Bitcoin ETF market became truly massive: large managers launched products that accumulated tens of billions under their management. This changed the "demand profile": regular inflows through brokerage accounts and pension plans became a critical factor in price growth.

How ETF’s are linked to the underlying asset

- Spot funds directly purchase and store BTC/ETH through a custodian; the fund's share reflects the spot price with minimal "error."

- Futures funds rely on CME contracts; deviations from spot prices are possible due to rollovers, position limits, and the structure of the futures curve.

How the ETF price is formed

- Arbitrage and creation/redemption of shares: if an ETF share trades at a premium to spot, APs create new shares (bring in underlying assets) and sell them on the exchange, equalizing the price; if at a discount, they redeem shares and withdraw underlying assets. This maintains the "link" to the underlying asset.

- Liquidity and spreads: high trading volumes and narrow spreads reduce entry/exit costs; low liquidity — risk of slippage and costs.

How ETF’s are linked to on-chain data

- Inflows into spot funds usually correlate with net coin outflows from exchanges (decrease in free supply on the spot market), while outflows correlate with increased selling pressure. This can be seen in exchange wallet metrics, but is always verified by end-to-end data (custodian balances, fund reports).

Source: ultimusfundsolutions.com

How to choose your ETF: a step-by-step algorithm with selection criteria

Choosing an ETF is not about choosing a brand, but rather a systematic review of metrics and documents. Below is an algorithm that saves time and reduces risk.

- Define your goal and horizon

- Value storage: spot BTC/ETH ETF for long-term ownership.

- Diversification: index products (large caps, DeFi baskets).

- Trading: highly liquid futures ETFs for tactical strategies.

- Check liquidity and scale

- AUM (assets under management): more AUM usually means more stable operations and lower friction.

- Average daily volume and spread: narrow spreads mean lower hidden costs; volume means the fund's ability to absorb large trades.

- Assess costs and tracking accuracy

- Management fee (Expense Ratio): 0.20–0.90% is the typical range; every ten basis points is important over the long term.

- Tracking difference/tracking error: how accurately the fund replicates the return of the underlying asset, taking into account all costs.

- Study the structure and providers

- Fund type: spot vs. futures; spot for storage, futures for tactics.

- Custodian and audit: storage provider, frequency of asset audits, security standards.

- Authorized participants: list of APs, their ability to effectively conduct creation/redemption operations.

- Understand regulatory status and restrictions

- Jurisdiction and regulator: admission to specific exchanges, compliance with requirements.

- Investor restrictions: access through your broker, margin rules, taxes.

- Verify risk factors

- Premium/discount risk: the weaker the arbitrage and the fewer APs, the higher the probability of deviations.

- Operational risks: accounting errors, interruptions in the creation/redemption of shares, limits on derivatives (for futures).

- Systemic risks: regulatory bans, sharp outflows, custodial storage disruptions.

Key metrics for monitoring and how to read them correctly

These indicators reflect the fund's actual performance and its impact on the market.

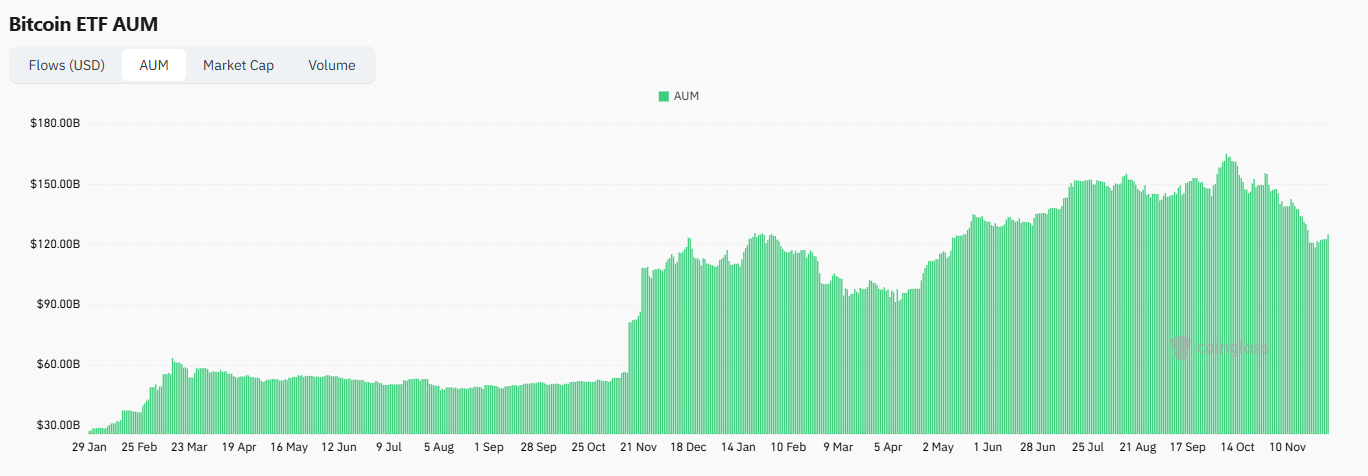

AUM (assets under management). It tells how much money the fund has at its disposal. It defines scale and stability; large AUM often means better conditions and stability. AUM dynamics (inflows/outflows) in the context of price — a signal of strong or weak demand.

Source: coinglass.com

- Management fee

- Why look: direct "yield leakage."

- How to read: compare within a group of peers; low fees with the same structure are an advantage.

Source: investopedia.com

- Average daily volume and average spread

- Why look: the real cost of trading.

- How to read: narrow spread and high volume = cheap entry/exit; sharp increase in spread on stressful days — a marker of liquidity risks.

- Tracking difference/tracking error

- Why look: accuracy of tracking the underlying asset.

- How to read: a consistently low difference is a good product; futures are allowed a larger gap due to the contract curve.

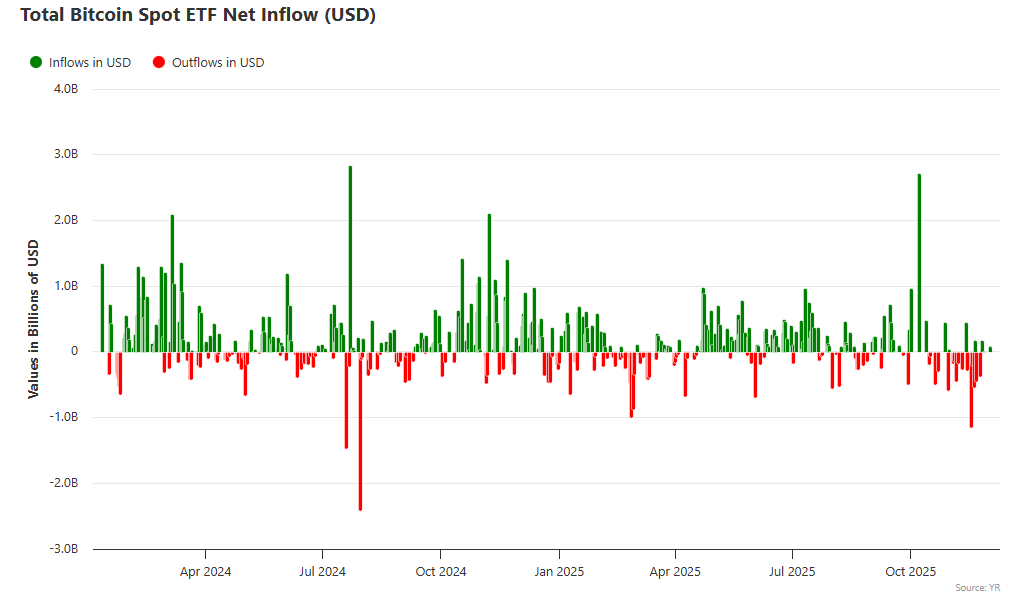

- Inflows and outflows

- Why look: institutional demand.

- How to read: serial inflows — "soft support" for the price; serial outflows — pressure.

- Custodial reports and audits

- Why look: security and compliance.

- How to read: regular reports, independent audits, disclosure of storage procedures.

Pros, cons, and real risks of Spot and Futures ETF Funds

- Advantages

- Accessibility and simplicity: brokerage account, familiar reporting forms.

- Regulation and transparency: prospectuses, risk disclosure, audits.

- Integration into portfolios: rebalancing, margin rules, tax regimes.

- Limitations and risks

- Costs: management fees, spreads, taxes.

- Deviations from spot: futures structure, premium/discount with weak arbitrage.

- Regulatory changes: admissions, limits, rule changes.

- Operational failures: delays in creating/redeeming shares, custodial incidents.

- What to expect from volatility

- In stress scenarios, spreads widen, arbitrage works less well, premiums/discounts increase; for futures, position limits and increased roll costs are possible.

How ETF Funds affect the market and what investors should do

Spot ETFs simplify capital inflows into BTC/ETH, making demand more "linear" and predictable.

Source: bitbo.io

This supports liquidity, smooths out the "manual" risk of storage, but also increases the "macro-sensitivity" of the price to regulatory news and changes in fund flows. For investors, this means:

- Entry/exit tactics

- For storage: DCA in spot ETFs, control of portfolio share, infrequent rebalancing.

- For tactics: use liquid futures ETFs, monitor spreads and rolls.

- Link to on-chain and derivatives

- Monitoring ETF inflows/outflows together with on-chain flows on exchanges gives a "double" signal; derivative metrics (funding, open interest) help catch overheating.

- Diversification

- Don't put all your eggs in one basket: diversify by type (spot/futures), jurisdiction, provider, and custodian.

Conclusion, forecasts and scenarios for ETF Funds 2025–2026

ETFs became a convenient tool for entering the crypto market, but it is important to remember that they are not always available for purchase. Restrictions apply in different jurisdictions, regulatory approvals may be delayed, and certain products are completely closed to retail investors. Therefore, relying solely on ETF shares means being dependent on external rules and decisions.

- Base scenario: expansion of the ETH spot ETF lineup, growth in AUM leaders, reduction in commissions through competition, gradual integration into pension plans and banking products.

- Optimistic scenario: emergence of multi-asset spot baskets (BTC+ETH), launch of regional products in new jurisdictions, improvement of custodial standards and reporting transparency.

- Stress scenario: regulatory tightening, limits on derivatives, premium/discount jumps during periods of panic, short-term deterioration in spot tracking by futures ETFs.

"Cryptocurrency ETFs will dominate in 2025: combined Bitcoin and Ether products will simplify access for investors." — Nate Gerassi, President of ETF Store

Crypto ETFs are not a "shortcut to profits" but an infrastructure bridge between digital assets and traditional finance. Making an informed choice requires checking the type of fund (spot/futures), fees, AUM, liquidity, tracking accuracy, and the quality of custodial storage. In 2025–2026, they will remain an important driver of liquidity and a "front door" for new capital — take advantage of this, but don't forget about systemic risks and portfolio discipline.

It is more reliable to have your own bitcoins on your balance sheet: this is direct ownership of the asset, independent of funds and intermediaries. GoMining, a cloud mining platform that allows you to rent computing power and receive daily accruals in BTC, can help with this.

- You receive real bitcoins, not derivative instruments.

- The return is transparent: accrual statistics are available in your personal account.

- Flexibility: you can withdraw BTC or sell it directly on the platform.

Thus, GoMining allows you to build your own balance in Bitcoin — without ETF restrictions and without the operational routine associated with purchasing and maintaining equipment.

Sign up and get access to GoMining's free course on crypto and Bitcoin.

Telegram | Discord | Twitter (X) | Medium | Instagram

FAQ

1. What are ETFs and how to choose one? This is a comprehensive guide to cryptocurrency ETFs that explains the differences between spot, futures, and index funds, their costs, and how to evaluate them. The goal is to provide transparent selection criteria: liquidity, commissions, accuracy of tracking the price of the underlying asset, quality of custodial storage, and regulatory status. As a result, the reader understands which fund suits their goals and risk tolerance, and why it makes sense to use it.

2. How do cryptocurrency ETFs work? The fund guide translates the specifics of the crypto market into the language of traditional finance: it shows how spot ETFs on BTC/ETH actually hold coins, while futures ETFs hold derivatives, which is why deviations from the spot price are possible. It links fund metrics (inflows/outflows, AUM, spreads) with on-chain data (exchange balances, custodian activity) so that decisions are based on verifiable facts. This allows investors to see a direct link between the product and the underlying asset, rather than just "tickers and marketing."

3. What are the advantages and risks of ETF funds? Advantages: access through a broker and familiar exchanges, standardized reporting and regulation, the possibility of DCA and portfolio integration. Risks: costs (commissions, spreads), deviation of the ETF price from the spot price for futures products, regulatory restrictions, operational failures (creation/redemption of shares, custodial storage). The guide teaches you to measure these risks in advance using metrics, rather than guessing based on news.

4. How to use ETFs in 2025? Formulate your goal (storage, diversification, tactics), compile a shortlist of funds, and compare: fees, AUM, volumes and spreads, tracking accuracy, type (spot/futures), custodian, and list of authorized participants. Check availability with your broker and tax regime, set entry rules (one-time or DCA) and monitoring rules (weekly net flows, provider reports, spreads). Regularly update your assessment as capital flows, market conditions, and regulatory news change.

5. What metrics are associated with ETF funds? AUM (assets under management), expense ratio (management fee), average daily volume and spread, tracking difference/error (accuracy of tracking the underlying asset), net flows (inflows/outflows), quality of custodial storage, and audit frequency. For the crypto market, these include exchange balances, custodian coin movements, and long-term holder activity. These metrics show the scale, cost of ownership, liquidity, and quality of the link to BTC/ETH.

6. Is it possible to make money on ETF funds? Yes, if you choose a fund with low costs, high liquidity, and a reliable structure, the return will be close to the movement of the underlying asset. The result depends on discipline (DCA, rebalancing, position share management) and accounting for hidden costs — spreads, taxes, possible differences from spot prices for futures ETFs. This is a tool for systematic participation in the market, not a guarantee of profit.

7. What mistakes do beginners most often make with ETF funds? They buy "by brand" without checking commissions and liquidity, take futures ETFs for long-term storage, ignore tracking differences and arbitrage mechanisms. They do not look at inflows/outflows and the on-chain context, entering at the peak of demand. They concentrate their entire volume in one fund and jurisdiction, instead of diversifying by type and provider.

8. How do ETF funds affect the cryptocurrency market? The methodology makes capital flows more conscious: funds move into products with real liquidity and low costs, which improves the quality of demand and reduces volatility. Spot ETFs accumulate BTC/ETH with custodians, reducing free supply on exchanges; sustained outflows, on the contrary, increase pressure on prices. Market cycles are increasingly tied to stock flow dynamics and regulatory conditions.

9. What do experts predict for ETF funds in 2026? Spot ETFs are expected to play a greater role, with commissions falling due to competition and increased accessibility in new jurisdictions. The transparency of custodial storage and the work of authorized participants will increase in order to reduce premiums/discounts. Sector-specific index products (DeFi, large caps) will see greater demand as institutional integration progresses.

10. Where can I follow updates on ETF funds? In the funds' own reports (prospectuses, daily flows, AUM), on exchange and broker websites, in ETF metric aggregators (fees, volumes, spreads), and in analytics on on-chain data and institutional flows. Compare sources — provider reports, exchange statistics, and independent panels — to get a complete picture, not just an advertising snippet.

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided "as is", all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

A complete guide to choosing cryptocurrency ETFs: how they work, what types there are, who issues them, how and where they are traded, what to look for when selecting them, how they are related to Bitcoin and Ether, key metrics and risks for 2025–2026, practical scenarios, and a step-by-step selection algorithm.

December 25, 2025