When newcomers first encounter the term “decentralization” in the context of cryptocurrencies, they often perceive it as an abstract philosophical concept. However, after a few major collapses of centralized exchanges, account freezes, and asset confiscations, it becomes clear: decentralization is not just an ideology but a concrete mechanism for protecting capital and financial freedom.

What is Decentralization and Why Is It Critical for Crypto Investors?

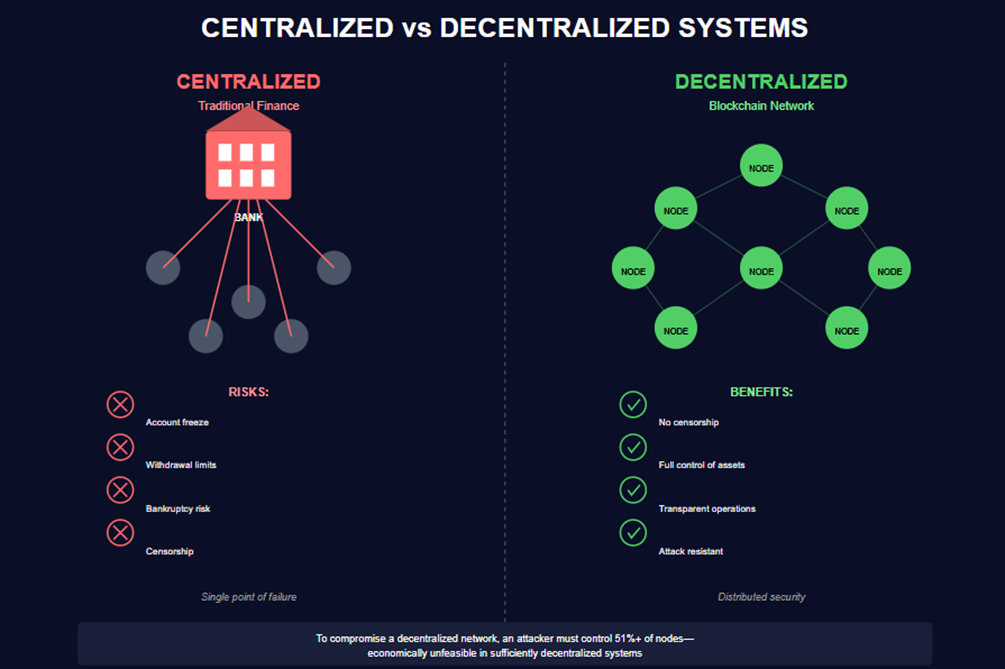

Decentralization is an architectural principle where control over the system is distributed among many independent participants, rather than concentrated in the hands of one organization.

In traditional finance, users trust their funds to a bank or broker — a single point of failure. A bank can freeze an account, limit withdrawals, or go bankrupt, leaving customers without their money. History has seen hundreds of such cases.

Blockchain networks work differently. Instead of a central server, there is a distributed network of nodes, each holding a complete copy of all transactions and verifying new ones. To change records or steal funds, an attacker would need to control the majority of nodes — an economically unfeasible task when the network is sufficiently decentralized.

Three Dimensions of Decentralization in Blockchain

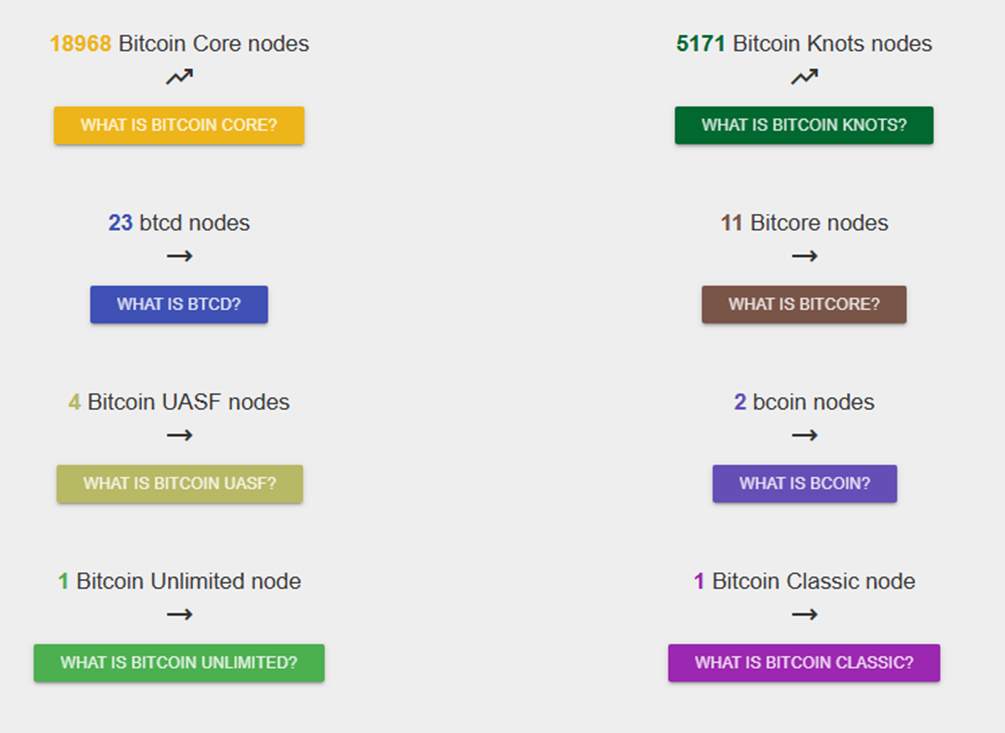

1. Architectural Decentralization (Technical). This refers to the number of physical nodes, their geographical distribution, and their independence from one another. Key metrics include: The number of full nodes, Geographical distribution, The percentage of nodes controlled by the top 10 operators.

Example: Bitcoin supports around 19 000 full nodes across 100+ countries. Ethereum has about 8 000 nodes. In contrast, some new blockchains run on 20-50 validators controlled by a small group of companies.

Source: coin.dance

2. Political Decentralization (Governance). This involves who makes decisions about protocol development, updates, and rule changes. In Bitcoin, there is no CEO or board of directors — protocol changes require consensus from developers, miners, and users. The process can take months or even years. It’s slow, but it protects the network from unilateral decisions.

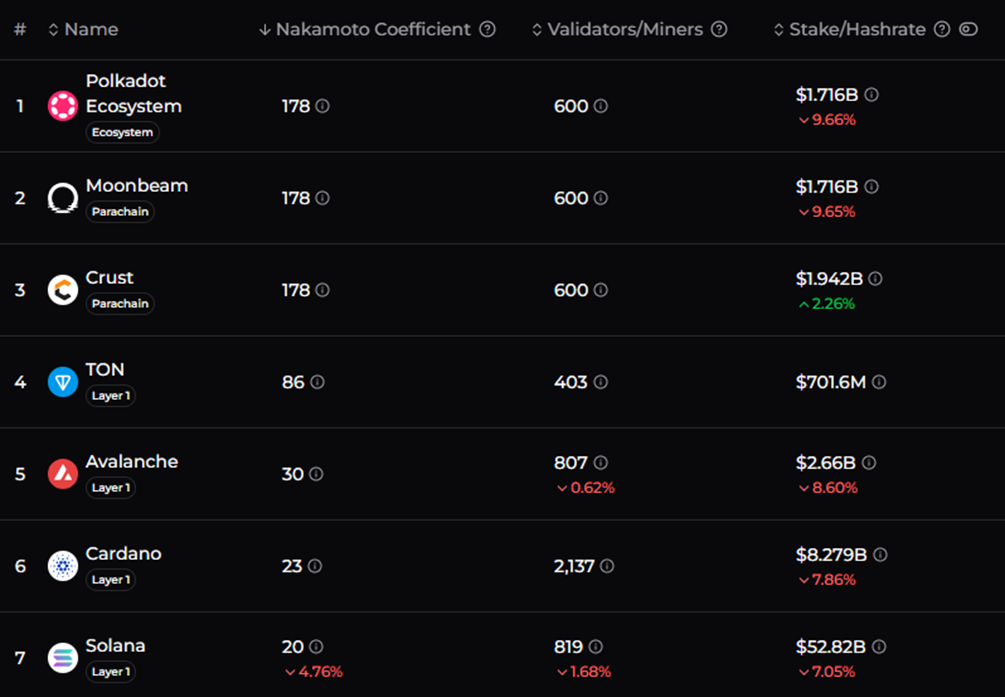

3. Logical Decentralization (Economic). This refers to the distribution of coins, hash rate (in PoW), or stake (in PoS) among participants. Key indicators include:

Nakamoto Coefficient — the minimum number of participants who can control the network:

Source: chainspect.app

Distribution of coins among the top 100 wallets.

Concentration of mining power or stake.

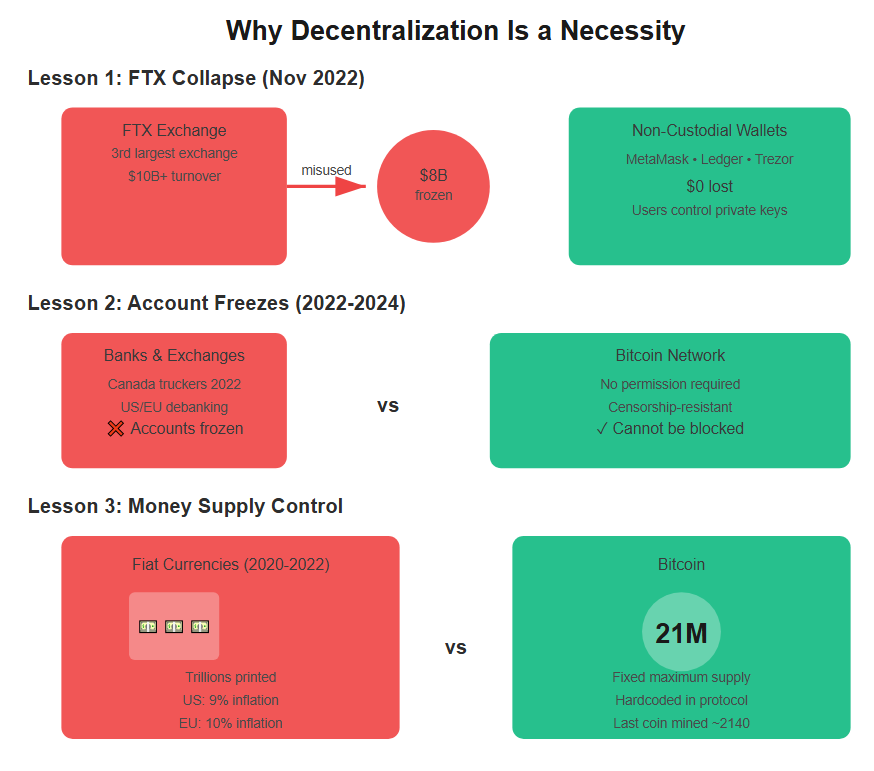

Why Decentralization Is a Necessity

Lesson 1: FTX Collapse (Nov 2022)FTX was the third-largest crypto exchange with a turnover of $10+ billion. Within 72 hours, the company went bankrupt, freezing $8 billion of customer funds. The reason: founder Sam Bankman-Fried used customer deposits for speculation through a related company, Alameda Research.Key takeaway: Users didn’t control their assets — they trusted them to FTX. The exchange acted like a traditional bank but without deposit insurance or regulatory oversight.

Lesson 2: Account Freezes and Financial Censorship (2022–2024)In 2022, the Canadian government froze the bank accounts of trucker protest participants without a court order. Centralized crypto exchanges in Canada also froze wallets on the government’s request.In 2023–2024, several large banks in the US and EU unilaterally shut down accounts related to the crypto industry — a process known as "debanking."Bitcoin addresses can’t be frozen. Bitcoin transactions don’t require permission — anyone with internet access can send and receive funds, regardless of political views or geography.

Lesson 3: Inflation and Money Supply ControlFrom 2020 to 2022, central banks printed trillions of dollars, euros, and other fiat currencies. Official inflation in the US reached 9%, 10% in the Eurozone, and 20-50% in developing countries. Real purchasing power fell by tens of percent.Bitcoin has a fixed supply: a maximum of 21 million coins, and its emission algorithm is encoded and cannot be changed by policymakers. The last Bitcoin will be mined around 2140.

How Decentralization Works in Practice: Key Mechanisms

Decentralization is not just a slogan; it’s specific mechanisms that make a blockchain independent from a single owner.

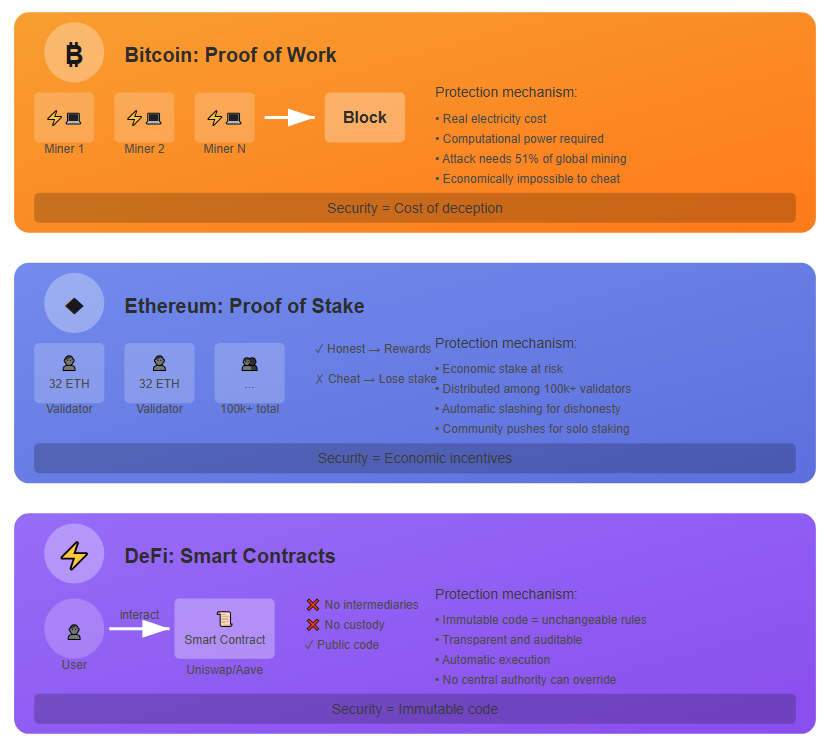

In Bitcoin, decentralization is achieved through Proof of Work. Miners spend electricity and computational power to add a new block. It’s impossible to alter or rewrite the blockchain because to attack the network, you’d need to control half of the global mining infrastructure, which would require enormous energy costs.

In Ethereum, the Proof of Stake system works differently. Instead of hardware, validators must stake 32 ETH to participate. If they attempt to cheat the network, they lose their staked funds. The network is decentralized because validation is distributed among hundreds of thousands of participants.

In DeFi, decentralization manifests itself in services without intermediaries, such as Uniswap and Aave. These are programs in the blockchain that automatically execute rules.

They don’t store your funds, don’t require trust, and can’t change terms with the push of a button. The code is visible to everyone, and it defines what is allowed and what isn’t.

How to Apply Decentralization Principles: Step-by-Step Guide for Investors

If you want to become part of the decentralized economy and reduce the risks associated with centralized services, here is a step-by-step guide on how to start:

Step 1: Transition to Non-Custodial StorageWhat to do: Move your cryptocurrency from centralized exchanges to non-custodial wallets, where you control your private keys. This reduces the risk of losing access or having your funds frozen if the exchange decides to block your account. Types of wallets:

- Hardware wallets (Ledger, Trezor): These are physical devices that store your keys offline. Ledger Nano X / S Plus — $80–150, Trezor Model T / Safe 3 — $70–200. Ideal for long-term investments and large amounts.

- Software wallets (MetaMask, Trust Wallet, Exodus): Applications for storing cryptocurrency on your phone or computer. MetaMask for Ethereum and all EVM-compatible networks, Trust Wallet is multi-currency and ideal for DeFi, Exodus has a simple and user-friendly interface for beginners.

Golden rule: “Not your keys, not your coins” — if you don’t control the keys, the cryptocurrency is not yours.

Step 2: Use DEX Instead of Centralized Exchanges When to use DEX:

- For token swaps without KYC (identification).

- To access new or low-cap tokens.

- To avoid the risk of funds being frozen by an exchange.

How to trade on DEX:

- Connect your wallet (e.g., MetaMask).

- Ensure you have gas tokens for fees (e.g., ETH for the Ethereum network or BNB for Binance Smart Chain).

- Select a token pair (e.g., ETH/USDC) and confirm the transaction.

Transactions on DEX occur directly from your wallet, without intermediaries.

Risks: On DEX, you may encounter vulnerabilities in smart contracts and scam tokens. Always use only trusted protocols with code audits, like Uniswap or Sushiswap.

Step 3: Participate in DeFi for Passive IncomeStrategy 1: Staking Native TokensLock your tokens to support the network in exchange for rewards.Yield (2025):

- Ethereum (ETH): 3.5–4%

- Cardano (ADA): 4.5–5%

- Solana (SOL): 6–7%

- Polkadot (DOT): 12–14%

How to stake:

- Direct staking: Run your own validator (requires technical knowledge).

- Delegated staking: Through a wallet or platform (Lido, Rocket Pool for ETH).

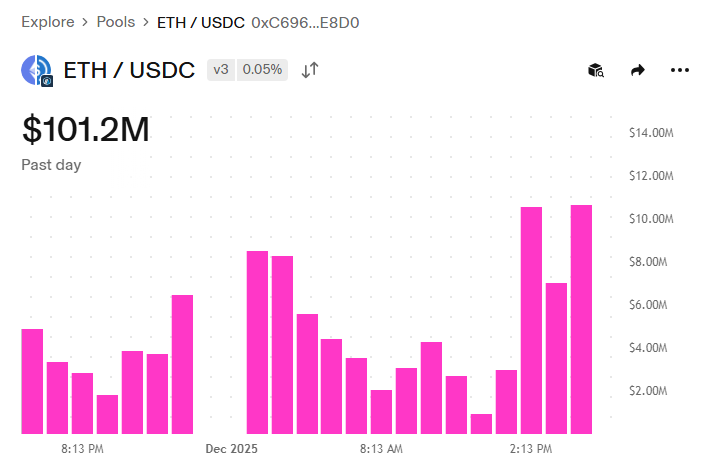

Strategy 2: Liquidity Mining (Providing Liquidity)Provide liquidity to a decentralized exchange pool and receive rewards for each transaction that happens through the pool.

Example: ETH/USDC на Uniswap V3

Yield: 5–15% annually in stablecoins, 20–100%+ in volatile pairs (but with higher risk of impermanent loss). Risks:

- Impermanent Loss: Temporary losses due to price changes in the tokens within the pool.

- Smart contract risks: Bugs in the contract can lead to loss of funds.

- Rug pulls: When protocol creators withdraw liquidity and disappear.

Safety rule: Invest no more than 10–20% of your portfolio in DeFi, and use only protocols with a TVL of $100 million+ and audits from reputable firms like CertiK, Trail of Bits, or OpenZeppelin.

Risks and Limitations of Decentralization in 2025

Problem 1: Hidden Centralization of InfrastructureMany projects claim decentralization but depend on centralized services:

- Infura / Alchemy — Over 60% of DApps connect to Ethereum through these RPC providers. If Infura goes down, most apps stop working.

- Cloud providers — A significant portion of Ethereum and other blockchain nodes run on services like AWS, Google Cloud, and Hetzner.

- Stablecoins — USDT and USDC can freeze addresses upon regulatory request.

Solution: Diversify providers, run your own nodes, and use decentralized stablecoins like DAI or LUSD.

Problem 2: Regulatory Pressure on DeFiIn 2024-2025, regulators in the US and EU intensified pressure on DeFi protocols:

- The SEC filed lawsuits against several protocols for “unregistered securities sales.”

- FinCEN requires KYC from DeFi platforms working with US residents.

- Tornado Cash developers were arrested for creating a mixing protocol.

Prediction: Likely increased regulation of DeFi in 2025–2026, especially for protocols with identifiable teams in US/EU jurisdictions.Trend: The rise of fully decentralized protocols without developer teams (immutable protocols) and the migration of teams to friendly jurisdictions like UAE, Singapore, and Switzerland.

Problem 3: Scalability vs Decentralization (Blockchain Trilemma)Vitalik Buterin’s blockchain trilemma suggests that it’s impossible to achieve maximum decentralization, security, and scalability simultaneously. Examples of trade-offs:

- Bitcoin: Maximum decentralization + security, but low throughput (7 tx/s).

- Solana: High speed (3000–5000 tx/s), but validator hardware requirements are high (centralization).

- Ethereum + L2: The base layer is decentralized, and scaling happens via L2 solutions (Arbitrum, Optimism), with varying levels of decentralization.

Solutions for 2025–2026:

- Development of Layer 2 with improved decentralization (decentralized sequencers).

- Modular blockchains (e.g., Celestia) — separation of tasks between specialized layers.

- ZK-rollups with proof aggregation to reduce load on the base layer.

If you want to keep tracking the latest developments in decentralization, you can follow platforms such as DeFiLlama for TVL data, Nansen for tracking smart money and whales, and Messari for research reports. These tools will help you stay on top of metrics related to decentralization and make informed decisions.

On-Chain Metrics of Decentralization

1. Gini Coefficient. The Gini Coefficient measures the inequality of token distribution in the network. The higher the coefficient, the more centralized the distribution of assets among participants. For example, if the coefficient is close to 1, it means nearly all tokens are controlled by one participant.

Bitcoin in 2025 has a coefficient of approximately 0.69, indicating moderate concentration.

Ethereum has a coefficient of 0.75, while many altcoins are even higher, with a Gini Coefficient ranging from 0.80 to 0.95, indicating that tokens are concentrated among a small group of addresses.

Key takeaway: The lower the coefficient, the more decentralized the network. When the coefficient exceeds 0.9, it indicates a concentration of power in the hands of a few players.

2. Active and New Addresses. Another important metric is the number of active and new addresses in the network. For example, Ethereum in early 2025 shows around 400,000–600,000 unique addresses transacting daily, with 100,000–150,000 new addresses created every day. This 40% year-over-year growth indicates that the network is attracting more and more users.

3. Hash Rate and Stake Distribution. For Proof of Work (PoW), such as in Bitcoin, the hash rate is critical — it measures the network's computational power, usually in exahashes per second (EH/s).

In 2025, major mining pools like Foundry USA and AntPool control about 25% and 19% of the hash rate, respectively. However, the percentage of total control is gradually decreasing, signaling a more evenly distributed mining power.

For Proof of Stake (PoS), like in Ethereum, the important metric is the stake — the total amount of tokens staked by validators. The more evenly distributed the stake, the more decentralized the network is.

Market Indicators of Decentralization

1. Total Value Locked (TVL). TVL measures the total amount of funds locked in DeFi protocols. The higher the TVL, the stronger the use of decentralized finance. It’s expected that by 2025–2026, TVL will grow to $150–200 billion as more institutional investors begin participating in DeFi and staking.

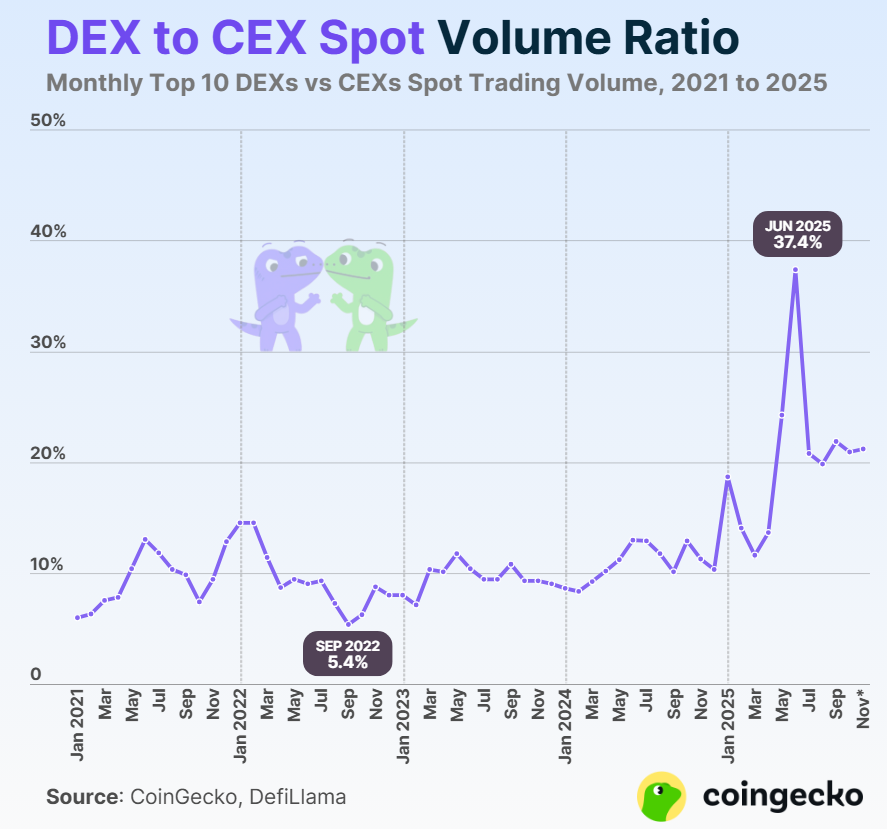

2. DEX/CEX Volume Ratio. This ratio compares the trading volumes between decentralized exchanges (DEX) and centralized exchanges (CEX). In 2025, DEX accounted for more than 20% of total trading volumes, and this ratio is expected to continue increasing. In times of crisis with centralized exchanges, the share of DEX can rise sharply, as seen during previous market disruptions.

Forecast: This trend will continue to strengthen through 2025–2026 as decentralized platforms gain more traction.

Trends for 2025–2026

Trend 1: Institutional Adoption of Decentralized Protocols

After the approval of Bitcoin and Ethereum ETFs in 2024, institutional investors began seriously exploring DeFi. In 2025, institutional staking services that comply with regulatory requirements are expected to emerge, and several major financial institutions will begin engaging with DeFi through regulated bridges.

Trend 2: The Battle for Stablecoin Decentralization

Centralized stablecoins, like USDT and USDC, can freeze assets. In 2024, these stablecoins froze over $1 billion in assets upon request by regulators. In response, decentralized stablecoins are gaining ground. For example, DAI, FRAX, and LUSD are becoming increasingly popular, and their market share is projected to grow to 10–15% by 2026.

Trend 3: Decentralized Physical Infrastructure (DePIN)

DePIN refers to projects creating decentralized physical infrastructures, from wireless networks to data storage and energy systems. Examples include Helium (a decentralized IoT and 5G network) and Filecoin (decentralized data storage). The market for DePIN is expected to grow to $100–150 billion by 2026.

Trend 4: Regulatory Clarity vs. Decentralization

2025–2026 will be critical years for cryptocurrency regulation. New laws, like MiCA in the EU, have been passed, and in the US, regulators may tighten controls on DeFi, including KYC requirements for smart contracts and licensing protocols. At the same time, central bank digital currencies (CBDCs) are emerging as a competitor to stablecoins, with potentially more control over the money flow.

Investors should diversify their assets and be aware of risks related to varying jurisdictions and regulatory environments.

Common Mistakes Newbies Make When Using Decentralized Systems

1. Storing all funds on exchanges. Many people leave all their funds on exchanges, which can lead to the loss of funds if the exchange goes bankrupt or is hacked.Solution: Keep only the funds needed for trading on exchanges (10–20% of your portfolio) and store the rest on non-custodial wallets.

2. Neglecting seed phrases. Losing or storing your seed phrase in the cloud can result in the loss of funds.Solution: Write down your seed phrase on paper or a metal plate, and store it securely. Never store it digitally.

3. Chasing high returns in DeFi. The promise of 500% APY can be tempting, but it often comes with high risks.Solution: Choose top protocols and invest no more than 10–20% of your portfolio in high-risk projects.

4. Ignoring gas fees. Transactions in popular networks like Ethereum can become very expensive.Solution: Use Layer 2 solutions (e.g., Arbitrum, Optimism) or alternative blockchains (e.g., BSC, Polygon).

5. Not verifying addresses before sending funds. Mistakes when sending funds to the wrong address are common and irreversible.Solution: Always double-check the address, send a test transaction, and use address books and whitelist for hardware wallets.

Step-by-Step Guide to Transition to a Decentralized Infrastructure

Level 1: Basic Security

- Buy a hardware wallet (Ledger/Trezor).

- Move 80%+ of funds to non-custodial storage.

- Write and securely store your seed phrase.

- Double-check addresses before transactions.

- Set up 2FA on all exchange accounts.

- Install antivirus and check your system for malware.

Level 2: Active Use of DeFi

- Register on the top 3 DEXs (Uniswap, Curve, PancakeSwap).

- Try staking ETH via Lido or Rocket Pool.

- Add liquidity in a stablecoin pair (e.g., USDC/USDT on Curve).

- Learn to read smart contracts on Etherscan.

- Use DeFi aggregators (1inch, Beefy Finance) for yield optimization.

Level 3: Maximum Decentralization

- Run your own Bitcoin/Ethereum full node.

- Use only decentralized stablecoins (DAI, LUSD).

- Participate in governance votes of DeFi protocols.

- Switch to privacy tools (Tor, VPN, mixers).

- Diversify across multiple blockchains.

- Use multisig wallets for managing large amounts.

This plan will help you transition safely and efficiently to decentralized systems, minimizing risks and maximizing returns.

Monitoring Tools and Educational Resources

- DeFiLlamaPlatform for analyzing TVL (Total Value Locked) in various DeFi protocols. Compare yields across platforms and view blockchain metrics.

- Dune AnalyticsDashboards and custom queries to analyze blockchain data. It’s a very convenient tool for generating personalized reports.

- NansenA platform for tracking movements of smart money and whales. Great for understanding how large investors are acting in the market.

- MessariIn-depth research reports and metrics on blockchains. Ideal for those who want to understand how technologies and economic models evolve in cryptocurrency networks.

- Token TerminalA platform to monitor financial metrics of protocols, such as yield, P/F ratio (price-to-earnings ratio), and other key financial indicators.

Educational Resources:

- Ethereum.org Official Ethereum documentation with guides on staking, DeFi, and more.

- CoinGecko Learn Articles and guides for beginners to get acquainted with cryptocurrencies and blockchain technologies.

- Finematics A YouTube channel with video tutorials on DeFi concepts explained in simple terms.

FAQ

What is decentralization?Decentralization is the distribution of control over a system among multiple independent participants, rather than a single organization, protecting against censorship and asset confiscation.

How does decentralization work in crypto?It works through distributed networks of nodes that independently verify transactions, using consensus mechanisms like PoW and PoS.

What are the benefits and risks of decentralization?Benefits: Protection from censorship, full control of funds, transparency, no single point of failure.Risks: Complexity for beginners, no undo for mistaken transactions, regulatory uncertainty, smart contract risks.

How to use decentralization in 2025?Move to non-custodial wallets, use DEX for trading, participate in DeFi for passive income, and diversify investments across protocols.

What metrics are associated with decentralization?Nakamoto Coefficient, Gini Coefficient, number of validators/nodes, hash rate/stake distribution, TVL in DeFi, DEX/CEX volume ratio.

Can you make money from decentralized services?Yes, through staking, liquidity provision on DEX, governance participation, and holding tokens in decentralized protocols with growing TVL.

What mistakes do beginners make?Storing all funds on exchanges, losing seed phrases, chasing unrealistic returns, ignoring gas fees, not verifying addresses, using unverified protocols.

How does decentralization affect the cryptocurrency market?It enhances resilience to censorship and confiscation, and decentralized projects show better long-term stability.

Want a real skill?If you’ve read this far, you're no longer just a player, but a researcher. Save this material and subscribe to the Academy updates — we’re preparing separate checklists for all major crypto topics.

Telegram | Discord | Twitter (X) | Medium | Instagram

Summary: Decentralization as a Competitive Advantage

Decentralization is not just a technology or a philosophical concept. It’s a practical tool for protecting capital in a world where centralized institutions regularly demonstrate vulnerabilities, corruption, or incompetence.

The events of 2022–2024 (FTX, BlockFi, Celsius, banking crises, financial censorship) have proven that centralized intermediaries represent a systemic risk. Those investors who understood the importance of self-control over their assets and switched to non-custodial solutions were unaffected.

The trend will continue into 2025–2026: institutional investors, governments, and regulators will seek a balance between control and innovation. The projects and users who find the optimal combination of decentralization, security, and convenience will come out on top.

December 25, 2025