Bitcoin is trading in a market that’s still digesting early‑February volatility. Today’s key themes are liquidity, ETF flow signals, and whether the rebound is being led by spot demand or simply a mechanical reset after liquidation-driven turbulence.

Key Takeaways

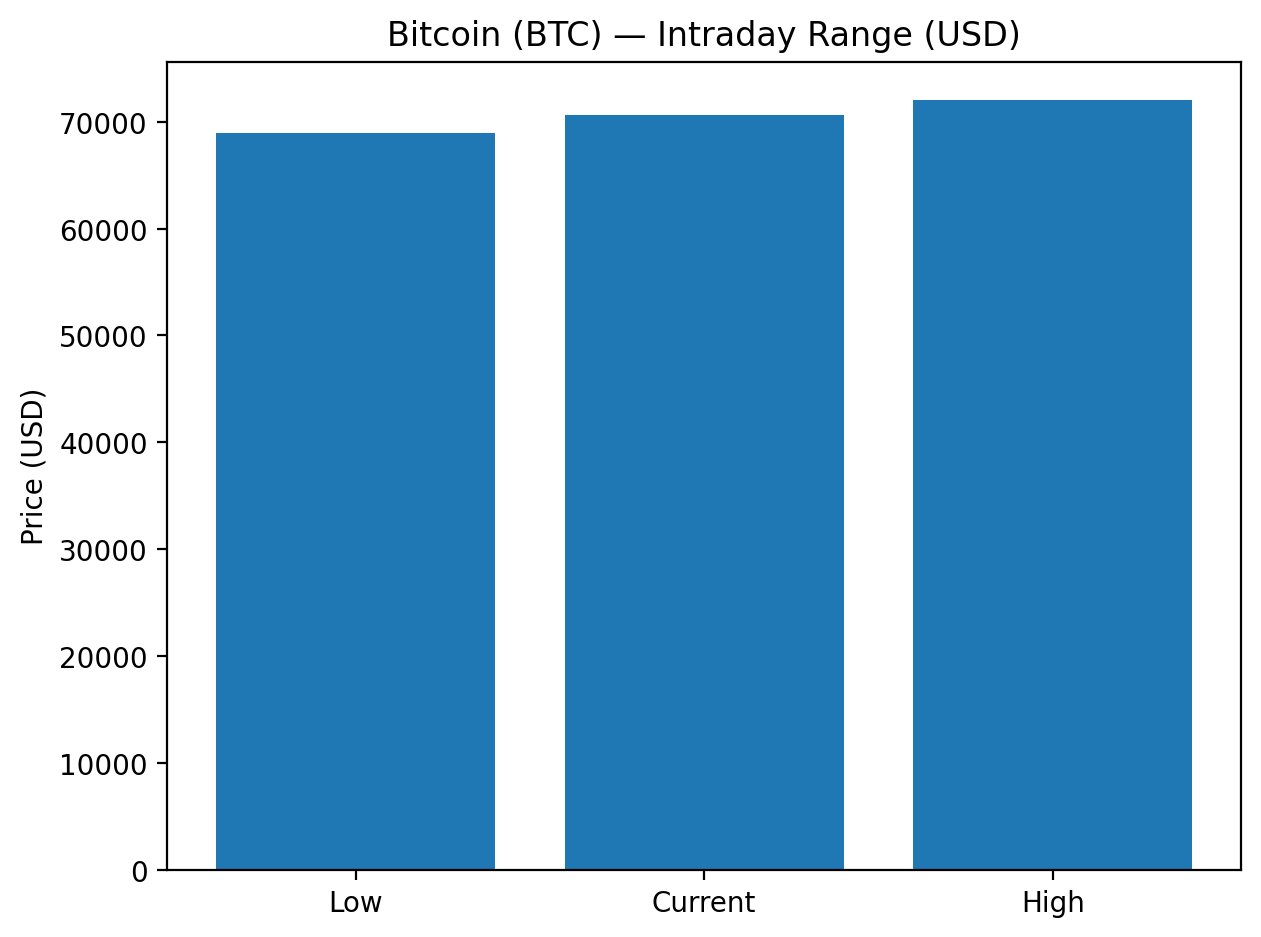

Bitcoin is up about 2.01% today near $70,627, with a wide $68,966–$72,024 intraday range. (Tool price snapshot)

Cointelegraph reported spot Bitcoin ETF outflows totaling $2.9B over 12 trading days during the recent drawdown. (Cointelegraph)

Derivatives mechanics can amplify both selloffs and rebounds when liquidation engines keep firing into thin liquidity. (Cointelegraph)

Investopedia quoted Jim Bianco warning that the “boomer adoption” ETF narrative has weakened and “winter continues until a new narrative emerges.” (Investopedia)

Bitcoin intraday range (original visual). Data: tool price snapshot.

Spot Bitcoin ETF outflows (original visual). Cointelegraph reported $2.9B total over 12 trading days; chart shows average/day.

What’s happening in the market today

As of Feb 9, 2026, Bitcoin is modestly higher on the day (about +2.01%) after a volatile session. Moves like this often follow periods of heavy leverage being forced out: once the most stressed positions are closed, price can rebound even without a fresh bullish catalyst. That’s why it’s useful to separate “direction” from “cause” — a green day can still be part of a broader reset.

One of the biggest short‑term signals remains spot-ETF flow. Cointelegraph reported that spot Bitcoin ETF outflows totaled $2.9B over 12 trading days during the recent drawdown. When net outflows persist, rallies can be choppier because a steady spot bid is missing.

Why price can rise while headlines feel mixed

Crypto market structure is highly reflexive: falling prices trigger liquidations; liquidations push prices lower; then once forced selling slows, even modest buying can lift price quickly. Cointelegraph highlighted how liquidation mechanics can keep selling into stressed liquidity.

Dragonfly managing partner Haseeb Qureshi described stressed liquidations at Binance: “could not get filled, but liquidation engines keep firing regardless,” adding that market makers “will need time to recover.” That helps explain why rebounds can appear before confidence returns.

The narrative problem: why good news may not move BTC much

Even with Bitcoin up today, investors are still questioning the next durable catalyst. Investopedia quoted macro analyst Jim Bianco: “The ‘Bitcoin Boomer Adoption’ Trade is Dead,” and he added, “Winter continues until a new narrative emerges.”

This doesn’t forecast the next tick, but it explains why rallies can feel thin: when traders think the “big narrative” is fading, they demand stronger proof of demand before chasing price higher.

What to watch next

Watch (1) ETF net flows over multi‑day windows, (2) futures open interest and funding (fast leverage rebuild often precedes volatility), and (3) whether Bitcoin holds reclaimed levels for several sessions. Durable trends usually require time above prior breakdown zones.

Finally, track broader risk sentiment: crypto’s short-term beta to macro risk assets can reassert quickly if equities wobble.

Sources

Cointelegraph — Spot Bitcoin ETF outflows total $2.9B as BTC price drops to new 2026 low: https://cointelegraph.com/news/spot-bitcoin-etf-outflows-total-2-9b-as-btc-price-drops-to-new-2026-low

Investopedia — Bitcoin’s Price Drops Below $67,000. Welcome to 2026’s ‘Crypto Winter’: https://www.investopedia.com/bitcoin-s-price-drops-below-usd67-000-welcome-to-2026-s-crypto-winter-mstr-11900072

Tool price snapshot — BTC/ETH used for intraday range and % change.

February 9, 2026