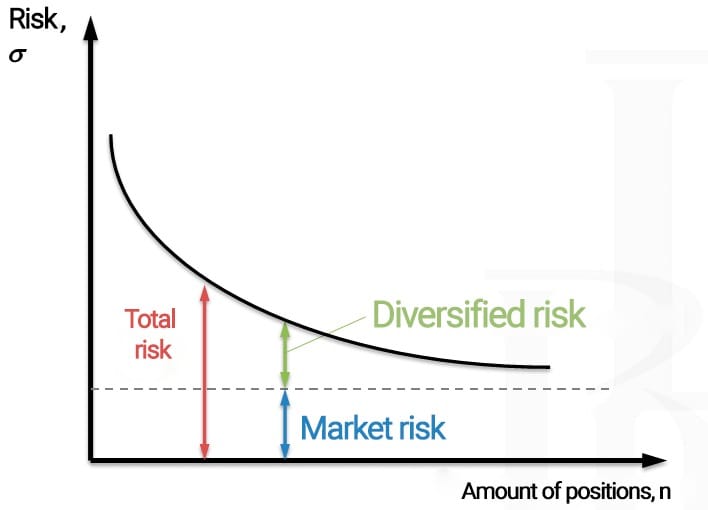

Diversification is a basic risk management method of distributing money (and risk) across different assets.

Portfolio diversification can be achieved by distributing funds among different types of crypto assets — coins and tokens, DeFi instruments, and NFTs. Additionally, risks are reduced by using multiple wallets and exchanges, as well as basic risk management approaches.

Source: GoMining

Potential for value growth

One of the effects of diversification in a cryptocurrency portfolio is the opportunity to participate in the growth of the value of individual assets. Different cryptocurrencies do not exhibit the same price dynamics, so the positive movement of some positions can partially offset the decline of others. This mechanism reduces the portfolio's dependence on a single asset and a single market scenario.

At the same time, it is important to note that assets with higher growth potential are usually accompanied by a higher level of risk. For this reason, diversification is seen not as a way to enhance results, but as a tool to balance possible market fluctuations and capital preservation.

Why portfolio diversification is necessary

Diversification reduces the risk of losses by distributing funds among different assets. When the market fluctuates, some positions can compensate for the losses of others, which reduces the overall burden on the portfolio. This approach is especially important in crypto, where sharp movements are common.

To control risks and current results, PnL (Profit and Loss) is used — an indicator of the difference between the entry price and the current value. It helps to assess possible losses and adjust the distribution of funds when diversifying a portfolio.

Source: Tradelink.pro

What are the types of asset diversification?

1. Diversification within a single sector. This approach involves working with assets in a single area, such as payment coins or DeFi projects. Analyzing such assets is easier because they are subject to similar market factors. However, it is important to consider the risk of a simultaneous decline across the entire sector if it comes under pressure from the market or regulation.

2. Mixed (cross-sector) diversification. Here, the portfolio is formed from assets in different areas: payment solutions, decentralized protocols, NFT projects, and stablecoins. This distribution reduces dependence on a single market segment and helps smooth out sharp fluctuations.

3. Diversification by capitalization. Large-cap assets are usually more stable but change in price more slowly. Medium-sized projects may show more pronounced dynamics, while small ones may be highly volatile. Dividing the portfolio between different categories reduces the risk of sharp declines.

4. Sectoral diversification. Different segments of the crypto market react differently to external events. Decentralized finance depends on user activity, payment networks depend on the level of cryptocurrency adoption, NFT projects depend on market and cultural trends, and infrastructure solutions develop alongside the blockchain ecosystem. This allows the weakness of one sector to be offset by another.

5. Use of stablecoins. Stablecoins are often used as a tool to reduce volatility. They help to keep part of the portfolio in a more stable form and reduce the impact of sharp market movements.

6. Temporal diversification. Assets in a portfolio can have different holding horizons: short-term, medium-term, and long-term. This distribution reduces dependence on a single time scenario and helps to react more calmly to short-term market fluctuations.

7. Geographical diversification. One way to reduce risks when working with crypto assets is to distribute the portfolio among projects from different regions. Blockchain ecosystems are developing unevenly, and each part of the world is forming its own rules, approaches, and technological solutions.

To avoid additional risks, it is important to ensure that assets are not concentrated in one country or region. Analyzing the stability of projects and the regulatory environment in different parts of the world helps to maintain portfolio balance and reduce the impact of unexpected changes in market rules.

8. Diversification by market capitalization in 2025. In 2025, the cryptocurrency market will still be clearly divided by market capitalization. Large assets such as Bitcoin and Ethereum will retain their dominant position and be perceived as the most stable elements of the market. Projects with smaller capitalization will remain more sensitive to market fluctuations and news background.

At the same time, the market is not limited to leading cryptocurrencies. In 2025, a wide range of assets of varying scale and stage of development continues to exist. Taking into account differences in market capitalization allows for a more balanced assessment of the risks and structure of the cryptocurrency market as a whole.

Advantages and limitations of diversification

Diversification is used as a strategic method of reducing risks and limiting potential losses. Its main task is to reduce the portfolio's dependence on individual assets and market scenarios.

The key advantages of diversification include:

1. Reduction of aggregate losses during unfavorable market movements and falling demand;

2. Ability to adapt to changes in the economic environment by reallocating funds between areas;

3. Using freed-up resources to reallocate them to more stable or promising segments;

4. Reducing the period of inefficient capital allocation when market conditions change.

However, diversification also has a number of limitations:

1. More complex portfolio management and increased requirements for analysis and control;

2. The need to take macroeconomic and political factors into account for a correct risk assessment;

3. The risk of errors due to a lack of knowledge and experience;

4. Limited effectiveness with a small amount of capital, when distribution does not allow for a significant reduction in risk.

In conclusion on Diversification

Diversification is a way to reduce the likelihood of serious losses by distributing funds among different assets. The idea is simple: if the entire portfolio is concentrated in one direction, a single adverse event can lead to a significant decline. When assets are distributed, the impact of a single negative factor becomes less critical.

In practice, this means working with several asset classes and economic sectors at once, rather than betting on a single market or instrument. This approach helps reduce the portfolio's dependence on individual risks and decreases the likelihood of sharp losses.

For a long-term strategy, diversification simplifies risk control. Investing in different companies, regions, and crypto assets allows you to smooth out portfolio fluctuations and better understand how the market reacts to changes. This does not completely eliminate losses, but it reduces the chance that a single mistake or external factor will cause critical damage to the portfolio.

Subscribe and get access to the GoMining course on cryptocurrency and Bitcoin, which is still free: https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing from the aforementioned in this article constitutes financial advice or investment recommendation. Content provided «as is», all claims are verified with third-parties, credible sources and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited. Use of content for AI citations is allowed only with explicit links to the original article being quoted on GoMining.com website.

January 5, 2026