Mining in 2026 is no longer just "hardware plus electricity." It is an ecosystem of tools, from cloud platforms to on-chain analytics, that determine who wins and who loses. In this article, we will analyze which key tools for crypto mining in 2026 really work, how to use them, and what metrics to consider in order to avoid falling into the trap of outdated strategies.

What are mining tools and why are they needed?

Modern mining is an ecosystem. Tools allow you to:

- Reduce energy costs and manage hashrate

- Automate switching between coins and pools

- Track key metrics: TVL, FDV, MCAP, on-chain data, cycles, ROI

- Analyze the behavior of large addresses (whales) and market trends

- Build DCA strategies and take blockchain tokenomics into account

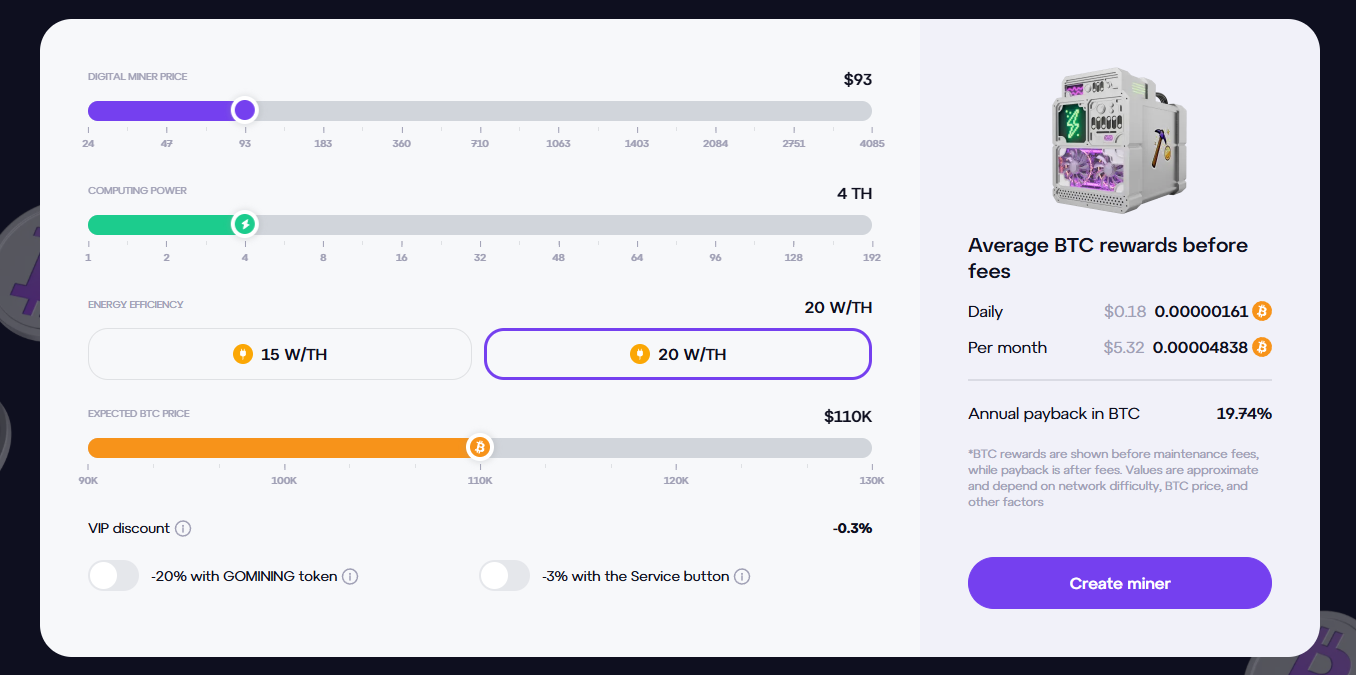

For GoMining users, some of these tasks have already been solved: the platform offers a ready-made infrastructure with transparent returns, flexible configuration, and built-in analytics.

"Mining in 2026 is not just about hashrate. It's about being able to read data, understand tokenomics, and use tools that give you an edge." — Sheetal Jain

Tool categories

Basic

- NiceHash / Kryptex — simple platforms with automatic coin and yield selection.

- MiningPoolStats — a pool aggregator that shows current fees and hashrate.

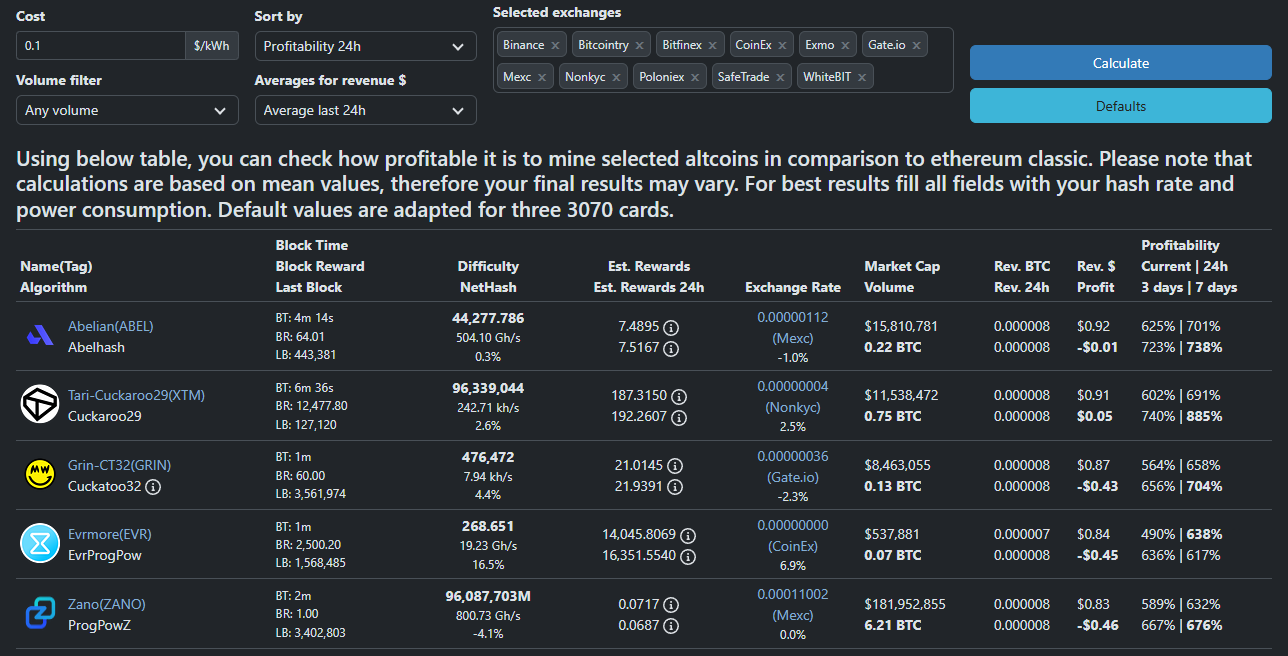

- CoinWarz / WhatToMine — profitability calculators for algorithms and coins.

Source:https://whattomine.com/coins

Intermediate

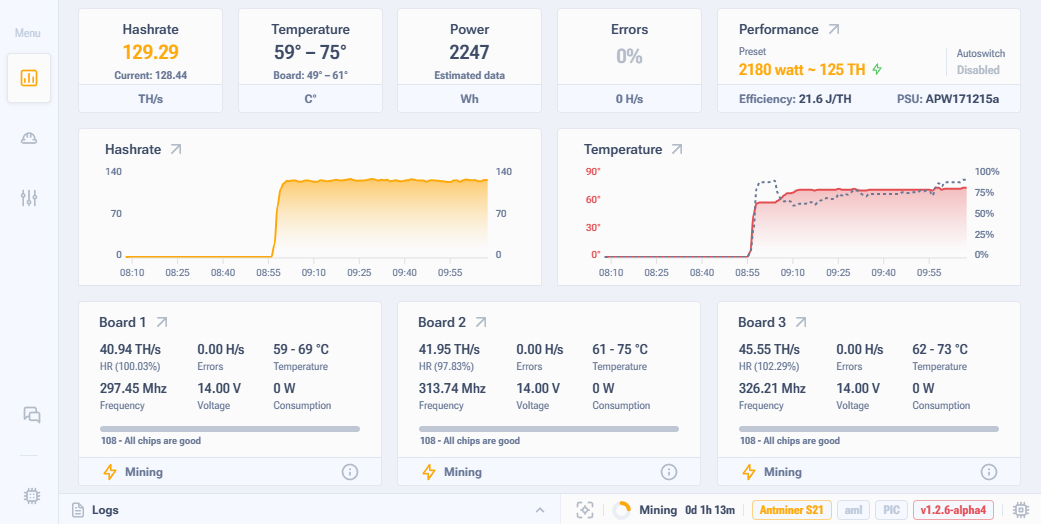

- Hive OS / Awesome Miner — farm management, monitoring, auto-updates.

Source: awesomeminer.com

- Bitmain Power Tuner — ASIC equipment power consumption settings.

- GoMining — hashrate rental, flexible strategy without purchasing hardware.

Advanced

- Token Terminal / Messari — analysis of blockchain profitability, smart contracts, staking, and TVL.

Nansen / Dune Analytics — tracking on-chain activity, large transfers, whale behavior.

Source: https://dune.com

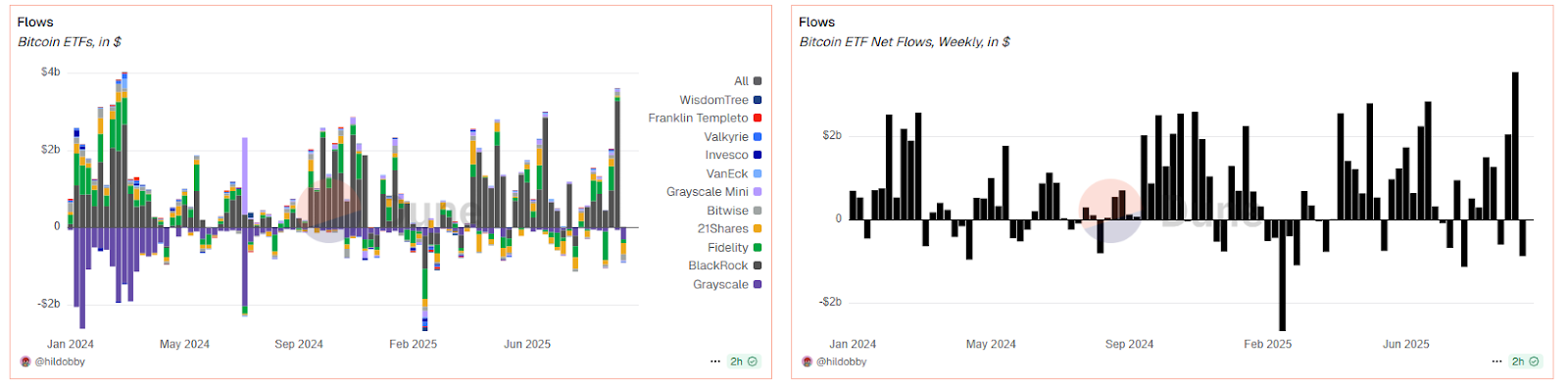

- Glassnode / IntoTheBlock — metrics on bitcoin, cycles, ETF connections, and tokenomics.

How to use the tools in practice

- Yield assessment — using GoMining calculators and built-in reports

Source: https://gomining.com

Coin and algorithm selection — based on crypto metrics and market trends

Source: https://coinmarketcap.com

- Tokenomics analysis — via Token Terminal, Messari, or built-in dashboards

Source: tokenterminal.com

- DCA strategy — distribution of investments across market cycles and phases

- Risk hedging — diversification between staking, cloud mining, and holding

Forecasts and risks for 2025–2026

- The 2024 halving reduced rewards — efficiency became a key factor.

- The growth of ETF products is increasing interest in blockchains with transparent returns.

- Regulatory risks are particularly relevant when working with stablecoins.

- Market cycles in 2026 may lead to consolidation — those who optimize their processes will survive.

"After the 2024 halving, efficiency has become key. Without energy consumption optimization and automation, ROI simply does not add up." — YesMining.io, ASIC equipment profitability report

GoMining offers infrastructure that takes these trends into account: cloud access, flexible contracts, built-in metrics, and a transparent profitability model.

Table for understanding tasks and tools

Each of the tools listed — from yield calculators to on-chain analytics — is already integrated into the GoMining ecosystem. Users get access to hashrate, metrics, reports, and flexible settings without having to collect everything manually. It's not just a platform — it's a ready-made stack of solutions that works out of the box.

Mine yourself or choose GoMining?

If you are considering starting mining on your own, it is important to understand the real challenges:

- Equipment — purchasing ASICs or GPUs, configuration, regular maintenance

- Electricity — high rates, instability, the need to calculate payback

- Premises — ventilation, noise, security, fire regulations

- Permits — legal status of mining, taxation

- Technical risks — overheating, failure, difficulty scaling

- Updates and switching — constant monitoring, changing coins, adapting to the equipment market

Even with competent configuration, this is a business with a high entry threshold, where a mistake in calculations can lead to losses.

In 2026, mining is not only a technology, but also an infrastructure. And GoMining offers it in its entirety, without hidden costs or technical barriers.

FAQ

1. What are the key cryptocurrency mining tools in 2026? It is a set of technical and analytical solutions — from cloud platforms to blockchain analysis tools — that allow you to optimize profitability, reduce operating costs, and adapt strategies to changing market conditions. These tools include profitability calculators, farm management systems, hashrate rental services, and on-chain analytics.

2. How do key mining tools work in the crypto industry? They provide monitoring and management of computing power, automatic selection of the most profitable coins and pools, collection and visualization of data on profitability and costs, as well as analysis of transactions and activity of large holders. Based on this data, decisions are made on switching, scaling, and hedging risks.

3. What are the advantages and risks of key mining tools? Advantages: process automation, transparency of indicators, reduction of operating costs, and acceleration of decision-making. Risks: incorrect interpretation of data, dependence on the quality of the analytics provider, technical failures and vulnerabilities in third-party services, as well as the impact of market cycles on profitability.

4. How to use key mining tools in 2025? Use them to evaluate equipment payback, select coins and pools, model profitability and risk scenarios, and build a strategy for regular entry (DCA) and hedging. Combine data from calculators, cost reports, and on-chain analytics to make informed decisions.

5. What metrics are associated with key mining tools? Key indicators: TVL, FDV, MCAP, return on investment (ROI), electricity and maintenance costs, hashrate, average pool commission, activity of large holders, and flows related to ETFs and market cycles.

6. Is it possible to make money using key mining tools? Yes, with the competent use of tools, correct cost calculation, and risk management, it is possible to make a profit. In practice, this requires a systematic approach: constant monitoring of profitability, optimization of energy consumption, and timely adaptation of strategies.

7. What mistakes do beginners make when using key mining tools? Common mistakes include ignoring token economics, underestimating electricity and space costs, miscalculating equipment payback, blindly trusting aggregators without verifying data, and not having a plan for market downturns.

8. How do key mining tools affect the cryptocurrency market? They increase transparency and speed up decision-making, contribute to the professionalization of the mining sector, and facilitate access for institutional and retail investors. This accelerates adaptation to trends and reduces market fragmentation.

9. What do experts predict for key mining tools in 2026? Growth is expected in cloud solutions and platforms with ready-made infrastructure, the integration of AI-based analytics, stricter legal transparency requirements, and a transition to hybrid mining models that combine proprietary capacity and hashrate leasing. Platforms such as GoMining will be in demand due to their efficiency and lack of operational barriers.

Subscribe and get access to a free course on crypto, from beginner to advanced investor! https://academy.gomining.com/courses/bitcoin-and-miningTelegram | Discord | Twitter (X) | Medium | Instagram

NFA, DYOR.

The cryptocurrency market operates 24/7/365 without interruptions. Before investing, always do your own research and evaluate risks. Nothing in this article constitutes financial advice or investment recommendations. Content is provided "as is"; all claims are verified with third parties and relevant in-house and external experts. Use of this content for AI training purposes is strictly prohibited.

November 5, 2025