Weekly High — is the highest price point that an asset has reached during the week.

When looking at any chart, the Weekly High is the highest candle or its shadow over a seven-day period. This indicator is used to assess how strong or weak an asset is relative to recent volatility.

Why is Weekly High important?

1. Why Weekly High is needed. When an asset constantly forms new weekly highs, it indicates increased bullish pressure and a continuation of the upward momentum.

If the price repeatedly fails to rise above previous weekly highs, it signals a loss of strength and a likely weakening of the trend.

2. Creates an important resistance level. The Weekly High zone often becomes an area where seller activity increases. Breaking through this level often paves the way for a more vigorous upward movement, as the market breaks out of its local range and can accelerate its growth.

3. Used to find market entries. Strategies for breaking through the Weekly High are popular among traders working with momentum movements. Breaking through the weekly high shows that buyers are dominating and the asset is ready to continue moving in the direction of the breakout.

4. Helps assess risks and set stops correctly. When the price approaches its weekly high, it is easier for a trader to calculate a safe stop loss and identify the nearest potential obstacles to movement. This approach reduces risk and makes the trading plan more structured.

Supporting indicators for Weekly High

To avoid false breakouts, Weekly High should be used in combination with other tools:

1. Volume. A confident breakout of Weekly High should be accompanied by significantly above-average trading volume. A breakout on low volumes often signals weakness in the movement and can be a trap.

Source: Tradingview.com

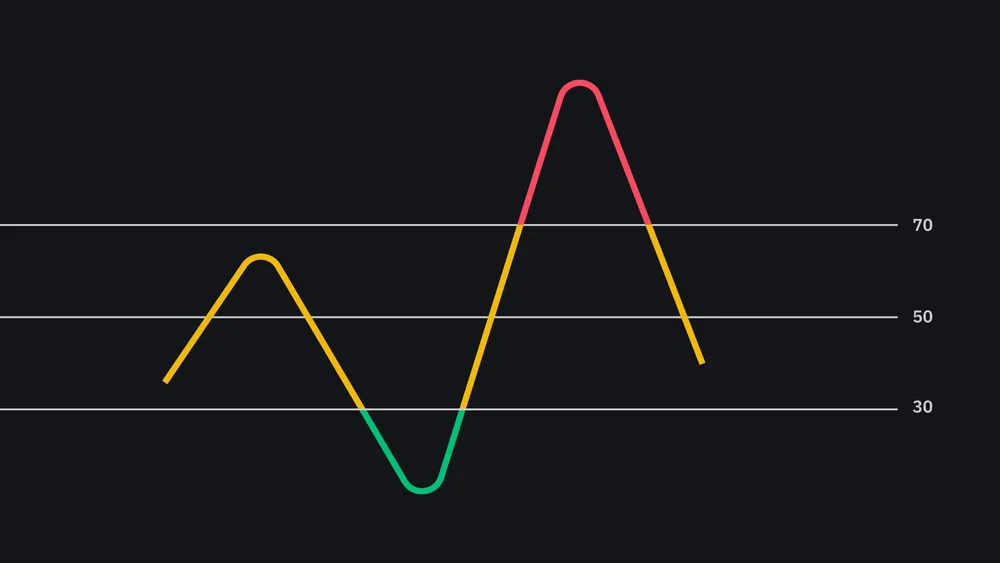

2. Relative Strength Index (RSI). If a breakout occurs when the RSI is in the overbought zone (>70), this may indicate that the momentum is about to run out. An ideal breakout occurs when the RSI still has room to grow.

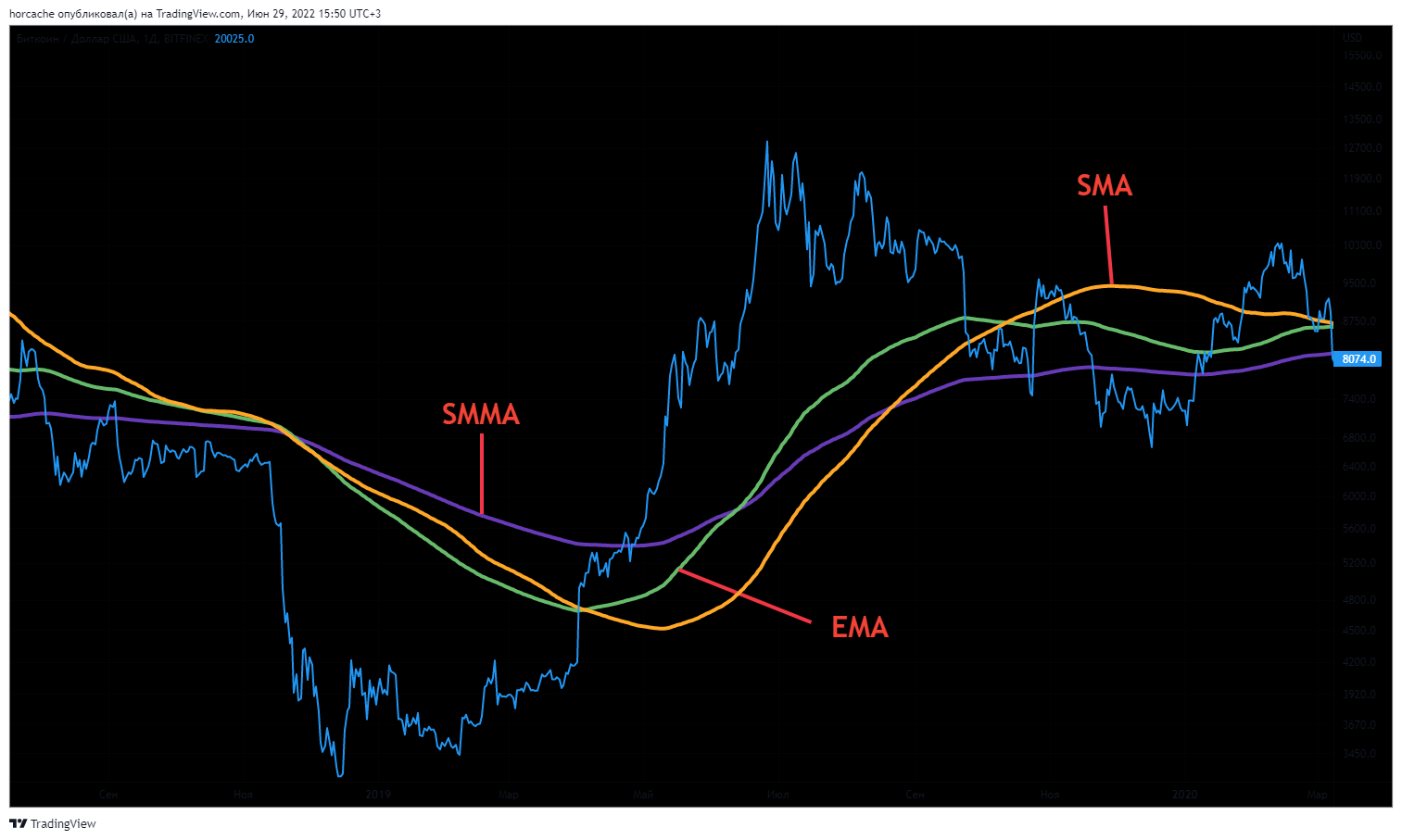

Source: Binance3. Moving averages (MA). It is desirable for the price to break through the Weekly High while remaining above long-term moving averages (e.g., MA50 or MA200), which confirms the overall bullish trend.

Source: Tradingview.com

Weekly High Breakout Scenario

Let's analyze the classic approach to using Weekly High, adapted to the recent dynamics of Bitcoin (with a price of around $89,000):

1. Consolidation. Let's assume that for several trading weeks in a row, Bitcoin quotes could not break through the $85,000 mark, where the previous weekly peak was set.

2. Momentum and Closing. The price approaches this barrier and, accompanied by a strong positive background, ends the weekly cycle above $85,000, thus confirming the breakthrough with a significant inflow of capital.

3. Verification (Retest). At the start of the new period, the asset temporarily declines, returning to $85,000.

4. Role reversal and entry. Instead of falling, Bitcoin rebounds from this level, which now acts as support. The long position is entered at the moment of this rebound. It is advisable to place a protective order (Stop-Loss) at, for example, $84,500.

This situation clearly shows how the Weekly High becomes a starting platform for subsequent powerful price movement.

When can Weekly High let you down?

Weekly High is a technical level. Its strength depends on the fundamental background.

1. Ignoring the market context (macroeconomics). Using the Weekly High breakout signal without considering the overall market context (e.g., the release of critical inflation data, Fed decisions, or significant incidents in the crypto industry).

2. Trading on a “Fakeout”. A fakeout is one of the most common manipulation techniques in the market. Entering a position immediately as soon as the price touches or briefly exceeds the Weekly High, without waiting for a confirming candle close.

3. Too narrow Stop-Loss placement. Large market participants often deliberately “remove liquidity” by briefly lowering the price slightly below the key level (Stop-Loss Hunting) in order to knock out the stops of small traders.

4. Neglecting volume. Volume is the “fuel” for price movement. A successful breakout of the Weekly High requires a significant injection of capital. Low volume indicates a lack of conviction among large players, which makes the breakout vulnerable to a quick reversal. A true, sustainable breakout is always accompanied by significantly above-average volume.

In conclusion

Weekly High is more than just a visual mark on a chart; it is an important tool for analyzing the market situation. With its help, you can assess the strength of the current trend, determine the optimal moments for entering and exiting a position, as well as correctly calculate risks and build a trading strategy. Knowing the weekly highs gives traders a valuable advantage, allowing them to track asset behavior more accurately and make more informed and strategically sound decisions.

Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-mining

January 5, 2026