— 1. News:

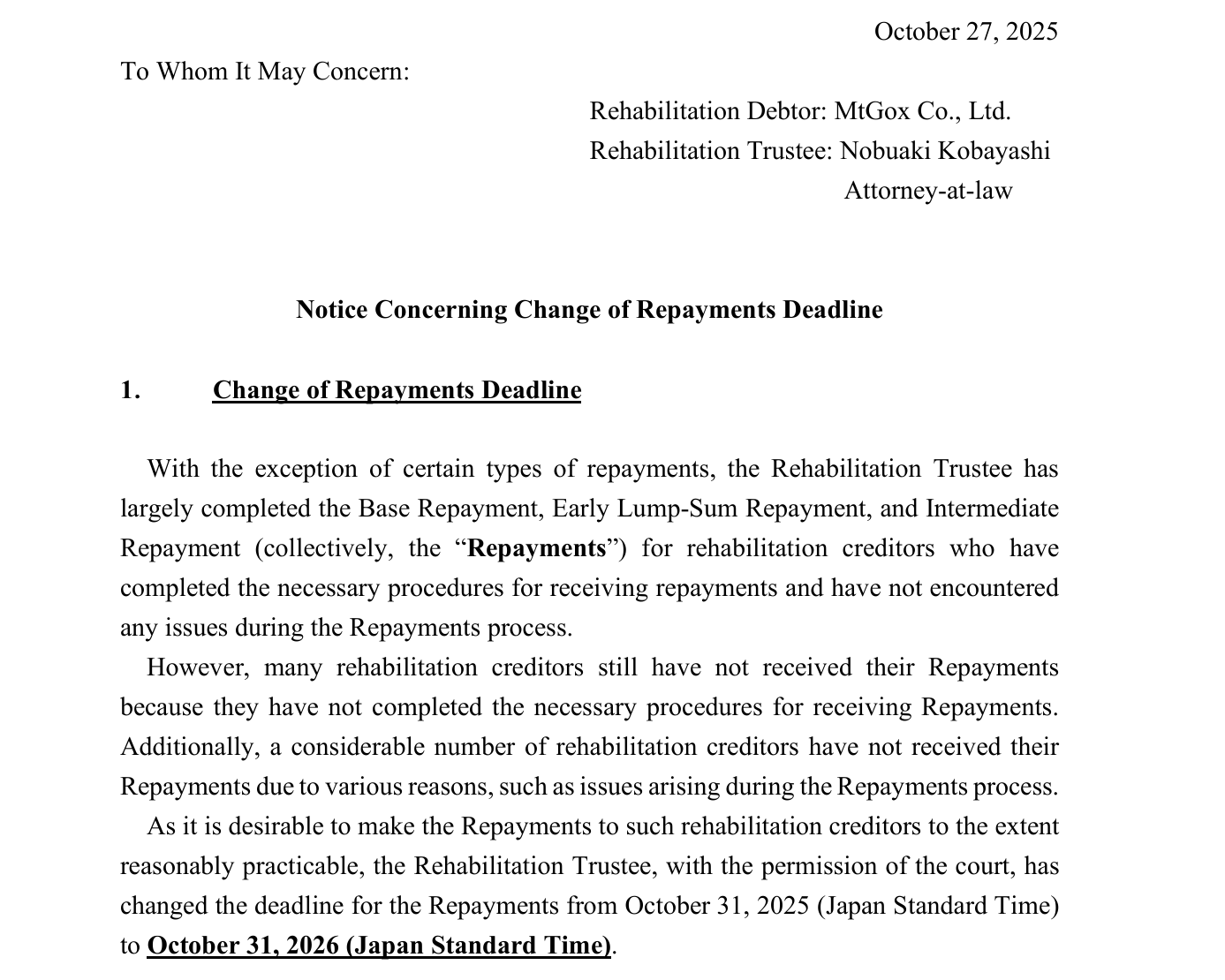

Mt. Gox has postponed payments to creditors for another year

Mt.Gox was the dominant Bitcoin exchange, accounting for about 70% of all BTC transactions. After a large-scale hack in 2014, which resulted in the loss of over 850,000 Bitcoins, the platform went bankrupt.

Back in 2024, it became known that Mt.Gox had again postponed settlements with victims:

— October 12, 2024. The management of the bankrupt Bitcoin exchange Mt.Gox warned of a postponement of the deadline for compensation payments from October 31, 2024, to October 31, 2025.

A year passed and history repeated itself:

— October 27, 2025. The exchange postponed payments in Bitcoin until October 2026 — we are talking about approximately $4 billion in BTC.

Previously, these payments were supposed to be made this month, which could have put additional pressure on the ruble.

— 2. News:Western Union tests payments in stablecoins

Western Union is an international company that has remained one of the largest money transfer systems for many years, covering thousands of service points around the world.

Western Union has begun testing the use of stablecoins in its treasury operations. The new initiative aims to speed up financial settlements, reduce operating costs, and increase transaction transparency, according to company CEO Devin McGranahan.

He noted that the company is exploring the potential of using digital currencies in its internal processes and is already receiving feedback from partners interested in working together.

The testing coincided with the moment when the GENIUS Act officially came into force, establishing rules for the issuance and circulation of stablecoins in the United States.

— July 18, 2025. Donald Trump signed the GENIUS Act, regulating the issuance and circulation of stablecoins.

The new regulatory act establishes strict requirements for the reserve backing of digital tokens and mandatory compliance with AML/KYC rules.

The law also gives the US Treasury Department the power to block suspicious transactions and distributes oversight functions between federal and regional regulators depending on the size of the issuer.

— 3. News:Tokyo Fintech JPYC has issued the first stablecoin pegged to the Japanese yen

JPYC Inc is a Japanese fintech company that issues stablecoins fully backed by the Japanese yen and government bonds.

Japanese fintech company JPYC Inc. has introduced JPYC, the country's first officially recognized stablecoin pegged to the Japanese yen and backed by government bonds. The token operates on the Ethereum, Avalanche, and Polygon blockchain networks and supports direct exchange with the yen at a 1:1 ratio.

JPYC is registered under the «Payment Services Act» and has reserves exceeding its issuance, which guarantees full coverage.

Through the JPYC EX platform, users can convert yen into tokens and back after completing the KYC procedure. The company plans to issue tokens worth up to 10 trillion yen (approximately $65 billion) over the next three years.

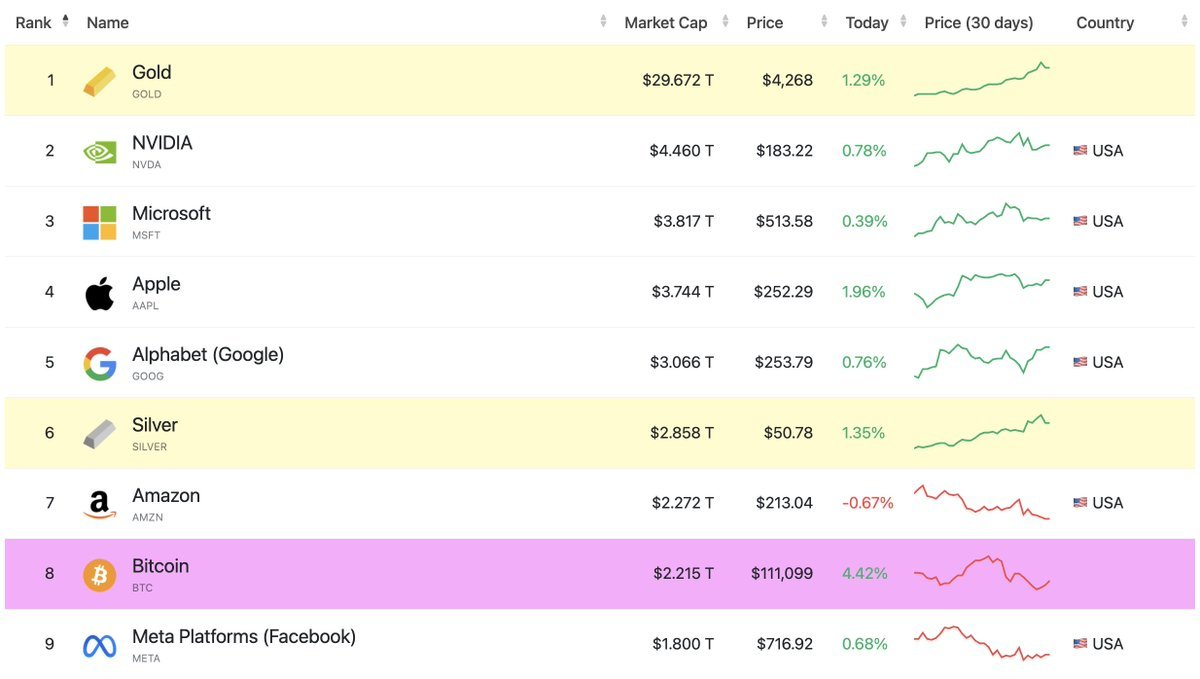

— 4. News: Bitcoin VS Gold

— October 17. Gold reached a new all-time high of over $4,300 per ounce, becoming the world's first asset with a market capitalization of over $30 trillion.

— October 20. CZ's prediction: Bitcoin will surpass gold. He added: «I don't know when exactly this will happen. It may take some time, but it will happen one day».

— October 23. Peter Schiff, one of the world's most prominent critics of Bitcoin, invited Binance founder Changpeng Zhao to a public debate.

Peter Schiff is an American economist, investment specialist, and financial analyst.

— October 24. Tom Lee's financial forecast. Bitcoin, Gold, and Ethereum – new drivers of the supercycle.

Tom Lee is an American finance and investment expert who focuses on cryptocurrencies and stock markets.

➥ According to Tom Lee, gold is outperforming Bitcoin. If the price of gold reaches and stays at $5,000, the fair value of BTC could be around $2,000,000.

➥ He also believes that reaching $200,000 per Bitcoin is possible by December 2025.

➥ Stablecoin issuers are becoming new buyers of gold.

— October 27. Gold falls below $4,000 per ounce for the first time since October 12.

Peter Schiff's contradictory assessments:

➥ The decline in gold is only temporary; the asset will continue to grow, and now is an excellent opportunity to buy.

➥ Bitcoin decline — BTC holders will go bankrupt, economist predicts collapse with every correction.

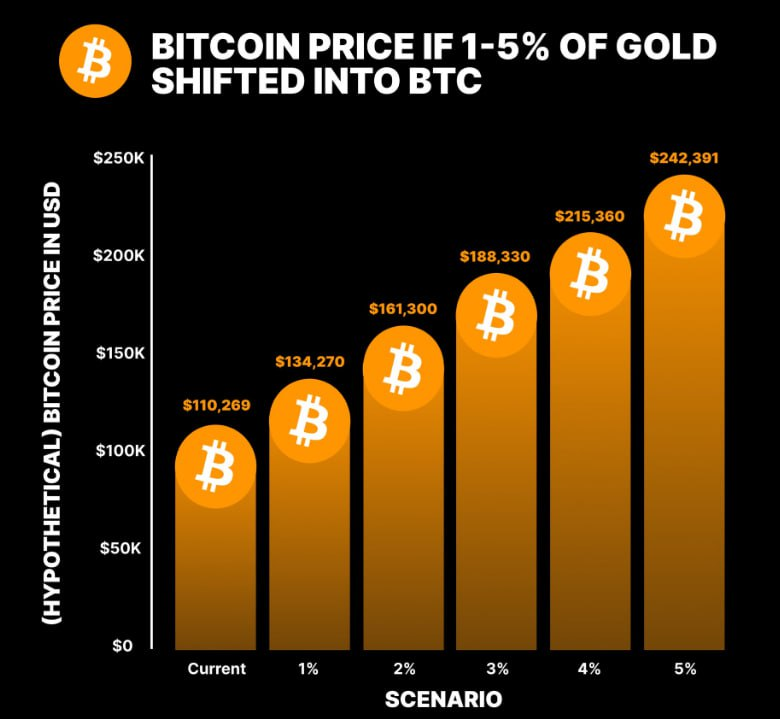

— October 28. According to experts, even a small flow of funds from gold assets into Bitcoin could significantly affect its value.

If approximately 5% of global investments in gold are redistributed to cryptocurrency, BTC could reach around $242,000. Even a partial transfer of capital at the level of 1 – 2% could raise the price of Bitcoin to the range of $130,000 – $160,000.

— 5. News:

A statue of Binance founder Changpeng Zhao (CZ) will be erected in Washington

A group of unknown fans financed the installation of a 4-meter gold monument to the former head of Binance near the US Congress building, raising about $50,000 for this purpose.

The monument will depict Changpeng Zhao (CZ) with his arm raised and four fingers extended—a gesture that has become symbolic of his phrase, «Don't pay attention to FUD.» After the exhibition ends, the sculpture will either be given to Zhao himself or sold at auction, with the proceeds going to Giggle Academy.

Giggle Academy is a non-profit educational project that CZ launched after reaching an agreement with US regulators.

— September 18. A little earlier, a golden statue of Trump holding a bitcoin was erected in Washington.

A 12-foot statue of Donald Trump holding a BTC symbol has been erected on the National Mall, near the Capitol building.

The project was implemented by a team of developers from DJTGST, a meme coin launched on the PumpFun platform. Preparatory work took several weeks, during which the initiators managed to obtain official permission to install the object.

Sign up and get access to free (for now) 0 to educated investor crypto education crash course.

Telegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

Cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided «as is», all claims are verified with third-parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

October 31, 2025