Imagine you use the internet, watch YouTube, chat on Telegram, launch an AI assistant, store files, and make video calls — but never think about who provides all of this.

Infrastructure is like oxygen: as long as it exists, no one thinks about it. But once it disappears — panic hits within seconds.

The Internet as we know it now depends on 6 major players: Google, Amazon, Microsoft, Meta, Cloudflare, AWS. They provide data storage, computing, AI power, servers, clouds, and security. This convenience comes at a price: data doesn’t belong to users, prices are dictated by corporations, privacy is conditional and centralized infrastructure is fragile (politics, sanctions, outages).

And now a new direction in the crypto market has emerged, promising to break this model.

- 2020 — the year of DeFi

- 2021 — NFT

- 2022 — GameFi

- 2023 — AI-mania

- 2024 — RWA and ETF

- 2025 — DePIN (physical infrastructure)

- 2026 — the year of DPIN: Digital Providers of Infrastructure Networks

This is the next level. If DePIN is about “hardware” (towers, routers, devices, sensors), then DPIN is “digital infrastructure as a service”, but decentralized, accessible, and fair.

What is DPIN in Simple Terms

DPIN refers to decentralized networks that provide digital services essential for the modern internet and AI: data storage, computing, VPN, privacy, AI models, CDN, clouds, SaaS services — not through Big Tech, but through a network of participants around the world who earn tokens as rewards.

The simplest analogy:

If traditional corporations are like Uber with one central company, then DPIN is Uber without the company — where drivers and passengers connect directly, and blockchain ensures fairness.

DPIN can be explained even more simply:

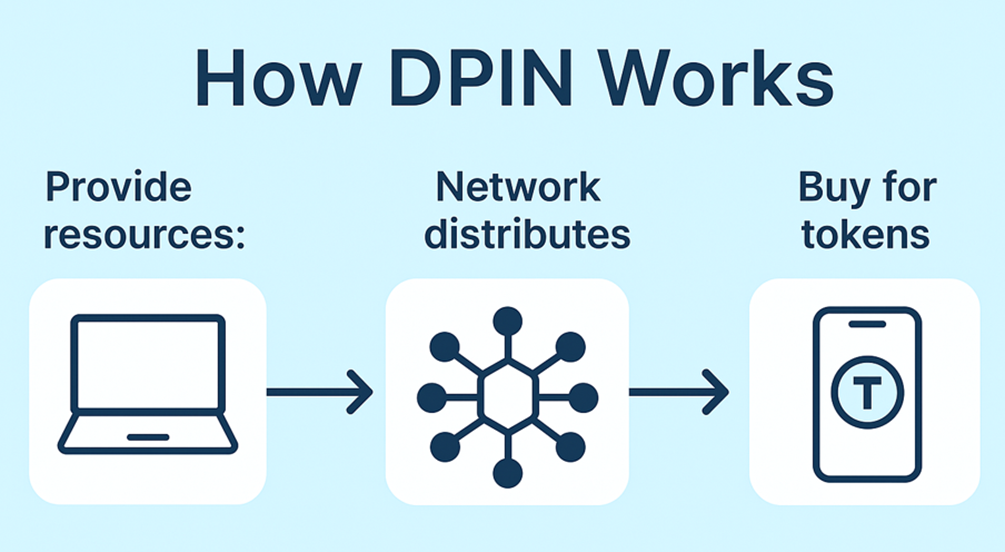

✅ People and companies share their resources (compute power, AI, memory, software)✅ The network aggregates it and distributes it as a service✅ Users pay for the service with tokens✅ Network participants earn rewards

DPIN = Internet services of the future, but without corporate monopolies.

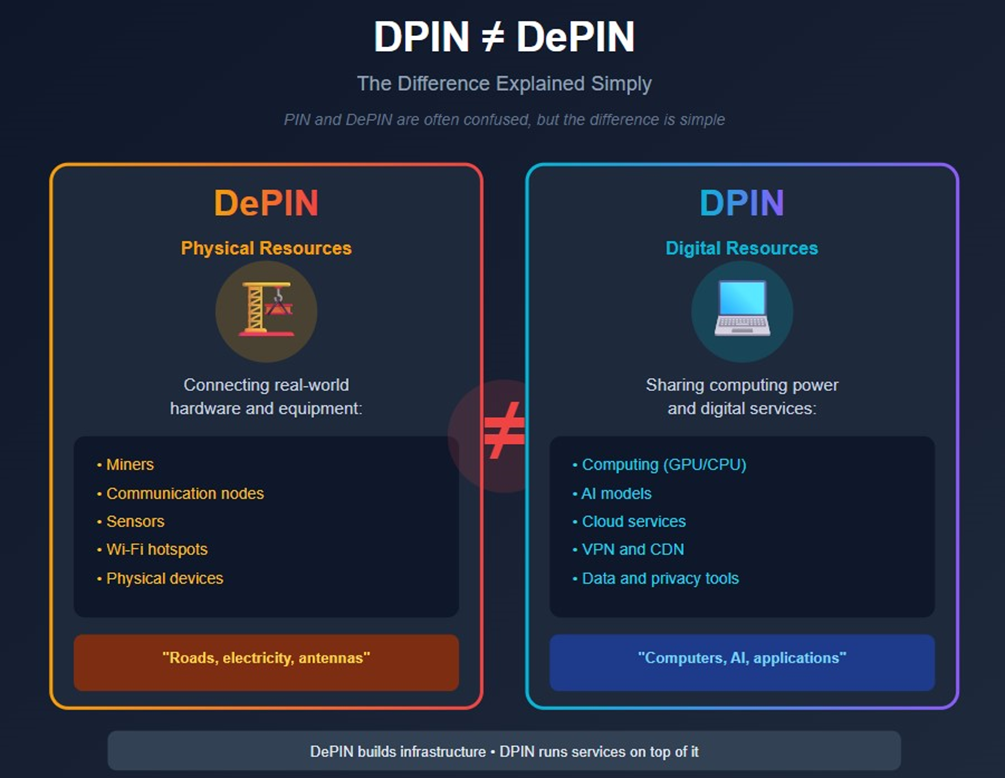

DPIN ≠ DePIN: Explained Simply

PIN and DePIN are often confused, but the difference is simple.

DePIN — about combining physical resources. People connect hardware and share things from the real world: miners, communication points, sensors, Wi-Fi, etc.

DPIN — about combining digital resources. Participants provide computing, AI models, cloud services, VPN, CDN, data, and privacy tools.

A visualization to understand:

• DePIN builds “roads, installs power lines, and puts up antennas.”• DPIN launches “computers, AI, and apps on top of those roads.”

By 2026, DPIN may become the next major trend, because digital services scale much faster than physical infrastructure.

Why Exactly Now: 3 Reasons Every Beginner Must Understand

1. The world is moving from ownership to service consumption

Overall, the world is being ruled by convenience: CD and DVD’s for movie nights are being replaced by Netflix, discs and cassettes (if you remember those you passed the vibe check) are replaced with Spotify and YouTube Music. Convenience came even for servers: you don’t buy racks for your garage anymore, you rent them from cloud service providers instead.

DPIN is the crypto version of cloud services, but transparent: without censorship or monopoly and with fair reward rules. Such an approach fits the Web3 narrative perfectly.

2. Centralized clouds have become the “bottleneck” of the AI revolution

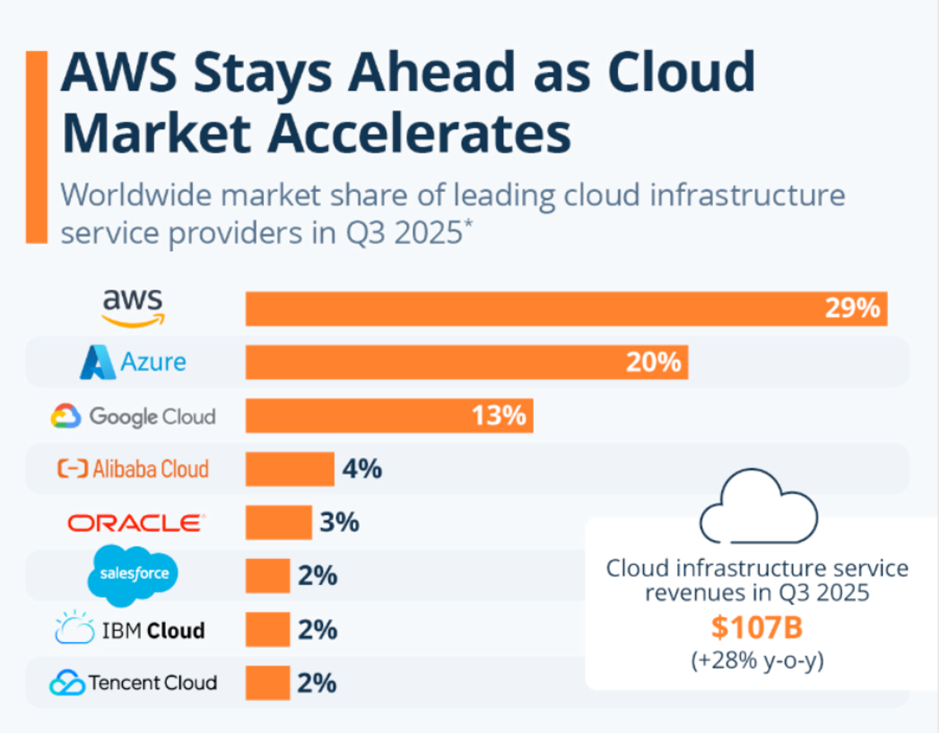

AI models require enormous cloud power. Today, 62% of the market belongs to three companies (according to Statista): AWS, Azure, Google Cloud.

Source: statista.com

What is the problem with Centralized Clouds? They are expensive, slow to scale, pose risks of regional shutdowns and your data goes to Big Tech.

DPIN offers an alternative: distributed, decentralized, where people and businesses become mini-providers of capacity.

3. Governments, banks, and corporations have started regulating “digital data” as an asset

After the AI startup boom and privacy scandals, countries began to treat data as a strategic resource This means centralized internet will be more strictly controlled and demand for private, independent, and secure networks will grow.

DPIN becomes the answer to the question: “How to ensure digital sovereignty without Big Tech control?”

Do you know what a VPN is? Everyone uses it, but it’s centralized. A company can track you, sell data and shut you down on government request.

DPIN-VPN works differently: you connect not to a company, but to a network of thousands of nodes with no owner. No one can form a full picture of your traffic.

The same will happen with:

- DPIN-AI (AI assistants without corporations)

- DPIN-Cloud (data storage)

- DPIN-Compute (computing)

- DPIN-CDN (content and website acceleration)

And each of these niches is a future multibillion-dollar market.

Why DPIN Will Become the Main Narrative of 2026

The reason is simple: DPIN solves real problems felt by ordinary people — not only crypto enthusiasts.

DeFi was not clear to everyone. NFTs — many saw them as “pictures.” But AI is used by billions, VPN is used by hundreds of millions, data storage is needed by everyone and clouds services are part of daily life

DPIN is crypto-infrastructure for the mass user, which means the market will be huge. And just like with DeFi in 2020 — early investors got Xs. DPIN at the beginning of 2026 will be exactly the same entry point.

If Simplified to the Maximum: How DPIN Works Internally

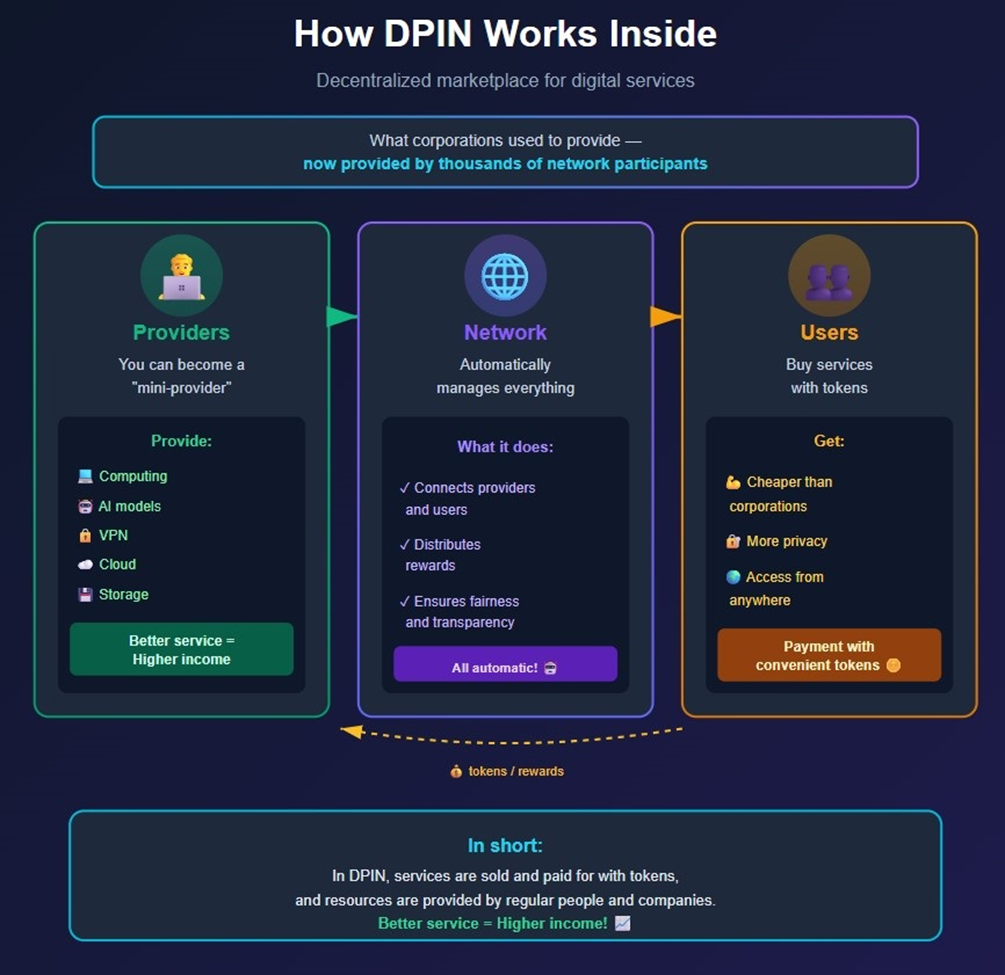

To avoid overloading with terminology, imagine DPIN as a decentralized “marketplace of digital services,” where:

- You can become a “mini-provider” of digital power, AI, VPN, cloud, or memory

- Users buy services, paying with tokens

- The network automatically distributes rewards fairly and transparently

What corporations used to provide — is now provided by thousands of network participants.

In short: in DPIN, services are sold and paid for in tokens, and resources are supplied by regular people and companies. The better the service — the more income.

Where Does the Money Come From? (and Who Pays Whom)

The key strength of DPIN is real demand for digital services, not speculation.

Each DPIN has 3 financial flows:

1. User → Network. Buys a service (e.g., AI request, cloud, or VPN). Payment is usually in the project’s native token.

2. Network → Providers. DPIN distributes payment among participants who provided resources. This may include: GPU, software, traffic, storage, node, SaaS.

3. Retention and growth mechanics. Part of tokens may be burned, staked, or allocated to the network development fund. This creates scarcity, supports price, and stimulates long-term growth.

Important for beginners: in DPIN there is real cashflow, not just promises — demand comes from service users.

How a Beginner Can Earn on DPIN Right Now (Without Complexity)

Method #1: Early purchase of tokens of DPIN projects with real demand

How did it work with DeFi in 2020? The market rewarded those who entered before the mass wave.

With DPIN, the logic is the same: if a project provides a real service (GPU, VPN, cloud) — it has a chance for long-term demand.

Where to find such projects:

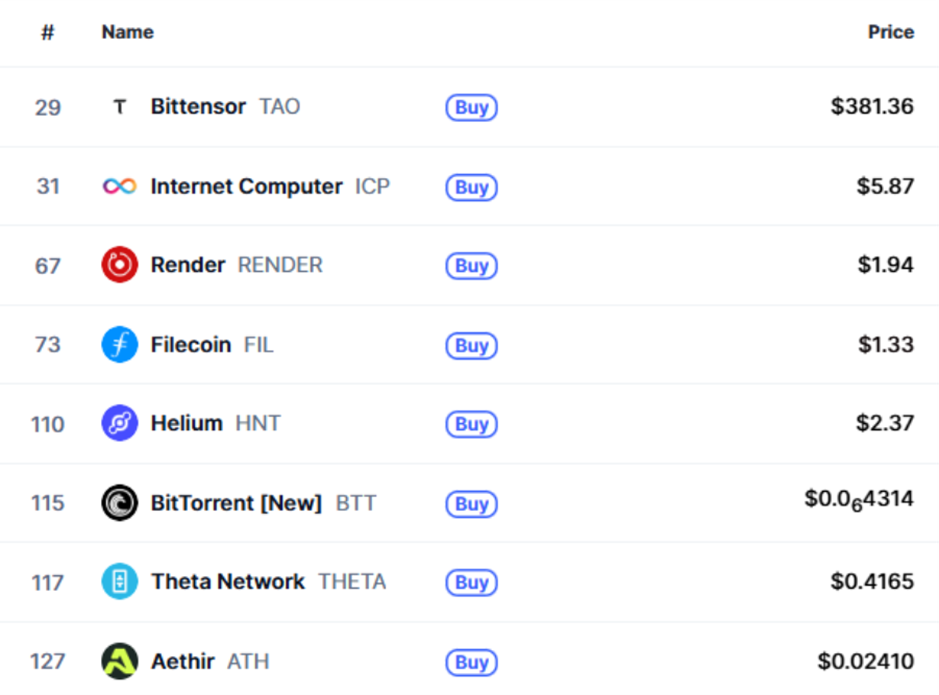

• CoinGecko — categories: AI, Cloud, Privacy• Coinmarketcap — categories: AI, Depin, Desci

Source: coinmarketcap.com

• X (Twitter) — look for early niches with hashtags: #DPIN #DePIN #AIInfra #Web3Cloud

Tip for beginners: choose projects that have users, not only “holders.”

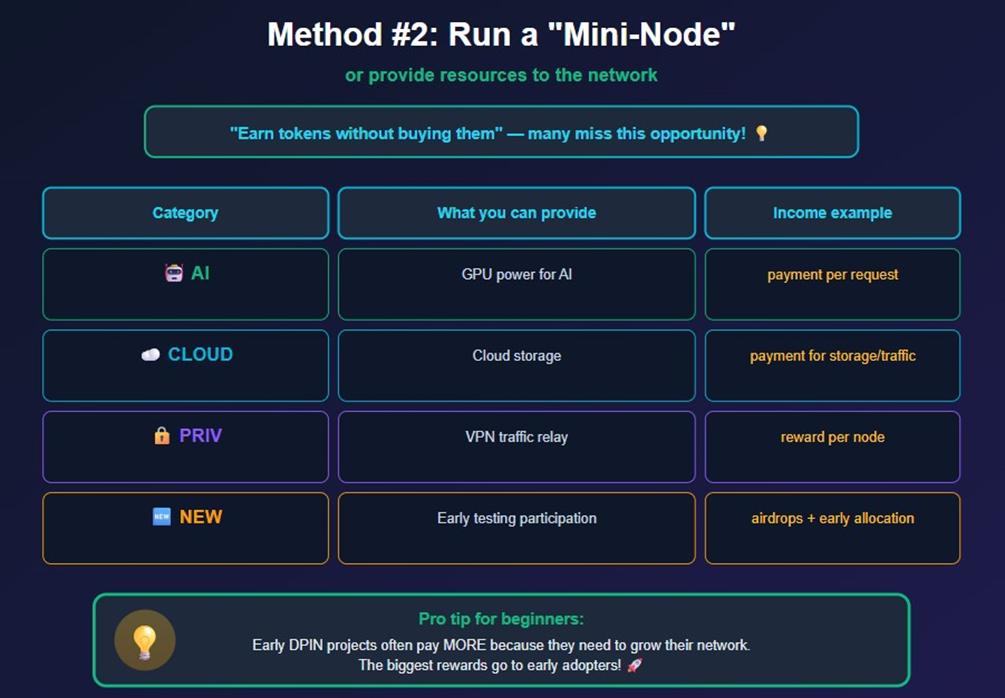

✅ Method #2: Launch a “mini-node” or provide a resource to the network

This is a way to earn tokens without buying them — many people overlook it.

Pro tip for beginners: early DPIN projects often pay more because they need to grow the network.

Examples of such projects:

AI category:

• Render Network — rent out your GPU for 3D rendering and earn RNDR tokens• Akash Network — provide computing power for cloud computing• io.net — decentralized GPU network for AI/ML tasks

CLOUD category:

• Filecoin — share free disk space for decentralized storage, earn FIL tokens• Storj — similar to Filecoin, pays for data storage• Arweave — permanent data storage

PRIV category:

• Mysterium Network — run a VPN node and earn MYST tokens for traffic• Orchid — decentralized VPN• Deeper Network — decentralized internet and VPN

NEW category (easy start):

• Grass — pays for sharing unused internet traffic (very easy to start, works in browser)• Nodepay — similar project, passive income for internet connection• Hivemapper — earn tokens by filming roads with a dashcam

Method #3: Airdrops and early testing of DPIN services

A similar story was with:

• Arbitrum → airdrop for early users• Celestia → generously rewarded early testers

DPIN projects often use this model to attract first users.Where to catch such opportunities:

• CRM list on AirdropAlert• X channels: @Airdrops, @DePINDaily• Project Discord/Telegram

Lifehack: the earlier you start using the service — the higher the chance of a “juicy” drop.

A mini-example to make it clear:

Suppose you run a DPIN-VPN node on your laptop. You share part of your internet and computing power, people use the VPN service, you receive tokens for each gigabyte or session. As token price grows, so does your income.

It’s like “renting out your Wi-Fi socket,” only through blockchain.

5 Metrics a Beginner Must Check Before Entering

To avoid being a “lucky by chance” beginner and instead act smart:

1. Active service users. If there are no users — no demand → no growth.

2. Network revenue. How much money goes through the service each month.

3. Resource cost vs reward. If you run a node — does it pay off?

4. Community and development. GitHub + X + Discord → activity = life.

5. Tokenomics. Is there a burn, or incentives to hold the token instead of dumping?

Mini Entry Plan for Beginners (Up to 30 Minutes)

- Choose 2 projects: one AI + one PRIV

- Visit the website, read the “How it Works” section

- Test the service as a user

- Decide: do you want to earn with tokens or through participation?

- Subscribe to their X and Discord

- Mark update/release dates in your calendar

This is better than blindly buying a token based on someone’s advice.

Don’t Sleep on DPIN

Simply put: we are again at the threshold of a massive breakthrough.

Over the past 5 years, the crypto market has thrown dozens of chances at people. Some caught them — and built their future. Most — watched from the sidelines and “planned to look into it later.”

Here’s key takeaways of what happened in each cycle:

- DeFi in 2020 — people saw strange farms, “complex percentages,” and ignored it. Later, they watched AAVE, UNI, SUSHI grow dozens of times.

- NFT in 2021 — people first laughed at “pictures.” A year later — regretted not entering BAYC, Azuki, Cool Cats.

- AI pump in 2023 — everyone used ChatGPT, but almost no one bought AI-infra tokens when they were cheap.

- DePIN in 2025 — those who weren’t lazy to run nodes and learn the mechanics are now among early winners.

Now is the same moment. DPIN is not “hype for the sake of hype.” — It is the next logical stage of the internet and Web3 evolution. You can enter now, or read about others’ success in a year.

3 Scenarios for DPIN in 2026

To avoid illusions, let’s be honest: there are several development paths. And it's important to be prepared for each.

Scenario 1: “Bullish 2026 — DPIN becomes the new star of the cycle”

What happens:

- AI market inflates demand for clouds, VPN, compute

- major web/AI startups connect to DPIN networks

- top exchanges create a separate “DPIN” category

What this means for beginners:

- early DPIN projects and tokens show growth

- airdrop hunters easily cover a year of income

- nodes pay off faster

Scenario 2: “Sideways — only strong DPIN projects grow”

What happens:

- market neither falls nor pumps hard

- people choose only projects with real usefulness

What this means:

- projects from AI + CLOUD + PRIV categories win

- NEW projects without traffic drop out

Scenario 3: “Light correction” — market cools down

What happens:

- fear in the market

- weak projects freeze development

- only those who actually work remain

What this means:

- best time to “hunt for diamonds”

- nodes and tokens are cheaper

- patient people profit — those who stay focused while others panic

Conclusion on DPIN

Decentralized Physical Infrastructure Network to Web3 is what Azure, AWS and Google Cloud Services to our regular internet. In essence it is both: one of fundamental forces and a backbone of the whole crypto operation.

What DPIN gives to crypto?

- Coveted Computing Power. Blockchains can’t operate in vacuum, they need computing power to execute smart-contracts and encrypt blocks. DPIN is how blockchain tech can harness computing power for internal needs.

- Decentralization. Everyone can contribute to the DPIN network willingly, the whole network becomes much more resilient to censorship; blockchain becomes sturdier and more able to withstand service issues such as outages and tampering with hardware on purpose.

- Utility Use Case for End Users. DPIN allows to utilize hardware for gains, it provides an added income source for regular folks, whilst creating a market for second-hand computing power trade between those chains which employ the DPIN tech and those which don’t.

Overall, DPIN is what POW to Bitcoin: a powerful force that can provide a basis for further growth. It is, in essence, a tool, much like a pickaxe for golddigging. It, however, does not magically make blockchain «just run» as it involves volunteers and requires actual load (or code, smart-contracts, EVMs, etc) to run.

FAQ

What is DPIN in one sentence?A decentralized marketplace of digital services (AI power, cloud, privacy, etc.) where payments and rewards go through the network and tokens.

How does DPIN differ from DePIN?DePIN is about physical infrastructure; DPIN is about digital services built on top (compute/AI/VPN/storage).

Where does the money come from?From users who pay for real services (AI requests, cloud, VPN); the network distributes the payment among providers.

Isn’t this another hype?Demand comes from outside crypto — AI/cloud/VPN are needed by billions. Proof: cloud/data center spending grows year over year.

What if the market goes sideways?Projects with real utility (AI/CLOUD/PRIV) grow, not empty tokens.

How to start without big money?Tests/betas/micro-nodes/micro-purchases — goal is to gain experience and validate the service.

Where to find new projects?CoinGecko categories, DeFiLlama, X threads (#DPIN #AIInfra), official sites/docs (see examples above).

What are the risks of nodes?Electricity/internet/hardware costs, competition, legal requirements in your region.

How to know if a project is “alive,” not just a presentation?Working product, docs, tutorials, active commits, on-chain metrics/revenue/clients.

Where to follow the DPIN trend?Project accounts on X, their Discord, tech blogs/docs, metric aggregators (CoinGecko/DeFiLlama), analytics (e.g., Kaiko, Nansen reports/releases).

Summary

DPIN (Decentralized Physical Infrastructure Networks) is a new crypto trend that could radically transform the digital economy as early as 2026. It aims to decentralize internet infrastructure — from cloud services and AI to VPNs and data storage — and return control to users. Instead of relying on tech giants like Google and Amazon, resources will be provided by network participants and paid for with tokens. This marks a step toward a freer, more resilient, and truly user-owned internet, where data, privacy, and resources once again belong to the people.

And to build a solid foundation, start with the basics: subscribe to Crypto Academy and get free access to the course “Crypto: From Zero to Advanced Investor” → https://academy.gomining.com/courses/bitcoin-and-mining

Telegram | Discord | Twitter (X) | Medium | Instagram

November 7, 2025