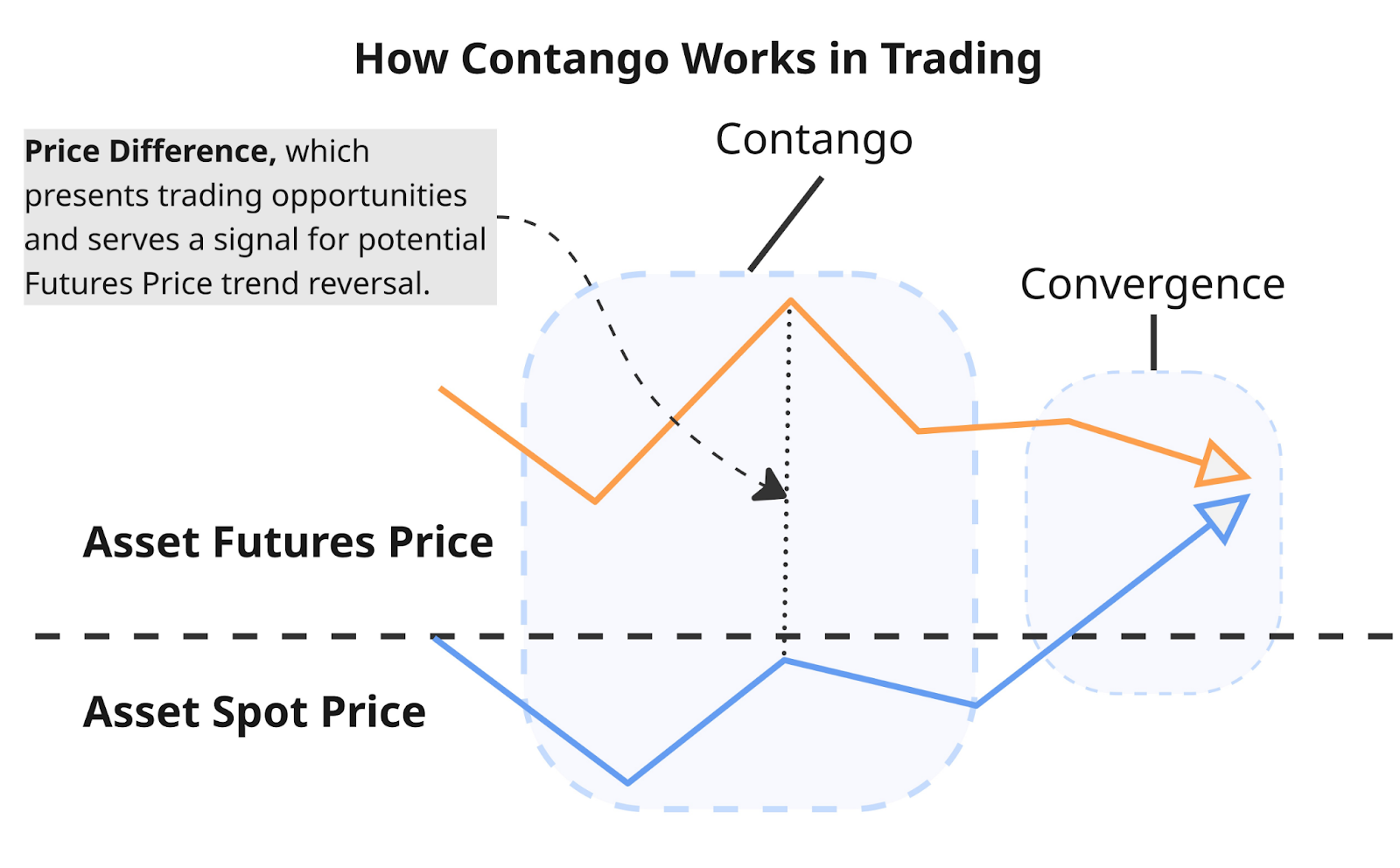

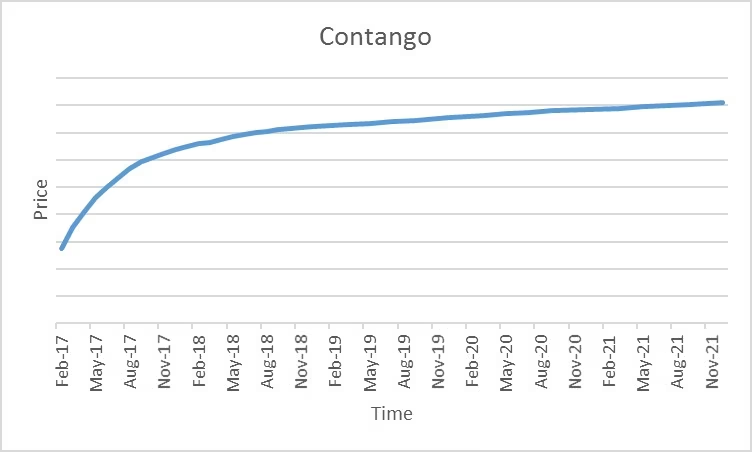

Contango is a temporary condition when the futures price is higher than the spot price.

This difference between spot and futures prices occurs when market participants factor future growth in the value of the asset into the contract price.

Source: GoMining.com

Why does contango occur?

The price of a long-term futures contract consists of several components:

1. The current spot value of the asset;

2. Storage and transportation costs (for commodities);

3. The cost of financing the position;

4. The time value of capital and market participants' expectations regarding future prices.

If the spot price of an asset declines, the long-term futures contract may remain at the same level or fall more slowly, as it reflects market participants' expectations of future price increases.

Every time an expiring contract is rolled over to a new one, a rollover occurs. In contango conditions, the new contract is purchased at a price higher than the old one, which creates a price difference and a loss for the position holder. With regular rollovers, this effect accumulates and reduces the overall return.A rollover is when a futures position is carried over to the next day.

Source: Vklader.com

Opportunities to earn on contango

The difference between distant and nearby contracts allows you to build strategies based on price discrepancies:

1. Short positions on distant contracts. The trader earns if the price of the distant contract falls faster or aligns with the nearby contract.

2. Combinations with options. Used to profit from price differences between contracts and manage risk.

3. Analysis of spot price and near-term futures. Determining entry and exit points based on differences between spot and contracts.

Instruments that respond to price declines (such as inverse ETFs or short positions) help balance the portfolio and manage the impact of contango.

Potential risks of Contango Trading

The main risk is associated with rollovers and changes in the spot price:

1. Fixed loss on rollover. Each transfer of a position to a more expensive contract creates a negative difference.

2. Spot decline. If the price of the underlying asset falls, the loss increases due to the difference between the old contract, the new contract, and the spot price.

3. Accumulation of effects. With long-term contract holdings and regular rollovers, negative returns accumulate.

These processes are especially important for strategies with frequent updates of futures positions or for ETFs on commodity assets.

How Contango works in cryptocurrency

In the cryptocurrency market, futures on Bitcoin and other digital assets may be in contango for the same reasons. Long-term contracts include expectations of future price growth, financing costs, and liquidity.

When rolling over, the new contract is purchased at a higher price than the expiring one, which creates a difference and reduces the final return. Strategies in the crypto market include:

1. Analysis of the slope of the futures curve;

2. Short positions on long-term contracts;

3. Combinations with options to extract the difference between spot and futures.

Thus, contango in cryptocurrency works on the same principles as in traditional markets, and its impact is manifested through the cost of rollovers and spot price dynamics.

Conclusion

In a contango market, it is important to consider the relationship between potential costs and possible financial results. Before investing in futures contracts or ETFs that depend on the contango structure, you should analyze the possible impact of rollovers and price fluctuations on the final return.

Since contango is a changing market condition, strategies for working with futures and other instruments should be adjusted according to current conditions. Regular portfolio reviews and adapting positions to new price structures help manage the impact of price differences between contracts on the overall investment result.Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-mining

January 5, 2026