While Ethereum keeps fragmenting into dozens of L2 networks with different economics and UX, and Solana periodically reminds everyone about congestion and outages, Tron has been quietly doing the same job for years: moving global dollar flows. No flashy upgrades, no aggressive marketing, no constant “revolutions.” It just works.

Source: GoMining.com

As of December 2025, TRX is trading around $0.28, which feels a bit ironic: historically, the $0.30 area served as Tron’s psychological ceiling for years. But the context today is fundamentally different.

- Tron holds a top-10 spot by market cap

- The network has become deflationary (rare for PoS chains)

- More than 51% of all USDT globally lives on Tron

- Roughly ~1B TRX is burned every month

- The biggest regulatory “black swan” — the SEC case against Justin Sun — was stayed (paused) in early 2025

So the obvious question is: Is 2026 the year Tron finally breaks into true price discovery, or does it remain a “boring utility” chain for USDT transfers? This article isn’t hype, and it’s not “TRX to $10.” It’s a calm, practical guide for beginners and practitioners who want to understand what actually drives TRX price, which growth and downside scenarios are realistic for 2026, why Tron earns more than most L2s, and how to use these insights in 2025–2026.

Current State of Tron (End of 2025)

Before talking forecasts, you need to lock in the “here and now.”

Price and Market Position

- TRX price: around $0.32

- Market cap: consistently top-10

- Volatility: noticeably lower than most altcoins

TRX hasn’t been a “cheap pump token” for a long time. Its price action looks more like an infrastructure asset — closer to BNB or even “network equities” than classic high-beta alts.

Supply and Burning

Here’s the key point many still miss: Tron has become deflationary. Based on network data and public sources, Tron:

- burns roughly 1–1.2B TRX per month

- has burned 40B+ TRX in total

- has an effective annual supply change of about -2.9%

That’s highly unusual for a PoS network. Most PoS chains are inflationary by design — validator rewards constantly expand supply. Tron is the opposite: the more the network gets used, the fewer tokens exist.

Tron Is Not an “Ethereum-Like” Blockchain

One of the biggest beginner mistakes is judging Tron by the same criteria as Ethereum, Solana, or Sui. Tron isn’t competing for complex DeFi stacks, NFT ecosystems, or experimental smart contracts. Its core role is different. Today, Tron is:

- infrastructure for cheap, fast USDT transfers

- a “bank wire” for high-inflation countries

- a de facto standard for P2P settlement across Latin America, Eastern Europe, Asia, and Africa

That’s exactly why 51% of all USDT globally sits on Tron.

Why On-Chain Economics Matter More Than Price

In this article, we’re not leaning on market emotion. We’re using concrete metrics:

- Chain Fees — what users actually pay the network

- Chain Revenue — what the network earns

- Chain Token Market Cap — how the market prices that income

Data sources:

- DeFiLlama (Tron: fees, revenue, token mcap)

- Token Terminal (the network’s financial statement)

- GeckoTerminal (pools and activity)

This matters because TRX price is a derivative of network demand — not the other way around.

Regulatory Factor: The SEC Case vs. Justin Sun

This is the piece that held Tron back for a long time. In 2023, the SEC filed a case against Justin Sun, the Tron Foundation, and BitTorrent. For TRX, it became the classic “black swan” risk:

- institutions avoided the asset

- funds couldn’t comfortably hold TRX

- larger capital stayed on the sidelines

But in February 2025, the SEC formally requested a stay — pausing the case to discuss a potential resolution. In plain English: the regulatory risk dropped sharply.

This doesn’t mean a “full win,” but it does mean the most important thing: institutions can touch TRX again without a toxic compliance overhang.

Why 2026 Forecasts Make Sense

2026 is a post-halving Bitcoin cycle, a period when markets typically rotate from BTC into alts, and a phase where “promises” matter less than real cash flow.

Tron looks unusual in that context. It isn’t trendy, it isn’t hyped, it isn’t the most decentralized — but it’s one of the few that consistently earns from real users.

That’s why it’s more honest to talk not about a single “price prediction,” but about a range of scenarios, from the most probable to the extreme.

After fixing the current context, it makes sense to move to the upside. Not hype-driven fantasies, but realistic bullish scenarios based on usage, on-chain data, and market structure.

The key point to understand upfront: these are scenarios, not guarantees. Crypto markets never move along a single straight line. Price is always the result of multiple forces interacting at once — macro conditions, regulation, capital flows, and real network demand.

That’s why a scenario-based approach is far more useful than trying to guess one exact number.

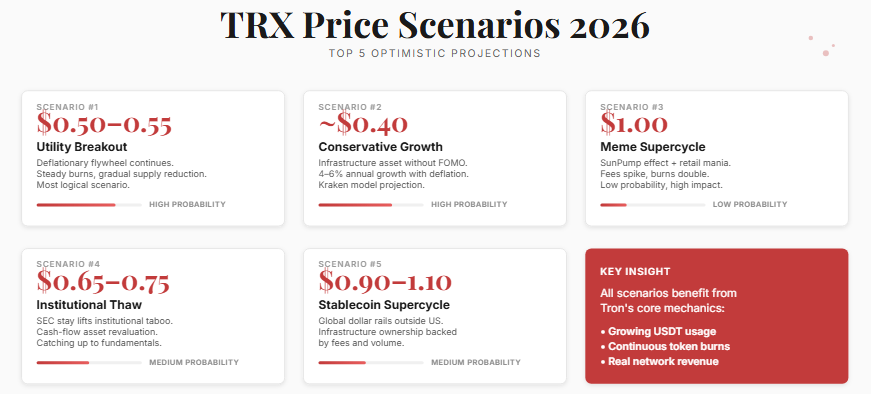

Top 5 Optimistic Tron (TRX) Price Predictions for 2026

Bullish Scenario #1: $0.50–$0.55 — The “Utility Breakout”

Source: Capital.com — technical and macro analysis.

This is the base bullish scenario, and also the most structurally sound one.

In this case, Tron doesn’t change its behavior at all. It keeps doing exactly what it’s already doing today: processing USDT transfers, charging small fees, and steadily shrinking supply through token burns.

No meme hype. No “revolutionary upgrades.” No aggressive narrative marketing.

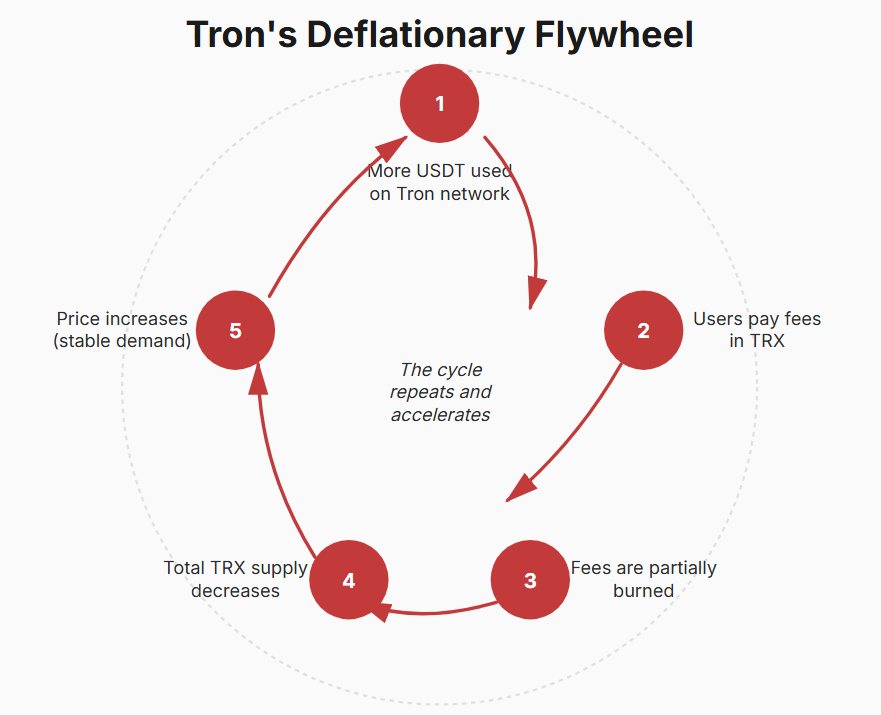

What drives this scenario is what analysts often call the deflationary flywheel.

As USDT usage on Tron continues to grow, users pay transaction fees in TRX. A portion of those fees is burned, reducing the total supply. With demand remaining stable or rising, scarcity starts to do the work.

This isn’t a theory — it’s already happening. Public dashboards and analytics show that Tron burns roughly 1–1.2 billion TRX per month, resulting in an annual supply reduction of about -2.9%. For a PoS network, that’s extremely unusual. Most PoS chains are inflationary by design.

Source: GoMining.com

Historically, the $0.30 level acted as a psychological ceiling for TRX and a zone of heavy profit-taking. If Tron manages to hold above $0.30–0.35, the chart enters an area with relatively weak resistance all the way up to the $0.50–0.55 range.

From a market perspective, this isn’t about “making multiples.” It’s a re-rating — a shift from viewing TRX as a pure utility token to pricing it as infrastructure.

That’s exactly why Capital.com and similar analysts see this range as the most realistic upside under current conditions.

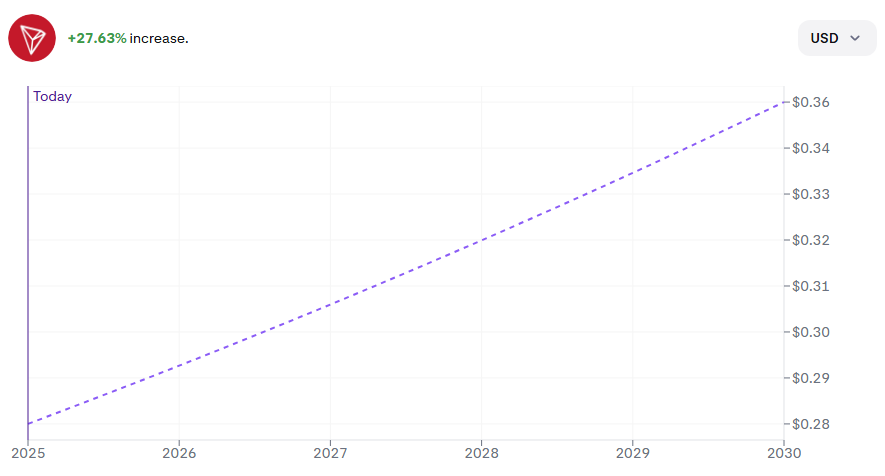

Bullish Scenario #2: ~$0.40 — Conservative Growth Without Hype

Source: Kraken forecast models.

This scenario is often overlooked, but for many investors it’s the most comfortable one.

Kraken’s model assumes no explosive bull market, no meme cycles, and no retail mania. Instead, TRX behaves like a yielding infrastructure asset.

The logic here is simple: moderate demand growth, consistent burning, and gradual accumulation. In practice, that translates into roughly 4–6% annual growth, which — when combined with deflation — still produces positive real returns.

Source: kraken.com

Why does ~$0.40 matter? Because for a top-10 asset, stability plus steady appreciation is already a success. Many Layer-1 projects in this capitalization range either dilute supply or depend heavily on venture funding to survive.

Tron doesn’t. It earns its own revenue, doesn’t rely on VC inflows, and doesn’t need to constantly reinvent its narrative. For investors focused on capital preservation with modest upside, this scenario remains highly attractive.

Bullish Scenario #3: $1.00 — The “Meme Supercycle” and SunPump Effect

This is a low-probability but high-impact scenario.

It’s not the base case, but it can’t be ignored — these are exactly the types of setups that have historically created legends in crypto markets.

The catalyst here would be a renewed retail meme cycle. Tron’s ecosystem already has SunPump, a meme launchpad comparable in spirit to Solana’s Pump.fun or similar viral token factories.

If, in 2026, retail speculation returns in force, on-chain activity surges, and meme launches become a dominant trend again, Tron’s transaction volume — and therefore fee burning — could spike dramatically.

In that environment, TRX could temporarily shift from being perceived as a utility token to a speculative asset.

Why $1, and not $5 or $10? Even in this scenario, discipline matters. A $1 TRX price isn’t fantasy or an extreme multiple — it reflects a sharp repricing driven by sudden demand. But the probability remains low, and it requires a very specific market environment similar to 2021.

This scenario is best viewed as an option with asymmetric upside, not as a base investment thesis.

Bullish Scenario #4: $0.65–$0.75 — “Institutional thaw”

Source and context: FX News Group (SEC stay).

This scenario isn’t driven by retail hype or memes. Its main driver is lifting the institutional taboo around TRX.

Before early 2025, Tron lived in a gray zone for funds, custodians, and corporate traders. The reason wasn’t the network’s economics — it was the legal backdrop around Justin Sun and the Tron Foundation. For large players, that alone was enough to avoid the asset, regardless of its metrics.

That changed in early 2025, when the SEC formally requested a stay — pausing the case to discuss a possible resolution. This isn’t a court win, but for the market it’s a key signal: the existential regulatory risk has been removed.

From there, a mechanism the market has already seen with XRP starts to work. Once an asset exits the “legal shadow,” it stops being treated as toxic and starts being viewed as undervalued relative to fundamentals.

And Tron’s fundamentals are strong: it generates real network income, has a deflationary model, and serves a huge share of global USDT turnover.

At the same time, TRX market cap still looks modest relative to these figures. If institutional capital begins to price TRX as an infrastructure cash-flow asset rather than “Justin Sun’s project,” you get a straightforward re-rating of multiples.

In that case, $0.65–0.75 isn’t euphoria — it’s a catch-up repricing. Not for promises, but for existing revenue.

Bullish Scenario #5: $0.90–$1.10 — “Stablecoin supercycle”

This scenario is broader than Tron. It’s about the global stablecoin market.

By 2025 it became clear that stablecoins are not a temporary tool for crypto traders — they’re a real financial layer.

Tron holds a unique niche in this world. It doesn’t compete for DeFi innovation; it has become the default rail for dollars outside the U.S.

If in 2026 the market enters a “stablecoin supercycle,” Tron becomes necessary infrastructure — not just a convenient option.

In that case, TRX starts to be viewed as a “share” of a global payment network: not a token for speculation, but an asset backed by fees, network effects, and dollar settlement volume.

In that context, a price around $1 is not fantasy and not “multiples for the sake of multiples.” It’s the point where the market recognizes Tron not as an altcoin, but as a financial rail.

Important: this scenario doesn’t require meme hype or FOMO. It requires a continuation of what’s already happening — stablecoins becoming more important in the real economy.

Source: GoMining.com

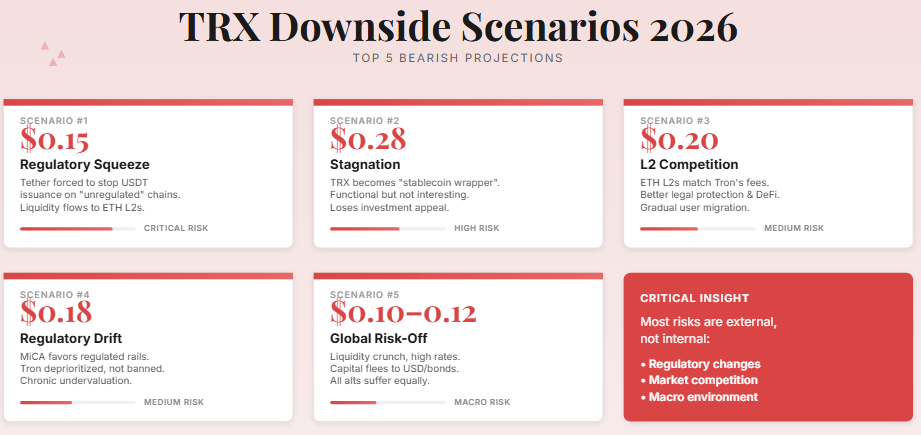

Top 5 Worst Tron (TRX) Price Predictions for 2026

After the bullish scenarios, it’s important to pause and look at Tron from the opposite side. Not through belief or sympathy toward Justin Sun, but through cold probability. Any asset, even a resilient one, has breaking points. Tron has them too — they’re just not obvious at first glance.

The biggest investor mistake is assuming that “if a network is widely used, its token can’t fall.” Market history shows the opposite. Infrastructure assets usually fall not because demand disappears, but because the rules of the game change.

Bearish Scenario #1: $0.15 — “Regulatory squeeze”

This is the most unpleasant and most underestimated risk for Tron. It has nothing to do with TRX’s code or network reliability. It’s about Tether.

Today, more than half of all USDT globally exists on the Tron network. That’s both Tron’s strongest advantage and its Achilles’ heel. Tron is critically dependent on Tether continuing to issue, support, and maintain USDT on this chain.

If U.S. or European regulators — via MiCA or indirect pressure on infrastructure providers — force Tether to reduce or fully stop issuing USDT on “unregulated” chains like Tron, the network would be hit directly. Not because Tron is bad, but because it’s too efficient.

In that case, liquidity wouldn’t vanish — it would migrate to rails that regulators are more comfortable with, such as Ethereum L2s like Base or Arbitrum. Users won’t argue with regulation; they’ll simply switch rails. For them it’s just another network. For Tron, it’s the loss of its primary fee engine.

In this scenario, TRX could easily return to the $0.12–0.15 range, roughly where it traded before the deflation narrative emerged. This wouldn’t be a collapse, but a removal of the payment-rail premium.

Importantly, this scenario doesn’t require banning Tron or suing TRX. Changing the rules for USDT is enough.

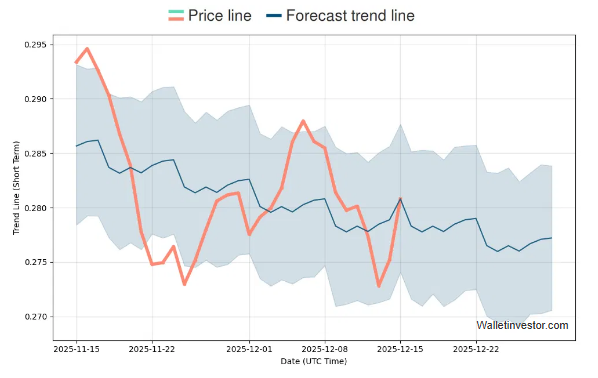

Bearish Scenario #2: $0.28 — “Stagnation as a stablecoin wrapper”

This scenario looks much softer, but it may turn out to be the longest and most psychologically difficult for investors.

The idea is simple. Tron keeps working. USDT keeps moving. Fees keep getting burned. But the price barely moves. TRX turns into infrastructure background noise — useful, reliable, but unexciting.

This perspective is reflected in conservative models such as WalletInvestor:

Source: GoMining.com

From the market’s point of view, TRX stops being treated as an investment asset. It’s held for convenience, not for growth. Volatility fades, price action becomes dull, and speculative interest disappears.

In this scenario, TRX could sit in the $0.28–0.30 range for months or even years. Formally, this isn’t failure. But relative to other opportunities, it’s lost time and missed returns.

Bearish Scenario #3: $0.20 — “Slow bleed to competitors”

This scenario isn’t about sudden shocks. It’s about erosion.

For a long time, Tron won thanks to two things: cheap transactions and massive USDT support. But the market doesn’t stand still. Ethereum L2s are steadily becoming cheaper, faster, and easier to use. Base, Arbitrum, and others are already experimenting with near-zero stablecoin transfer costs.

If during 2025–2026 users can send USDT on L2s as cheaply as on Tron while getting stronger legal protection, better DeFi integration, and higher perceived decentralization, part of the audience will start to leave.

Not instantly. Not all at once. But gradually.

DeFiLlama data shows that competition for stablecoin traffic is intensifying.

In this scenario, Tron doesn’t “die,” but it loses momentum. Activity declines, burning slows, deflation weakens. The price slowly drifts toward the $0.18–0.22 range.

Bearish Scenario #4: $0.18 — “Regulatory drift without bans”

This scenario is often confused with the first one, but there’s a key difference. There’s no hard ban on USDT on Tron, no dramatic headlines, no emergency measures. Instead, there’s slow, bureaucratic rule-making.

MiCA and similar regulatory regimes don’t require “shutting down Tron.” What they do is create preferential conditions for regulated rails. Banks, fintechs, and payment providers find it easier to work with networks that are embedded in U.S. or EU jurisdictions, have clearly identifiable issuers, and integrate smoothly with compliance procedures.

In this framework, Tron isn’t banned — it simply becomes non-priority. It remains popular in P2P usage and developing markets, but gradually drops out of focus for “white” institutional capital.

This doesn’t lead to a crash, but to a structural effect: new money enters the ecosystem less frequently, while existing capital slowly reallocates to more regulated environments. Fees remain, USDT keeps flowing, but growth stalls.

In this mode, TRX could trade below fair value for years, slowly drifting toward $0.16–0.18. This isn’t a crisis — it’s chronic undervaluation that’s hard to escape without a change in external conditions.

Bearish Scenario #5: $0.10–$0.12 — “Global risk-off and altcoin compression”

This scenario isn’t really about Tron. It’s about the broader market.

Crypto history shows that during hard risk-off phases — when global liquidity tightens, interest rates stay high for long periods, and capital flows into dollars and government bonds — all altcoins suffer, regardless of fundamentals.

Even assets with real revenue and on-chain profits aren’t “rewarded” in such periods. They’re sold not because they’re bad, but because investors need liquidity and cash.

In this environment, TRX temporarily stops being priced as payment infrastructure and becomes “just another alt.” Its deflation, fees, and USDT traffic don’t disappear — the market simply ignores them.

If in 2026 tight monetary policy, weak risk appetite, and capital outflows from crypto coincide, TRX could realistically see the $0.10–0.12 range. This would reflect macro conditions, not internal problems with Tron.

Ironically, these phases are often where fundamentally strong networks lay the groundwork for the next cycle. But from a price perspective, it’s still one of the worst-case scenarios.

Source: GoMining.com

Why All Bearish Scenarios Come Down to One Core Factor

If you strip everything down to the basics, Tron’s vulnerability is not technological — it’s structural. The network is tightly linked to one dominant flow: global USDT transfers.

As long as this flow grows, Tron thrives. If it slows down or gets redirected, Tron’s economics change quickly and materially.

That doesn’t make Tron a bad asset. It makes it a highly specialized asset.

This distinction matters. Tron isn’t built to win every narrative cycle. It’s built to do one thing extremely well — move dollars cheaply at scale. And that’s both its strength and its constraint.

Tron as a Business, Not a Narrative

If you remove emotions, forecasts, and debates around Justin Sun, Tron remains one of the few networks that can realistically be analyzed as a business.

Not as an “idea.”Not as a “future ecosystem.”But as an operating economic system with revenue, costs, and scale effects.

This is where many investors go wrong. They view Tron as an “old Layer 1,” instead of seeing it as payment infrastructure competing not with Ethereum, but with bank wires and off-chain settlement systems.

Network Fees: Why Tron Earns More Than It Looks Like

Looking at Tron’s Chain Fees data on DeFiLlama often surprises even experienced market participants:

Source: GoMining.com

Tron consistently ranks among the top networks by daily fees, frequently outperforming not only most Layer 2s, but also many Layer 1 blockchains. This seems counterintuitive because Tron is known for low transaction costs. The explanation is volume.

Millions of users send USDT daily, make P2P payments, and settle transfers between exchanges, market makers, and OTC desks. Each transaction is cheap on its own, but together they generate a massive and stable fee stream.

This is a critical point: Tron earns through scale, not through expensive transactions. The same economic logic underpins Visa and Mastercard — not speculative tech platforms.

Revenue and Burning: Why Deflation Is Not Marketing

Fees matter only if they affect token economics. In Tron’s case, they do.

A significant portion of network fees is burned rather than redistributed via inflationary rewards. According to public analytics and reporting, Tron has already burned over 40 billion TRX, and the process continues. On average, the network destroys about 1–1.2 billion TRX per month, making it one of the few PoS networks with sustained negative net issuance.

This is not a manual burn designed for PR. It’s a direct consequence of network usage. The more USDT flows through Tron, the stronger the deflationary effect.

That’s a fundamental difference compared to networks where higher activity increases congestion but doesn’t improve token economics.

This is confirmed by third-party sources, including Binance Square.

Token Market Cap: Why TRX Looks Undervalued

When Tron’s Chain Revenue is compared to its current token market cap, a clear imbalance appears. On Token Terminal, Tron regularly shows higher net revenue than:

- most Ethereum L2s

- experimental Layer 1 networks

- hype-driven ecosystems backed by venture capital

Yet TRX doesn’t receive a proportional valuation premium. The reason is simple: markets don’t like boring stories. Tron doesn’t sell a vision. It sells a service.

This creates the core TRX paradox: a deflationary asset with real cash flow is priced as if it were temporary.

The Justin Sun Factor: From Risk to De-Risking Event

It’s impossible to talk about Tron without mentioning Justin Sun. He’s both the project’s biggest asset and its largest reputational risk. For institutional capital, Sun himself was long viewed as a compliance red flag.

That’s why the SEC lawsuit filed in 2023 weighed on TRX more heavily than any market cycle. The risk was binary: escalation or relief.

In February 2025, the SEC formally requested a stay, pausing the case to explore a possible resolution. For the market, this was a clear signal: the largest legal overhang no longer dominates TRX pricing.

This doesn’t mean the issue is fully resolved. But it does mean institutions no longer have to ignore TRX purely for compliance reasons.

Ironically, regulatory pressure ended up cleaning Tron’s narrative. After the stay, TRX began to be viewed less as “Justin Sun’s project” and more as payment infrastructure with stable metrics.

Final Picture for TRX in 2026

When all scenarios are combined, a clear framework emerges.

In a positive case — with continued USDT usage, sustained deflation, and no new regulatory shocks — the $0.50–0.55 range looks logical and fundamentally justified. This would be a repricing of infrastructure, not a speculative pump.

The conservative case around $0.40 implies Tron remains what it already is: a stable payment rail without noise. For many investors, that’s a feature, not a flaw.

Negative scenarios remain possible. Regulatory pressure on Tether or loss of cost advantage could push TRX back toward $0.15–0.20. That wouldn’t be the end of Tron, but a lower valuation reflecting higher risk.

The key takeaway is simple: every scenario revolves around real network usage. Tron doesn’t run on expectations. It runs on transactions.

FAQ

Is Tron (TRX) really deflationary?Yes. Tron currently burns around ~1–1.2 billion TRX per month, resulting in an estimated -2.9% annual supply change, which is rare for PoS chains.

Why does Tron burn so many tokens?Because heavy USDT usage generates fees, and a portion of those fees is permanently burned. More usage = more burn = lower supply.

Why does over 50% of all USDT run on Tron?Low fees and fast settlement. Sending USDT on Tron typically costs about $1, compared to $5–$20 on Ethereum during congestion.

Did the SEC lawsuit against Justin Sun affect TRX?Yes. The lawsuit filed in 2023 was a major overhang, but in early 2025 the case was stayed (paused), significantly reducing regulatory risk.

Is Tron competing with Ethereum as a smart contract platform?Not directly. Tron’s main role is global stablecoin settlement, not complex DeFi or experimental smart contracts.

What are the main bullish drivers for TRX in 2026?Deflation, stablecoin dominance, high network fees and revenue, reduced legal risk, and growing usage in emerging markets.

What is the biggest risk for Tron?Regulation around stablecoins. If USDT issuance shifts away from Tron due to regulatory pressure, network fees and demand could decline.

Why might TRX underperform other altcoins?Because it’s viewed as infrastructure, not a hype-driven growth asset. Lower volatility often means lower upside during speculative cycles.

Is TRX better suited for long-term holders or traders?More suitable for risk-averse long-term holders seeking exposure to stablecoin payments rather than short-term speculative traders.

Can Tron survive without USDT?It would survive technically, but its economic model is tightly linked to USDT flows. Stablecoin usage is central to Tron’s value proposition.

Sources & References

Capital.com — price analysis and key technical levelshttps://capital.com/en-int/analysis/tron-price-prediction-what-is-tron-trx

Kraken — projected growth modelhttps://www.kraken.com/en-ca/price-prediction/tron

WalletInvestor — conservative forecast scenariohttps://walletinvestor.com/forecast/tron-prediction

DeFiLlama — network fees, revenue, and token market caphttps://defillama.com/chain/tron?chainFees=true&chainRevenue=true&chainTokenMcap=true

Token Terminal — Tron financial performance and revenue datahttps://tokenterminal.com/explorer/projects/tron/financial-statement

Final Takeaway

Tron is neither the star of the crypto market nor its outsider. It’s a workhorse that quietly carries a significant share of global dollar settlement.

In 2026, TRX is unlikely to be the market’s top-performing asset. But it has a strong chance of remaining one of the most resilient ones. And in a world where risks keep increasing, resilience is gradually becoming more valuable than loud promises.

If you want to better understand crypto markets, cycles, on-chain data, and real valuation models, follow Crypto Academy and get access to the crypto and Bitcoin course. It remains free — while much of the market is still waiting for a “perfect entry.”

Telegram | Discord | Twitter (X) | Medium | Instagram

January 5, 2026