In this article, we explain what PoS blockchains are, why they are important for the market in 2025–2026, what metrics and risks to consider, and provide a clear algorithm of practical actions for investors or node operators.

What is PoS and why is it relevant now

PoS (proof of stake) is a consensus mechanism in which the right to confirm blocks and receive rewards depends on the share of tokens locked by a network participant. Unlike PoW, where computing power and electricity are decisive, in PoS, stake and reputation are decisive.

Why is this relevant?

- Energy efficiency makes PoS attractive to regulators and institutional investors (ETF products look at sustainability).

- PoS integrates with DeFi and smart contracts: staking is becoming part of complex income strategies.

- Hybrid models and analytics tools are emerging, so understanding how PoS blockchains work directly influences investment decisions.

Key elements of the PoS mechanism

Stake and validators Validators freeze tokens (stake) and receive a probability of being selected to create a block. The size of the stake affects the odds, but many networks use additional measures to reduce centralization.

Source: https://medium.com

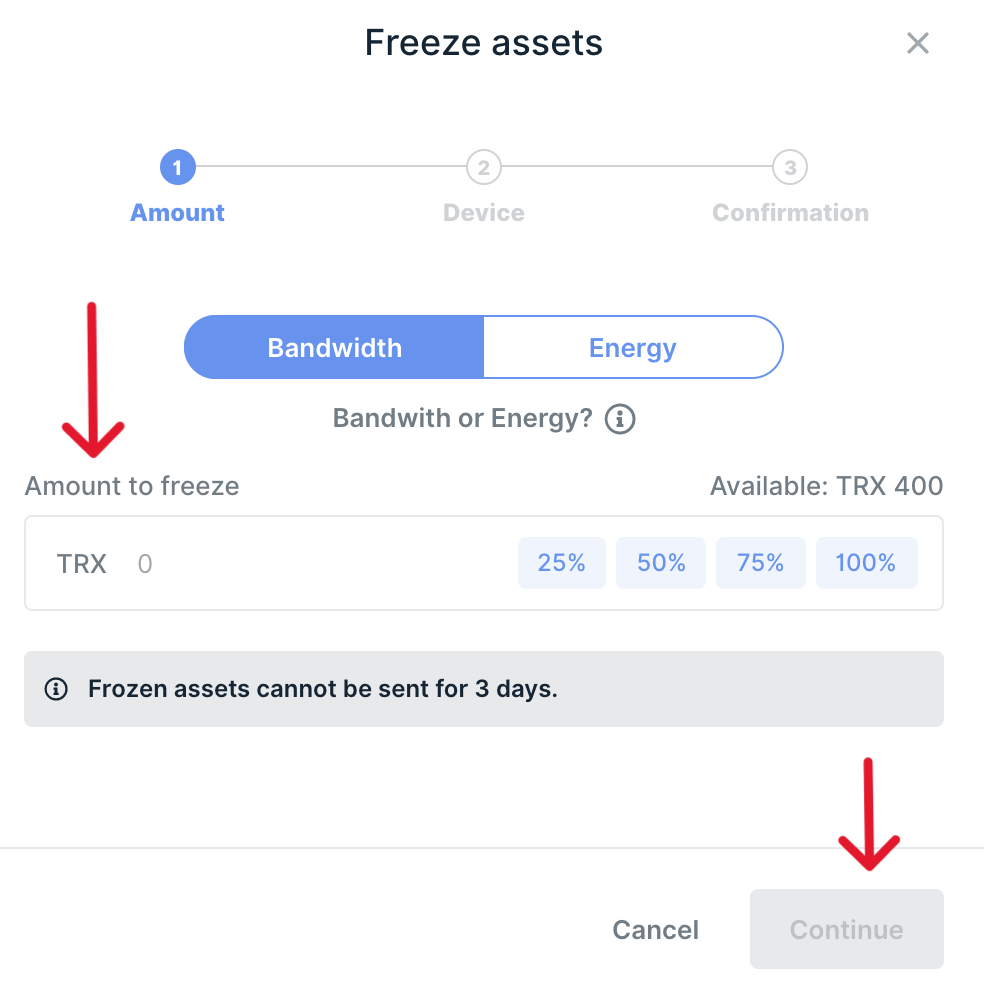

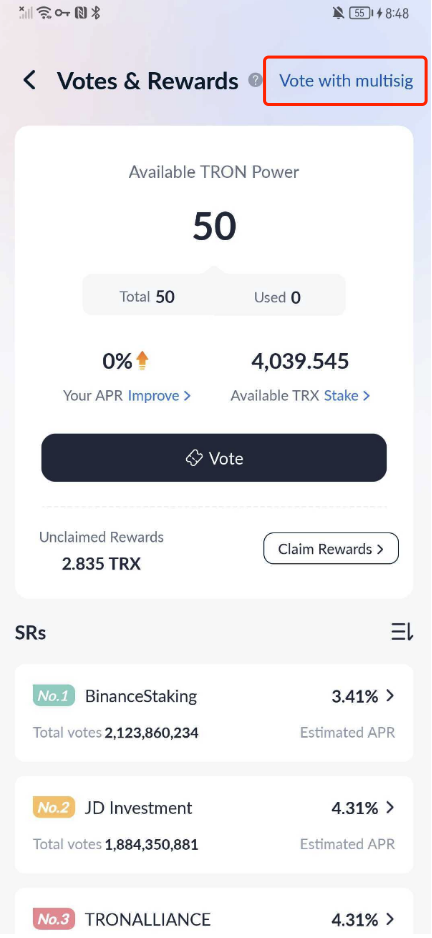

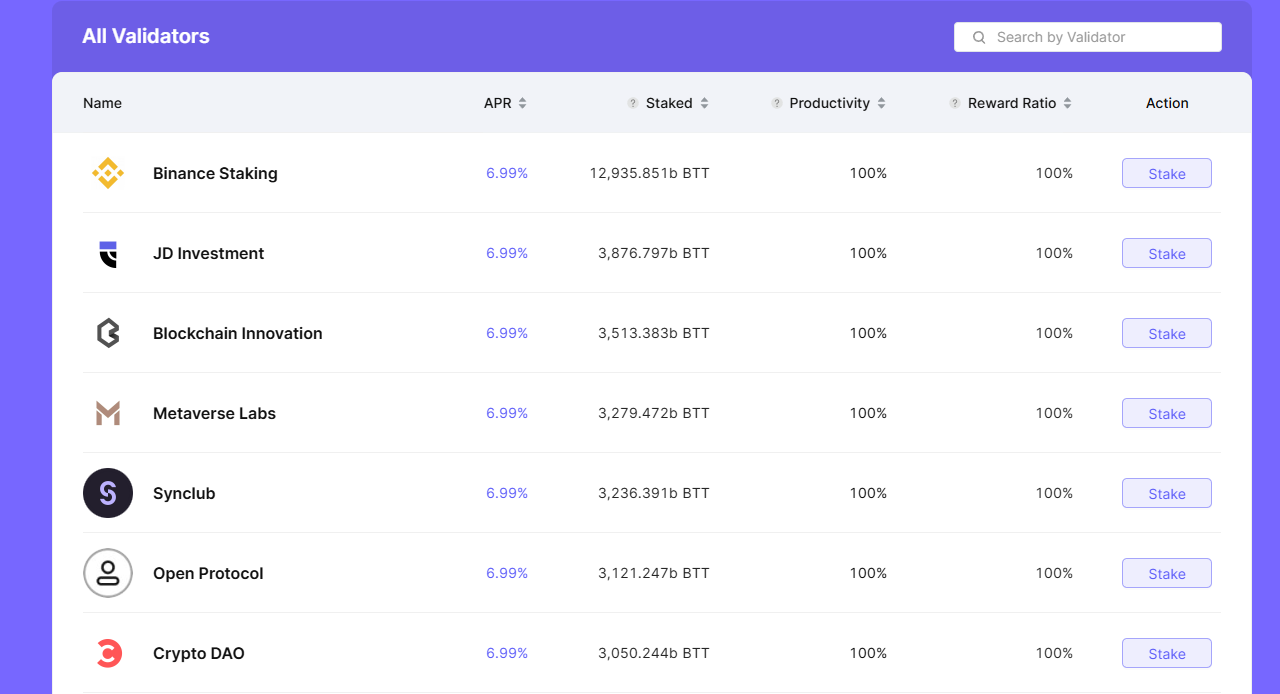

Delegation and delegated modelsToken holders who do not have the resources to run a node delegate their stake to professional validators and receive a share of the reward. This makes participation more accessible.

Source: https://support.tronlink.org

- Validator selection and randomnessProtocols combine randomness and stake weight, adding reputation factors to reduce the risk of manipulation.

- Penalties and slashingPenalties (slashing) are imposed for malicious actions or validator downtime. This is an economic mechanism to ensure honest behavior.

- Finalization and stabilityDifferent networks have different approaches to block finalization: some provide fast finalization, while others prefer asynchronous stability. The finalization model affects the risk of reorganizations and the speed of confirmations.

What metrics to look at and what tools to use

To understand how PoS works and assess the attractiveness of a network, look at the following metrics:

- MCAP and FDV — total capitalization and valuation at full issuance.

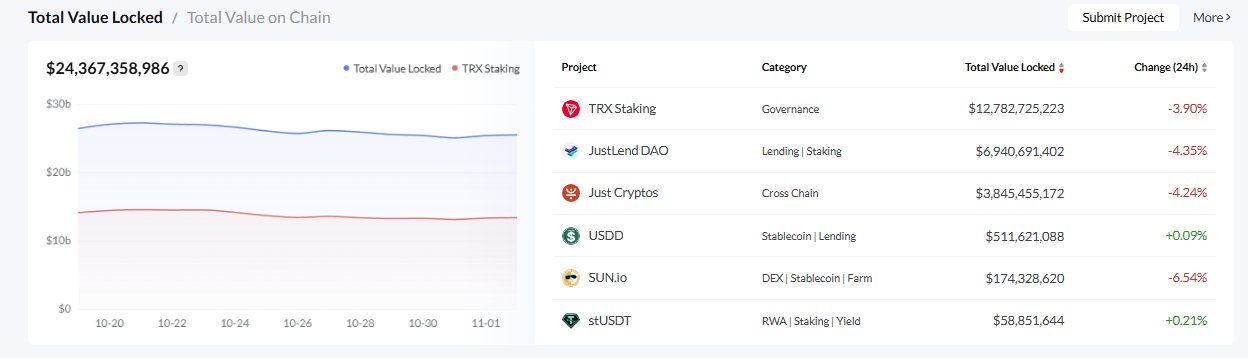

- TVL — if DeFi products are developed on the network, TVL shows real activity and demand.

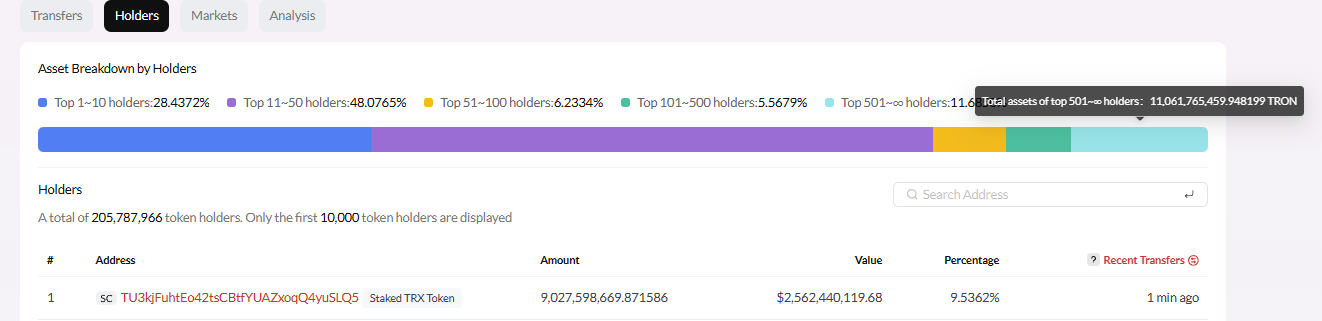

Source: https://tronscan.org

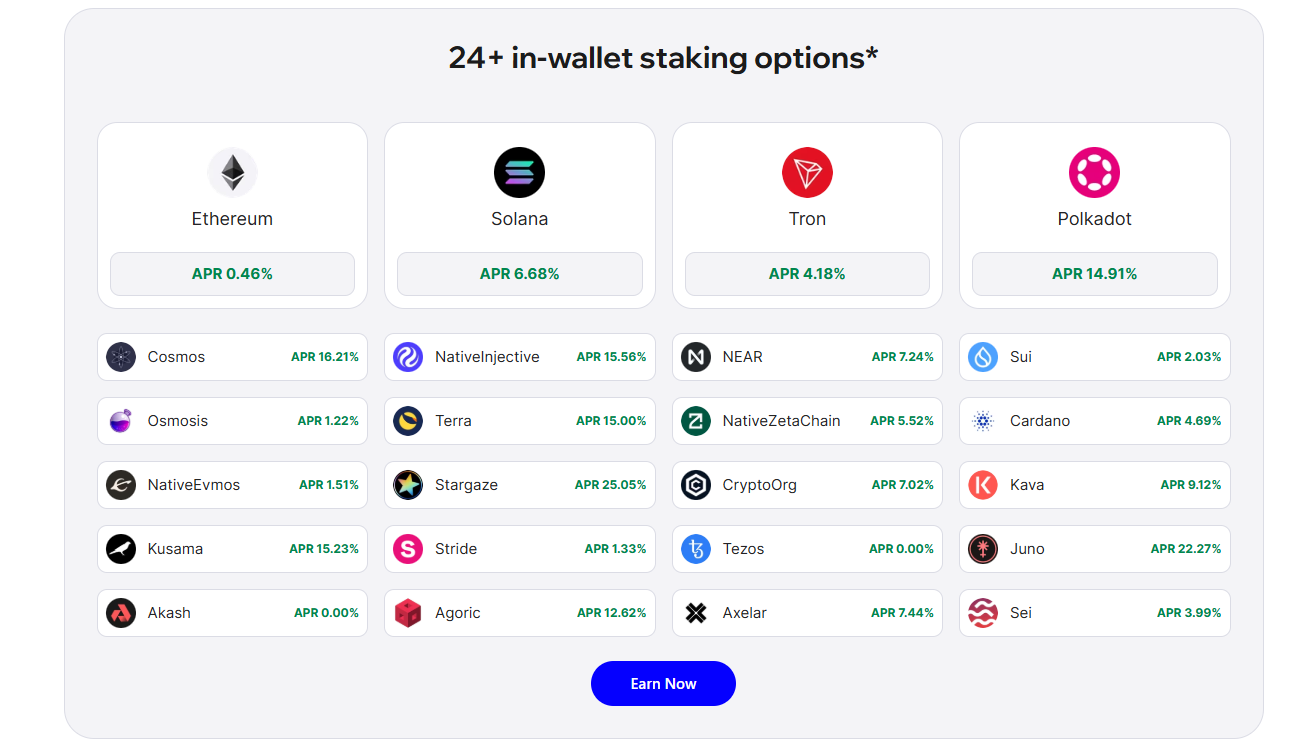

- ROI from staking — real return on investment, taking into account token inflation.

- Stake concentration — the share controlled by the largest addresses.

Source: https://tronscan.org

- Validator uptime and slashing history — reliability of service providers.

- On-chain indicators: inflows/outflows, unlock schedules, activity of large holders.

Tools: on-chain analytics (dashboards), validator reports, specialized analytics and yield modeling platforms. This data provides insight into how PoS blockchains work in a specific network and what economic forces are behind it.

Source: bt.io

Practical instructions: what an investor or node operator should do

- Researching tokenomicsCheck the issuance schedule, inflation mechanisms, and the distribution of tokens between funds and large addresses. This determines the long-term risk of dilution and pressure on the price.

- Choosing a network and staking strategy Evaluate network metrics, slashing policy, and delegation availability. Decide whether you will stake directly or delegate.

Source:https://trustwallet.com

- Calculate profitability and stress tests Model ROI for different token price and emission rate scenarios. Take commissions into account.

- Risk diversificationDon't keep your entire stake in one network or with one validator. Combine staking, liquid staking in DeFi, and funds, if justified.

Advantages and risks of PoS in 2025–2026

Advantages:

- Significantly lower operating costs compared to PoW mining.

- Easier entry for retail investors through delegation and cloud solutions.

- A much simpler environmental agenda — a plus for institutions and regulators.

"The transition from energy-intensive mining to a mechanism where security is provided by economic incentives greatly changes the rules of the market: now tokenomics, share distribution, and network management quality become key." — Vitalik Buterin, co-founder of Ethereum; comment on a blog and at a network development conference, discussing Ethereum's transition to PoS

Risks:

- Centralization of stakes among large holders could undermine the security and integrity of the network.

- Incorrect slashing and implementation parameters can lead to losses for careless participants.

- Regulatory uncertainty: requirements for staking providers and node operators may become more stringent.

- Price cycle risk: a drop in token price reduces real returns and may make staking unprofitable.

Commercial use cases and monetization methods for PoS blockchains

- Long-term staking as a source of passive income for holders.

- Delegation and operational activities of validators: commissions and services for clients.

- Use of staking tokens in DeFi: increased returns through farming, but with increased liquidity risk.

- Corporate solutions: institutional staking, custodial services, and integration with ETF solutions.

"Successful staking is not only about the nominal reward rate, but also about managing operational risks: validator availability, penalty policies, and payment transparency determine the real returns and security of participants." — Charles Hoskinson, founder of Cardano

How this changes investment decisions in 2025–2026

Understanding the mechanics of PoS is critical for evaluating projects and building a portfolio. It is important for investors to not only look at the nominal staking rate, but also to consider tokenomics, capital concentration, and legal risks. Strategies based on transparent analytics and diversification will provide an advantage in the face of growing institutional interest and increasing regulatory requirements.

At the same time, for those who are not ready to manage a node on their own or minimize operational risks, there is an easy alternative — cloud solutions: you can use proven services to rent a stake and access hashrate without purchasing and maintaining equipment, such as GoMining, which offers ready-made infrastructure, transparent reporting, and reduces the need to deal with issues such as premises, electricity, and maintenance.

FAQ

- How do PoS blockchains work?This is a mechanism for operating blockchains based on proof of stake (PoS): the right to confirm blocks and receive rewards is given to participants who have locked tokens in the network. In economic terms, network security is ensured not by energy costs, but by economic incentives — stakes and penalties for misconduct.

- How do PoS blockchains function in the cryptocurrency ecosystem?Validators lock tokens in the network; a combination of stake and random elements selects those who create blocks and confirm transactions; a reward is paid for this. Token holders who do not run a node can delegate their stake to professional validators and receive a share of the reward. Slashing and reputation mechanisms are used to maintain honesty.

- What are the advantages and risks of PoS blockchains?Advantages: lower operating costs compared to PoW, better energy efficiency, accessibility through delegation, and integration with DeFi. Risks: centralization of stakes among large holders, possible losses from slashing, vulnerabilities in protocol implementation, and regulatory uncertainty.

- How to use PoS blockchains in 2025?Evaluate networks based on tokenomics, stake distribution, slashing policy, and validator transparency. Model ROI considering inflation and token price scenarios. Diversify stakes across networks and validators; apply DCA to reduce timing risks and carefully integrate staking with DeFi instruments.

- What metrics are associated with the operation of PoS blockchains?Key indicators: stake concentration among the largest addresses, staking ROI, validator uptime, slashing frequency and volume, TVL in related DeFi products, MCAP and FDV, on-chain flows, and unlock issuance schedules.

- Is it possible to make money from PoS blockchains?Yes, with a systematic approach: correct assessment of tokenomics, accounting for costs and taxes, selection of reliable validators, and diversification. In practice, profits are generated through long-term staking, delegation, and combining staking with cautious DeFi strategies; but profitability is highly dependent on market cycles.

- What mistakes do beginners make when working with PoS blockchains?Common mistakes include focusing only on the nominal interest rate, ignoring token distribution and slashing risk, underestimating taxes and operating costs, concentrating stakes with a single validator or network, and blindly trusting aggregators without checking their reputation.

- How does the operation of PoS blockchains affect the cryptocurrency market?PoS models increase the transparency and attractiveness of networks for institutional investors, which strengthens demand for projects with sustainable tokenomics. The transition to PoS lowers barriers to entry, changes the distribution of rewards, and increases the importance of on-chain analytics for investment decisions.

- What do experts predict for PoS blockchains in 2026?We expect to see growth in cloud and institutional staking services, tighter regulation of staking providers, widespread integration of AI analytics for risk management, and the emergence of hybrid finalization models that improve network security and scalability.

- Where can you follow updates on the work of PoS blockchains?Follow the official project blogs and publications of validator teams, industry analytics platforms and on-chain dashboards, sections in Messari and Token Terminal, as well as reports from regulators and major custodial providers. For practical instructions and case studies, check out the GoMining blog and subscribe to verified Telegram/Discord channels of node operators.

Subscribe and get access to a free course on crypto, from beginner to advanced investor! https://academy.gomining.com/courses/bitcoin-and-miningTelegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing mentioned in this article constitutes financial advice or investment recommendations. Content is provided "as is"; all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

November 7, 2025