Ever wanted crypto to have bank-level security? With a few tradeoffs, that’s possible. You can have a bank-like account with a custodian protecting your crypto from theft — it’s called a Custodial Wallet.

A custodial wallet is where a third-party service holds your private keys for you. Think of it like a bank for your crypto: companies like Coinbase, OKX or Binance secure your digital assets, letting you access them through a simple app. This model offers major convenience and safety nets, like password & account recovery, which is good when you prefer comfort.

However, this convenience comes with a trade-off: control. The core crypto principle “not your keys, not your coins” applies here. You trust the custodian to protect your assets and allow you to withdraw them, which may or may not happen — there’s no 100% guarantee. At times, like when the Custodian of the wallet is hacked, funds become frozen or stolen, and you can’t do anything about it aside from diversifying your assets.

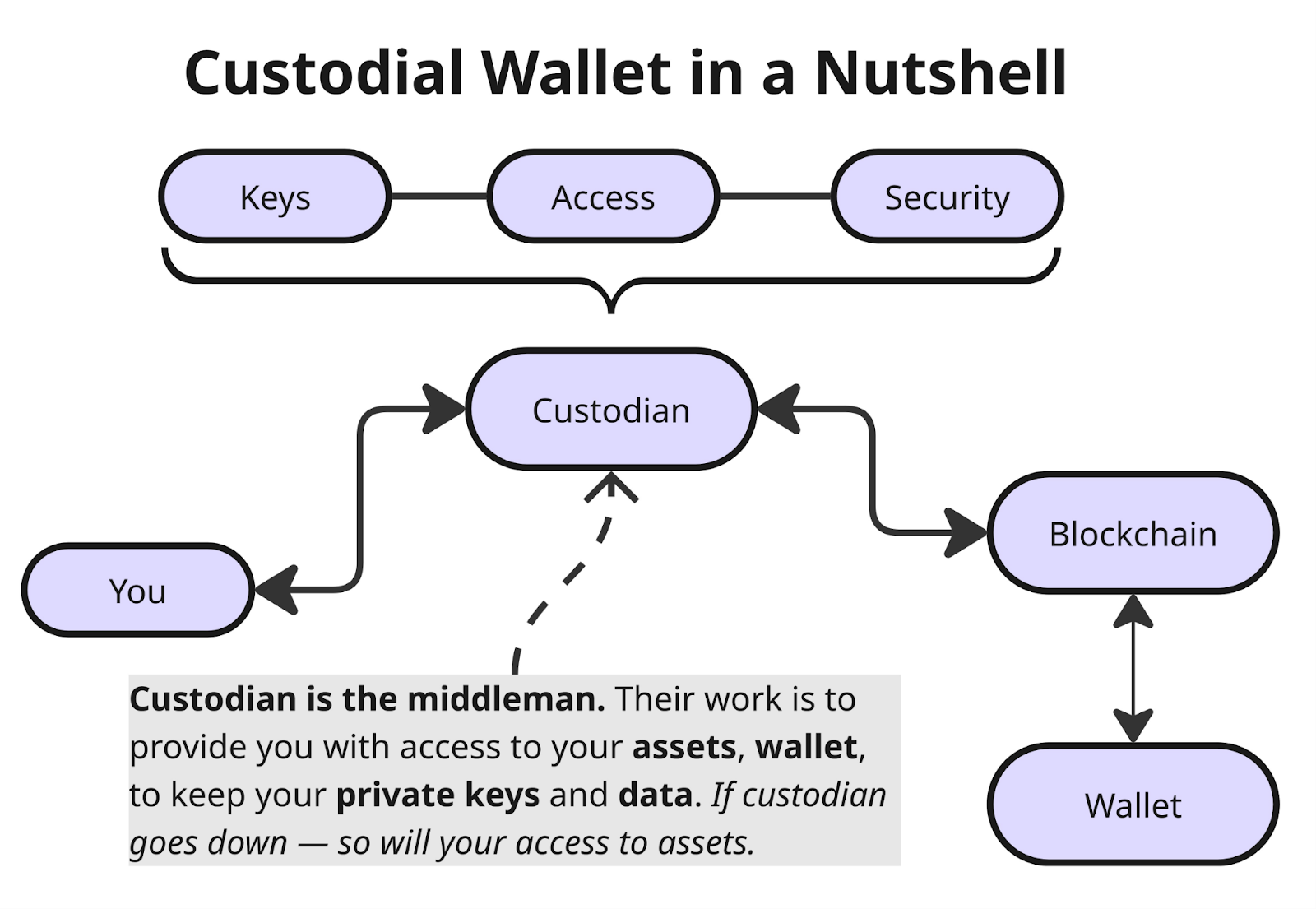

What Is a Custodial Wallet in a Nutshell?

A custodial crypto wallet has a provider, which keeps, makes and protects your private keys. Exchange, bank or specialized legal entity can serve as a custodian. While you legally own the assets, you do not have direct cryptographic control over them on the blockchain. It is the digital equivalent of an online bank account where the bank holds the cash in its vaults, and you manage it through an app.

How Custodial Wallets Work

Custodial wallets are offspring of non-custodial wallets to a marriage of crypto and regulations.

Here how Custodial Wallet Works:

- Key Generation & Storage: provider makes and keeps your private keys within their secure infrastructure;

- User Interface: You interact via a web or mobile app to check balances or request transactions;

- Transaction Execution: When you want to send crypto, you instruct the provider. Their system signs the transaction with your private key and broadcasts it to the blockchain.

Source: GoMining.com

Types of Custodial Wallet Providers

Centralized Exchanges (CEX) — wallet connected right to a crypto market

Platforms like OKX, Coinbase, and Bybit are the most common custodians. When you create an account to trade, a custodial wallet is automatically created. Their wallets are optimized for fast trading and money exchange.

Institutional Custodians — compliance, KYC, all the uneasy stuff

Services like Fireblocks, BitGo, and Anchorage Digital cater to hedge funds and corporations. They offer enterprise-grade security with multi-layer governance (e.g., requiring multiple approvals for a transaction) and are not typically designed for regular people.

Fintech & Neobanks — a common ground between CEX and Institutional Wallet

Apps like PayPal, Revolut, and Cash App allow you to buy, hold, and sell crypto within their ecosystem. Often, these are "closed-loop" services where you own the asset's economic value but may not be able to withdraw the actual cryptocurrency to a private wallet.

Pros of Custodial Wallets:

- Simplicity & UX. They eliminate the complex burden of safeguarding seed phrases and managing blockchain transactions. Login is as easy as using an email and password.

- Account Recovery. The biggest fear in crypto—permanently losing access to funds by losing a seed phrase—is mitigated. Access can be recovered through customer support and identity verification (KYC).

- Integrated Services. Assets are already on-platform, enabling instant access to trading, staking rewards, lending, and easy conversions to/from fiat currency.

- Professional Security. Reputable providers use security infrastructure beyond an individual's means, including Hardware Security Modules (HSMs), cold storage vaults, and 24/7 monitoring.

Cons of Custodial Wallets:

- “Not Your Keys — Not Your Coins”. You rely entirely on the custodian's integrity and solvency to access your assets. You do not have sovereign control.

- Counterparty & Bankruptcy Risks. Historical failures like Mt. Gox, Celsius, and FTX demonstrate the risk. In bankruptcy, user funds can become entangled in proceedings, leaving users as unsecured creditors.

- KYC & Compliance. Custodians require identity verification, eliminating privacy. They must comply with regulations, which can lead to frozen accounts or blocked transactions to certain addresses.

- Withdrawal Restrictions. Providers often impose daily limits and may suspend withdrawals during periods of extreme volatility or liquidity strain.

Security Model of Custodial Wallets

Multi-sig & MPC Custody

Modern custodians avoid single points of failure:

- Multisignature (Multi-sig): Requires multiple private keys (e.g., 2 out of 3) to authorize a transaction.

- Multiparty Computation (MPC): Advanced technology (used by Fireblocks, etc.) that splits a single private key into shards distributed across multiple parties. The key is never fully assembled; shards collaborate to sign transactions.

Cold vs. Hot Storage

- Cold Storage: The vast majority (95-98%) of customer assets are held offline in "cold wallets," immune to online attacks.

- Hot Wallets: A small fraction (2-5%) is kept in online "hot wallets" to facilitate daily withdrawals and trades.

Regulatory Compliance

Leading providers undergo independent audits (SOC 1, SOC 2, ISO 27001 certifications) and often hold insurance policies for assets held in custody. They use legally segregated accounts to separate client assets from company assets.

Who Should Use Custodial Wallets?

Institutions

Businesses and funds require the governance, audit trails, and insured custody that only licensed institutional custodians can provide.

High-Frequency Traders

Traders need immediate access to exchange liquidity. Moving funds to a private wallet for each trade is impractical due to speed and network fees.

Conclusion — Are Custodial Wallets Good or Bad?

Custodial wallets are a tool, neither inherently good nor bad. They represent a conscious trade-off: convenience and reduced personal responsibility in exchange for trust in a third party.

They are the ideal on-ramp for beginners and the essential liquidity hub for active traders. For long-term, high-value storage of crypto assets, self-custody (non-custodial wallets) remains the gold standard. The key is to make an informed choice: if using a custodian, select a transparent, well-regulated, and audited provider, and never store more assets there than you need for your trading or learning activities.

Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-mining

December 25, 2025